Get the free Calhome First Time Homebuyer Program Application

Get, Create, Make and Sign calhome first time homebuyer

How to edit calhome first time homebuyer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calhome first time homebuyer

How to fill out calhome first time homebuyer

Who needs calhome first time homebuyer?

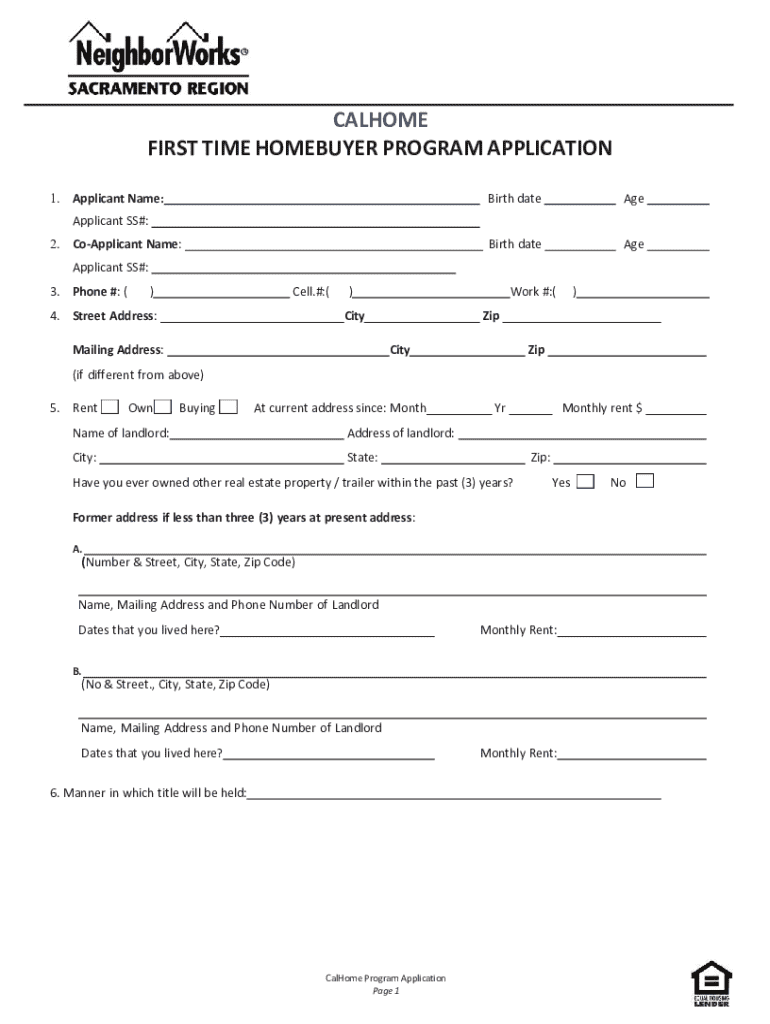

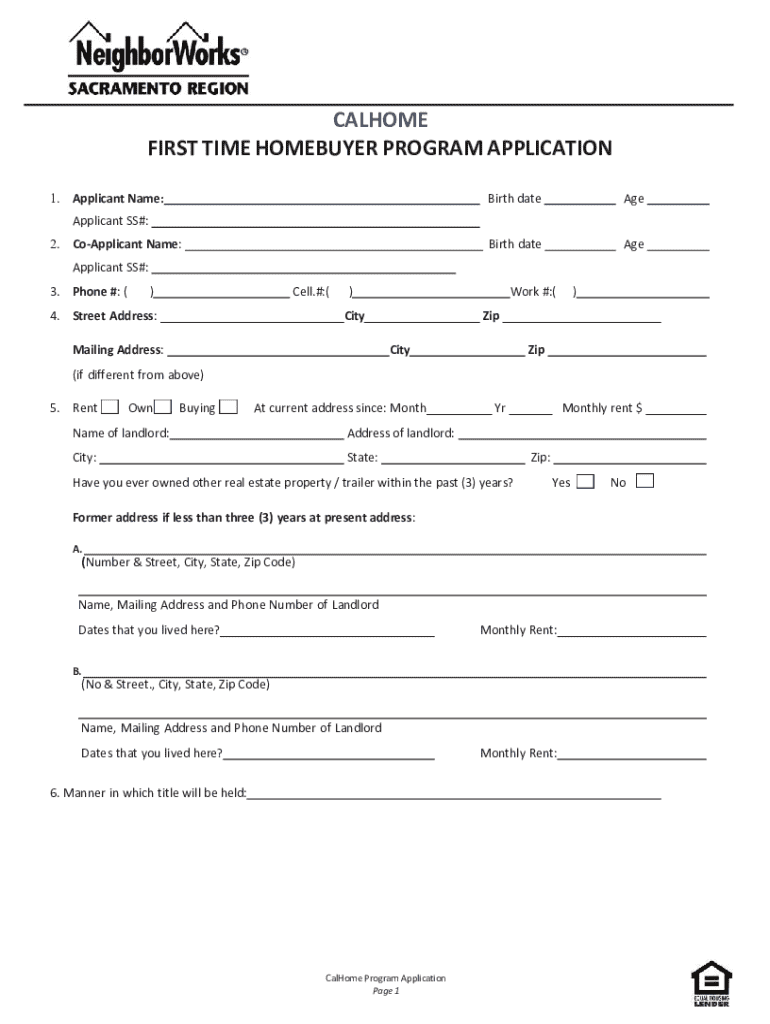

Understanding the CalHome First Time Homebuyer Form: A Comprehensive Guide

Overview of the CalHome Program

The CalHome Program is a vital initiative designed to assist first-time homebuyers in California, providing financial support and resources to make homeownership more accessible. With the rising costs of housing, many potential buyers find themselves unable to secure a mortgage or afford a down payment. The CalHome initiative addresses this issue by offering various forms of assistance, including loans and grants to help with down payments and closing costs.

First-time homebuyer assistance is crucial in fostering stable communities and creating opportunities for individuals and families. The benefits of utilizing the CalHome Program extend beyond financial support; they also include access to housing counseling, education, and networking opportunities that empower buyers to make informed decisions.

Understanding the first time homebuyer form

The CalHome First Time Homebuyer Form is essential for individuals seeking financial assistance through the program. This form serves multiple purposes, acting as an application and a pathway to determine eligibility for various assistance options. The importance of this form cannot be overstated; it directly influences the kind of support a buyer might receive and ensures that the program’s resources are targeted effectively.

Anyone looking to secure assistance from the CalHome program must complete this form. Understanding what is required can streamline the process and increase the chances of a successful application. Key details typically required in the form include personal identification information, financial statuses, and specific home purchase details.

Types of assistance and eligibility

Under the CalHome program, various types of assistance are available to first-time homebuyers. This includes down payment assistance loans, deferred payment loans for closing costs, and even grants for specific areas or types of homes. Each of these assistance options is designed to cater to different financial circumstances and housing needs, empowering buyers to choose the best fit for their situation.

Eligibility criteria for first-time homebuyers involve several factors. Income limits vary by household size and location, which means buyers should be aware of the specific requirements for their area. Additionally, residency requirements must be met, often requiring that the buyer intends to occupy the home as their primary residence. Other qualifications may include credit score thresholds and asset limits to ensure that the assistance is going to those who need it most.

Detailed guide to completing the CalHome first time homebuyer form

When preparing to complete the CalHome First Time Homebuyer Form, being organized can make a significant difference. Start by gathering all necessary documentation, which includes proofs of income, asset statements, personal identification, and information regarding the desired property. Understanding the required information fields beforehand can also streamline the filling process.

The form consists of several sections, including personal information, home purchase details, income verification, and a signature section. It’s essential to take the time to fill out each part thoroughly to avoid delays in processing your application. Below is a step-by-step breakdown of the form completion process.

To enhance your chances of success, it’s advisable to double-check all filled information. Common mistakes include typographical errors, incomplete sections, and failure to sign the form. Utilizing tools like pdfFiller can help avoid these pitfalls, as its editing and reviewing features ensure everything is in order before submission.

Interactive tools for form completion

As technology continues to evolve, many platforms have integrated interactive tools to enhance the form completion experience. pdfFiller is at the forefront of this, providing online form-filling and editing features that allow users to easily navigate the CalHome First Time Homebuyer Form.

eSigning options are available, enabling quick and secure signing directly on the device, eliminating the need for printing and scanning. Moreover, collaboration features enable teams to work on the application together, facilitating discussions and edits in real time. This is particularly beneficial for individuals who may be navigating homeownership with family members or partners.

Important dates and deadlines

Understanding the timeline of application submissions is crucial for prospective homebuyers utilizing the CalHome Program. Each funding round will have specific deadlines for form submissions, after which applications will be reviewed for eligibility. Awareness of these deadlines can provide significant advantages in securing timely assistance.

Key dates for funding announcements typically follow application submissions, offering timelines for when applicants can expect to hear back regarding their application status. Maintaining a clear calendar of these key dates can assist first-time homebuyers in staying informed and prepared.

Reporting and compliance guidelines

First-time homebuyers who receive assistance through the CalHome Program have specific obligations to ensure compliance with program requirements. These responsibilities help maintain the integrity of the program and ensure continued support for future homeowners. Obligations may include reporting changes in income, occupancy status, or any modifications made to the property.

How to maintain compliance involves understanding what forms and reports need to be submitted and when. Buyers should be proactive in keeping detailed records of their homeownership status and seek guidance if they encounter issues that may affect their compliance. This ensures they not only benefit from current assistance but are also eligible for any future aid.

Contacting support for help

Navigating the CalHome First Time Homebuyer Form can be challenging, which is why contacting support for assistance is a wise step. There are several channels available for obtaining help—from online resources to direct contact with program representatives. Familiarize yourself with the different ways to get assistance regarding the form, eligibility, and funding options.

When seeking help, it’s beneficial to prepare a set of specific questions to maximize the effectiveness of the conversation. Knowing whom to contact for what type of question can enhance communication and lead to quicker resolutions.

Testimonials and success stories

Many first-time homebuyers have successfully utilized the CalHome Program to achieve their dreams of homeownership. Real-life experiences provide insight into how the program can positively impact individual lives. Testimonials often highlight the ease of applying through the CalHome First Time Homebuyer Form and the valuable support received from local agencies.

Furthermore, solutions like pdfFiller have streamlined the process for users. With its user-friendly features, applicants report less frustration when navigating the form-filling experience. These stories inspire confidence and encourage potential buyers to pursue their homeownership goals.

FAQs related to the CalHome First Time Homebuyer Form

As potential homebuyers prepare to fill out the CalHome First Time Homebuyer Form, they often have questions. Understanding the common queries can clarify the process and reduce anxiety. Some commonly asked questions revolve around eligibility, needed documentation, and potential funding amounts.

Addressing these FAQs not only helps inform applicants but also encourages them to apply with a clearer understanding of what to expect. Detailed answers can demystify the process and empower users to confidently navigate the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit calhome first time homebuyer in Chrome?

How do I fill out calhome first time homebuyer using my mobile device?

How do I complete calhome first time homebuyer on an Android device?

What is calhome first time homebuyer?

Who is required to file calhome first time homebuyer?

How to fill out calhome first time homebuyer?

What is the purpose of calhome first time homebuyer?

What information must be reported on calhome first time homebuyer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.