Get the free Credit Card on File Authorization Form

Get, Create, Make and Sign credit card on file

Editing credit card on file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card on file

How to fill out credit card on file

Who needs credit card on file?

Understanding the Credit Card on File Form: A Comprehensive Guide

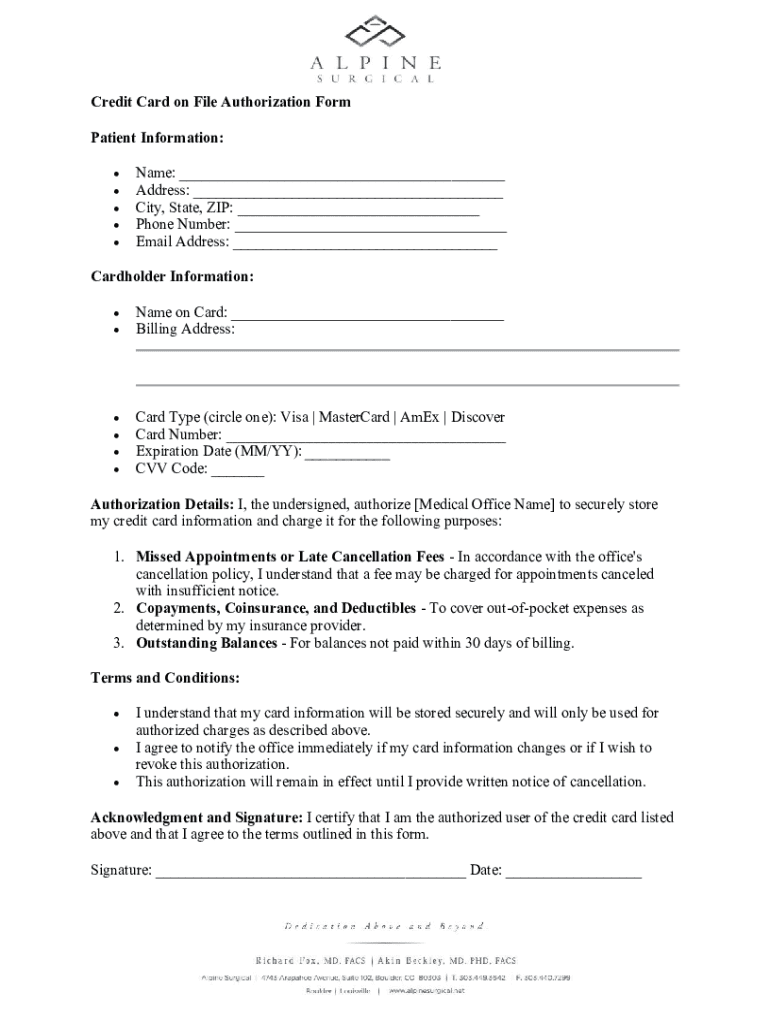

Overview of the credit card on file form

A credit card on file form is an essential document that allows businesses to securely store a customer’s credit card information for future transactions. This form is critical in industries where recurring payments are common, such as subscription services or healthcare providers. Understanding the purpose and importance of this form is vital for both businesses and customers, as it fosters convenience and ensures timely payments.

Businesses that require ongoing payment for services or products tend to benefit most from having a credit card on file form. Companies in the service industry, such as gyms, pet care providers, and software as a service (SaaS) companies, often rely on this tool to enhance customer experience and streamline billing.

What is a credit card on file form?

A credit card on file form is a document that customers fill out to authorize a business to store their credit card information securely. This document typically includes essential components such as the cardholder's name, billing address, card number, expiration date, and CVV. It must also contain language that clearly states the customer's consent to store their card information. Generally, businesses can create customized versions of this form based on their specific requirements.

Legal considerations are paramount when it comes to credit card information. Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) is necessary to safeguard customer data and ensure secure payment processing. Businesses must ensure that their forms adhere to legal requirements to protect both themselves and their customers.

Advantages of using a credit card on file form

Utilizing a credit card on file form offers numerous advantages. One of the most significant benefits is enhancing customer convenience. By allowing businesses to charge customers automatically, it reduces the hassle of repeated manual payments. Additionally, this setup simplifies the payment process and ensures timely payments, effectively reducing instances of late fees and chargebacks.

Here are some key advantages:

How to create a credit card on file form

Creating an effective credit card on file form requires careful planning and execution. Here’s a step-by-step approach to designing a form that meets your business needs:

pdfFiller provides interactive tools to help customize forms efficiently. With its user-friendly platform, businesses can leverage templates and readily adapt them to their specific purposes.

Filling out the credit card on file form

Customers need to fill out the credit card on file form carefully to avoid any future complications. Here are some best practices to ensure accuracy:

Common mistakes to avoid include not providing complete information and making typographical errors that could lead to declined transactions. It's crucial for customers to review their forms carefully before submission to prevent operational disruptions.

Storing and managing signed credit card on file forms

Once signed, credit card on file forms must be stored securely to protect customer information. There are legal timeframes for document retention that businesses must adhere to, typically ranging from three to seven years, depending on jurisdiction and specific regulations.

Best practices for secure storage include:

Adhering to these practices ensures compliance with regulations and enhances the overall security of customer data.

Addressing common concerns and FAQs

Customers often have questions about the credit card on file form. Here are some common concerns addressed:

Alternative payment options related to credit card on file forms

Alternatives to credit card on file forms exist, including direct debit and digital wallets. While credit card on file allows businesses to charge customers at specified intervals, direct debit services withdraw funds directly from a customer's bank account. Digital wallet services, like PayPal and Apple Pay, provide convenience as users can pay through stored payment methods without sharing card details directly.

Here are some key considerations:

Integrating the credit card on file form into your business workflow

To incorporate a credit card on file form into existing business workflows, it’s essential to develop a strategy. Begin with assessing current billing practices and processes. Identify points of customer interaction where the credit card on file form could be introduced. Training staff on effective use and compliance with regulations is necessary to ensure a smooth process.

Using pdfFiller’s collaborative features enables teams to manage documents effectively, facilitating task delegation and tracking for managing signed forms and ensuring compliance.

Real-world case studies and success stories

Many businesses have successfully leveraged credit card on file forms to enhance customer relations and improve cash flow. For instance, a local gym implemented this feature and saw a significant reduction in late payments, resulting in improved member retention rates. Customer feedback has been overwhelmingly positive, as members felt more at ease knowing they wouldn’t be charged late fees due to missed payments. The ability to manage billing without additional obstacles has streamlined operations considerably.

Additional related topics

As digital payment solutions advance, businesses should also consider related topics, such as the efficient use of eSignatures with forms. Understanding digital security best practices is crucial for protecting customer data in document management.

Integrating cloud-based platforms into current practices not only enhances document efficiency but also streamlines communication and collaboration within teams.

Staying up-to-date in payment processing

Current trends in credit card processing, including advancements in tokenization and biometric payments, are reshaping the future of how businesses handle transactions. Staying informed about these innovations is vital as they offer improved security and efficiency for both businesses and customers.

As the landscape shifts toward enhanced payment security, businesses must be prepared to adapt their processes, ensuring that they are not only compliant but also offer their customers a superior service experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card on file without leaving Google Drive?

Where do I find credit card on file?

How do I complete credit card on file on an Android device?

What is credit card on file?

Who is required to file credit card on file?

How to fill out credit card on file?

What is the purpose of credit card on file?

What information must be reported on credit card on file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.