Get the free Consolidated Financial Statements

Get, Create, Make and Sign consolidated financial statements

Editing consolidated financial statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consolidated financial statements

How to fill out consolidated financial statements

Who needs consolidated financial statements?

Comprehensive Guide to Consolidated Financial Statements Form

Understanding consolidated financial statements

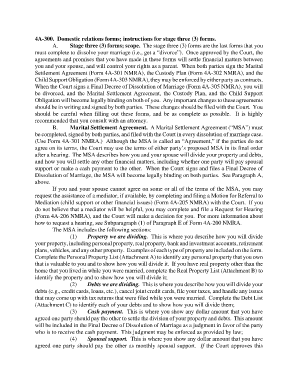

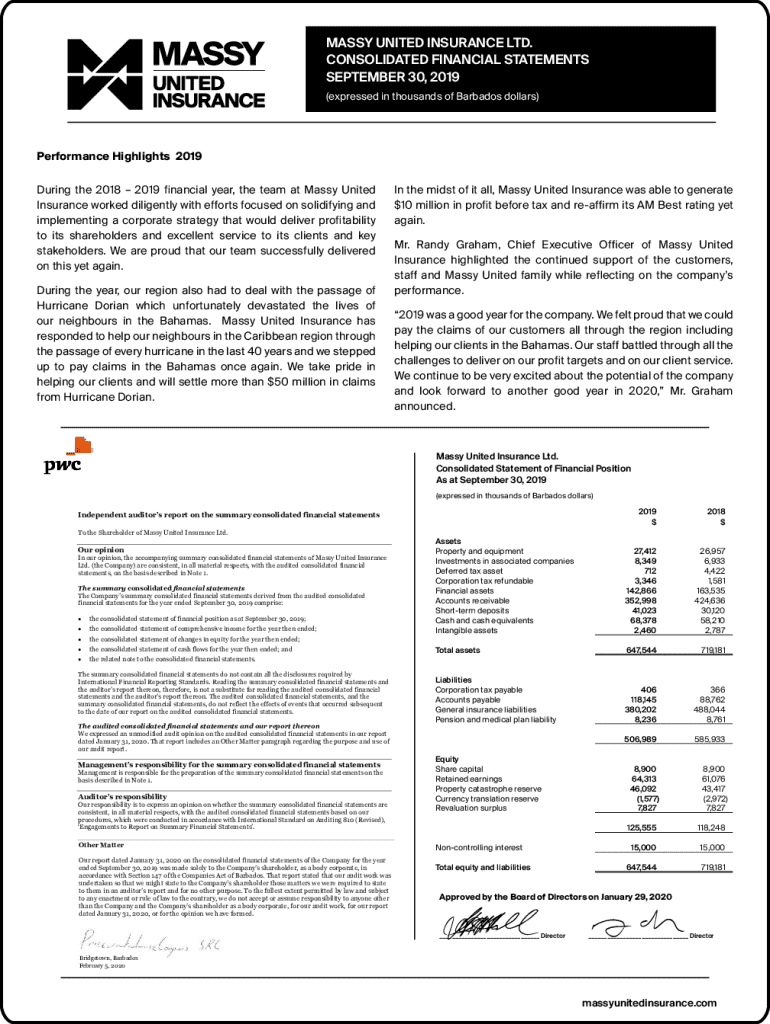

Consolidated financial statements are a comprehensive representation of the financial position and performance of a group of entities under a parent company. They combine the financial data of all subsidiaries, affiliates, and the parent company to provide a holistic view of the financial health of the entire corporate group. The primary purpose of these statements is to present an accurate and detailed depiction of the financial status and results of operations of all entities as a single unit.

Businesses, especially those with multiple subsidiaries or interests in various markets, rely on consolidated financial statements to fulfill regulatory requirements and provide transparency to shareholders, creditors, and other stakeholders. By aggregating financial data, these statements are critical for effective multi-entity reporting, allowing for clearer insights into the financial dynamics of the organization.

Key components of the consolidated financial statements form

The consolidated financial statements form typically includes three main components: the balance sheet, income statement, and cash flow statement. Each component plays a vital role in providing a complete picture of the financial performance and position of the corporate group.

Balance sheet

The balance sheet details a company's assets, liabilities, and equity at a specific point in time. This financial snapshot is crucial for stakeholders to understand the resources available to the company and its obligations. A simplified example of a balance sheet structure usually includes:

Income statement

The income statement provides information about a company’s revenues, expenses, and profits over a specific period. It demonstrates how much money the organization makes (or loses) from its operations. An essential factor in this component is the accurate recognition of revenue, as it directly influences reported financial performance and can impact investor perceptions and decision-making.

Cash flow statement

The cash flow statement outlines cash inflows and outflows across three primary categories: operating, investing, and financing activities. This document is critical for understanding how a company generates cash and how it uses that cash, which is especially important for assessing liquidity and flexibility.

Format considerations for consolidated financial statements

When preparing consolidated financial statements, it’s essential to follow standardized formats set forth by regulatory bodies. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) are the two primary frameworks that dictate how financial statements should be prepared and reported.

GAAP and IFRS each have their nuances, particularly concerning revenue recognition and consolidation methods. Adhering to these regulations is critical for legal compliance and maintaining investor trust. Moreover, choosing the right presentation style—be it vertical or horizontal—can significantly enhance the clarity of the financial data provided.

Filling out the consolidated financial statements form

Filling out the consolidated financial statements form requires a systematic approach. Start by collecting financial data from individual financial statements of all entities within the group. The method of consolidation selected is crucial: line-by-line consolidation, proportional consolidation, and equity method each allows for varying degrees of integration of financial information.

Line-by-line consolidation includes all revenues, expenses, assets, and liabilities, whereas proportional consolidation integrates only the share of those items belonging to the parent company. The equity method recognizes investments as assets, reflecting income as dividends. Regardless of the method employed, accuracy is key, and interactive tools like pdfFiller can simplify the process.

Detailed insights into group composition

Defining the reporting entity is pivotal in preparing consolidated financial statements. It's essential to establish the criteria for what line items will be included in these statements, typically based on ownership percentages. This inclusion has significant implications for financial performance and reporting accuracy.

Ownership percentages delineate the level of control an entity has over others and influence reporting methods. Common challenges arise when determining how to report subsidiaries, joint ventures, or affiliates that may have unique characteristics or ownership models. Navigating complex ownership structures is critical for ensuring compliance and accuracy in reporting.

Managing and editing your consolidated financial statements

Effective management and editing of consolidated financial statements can be streamlined by utilizing interactive tools. Software like pdfFiller offers features that allow users to edit documents easily, ensuring that financial information is accurately presented and up-to-date.

Collaborative editing is an integral aspect, as multiple stakeholders often need to review and discuss figures in a timely manner. The ability to share documents, comment on particular line items, and incorporate feedback efficiently can significantly reduce the turnaround time for each financial reporting cycle.

Tips for effective consolidated financial reporting

When it comes to consolidated financial reporting, accuracy and transparency are of utmost importance. Regular review cycles and updates for financial statements ensure that the information presented reflects the current business state. Engagement with stakeholders throughout the process helps foster understanding and trust in financial practices.

Moreover, leveraging technology, specifically automated tools, can substantially reduce human error in data entry and computation. Additionally, integrating financial reporting software with platforms like pdfFiller not only enhances the efficiency of document preparation but also ensures smoother operations throughout the reporting process.

FAQs on consolidated financial statements form

Frequently asked questions surrounding consolidated financial statements often reveal common pitfalls in filling out these forms. Issues can arise from incorrect data entry, misunderstanding of consolidation methods, or not aligning with current fiscal regulations. Addressing these common questions proactively can help mitigate errors and confusion.

Furthermore, insights from industry experts can provide valuable tips for efficient reporting practices, ranging from timelines for updates to preferred methods for stakeholder engagement that enhance the clarity of financial disclosures.

Conclusion on improving your financial reporting process

In conclusion, the preparation of consolidated financial statements is a multifaceted task that requires precision, accurate data aggregation, and adherence to regulatory standards. By adopting innovative solutions like pdfFiller, users not only streamline their document management processes but also enhance their capabilities to keep financial documents organized and compliant.

By integrating the lessons learned from this guide, individuals and teams can significantly improve their financial reporting processes. Embracing tools that support collaborative efforts and ensure document integrity can lead to better financial outcomes and strategic decision-making for the organization as a whole.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute consolidated financial statements online?

How do I make edits in consolidated financial statements without leaving Chrome?

How do I edit consolidated financial statements straight from my smartphone?

What is consolidated financial statements?

Who is required to file consolidated financial statements?

How to fill out consolidated financial statements?

What is the purpose of consolidated financial statements?

What information must be reported on consolidated financial statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.