Get the free National Automated Clearing House (nach) Mandate Form

Get, Create, Make and Sign national automated clearing house

How to edit national automated clearing house online

Uncompromising security for your PDF editing and eSignature needs

How to fill out national automated clearing house

How to fill out national automated clearing house

Who needs national automated clearing house?

National Automated Clearing House Form: A How-to Guide

Understanding the National Automated Clearing House (NACH)

The National Automated Clearing House (NACH) serves as a pivotal electronic payment system in India, designed to facilitate bulk electronic fund transfers. Established to streamline transactions, NACH aims to enhance the efficiency and accuracy of money transfers between banks, helping both individuals and businesses simplify their financial operations.

NACH essentially acts as a link between banks and payment service providers, allowing for seamless fund transfers via direct debit and credit. This robust platform is instrumental in the government's efforts to promote digital payments, ensuring that individuals and corporations can execute transactions swiftly and reliably.

When comparing NACH to other payment systems, such as the Electronic Clearing Service (ECS), NACH offers distinct advantages. ECS typically serves lower volumes and more manual processes, whereas NACH is fully automated, catering to high-frequency transactions without the same administrative burdens.

Furthermore, NACH encompasses not only banking transactions but also government payments and payroll services, making it far more versatile than traditional methods.

How to access the National Automated Clearing House Form

Accessing the National Automated Clearing House form is straightforward and can be accomplished through various platforms. Typically, banking websites and financial service providers offer downloadable forms, but the most user-friendly option is through dedicated online tools like pdfFiller.

The types of NACH forms available can vary based on the transaction type you intend to conduct. Knowing the correct form to use is crucial to ensure that your transactions are processed without delay.

For those preferring convenience, pdfFiller provides online access to fillable NACH forms. You can easily navigate their platform to find the specific form you need, ensuring a streamlined experience.

A step-by-step guide on locating NACH forms online can significantly simplify the process. By visiting pdfFiller, you can search with keywords or browse through categories to find the appropriate NACH form readily.

Filling out the NACH form: Step-by-step instructions

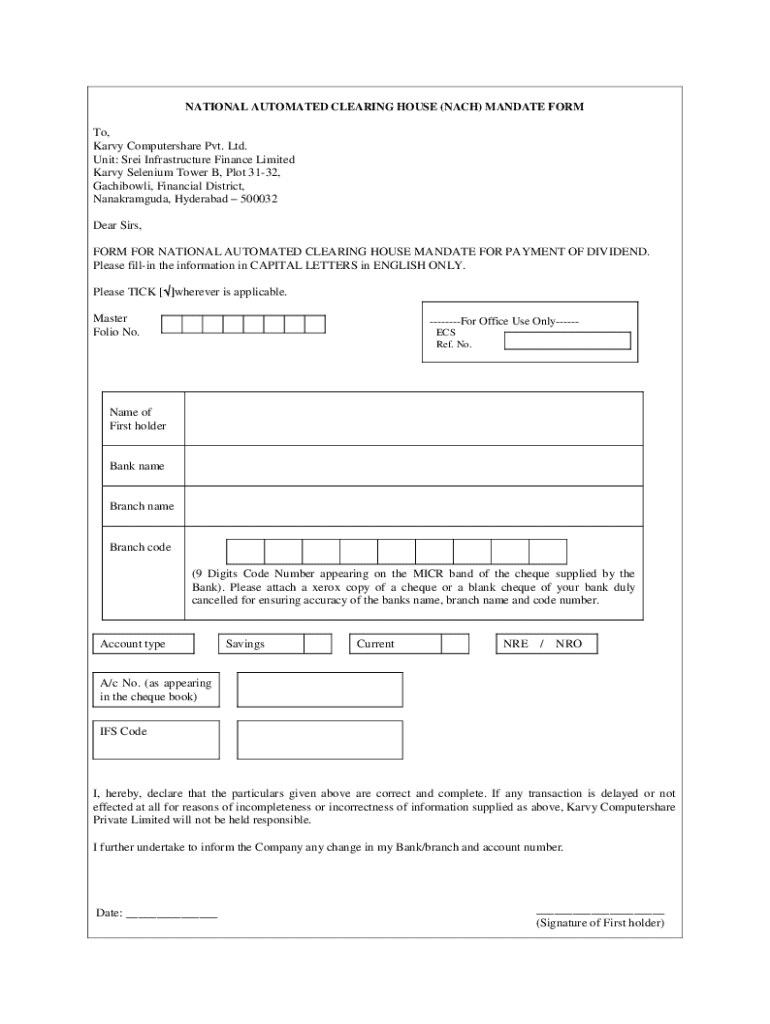

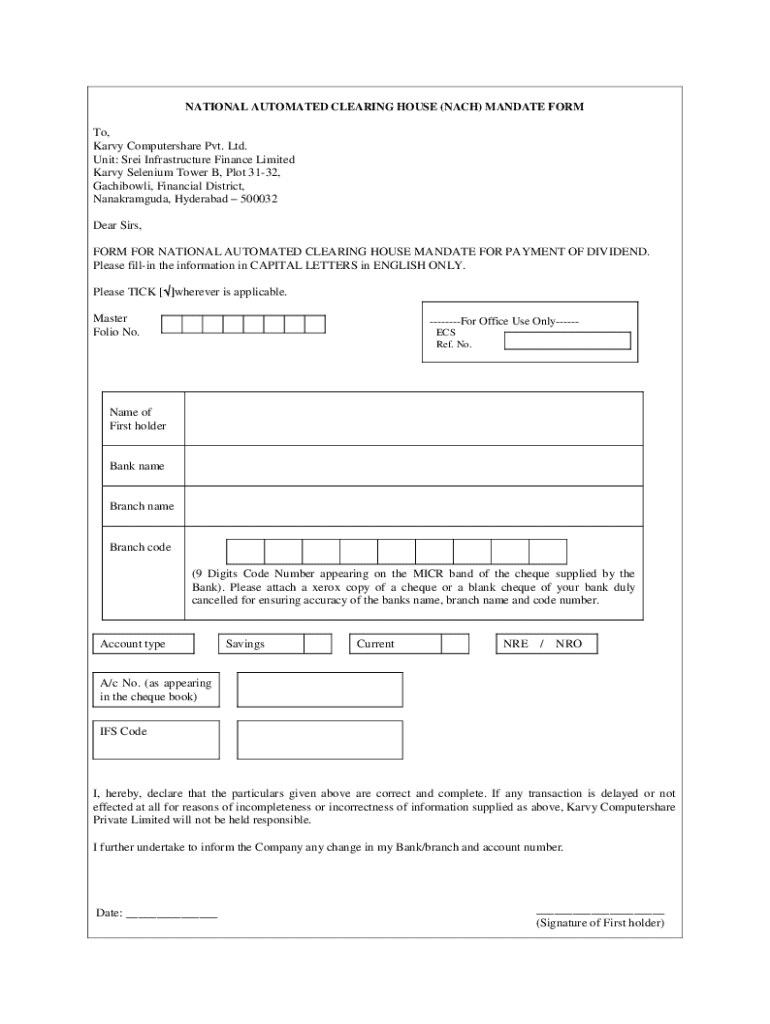

Completing the National Automated Clearing House form correctly is crucial to avoid complications in fund transfers. Specific information needs to be gathered before you start filling out any forms. Personal details and account information will be pivotal whether you're submitting as an individual or a corporation.

Common fields in the NACH form generally include your bank account information, mandate details, and the required authorization signature. It's essential to complete every section accurately to ensure prompt processing.

To enhance accuracy when completing the form, consider these tips: Always double-check the entered information to catch potential mistakes, know how to make corrections if something is wrong, and leverage pdfFiller's editing tools for adjustments in real-time.

Editing and signing the NACH form with pdfFiller

After filling out the NACH form, you might find that you need to edit some sections or add additional information. pdfFiller's platform allows you to make these edits easily and intuitively, enhancing the user experience.

For example, if you need to redact sensitive information from the form, pdfFiller offers solutions for secure deleting or hiding details so that any shared documents remain private.

Additionally, electronic signatures are becoming a staple in document handling. Creating an electronic signature using pdfFiller is seamless. You can draw, type, or upload an image of your signature. Once you've signed the form, you have multiple options for sending it electronically, ensuring that the submission process is efficient.

Collaboration on the NACH form can also streamline your workflow. By inviting team members to review the form using pdfFiller’s collaboration features, you can gather input and finalize documents efficiently. Utilize commenting tools to discuss amendments or clarifications directly on the form.

Managing and submitting the NACH form

With your NACH form completed and signed, the next step lies in managing and submitting the document appropriately. Saving your filled forms for future reference is vital, especially for maintaining financial records. pdfFiller allows you to store these documents securely in the cloud, making them accessible from anywhere.

For best practices in submission, consider the following recommendations: Timing is important; ensure you submit forms well ahead of deadlines to allow processing time. Additionally, tracking your submission’s status is crucial, particularly when dealing with financial institutions that often have specific processing windows.

Troubleshooting common submission issues can save time and resources. Issues may arise from incorrect data, missing signatures, or submission to the wrong department. Familiarize yourself with potential FAQs offered by your bank to anticipate problems.

Understanding the benefits of using NACH

The growth of the National Automated Clearing House has transformed how individuals and businesses conduct transactions in India. For individuals, one of the primary advantages of using NACH is the convenience of direct debit and credit payments. This eliminates the need for manual checks and cash handling, fostering a shift toward digital reliance.

Moreover, enhanced security measures ensure safeguard against potential fraud, assisting users in keeping better records of their financial activities. For corporates, NACH translates into cost efficiency, as utilizing this method reduces overhead related to payment processing and enhances financial reporting accuracy.

Furthermore, NACH significantly impacts financial inclusion in India, allowing diverse populations to access banking services without the need for physical branches. This technological advance plays a pivotal role in reducing economic barriers and promoting broader participation in the financial ecosystem.

FAQs about the National Automated Clearing House

Addressing common questions regarding the National Automated Clearing House can alleviate confusion for new users. For instance, the full form of NACH is indeed 'National Automated Clearing House', which helps clarify its purpose related to electronic transactions.

Primary uses of NACH include handling direct debit transactions, salary disbursements, and bill payments, making it a versatile tool for various financial needs. Furthermore, NACH implements robust dispute resolution measures, ensuring users can address errors swiftly and effectively.

When it comes to security, NACH employs stringent protocols to ensure user data remains protected, instilling confidence in individuals. Also, individuals can absolutely utilize NACH for personal transactions, streamlining their payment processes.

Conclusion and final thoughts on NACH form utilization

The National Automated Clearing House form is more than just a transactional document; it represents a shift towards efficient payment processing in India. With various forms available for personal, corporate, and government transactions, understanding how to navigate this system is crucial for maximizing its potential.

Encouragement to use platforms like pdfFiller allows users to manage their NACH forms effortlessly, taking advantage of features that facilitate editing, signing, and submitting documents securely. Adopting such tools can greatly enhance your document management capabilities, promoting a smoother financial operation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in national automated clearing house?

How do I complete national automated clearing house on an iOS device?

How do I complete national automated clearing house on an Android device?

What is national automated clearing house?

Who is required to file national automated clearing house?

How to fill out national automated clearing house?

What is the purpose of national automated clearing house?

What information must be reported on national automated clearing house?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.