Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

Editing form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

How to Fill Out Form 5500-SF: A Comprehensive Guide

Understanding Form 5500-SF

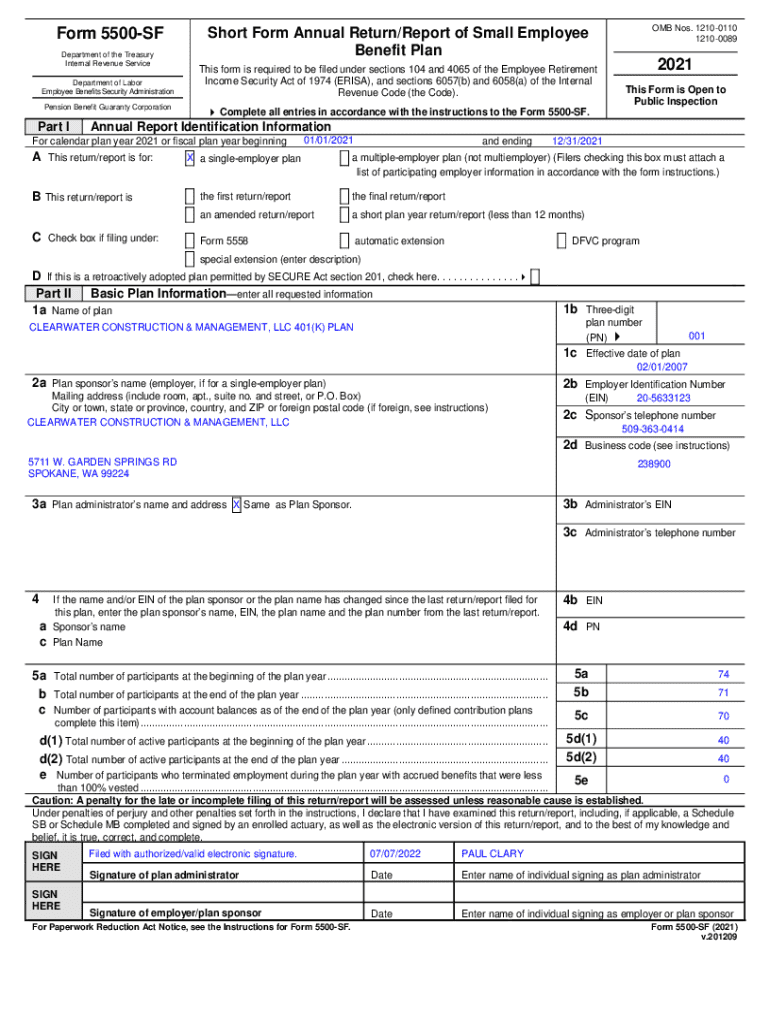

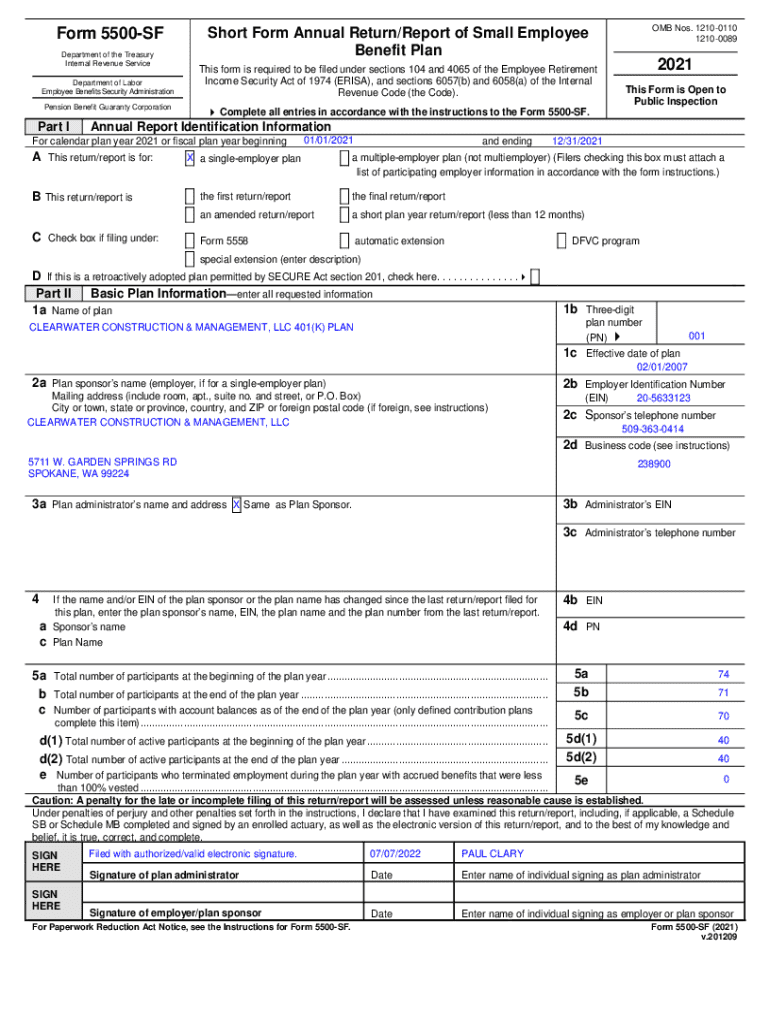

Form 5500-SF is a simplified version of the Form 5500 used by small pension and welfare benefit plans to report their financial status to the Department of Labor (DOL) and the Internal Revenue Service (IRS). This form is essential for ensuring transparency and compliance regarding employee benefit plans. The primary objective of Form 5500-SF is to provide easy access to important information about a plan's financial health and operations.

The importance of Form 5500-SF cannot be overstated, as it serves both regulatory and participant interests by ensuring that employee benefit plans maintain accountability. In terms of who needs to use this form, any small plan with fewer than 100 participants, which also qualifies for simplified reporting, is required to file it annually.

Quick links to key resources

Accessing the Form 5500-SF can be done through the official website of the DOL or directly via pdfFiller, which offers a user-friendly interface for managing forms. You can also find various related forms and templates useful for filing. Additionally, pdfFiller provides interactive tools that simplify document management, making your filing process more efficient.

Filing requirements for Form 5500-SF

Not every plan is required to file Form 5500-SF. The requirement is typically for plans that cover fewer than 100 participants and are not exempt from the filing requirements based on size or type. The specific filings due date is the last day of the seventh month following the end of the plan year. Extensions can be requested if necessary, but it's crucial to submit your requests in a timely manner to avoid potential penalties.

Getting started: preparations before filing

Before you begin filling out Form 5500-SF, it's essential to gather all necessary information and data. This includes identifying plan information such as plan name, type, and year, as well as collecting financial data including assets, liabilities, and contributions. These details are crucial for accurately completing the form and ensuring compliance with regulations.

Choosing the right filing method is also an important step. Electronic filing is often the preferred method due to its convenience and efficiency. Using pdfFiller for filing can streamline the process, as it allows users to edit, sign, and submit the form all in one platform. This minimizes the risk of errors while providing a clear audit trail.

Step-by-step instructions for completing Form 5500-SF

Common changes and updates to note

As regulations evolve, it's essential to stay informed about key changes to Form 5500-SF. In 2023, several updates were introduced that affect how organizations report on their plans. Understanding the adjustments to the EFAST2 processing system is crucial, as these enhancements are aimed at making the filing process more efficient and user-friendly.

It’s important to review new forms and schedules introduced and understand their requirements, as compliance is key to avoiding penalties.

Addressing potential issues and compliance concerns

Filing Form 5500-SF can sometimes lead to pitfalls. Common errors include missing entries and typos, which can trigger unnecessary audits and penalties. It’s critical to double-check all entries, comparing them with supporting documents to ensure accuracy.

If you're late in filing, immediately consider utilizing the Delinquent Filer Voluntary Compliance (DFVC) Program. This program allows you to correct your filing status while potentially avoiding steep penalties. Understanding the various penalties associated with late filing can save you from unexpected financial burdens.

How to get assistance and further support

For those who find the filing process daunting, assistance is readily available. pdfFiller offers extensive support for form completion, which can help elucidate confusing sections or requirements. Moreover, contacting professionals who specialize in employee benefits can provide tailored guidance to fit your unique needs.

Additionally, community forums and online support groups can be a wealth of information, as they allow users to share experiences and tips on successfully filing Form 5500-SF.

Utilizing pdfFiller for seamless document management

Using pdfFiller's platform significantly enhances the ease of document management. The platform supports editing, eSigning, and collaborating on Form 5500-SF, which ensures that all stakeholders can seamlessly participate in the filing process. This collaborative feature enriches the accuracy and efficiency of completing the form.

Moreover, pdfFiller’s secure cloud-based management solutions provide peace of mind, ensuring that your documents are accessible anytime and anywhere while keeping your information safe from unauthorized access.

Important notes on signatures

When filing Form 5500-SF, understanding the required signatures is pivotal. The form must typically be signed by the plan administrator or an authorized service provider. Knowing who can sign off on the document can save time and reduce errors during the submission process.

Digital signature compliance has also become more prevalent, allowing for faster processing times and improved record-keeping capabilities. It’s essential to ensure that any digital signatures used meet IRS compliance standards to avoid complications.

Additional filing considerations

Some plans may be exempt from filing Form 5500-SF based on criteria such as the type of benefits offered or the size of the plan. Understanding these exceptions is important for compliance efforts and helps prevent unnecessary paperwork.

Future planning also involves keeping track of changes in plan year and understanding additional compliance requirements for different plan types, which might include various disclosures or updates based on employee demographics or revenue levels.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 5500-sf?

How can I fill out form 5500-sf on an iOS device?

How do I complete form 5500-sf on an Android device?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.