Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

How to edit crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

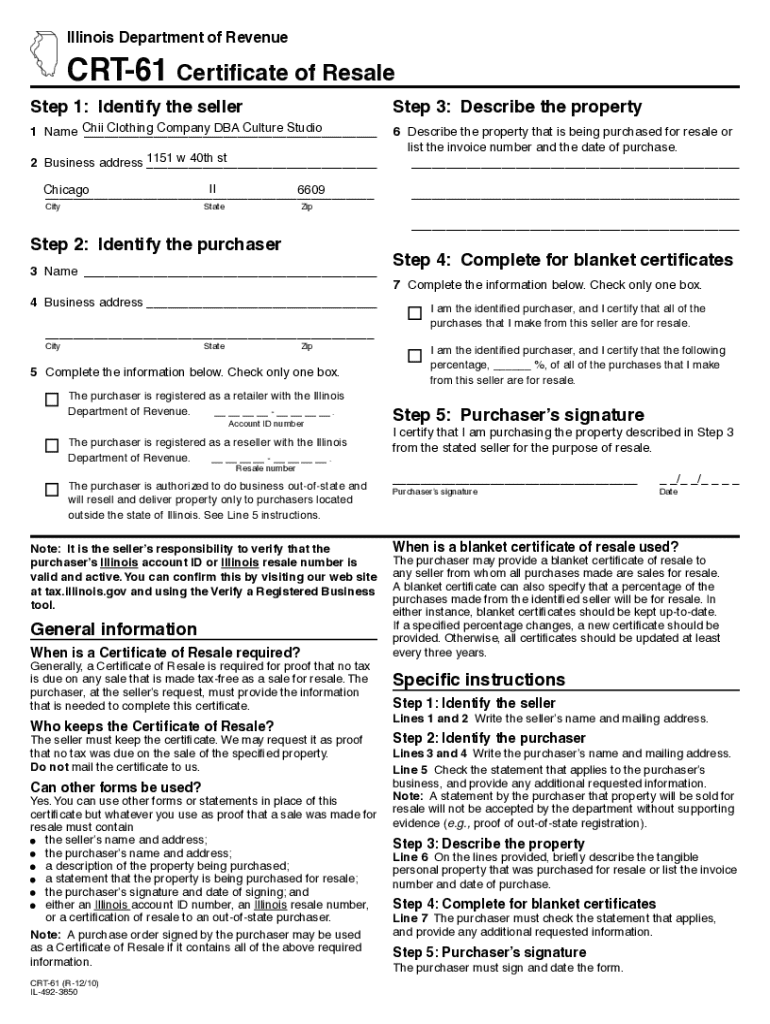

Understanding the CRT-61 Certificate of Resale Form

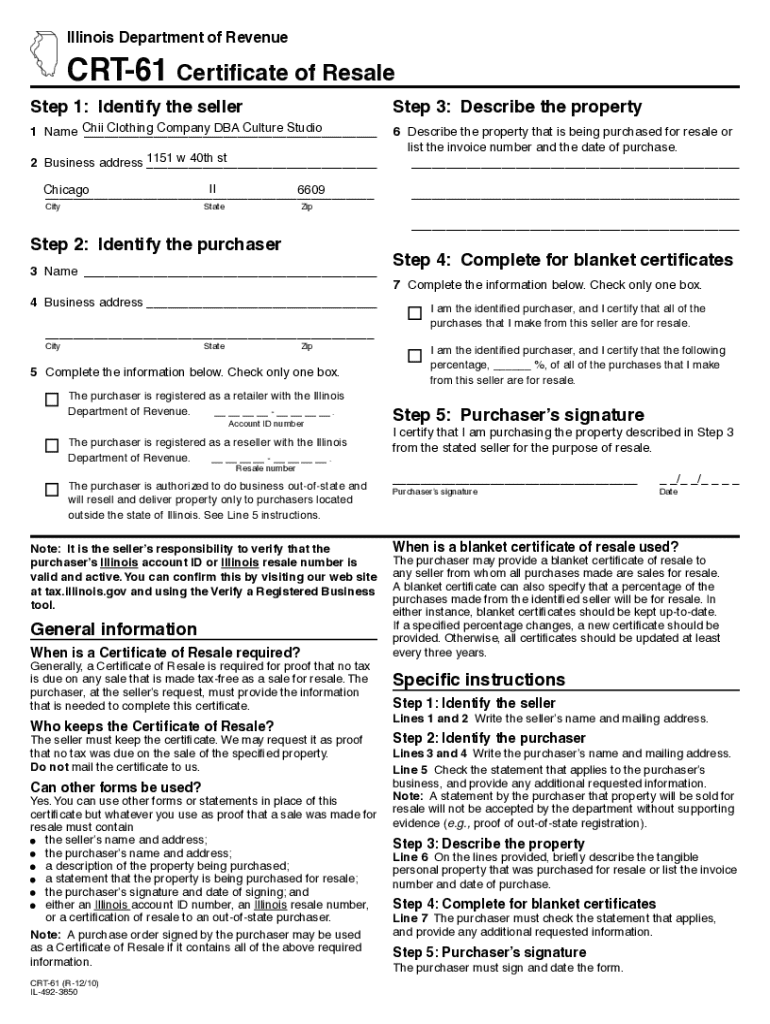

What is the CRT-61 certificate?

The CRT-61 Certificate of Resale form is a crucial document used in the state of Illinois to exempt eligible purchases from sales tax. This certificate empowers businesses to buy goods for resale without incurring sales tax at the point of purchase, streamlining the process of selling merchandise. For retailers, this is vital to their operations as it allows them to pass on the benefits of competitive pricing to their customers.

The importance of the CRT-61 certificate extends beyond tax savings. It instills a layer of trust in transactions as it confirms that a buyer qualifies as a legitimate resale entity, which is essential for compliance with tax regulations. Understanding and utilizing this certificate can lead to better financial management and compliance for businesses engaged in resale activities.

Who needs a CRT-61 certificate?

Businesses involved in retail and wholesale operations are the primary users of the CRT-61 certificate. This includes grocery stores, clothing retailers, and electronic shops that sell products directly to consumers. If you're buying items to resell them as part of your business, you're likely required to present this certificate when making purchases.

Illinois state regulations allow a diverse range of professionals and entities to use the CRT-61 certificate, including corporation representatives, partnerships, sole proprietorships, and even non-profit organizations under certain conditions. It's important to be aware of the specific requirements and definitions your state maintains to ensure compliance.

How to complete a CRT-61 certificate of resale form

Completing the CRT-61 certificate form might seem daunting initially, but it follows a straightforward process. First, ensure you have the most current version of the form, which can be found on the Illinois Department of Revenue’s website or on pdfFiller, a platform that provides the necessary templates for easy access. Begin by filling out your business name, address, and seller’s identification number. This information validates your identity as an entity qualified to utilize the resale certificate.

Common mistakes include failing to provide an accurate seller's ID number or leaving out crucial details about the items being purchased. It's beneficial to use interactive tools available on platforms like pdfFiller that guide you through each step.

Information required on the CRT-61

The CRT-61 requires specific information for proper processing. This includes the buyer's name, address, and identification number, which are essential for validation of the resale status. An accurate description of the items included in the transaction is also vital, as it establishes what goods fall under the resale agreement.

These fields ensure the certificate is compliant with state regulations and serves as a reliable document in case of audits or inquiries. Accuracy is not just a requirement; it also fosters confidence and transparency in business transactions, promoting robust business relationships.

How to accept a CRT-61 certificate from customers

When you receive a CRT-61 certificate from customers, it's essential to treat it with diligence. As a retailer or service provider, first confirm that the document is filled out correctly. Verify that it includes the buyer's details, and importantly, ensure the signature is present. This not only protects your business but also ensures alignment with tax regulations.

Implementing a systematic approach to track receipt and storage of CRT-61 certificates will ease future audits and validate tax-exempt purchases.

Verifying a CRT-61 certificate

Verifying the authenticity of a CRT-61 certificate is a proactive step in mitigating risks associated with non-compliance. One method of verification is cross-referencing the seller's ID with state databases or tax records. Additionally, many states offer online resources which allow you to confirm the validity of the certificate.

Taking these measures helps reinforce your business's credibility and assures adherence to local taxation laws.

Sales tax implications of using the CRT-61

Utilizing the CRT-61 certificate directly correlates with sales tax exemption, which fundamentally differs from the standard sales tax exemption status granted to non-profits or government entities. The CRT-61 is strictly designed for resale operations, allowing purchasers to buy items without incurring sales tax if those goods are meant to be resold.

Understanding the nuances of sales tax laws is vital for compliance purposes. Filing the incorrect forms can result in tax liabilities and penalties. Distinguishing between items that are qualified for resale versus those that are not is essential, as misuse of the CRT-61 certificate could lead to audits or financial scrutiny.

Maintaining compliance with state regulations

Once a CRT-61 certificate is issued, it’s important to adhere to state regulations regarding retention. Typically, you should maintain these certificates for a minimum of three years after the date of purchase, or until an audit is resolved. This timeline varies by state, making it crucial to familiarize yourself with specific local guidelines.

When managing these sales tax exemption certificates, consistent documentation can significantly bolster your defense in the case of any audits or inquiries by the Illinois Department of Revenue.

How the CRT-61 compares to other state resale certificates

The CRT-61 is unique to Illinois, and while many states have similar resale certificates, various laws and regulations dictate how they can be used. For example, California’s resale certificate allows similar exemptions but has different rules on form completion and retention periods. Understanding these differences can be significant for businesses operating in multiple states.

Each state’s version of a resale certificate serves the same basic purpose but can differ substantially in terms of the required data, processes for issuing them, and the legal ramifications of misuse. Retailers must always ensure that they’re using the correct forms for the respective state of operation.

Navigating marketplace facilitator laws

In recent years, Illinois has implemented marketplace facilitator laws that change how online sales work, including the acceptance and management of CRT-61 certificates. If you’re selling through platforms such as Amazon or eBay, you must be aware of the laws governing resale certificates applicable within those contexts.

Marketplace facilitators are generally responsible for collecting and remitting sales tax on sales made via their platforms. It’s necessary for retailers to know how these laws affect their obligations and whether they need to collect CRT-61 certificates for transactions in these environments.

Case studies: successful use of the CRT-61

Many Illinois-based businesses have successfully utilized the CRT-61 certificate to maximize profits while ensuring compliance. For instance, a local pet store leveraged this certificate to purchase inventory tax-free, allowing them to maintain competitive pricing against larger retailers. By properly managing their resale certificates, the store was able to invest the saved tax funds back into the business for marketing and engagement.

These examples highlight the effectiveness of understanding and properly employing the CRT-61 certificate as part of a broader business strategy, encouraging continual growth within the local economy.

Technology and tools for managing CRT-61 certificates

In the digital age, managing CRT-61 certificates can be made effortless with tools like pdfFiller. This platform not only provides the necessary templates but also enables seamless editing, signatures, and storage of documents, all from a single cloud-based interface. By utilizing innovative document management solutions, businesses can enhance their operational efficiency and keep organized records.

Embracing such technology not only minimizes the risk of inaccuracies but also frees businesses to focus on growth rather than paperwork.

Common queries about the CRT-61 certificate

Many users frequently have questions regarding their ability to utilize the CRT-61 certificate effectively. Common concerns include who qualifies for the certificate and how to maintain compliance with ever-changing tax laws. Clarifying these misunderstandings early can save businesses from potential issues down the line.

Engaging with regularly updated resources like those provided by pdfFiller ensures that users have the most accurate information and guidance at their disposal.

Expert tips for navigating the CRT-61 process

Navigating the CRT-61 process doesn’t have to be complicated. Experts suggest maintaining clear communication with your suppliers about your needs for sale certificates and ensuring all details are accurate. They also recommend keeping abreast of legislative changes that could affect the use of CRT-61 certificates in Illinois, allowing your business to adjust proactively.

These proactive steps can streamline your operations, ensuring that your business remains compliant with local regulations while also enhancing your ability to serve customers effectively.

Where to find more information on the CRT-61 certificate

For more information about the CRT-61 certificate, consult the Illinois Department of Revenue’s official website, which provides the latest updates, form downloads, and detailed instructions on how to use the certificate efficiently.

These resources ensure businesses remain compliant and informed, reducing the likelihood of tax-related issues.

Get assistance with the CRT-61 certificate

If you face challenges or need clarification about the CRT-61 process, consider reaching out to tax professionals or legal advisors specializing in state tax law. They can provide tailored guidance based on your specific operational needs, ensuring you’re compliant and efficiently managing resale certificates.

Utilizing these resources will bolster your confidence in handling the CRT-61 certificate and contribute to a seamless business operation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify crt-61 certificate of resale without leaving Google Drive?

Can I sign the crt-61 certificate of resale electronically in Chrome?

How do I fill out crt-61 certificate of resale using my mobile device?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.