Get the free Insurance Quotation Proposal

Get, Create, Make and Sign insurance quotation proposal

How to edit insurance quotation proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance quotation proposal

How to fill out insurance quotation proposal

Who needs insurance quotation proposal?

Comprehensive Guide to the Insurance Quotation Proposal Form

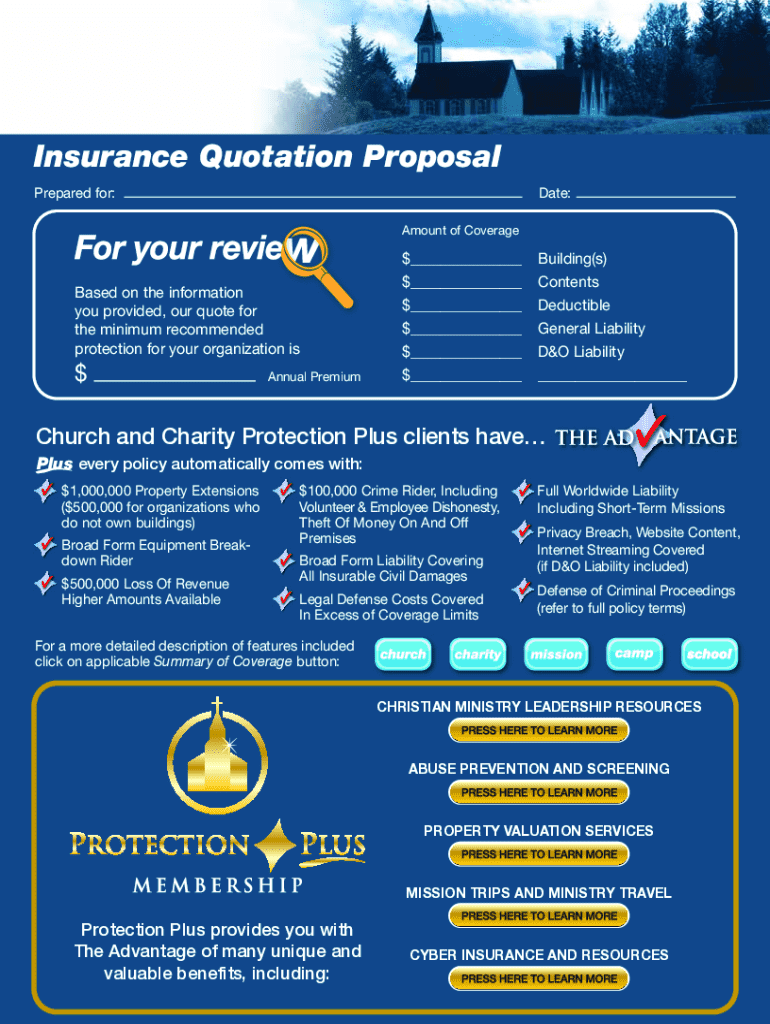

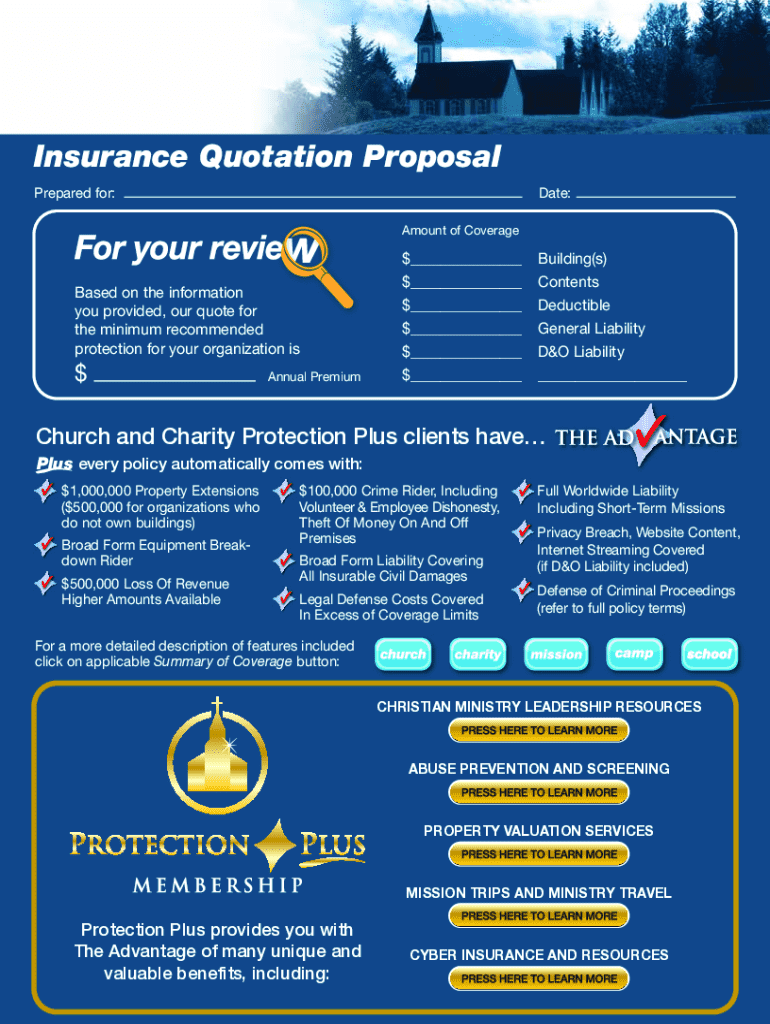

Understanding the insurance quotation proposal form

An insurance quotation proposal form serves as a foundational document in the insurance process. It outlines the terms and costs for potential coverage, providing clients with a clear overview of their insurance options. The primary purpose of this form is to inform clients about available policies and to serve as a step towards finalizing their insurance needs.

Having a well-structured insurance quotation proposal form is crucial; it not only presents accurate information but also instills confidence in the client. Accuracy and professionalism in this document can significantly impact the client's decision-making process, demonstrating the service provider's commitment to transparency and customer care.

Key components of an insurance quotation proposal form

An effective insurance quotation proposal form comprises several essential elements. These components ensure clarity and comprehensiveness in conveying insurance details to clients.

Step-by-step guide to filling out the insurance quotation proposal form

Filling out an insurance quotation proposal form requires attention to detail. Here’s a step-by-step approach to ensure accuracy and professionalism.

Tips for making your insurance quotation stand out

In an increasingly competitive market, making your insurance quotation proposal distinct is essential. Personalization and visual appeal can significantly enhance the client’s perception of your offer.

Sending and tracking your proposal

Once the insurance quotation proposal form is complete, the next step is its distribution. There are numerous methodologies to send your proposal, and tracking its progress is equally important.

Common challenges when crafting an insurance quotation proposal

Creating an effective insurance quotation proposal form isn't without challenges. It's essential to navigate these common pitfalls proactively to ensure a smooth process.

Frequently asked questions about insurance quotations

Addressing frequently posed inquiries surrounding insurance quotations can demystify the process for clients, fostering better communication.

Best practices for managing insurance quotations

Leveraging modern tools and strategies to manage insurance quotations can streamline your workflow and enhance productivity.

Related templates and tools

For those looking to enhance their insurance quotation proposal forms, various related templates and tools are available to aid in customization and effectiveness.

Maximizing the potential of your insurance quotation proposal

Crafting an insurance quotation proposal form can significantly influence client relationships and your business's overall success. By focusing on building rapport and utilizing technology effectively, insurance providers can enhance client trust and expand their customer base.

Maximizing the potential of your proposals involves building lasting connections with clients, ensuring they feel valued and understood. Employing technology to manage documents efficiently makes the process seamless for both the provider and the client, ultimately leading to a more successful insurance business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit insurance quotation proposal online?

How do I make edits in insurance quotation proposal without leaving Chrome?

Can I edit insurance quotation proposal on an Android device?

What is insurance quotation proposal?

Who is required to file insurance quotation proposal?

How to fill out insurance quotation proposal?

What is the purpose of insurance quotation proposal?

What information must be reported on insurance quotation proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.