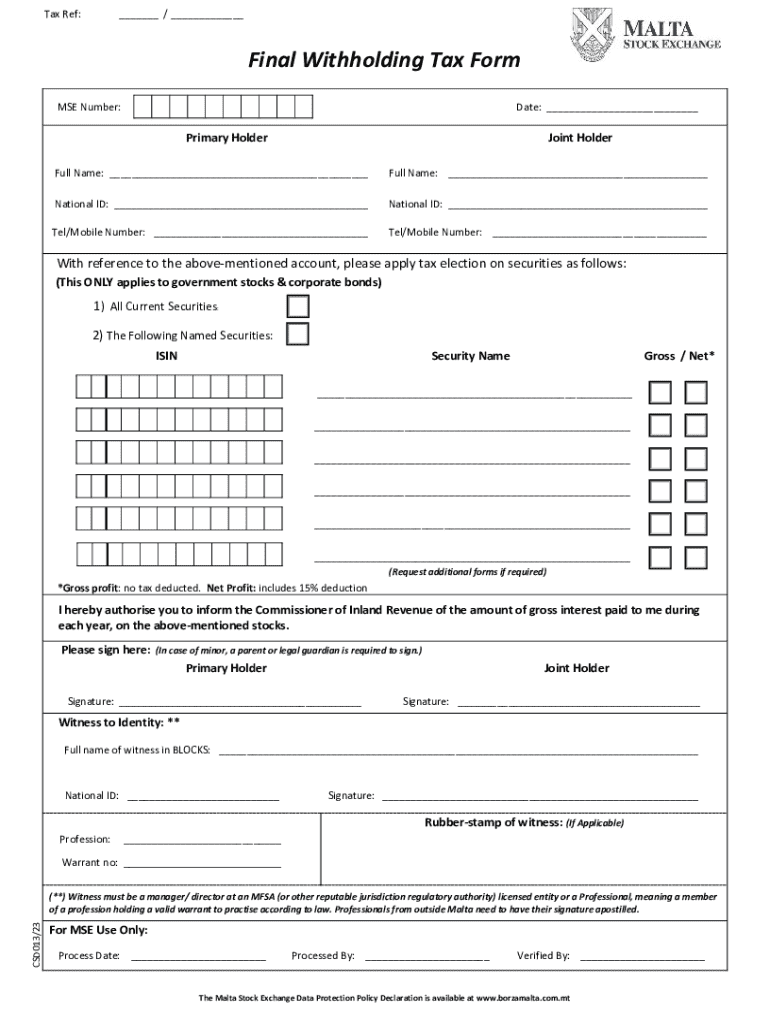

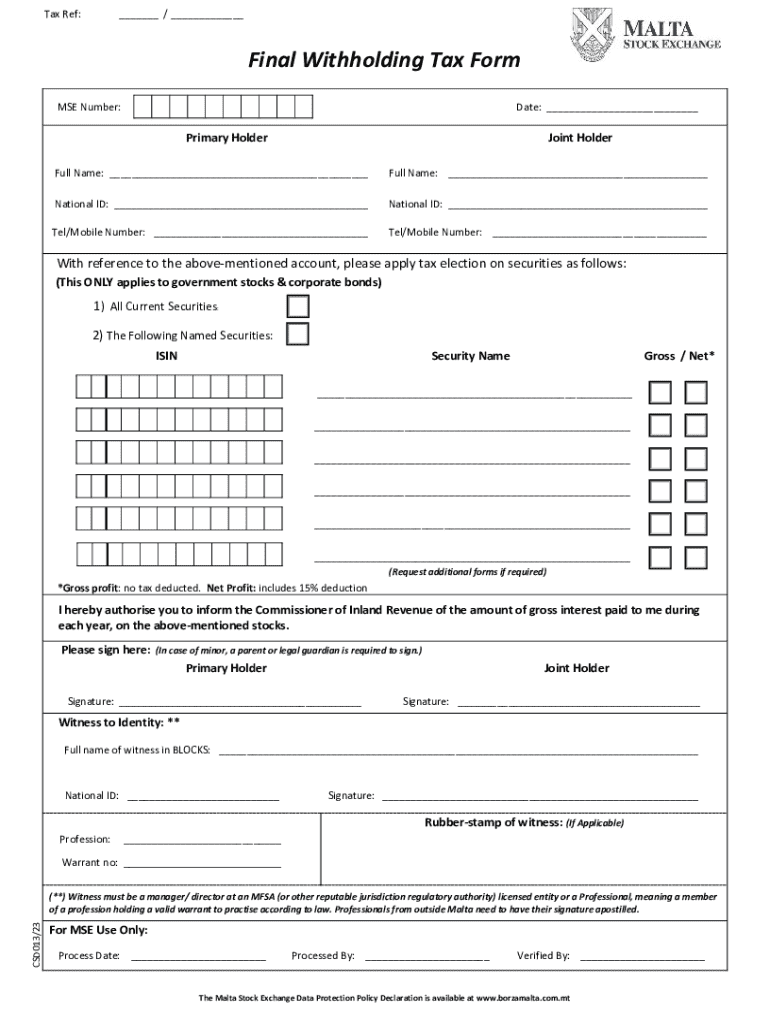

Get the free Final Withholding Tax Form

Get, Create, Make and Sign final withholding tax form

Editing final withholding tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out final withholding tax form

How to fill out final withholding tax form

Who needs final withholding tax form?

Final Withholding Tax Form: A Comprehensive Guide

Understanding the final withholding tax form

The final withholding tax form serves as a crucial document for taxpayers, encapsulating information about taxes withheld on specific income types. This form is typically used to report income on which tax has already been withheld at the source, hence the term 'final.' Understanding the essence of this form is vital for financial compliance and effective personal and corporate tax management.

Without the final withholding tax form, both taxpayers and withholding agents may face significant penalties due to non-compliance. As transactions become increasingly paperless and digitized, taxpayers must grasp the implications of this form, ensuring accurate reporting and tax filing.

Who needs to file the final withholding tax form?

The obligation to file the final withholding tax form extends to various entities, both individuals and organizations. Taxpayers who receive income subject to withholding taxes must ensure that they complete and submit this form accurately to avoid complications with tax authorities.

In the case of individuals, those with income that has tax withheld—such as employees, freelancers, or contractors—are typically required to fill this out. Additionally, non-resident aliens and foreign entities receiving income from domestic sources must also comply, ensuring the correct amount of taxes is accounted for.

Timeline for filing the final withholding tax form

Timeliness in filing the final withholding tax form is not just a best practice but a legal necessity. Tax authorities establish specific deadlines for submissions, often based on the nature of the income and the taxpayer's filing status. It's pivotal for individuals and organizations to note these dates to avoid incurring penalties.

Filing deadlines can vary—some individuals may need to file annually, while others could be required to submit quarterly based on their income levels. Furthermore, extensions might be available under certain circumstances, but one should be cautious as late filings can lead to significant fees and interest on unpaid balances.

Step-by-step guide on how to fill out the final withholding tax form

Completing the final withholding tax form can be straightforward when broken down into a series of manageable steps. Begin by accessing the form, which can easily be done either by downloading it from pdfFiller or utilizing their web-based editor. This format allows for interactive filling and reduces the likelihood of errors typically associated with physical document editing.

Begin with the personal information section, accurately inputting your name, TIN, and other identifying details. Next, detail your income sources in the income section, ensuring that all amounts reflect what has been reported by payers. Finally, conduct tax calculations with a keen eye, verifying that the withholding amounts align with your earnings—a step crucial to ensure the integrity of your submission.

Editing and managing your final withholding tax form

Once you've filled out the final withholding tax form, effective management of this document becomes essential. With pdfFiller’s comprehensive PDF editing tools, you can seamlessly modify any section of your form. This feature is especially beneficial if you realize edits are needed post-completion. You can easily make alterations, such as correcting a mistyped amount or adding additional notes for your records.

Moreover, utilizing pdfFiller's cloud capabilities offers excellent advantages, as your forms are stored securely with easy access, removing the hassle of maintaining physical copies. Implementing effective file organization strategies can significantly streamline your interactions with tax documents, ensuring quick retrieval for future audits or reference.

Signing and submitting your final withholding tax form

The final step in managing your final withholding tax form is its submission. With advancements in technology, users now have the convenience of electronic signatures—valid and recognized by many jurisdictions, making the process streamlined and efficient. Leveraging pdfFiller, you can eSign documents directly, ensuring that your signature is securely affixed and that your submission is compliant with all relevant regulations.

Additionally, choosing between e-filing and mail submission depends on individual circumstances and preferences. E-filing is generally faster and offers immediate confirmation of receipt from the tax authority, while mailing can be subject to delays depending on postal services. Either option chosen requires proper verification to ensure all documentation is correctly submitted.

Managing changes and amendments to your final withholding tax form

As life and financial circumstances can change, realizing that you may need to amend your final withholding tax form is vital. Understanding how to effectively make these changes can save time and money. The process typically involves submitting an amended return and declaring the specific changes for clarification with the tax authorities.

Bear in mind the timelines associated with amendments—each tax authority typically enfolds deadlines for submitting changes. Staying abreast of updates regarding new requirements and processes can ensure you're not caught off-guard during tax season.

Frequently asked questions (FAQs) about the final withholding tax form

As you navigate the intricacies of the final withholding tax form, several questions often arise. Common queries range from understanding what constitutes income subject to withholding to how to accurately complete the form to avoid misreporting. Engaging with these questions prepares you better for compliance while eliminating misconceptions.

It’s worthwhile to tap into expert insights as well—experienced tax professionals can shed light on the nuanced aspects of tax forms, ensuring your understanding is comprehensive. For personalized assistance, many resources are available, including IRS support and community forums, addressing specific concerns that may arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute final withholding tax form online?

How do I edit final withholding tax form online?

How can I edit final withholding tax form on a smartphone?

What is final withholding tax form?

Who is required to file final withholding tax form?

How to fill out final withholding tax form?

What is the purpose of final withholding tax form?

What information must be reported on final withholding tax form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.