Get the free Official Form 201

Get, Create, Make and Sign official form 201

How to edit official form 201 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out official form 201

How to fill out official form 201

Who needs official form 201?

Your Comprehensive Guide to the Official Form 201 Form

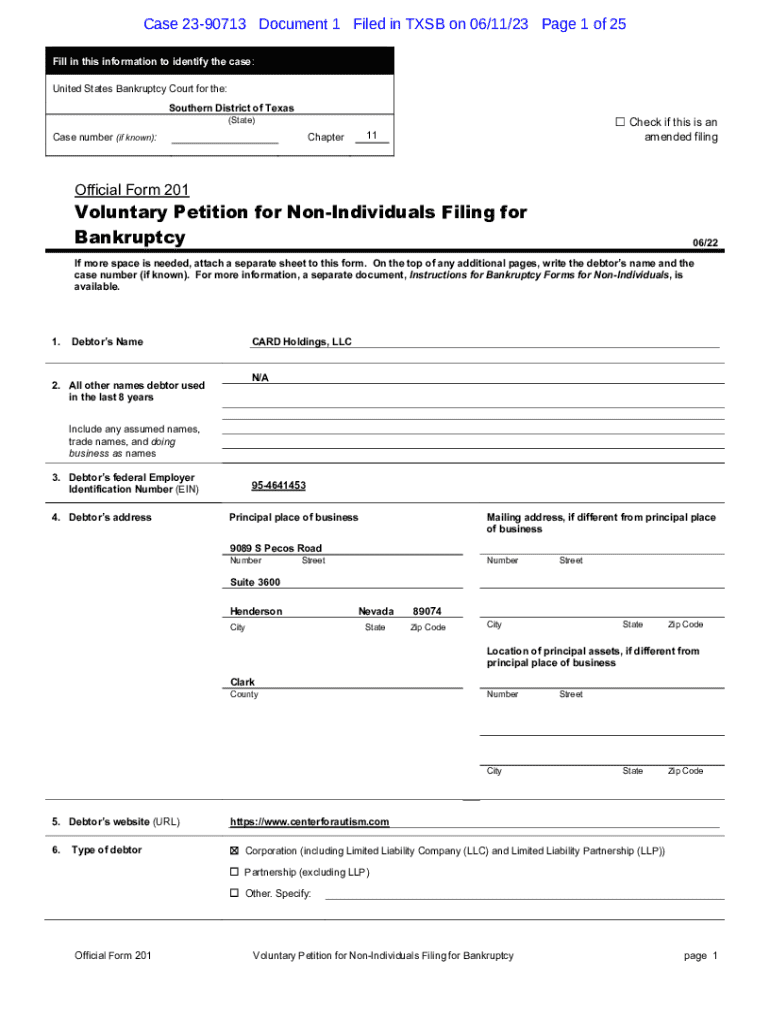

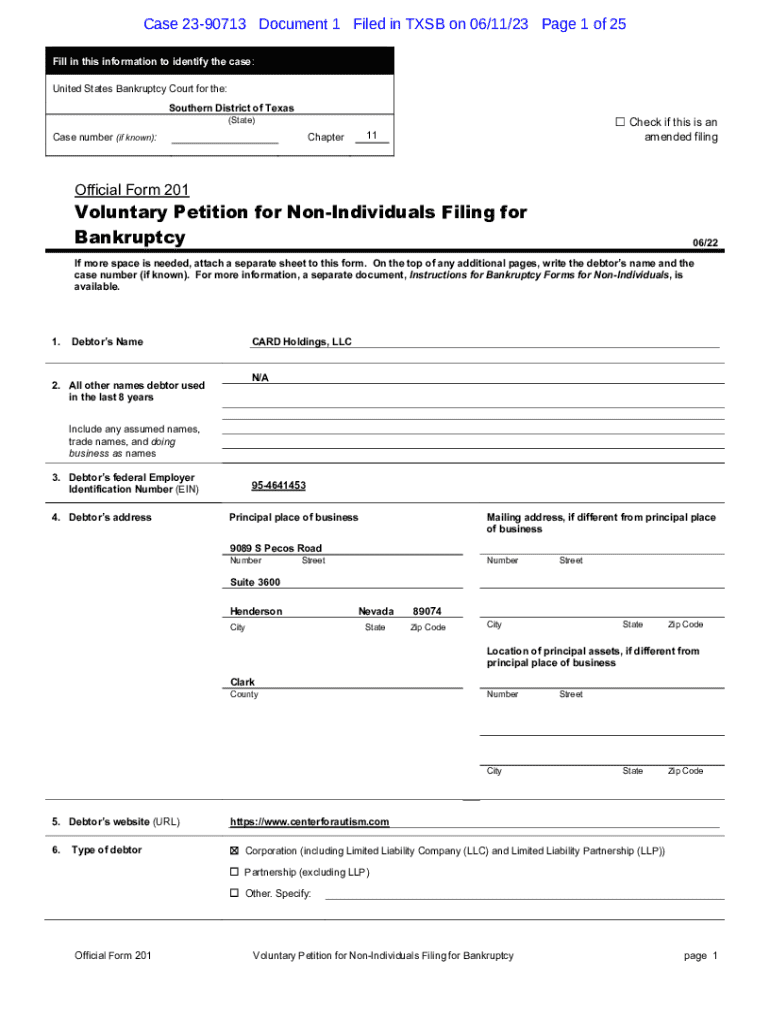

Understanding the Official Form 201

The Official Form 201, often referred to as the 'Voluntary Petition for Individuals Filing for Bankruptcy,' is a critical document in the U.S. bankruptcy process. Designed for individuals who seek debt relief under Chapter 7 or Chapter 13, this form allows debtors to formally request the court to discharge their debts. Its primary purpose is not only to initiate the bankruptcy procedure but to disclose the debtor's financial position, including income, expenses, assets, and liabilities.

The importance of the Official Form 201 cannot be overstated; it serves as the cornerstone of the bankruptcy filing process. Without it, the court cannot proceed with evaluating the bankruptcy case. Therefore, filling it out accurately and thoroughly is crucial to successful navigation through the bankruptcy system.

Who uses the Official Form 201?

The primary users of the Official Form 201 are individuals dealing with significant financial troubles who wish to explore bankruptcy as a means of relief. It is often utilized by those unable to repay their debts due to various reasons such as job loss, medical expenses, or unforeseen circumstances. Typical scenarios necessitating the use of the form include overwhelming credit card debt, mortgage foreclosure, or wage garnishments.

Key features of the Official Form 201

The structure of the Official Form 201 is methodically organized to capture essential information concerning the debtor. It typically includes several sections such as personal details, assets, liabilities, income, expenses, and declarations regarding the debtor's financial situation. Each segment is designed to provide the court with a complete picture of the debtor’s financial health and obligations.

The form mandates specific entries to ensure accuracy and detail. Required information spans across: 1. Personal Identification: Name, address, and personal identification numbers. 2. Financial Information: Detailed list of assets (real estate, vehicles, bank accounts) and liabilities (debts of all types). 3. Income and Expenses: Monthly income sources and detailed breakdown of monthly expenses. 4. Signature: Mandated sign-off certifying the accuracy of the information provided.

Step-by-step guide to filling out the Official Form 201

Filling out the Official Form 201 might seem daunting, but it becomes manageable when broken down into steps. The first step is to download the form in the preferred format. You can conveniently find the Official Form 201 on pdfFiller, which offers it in accessible formats like PDF or as an online editor to fill directly in your browser.

Once you have the form downloaded, proceed to complete it. Each section requires specific details: - Begin with your personal information. Make sure to write your name and address accurately as it will reflect in official documents. - For the financial disclosures, take time to gather documents that validate your assets and debts. This includes bank statements, pay stubs, and mortgage documents. Be thorough in presenting all data.

After completing the entries, it's essential to review the document. A careful proofreading process will help catch any potential mistakes that may cause delays in processing your case. pdfFiller provides useful editing tools to assist in this process. After you're confident everything is correct, e-sign the document directly through pdfFiller, which streamlines submission.

Finally, ensure you understand the methods for submitting the form. This may include electronic submission through the electronic court filing system or mailing a physical copy, depending on local rules. Familiarize yourself with any deadlines to avoid complications.

How to edit and manage your Official Form 201

Managing the Official Form 201 after its completion involves being able to revise and store it securely. pdfFiller provides a comprehensive suite of tools that allow users to make any necessary revisions directly within the platform. If changes arise, for example, additional debt is discovered or income sources change, you can easily access and edit your saved forms.

For secure storage, pdfFiller offers cloud storage solutions, ensuring that your forms are kept safe and accessible. Adopting best practices for document management, such as organizing forms by categories and consistently labeling them, can greatly simplify retrieval when necessary.

Collaborating on the Official Form 201

Collaboration can play an essential role in filling out the Official Form 201, especially when multiple parties are involved, such as spouses or financial advisors. pdfFiller facilitates sharing of the form with others for feedback and input. This can streamline the process, allowing various stakeholders to contribute their insights effectively.

To collaborate, simply utilize the sharing features within pdfFiller. Invite collaborators via email to review the document. Collecting feedback is made easy as involved parties can directly add their comments or modifications. After gathering input, revisions can be implemented swiftly, keeping the document accurate and up-to-date.

Troubleshooting common issues

While filling out the Official Form 201, several common errors can hinder the filing process. For instance, omitting critical information or providing incorrect figures can lead to the form being rejected or delayed. To avoid this, carefully review each section, and double-check numbers against relevant documents.

For any technical assistance while using pdfFiller, an array of resources is available. The platform includes a comprehensive FAQ section addressing frequent issues. Customers can also reach out to support personnel whenever encountering more complex challenges, ensuring that you have support when needed.

Additional tips for effective use of the Official Form 201

Completing legal forms like the Official Form 201 requires attention to detail and an understanding of the implications of your submission. To ensure clarity and prevent misunderstandings, write in simple, direct language. Each section should be completed meticulously, with no assumptions made about the reader's knowledge.

Understanding the legal ramifications of submitting the Official Form 201 is equally important. Successful completion can lead to debt discharge, but it also involves accountability for accurate reporting. Be prepared for outcomes, including potential court hearings or mandatory financial counseling, thereby aiding you in achieving financial stability post-bankruptcy.

Your next steps after submission

Once you submit the Official Form 201, it's important to monitor the progress of your case. Following up with the court system will help you stay informed about any necessary hearings or additional requirements. Typically, you can expect communication from the court or your attorney detailing the next steps.

Moreover, keeping meticulous records of your submission is crucial. Ensure you have copies of all forms submitted, along with any confirmation received from the court. This practice not only aids in clarity but also ensures that you remain organized throughout the bankruptcy process, which is vital in maintaining your progress and understanding your situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit official form 201 online?

How do I fill out the official form 201 form on my smartphone?

Can I edit official form 201 on an Android device?

What is official form 201?

Who is required to file official form 201?

How to fill out official form 201?

What is the purpose of official form 201?

What information must be reported on official form 201?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.