Get the free Ct-v 03-24

Get, Create, Make and Sign ct-v 03-24

Editing ct-v 03-24 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-v 03-24

How to fill out ct-v 03-24

Who needs ct-v 03-24?

Your ultimate guide to the ct- 03-24 form for seamless document management

Understanding the ct- 03-24 form

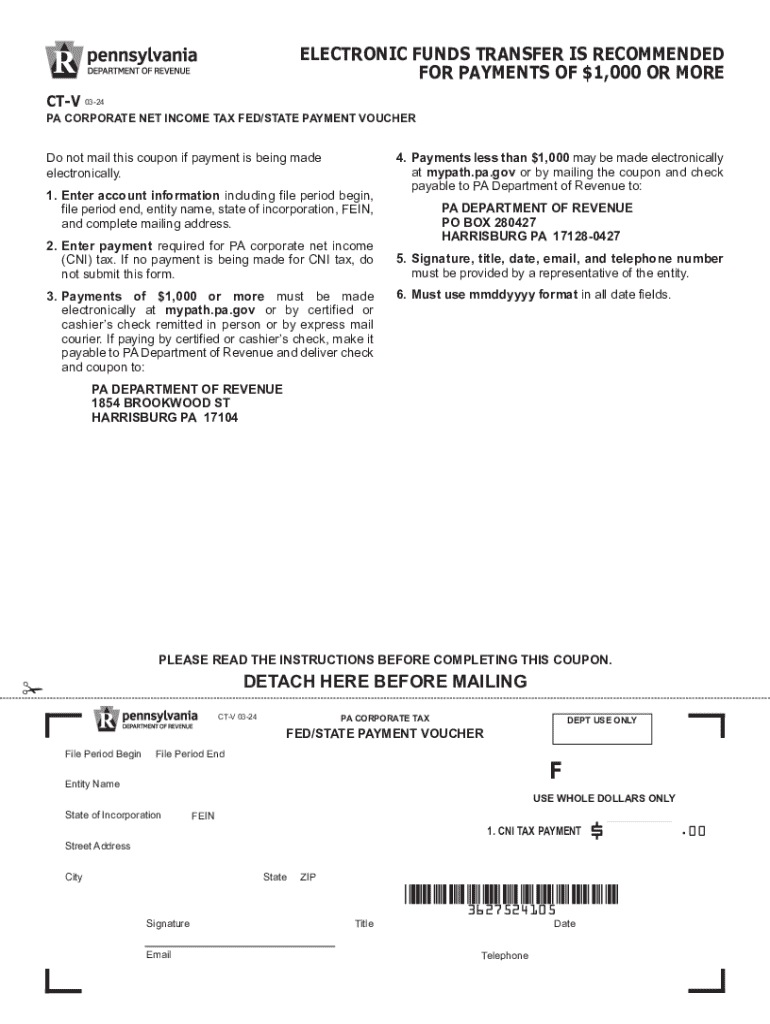

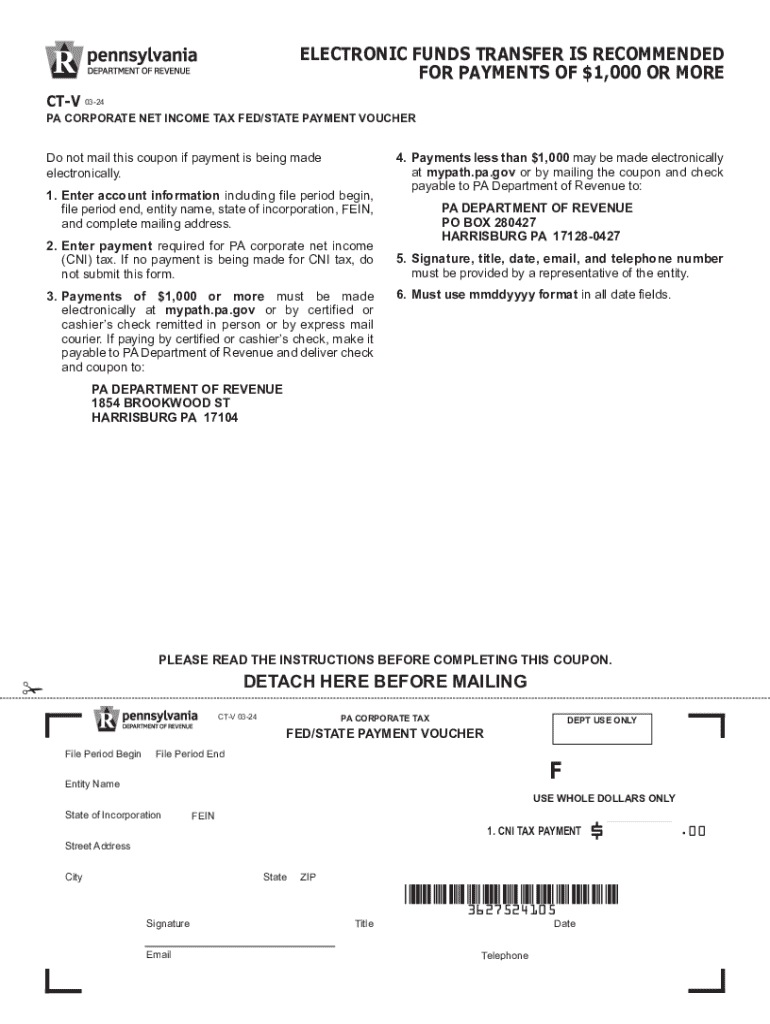

The ct-v 03-24 form is a crucial document that plays an essential role in various administrative processes. Primarily, it serves to collect relevant information for specific applications or requests within designated sectors. The importance of the ct-v 03-24 form lies in its requirement for accurate, comprehensive data that directly influences the outcome of processes such as claims, applications, or other formal documentation requirements.

Individuals, teams, and organizations turn to the ct-v 03-24 form when they need to fill out specific information that aligns with their operational needs, whether for employment, service requests, or other administrative purposes. Understanding this document not only simplifies the application process but also enhances the efficiency of organizational workflows.

Key features of the ct- 03-24 form

The ct-v 03-24 form is characterized by its distinctive structure designed to accommodate both required and optional fields, ensuring users can provide necessary information while having the flexibility to include additional insights. Required fields typically include personal identification details, contact information, and employment specifics, which form the backbone of the application process.

Optional fields may include additional comments and supplementary data that can bolster an application but are not strictly necessary. It's crucial for users to understand the difference in significance between these fields, as omitting required information can lead to delays or even rejection of the form.

How to access the ct- 03-24 form

Accessing the ct-v 03-24 form is streamlined through various online platforms, especially via pdfFiller. Users looking to download or print the form can find it easily without navigating through complex menus. To ensure efficient access, the official resources provide direct links, simplifying the search process.

To download and print the ct-v 03-24 form using pdfFiller, follow these steps: Visit the pdfFiller website, and use the search bar to enter 'ct-v 03-24 form'. Once you locate it, select the download option, and choose your preferred file format for printing. This ensures that you have a print-ready version available to fill out.

Filling out the ct- 03-24 form

Completing the ct-v 03-24 form involves several distinct sections that require careful consideration. The first section is the personal information section, where you need to input your name, address, date of birth, and other relevant personal details. Ensure that all details are accurate, as errors can lead to complications later in the process.

Next, you will encounter the employment details section, which requires information about your current or past employment, including company names, positions held, and the duration of employment. Finally, don’t forget to sign and date the form, as these are essential for the document's validity. To enhance accuracy, always double-check for common mistakes, such as incorrect dates or missing signatures.

Editing the ct- 03-24 form

One of the notable advantages of using pdfFiller is the versatile editing tools it offers for the ct-v 03-24 form. Users can easily modify content by adding, deleting, or rearranging fields to suit their requirements. This can be particularly useful for individuals who might want to customize the form for specific applications or streamline the information presented.

Incorporating digital signatures is another highlight of pdfFiller functionality. You can sign the ct-v 03-24 form electronically using pdfFiller's digital signature feature, which not only saves time but also ensures that submissions remain within the confines of digital privacy and security.

Collaborating on the ct- 03-24 form

For teams working on collective projects, collaboration is key. pdfFiller allows users to share the ct-v 03-24 form with colleagues for inputs, making it simple to gather feedback or additional information. The collaborative editing features enable multiple users to work on the document simultaneously, streamlining communication and enhancing the overall process.

Managing permissions is also a significant benefit, as it allows you to track who has access to the form, which versions have been edited, and any changes made throughout the collaboration process. This transparency ensures accountability while promoting effective teamwork.

Submitting the ct- 03-24 form

Once the ct-v 03-24 form is accurately filled out and reviewed, it is vital to follow specific submission guidelines. Depending on the intended purpose of the form, completed submissions may need to be sent via email, uploaded to a specific platform, or mailed to a designated office. Make sure to follow the instructions provided by the organization requesting the form.

After submission, confirming receipt should be a priority. Whether it involves receiving a confirmation email or following up with a call, this step ensures that your form was successfully received and will be processed as required.

Managing and storing the ct- 03-24 form

After submission, managing and storing the ct-v 03-24 form can significantly enhance your organizational workflow. Using pdfFiller, users can efficiently organize submitted forms into designated folders for easy access later. This categorization not only aids in retrieval but also makes it easier to keep track of deadlines for follow-ups.

Ensuring document security and privacy is paramount. pdfFiller provides users with various features to secure documents, such as encryption and restricted access, which safeguard sensitive information against unauthorized access.

FAQs about the ct- 03-24 form

It's natural to have questions about the ct-v 03-24 form, especially regarding procedures for corrections or potential rejections. If your ct-v 03-24 form is rejected, the best course is to carefully review the provided feedback, address the highlighted issues, and promptly resubmit.

Requesting corrections is typically straightforward. Users should reach out to the submitting authority with a request, accompanied by clear explanations of the necessary changes. Maintaining open communication can facilitate a quicker turnaround on corrections.

Conclusion on efficient use of the ct- 03-24 form

Utilizing the ct-v 03-24 form effectively can significantly enhance your document management processes. pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform, streamlining workflows for individuals and teams alike. Embracing digital solutions like pdfFiller not only increases efficiency but also simplifies administrative tasks, enabling users to focus on what truly matters in their professional endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ct-v 03-24?

Can I sign the ct-v 03-24 electronically in Chrome?

How do I edit ct-v 03-24 straight from my smartphone?

What is ct-v 03-24?

Who is required to file ct-v 03-24?

How to fill out ct-v 03-24?

What is the purpose of ct-v 03-24?

What information must be reported on ct-v 03-24?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.