Get the free Cancelling Part 4A permissions at firms' request - Practical Law

Get, Create, Make and Sign cancelling part 4a permissions

Editing cancelling part 4a permissions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cancelling part 4a permissions

How to fill out cancelling part 4a permissions

Who needs cancelling part 4a permissions?

Cancelling Part 4A Permissions Form: A Comprehensive Guide

Key overview of Part 4A permissions

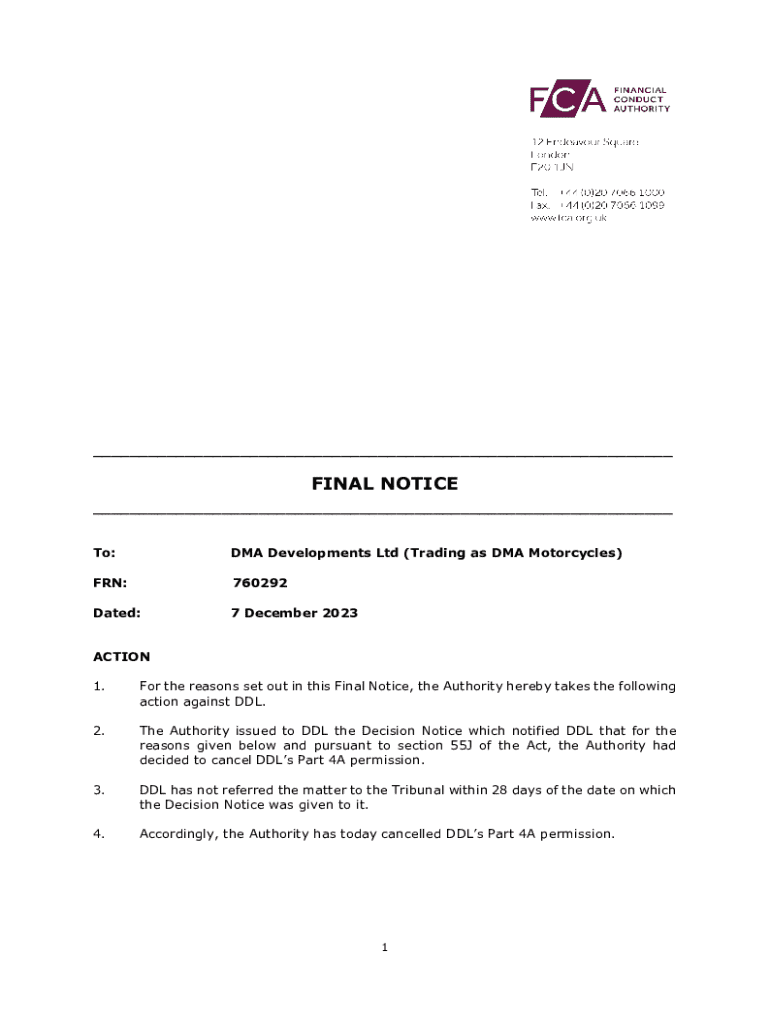

Part 4A permissions refer to the authorization system established under the Financial Services and Markets Act 2000 (FSMA), specifically for firms operating in the UK financial services sector. These permissions allow companies to conduct regulated activities, such as accepting deposits, providing financial advice, or conducting investment business. For regulated firms in the UK, maintaining these permissions is crucial as it safeguards both the integrity of the financial sector and the interests of consumers.

When a firm decides to cancel its Part 4A permissions, it can be a significant move often indicating a strategic shift or an operational restructuring. This process not only affects the firm itself but also resonates with clients, employees, and regulators. Understanding how to properly navigate the cancellation process is essential to ensuring compliance and mitigating any operational disruptions.

The cancellation process can be intricate, with specific requirements and documentation needed. Firms must be prepared to fulfill various obligations when seeking to revoke their permissions, ensuring that they adhere to all regulatory expectations throughout the procedure.

Understanding the cancellation process

Cancelling a Part 4A permission means that a firm will no longer be authorized to undertake regulated activities as defined by the Financial Conduct Authority (FCA) or Prudential Regulation Authority (PRA). This cancellation impacts the operational framework of the firm and may necessitate the winding down of various business functions. Legally, cancelling such permissions releases the firm from regulatory oversight concerning those activities, although it does not eliminate previously existing obligations.

For firms and stakeholders, this can have far-reaching implications. For example, stakeholders may lose confidence in the firm’s operations, clients may need to seek alternative service providers, and employees facing redundancies might require support during the transition. Moreover, aligning with regulatory bodies throughout this process is crucial to ensure that all compliance responsibilities are adequately managed.

Types of cancellations

Cancellations can be categorized into several types, each with distinct characteristics. Understanding these various forms is essential for firms to determine the best approach:

Preparing to cancel: Assessing your position

Before initiating the cancellation of Part 4A permissions, firms should conduct a comprehensive assessment of their situation. It is crucial to consider the business implications of cancelling permissions, including the potential loss of client trust, disruption to ongoing operations, and the future plans for the firm. This necessitates an evaluation of not just financial impact but also how existing partnerships and client relationships may be affected.

Ongoing compliance responsibilities should also be addressed before cancellation is sought. Firms need to remain compliant with FCA rules until their permissions are officially revoked. This involves proper planning for communication with stakeholders—such as clients, employees, and investors—to minimize uncertainty and maintain transparency throughout the process.

Necessary documentation & information

The success of the cancellation process significantly hinges on the submission of appropriate documentation. The required documents for cancellation submission typically include:

Additionally, a checklist of essential information should be prepared to facilitate a smooth submission process. Items on this checklist may include relevant regulatory references, business reasons for cancellation, client communications, and internal approval documentation.

Step-by-step process for cancelling a Part 4A permission

The process of cancelling a Part 4A permission requires several important steps, each crucial for ensuring compliance and managing the expectations of regulators.

Step 1: Gathering documentation

To start, compile a detailed list of the documents needed for submission. Essential documents include financial statements, governance structures, and previous communications concerning the permissions. Organizations should aim to compile accurate information, ensuring that references to specific regulations and firm activities are clearly documented.

Step 2: Completing the cancellation form

Once the documentation is collected, the next crucial step is to accurately complete the cancellation form. This form typically comprises sections that require detailed information about the firm’s operations, legal representatives, and rationale for the cancellation.

Common pitfalls include providing incomplete information or being vague about business reasons for cancellation. To mitigate these risks, ensure that each section is thoroughly reviewed and all necessary details incorporated.

Step 3: Submitting your application

After completing the form, firms may choose to submit their cancellation request either online or via a paper submission. Utilizing digital platforms provided by regulatory bodies can facilitate a quicker processing time. Regardless of the submission method, a confirmation of receipt should be sought to ensure the application has been acknowledged.

What happens after submission?

After a cancellation application is submitted, it enters a review phase. This stage is critical as firms await feedback regarding their request.

Cancellations timeline

The timeframe for processing cancellations can vary, with factors influencing assessment duration including the completeness of documentation, the complexity of the firm’s business model, and the current regulatory workload. Generally, the process may take anywhere from several weeks to a few months.

Assessment and decision-making process

The assessment is typically handled by relevant regulatory authorities such as the FCA or PRA. These bodies evaluate cancellation requests against strict criteria, ensuring compliance with broader regulatory frameworks. Their analysis examines the firm’s ongoing obligations and assesses any potential risks involved in the cancellation.

FAQs about cancelling Part 4A permissions

Firms often have queries regarding the cancellation process, particularly about the flexibility and implications of their application.

Common questions and concerns

Privacy and data management

Navigating the cancellation process calls for careful attention to data management and privacy compliance, especially under GDPR and other data protection legislation.

Ensuring compliance with data protection regulations

Personal data may be involved in the cancellation process, including details pertinent to clients and business operations. Firms are responsible for ensuring the security and confidentiality of this information during the transition.

Your rights and responsibilities

Under data protection legislation, firms are entitled to uphold rights regarding data management. This includes ensuring clients are informed about data usages and retention policies while fulfilling obligations to manage both client and firm data securely during cancellation.

Additional resources & practical tools

To assist firms in navigating the cancellation process, several resources can be beneficial.

User testimonials and case studies

Firms that have successfully navigated the cancellation process often share valuable insights. Their experiences can serve as case studies for others considering a similar path.

Success stories from various firms highlight the importance of thorough documentation and communication during the cancellation process. Lessons learned emphasize the value of proactive engagement with stakeholders and regulators for a smoother experience.

Related topics of interest

As firms delve deeper into regulatory frameworks, several related topics merit attention, including:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cancelling part 4a permissions?

How do I edit cancelling part 4a permissions online?

Can I create an eSignature for the cancelling part 4a permissions in Gmail?

What is cancelling part 4a permissions?

Who is required to file cancelling part 4a permissions?

How to fill out cancelling part 4a permissions?

What is the purpose of cancelling part 4a permissions?

What information must be reported on cancelling part 4a permissions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.