Get the free Crt-61 Certificate of Resale

Get, Create, Make and Sign crt-61 certificate of resale

Editing crt-61 certificate of resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crt-61 certificate of resale

How to fill out crt-61 certificate of resale

Who needs crt-61 certificate of resale?

Understanding the CRT-61 Certificate of Resale Form

Understanding the CRT-61 certificate of resale form

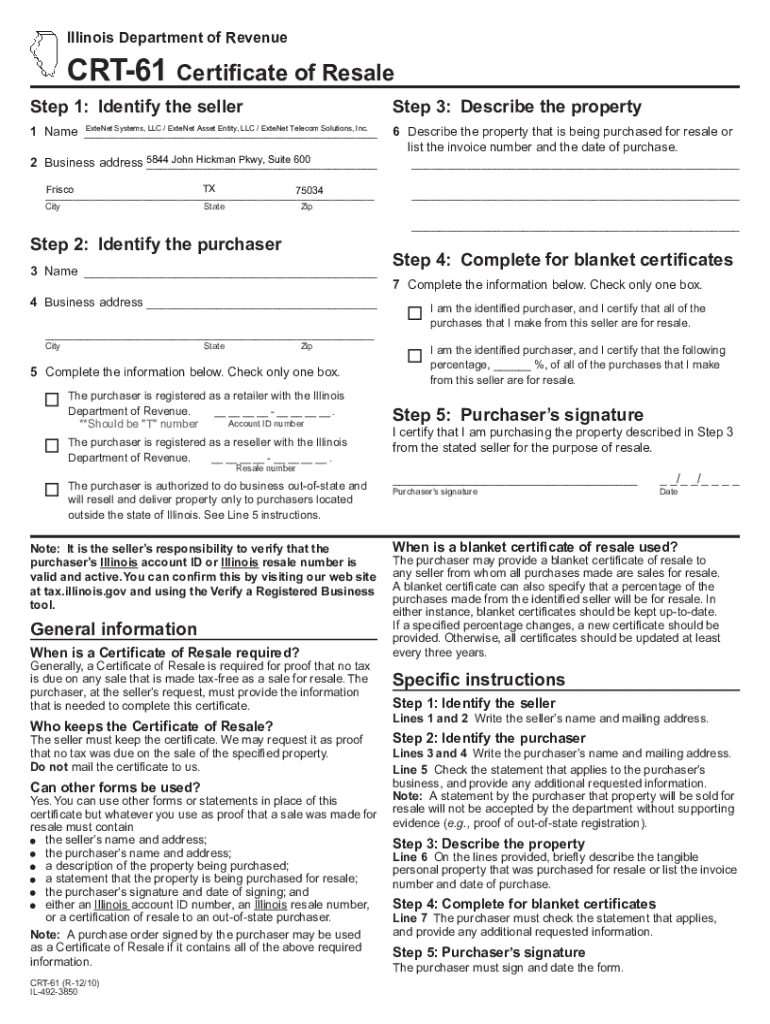

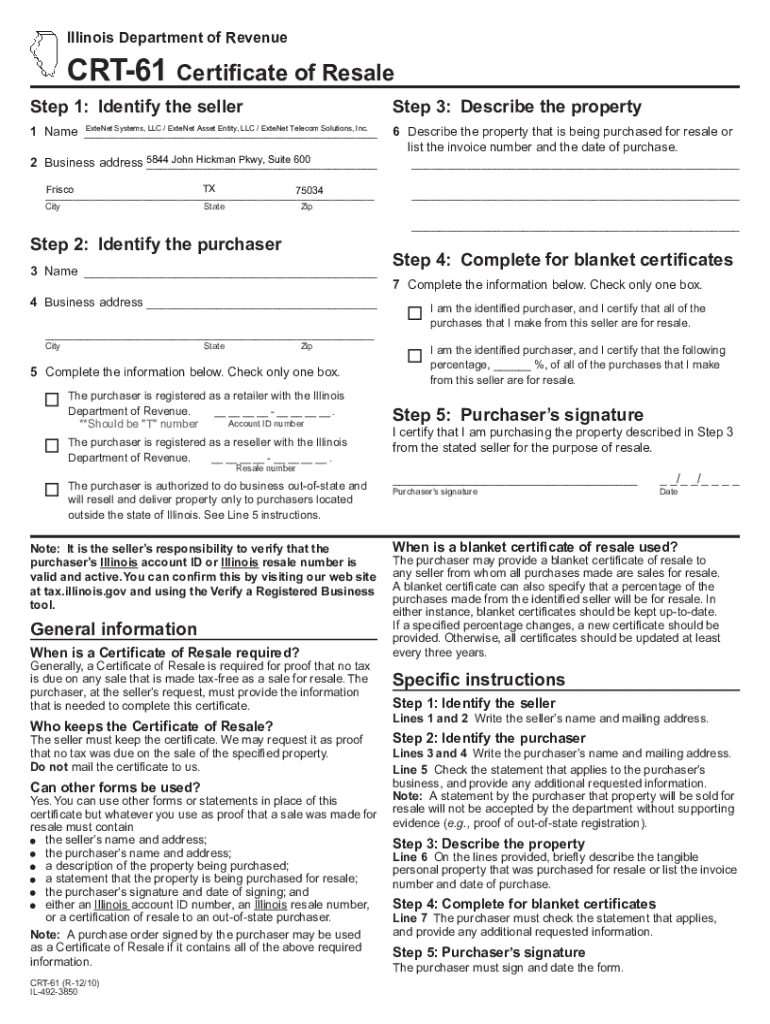

The CRT-61 certificate of resale form is an essential document for businesses engaged in the resale of goods in the state of Illinois. This form allows retailers and wholesalers to purchase items without having to pay sales tax at the time of purchase, as they intend to resell these items to consumers. The primary purpose of the CRT-61 is to facilitate tax-exempt purchases within wholesale transactions. Both suppliers and businesses gain a streamlined process through this certificate, helping to alleviate the financial burden of upfront sales tax.

The importance of the CRT-61 in resale transactions cannot be overstated. For businesses, it modernizes purchasing by enabling a direct flow of cash towards operations and inventory rather than taxes. Consumers, in turn, benefit from potentially lower prices, as retailers can pass the tax savings back to them. Thus, this certificate supports the retail business ecosystem by ensuring a more efficient marketplace, contributing to a healthier economy.

Key features of the CRT-61 Certificate

The CRT-61 certificate of resale form requires specific information to establish legitimacy and compliance. Notably, this includes business details such as the name, address, and contact information of the retailer or wholesaler. Additionally, the form mandates the inclusion of a tax identification number, ensuring the purchasing entity is properly registered with the Illinois Department of Revenue.

Eligibility to use the CRT-61 form is primarily designated for retailers and wholesalers who engage in the resale of goods. Various industries utilize resale certificates, particularly those in retail, wholesale, food service, and automotive sectors. By confirming their status as resellers, these businesses can operate under the tax exemption framework that the CRT-61 provides.

Getting started with your CRT-61 certificate

To begin using the CRT-61 certificate of resale form, individuals can access the form online through the Illinois Department of Revenue’s official website. Once located, users can conveniently download and print the form, ready for completion. If you’re unfamiliar with the process, here’s a step-by-step guide to access and fill out the CRT-61 form.

When filling out the CRT-61 certificate, ensure to double-check the accuracy of all provided information. Common mistakes include incorrect tax identification numbers, invalid or incomplete business details, and a lack of signatures. Accurate information not only facilitates smooth transactions but also ensures compliance with state tax laws, minimizing the risk of audits or penalties.

How to use the CRT-61 certificate effectively

Accepting the CRT-61 certificate in business transactions requires retailers and wholesalers to follow specific guidelines to ensure compliance. When presented with a CRT-61 certificate, businesses should verify the validity of the document by checking the accompanying business details against their records. It is critical not only to accept the certificate but also to maintain thorough recordkeeping of all sales transactions that utilize the CRT-61, as this documentation is invaluable during tax audits.

To maintain compliance with state regulations, best practices involve regularly reviewing the documents on file and training employees on the importance of resale certificates. Additionally, businesses should implement a system for organizing these forms in a secure yet accessible manner, ensuring they are readily available for review or during audits.

Frequently asked questions (FAQs) about the CRT-61 certificate

One common inquiry is how the CRT-61 certificate differs from other resale certificates. Unlike many states that issue varying formats, Illinois utilizes the CRT-61 as a standardized form for all resale transactions within its jurisdiction. Another point of confusion often arises around whether an Illinois sales tax permit is the same as a CRT-61 certificate; it's important to clarify that the permit allows businesses to collect sales tax, while the CRT-61 facilitates a tax-exempt purchase.

Moreover, if a business fails to obtain a CRT-61 certificate before making a resale purchase, it may face unnecessary financial burdens by paying sales tax upfront. Understanding the proper application and legitimacy of the CRT-61 certificate ultimately saves businesses substantial amounts of money while allowing them to operate without the fear of tax-related issues.

Troubleshooting common issues with CRT-61 certificates

While completing the CRT-61 certificate, individuals may encounter various issues. A common problem involves difficulties while filling out the form correctly, typically stemming from misunderstanding what information is necessary. In such scenarios, users should refer back to the Illinois Department of Revenue’s guides or consult with a tax professional to rectify any mistakes.

If disputes arise over sales tax issues related to the CRT-61, businesses should maintain a detailed record of all transactions where the certificate was used. This comprehensive documentation can serve as critical evidence if discrepancies develop. Engaging with tax authorities and demonstrating a willingness to comply with their requests further enhances credibility during resolving disputes.

Learning from real-world examples

Businesses that effectively utilize the CRT-61 certificate of resale have reported not only tax savings but increased operational efficiency. For example, a local grocery distributor frequently utilizes the CRT-61 to procure goods from wholesalers. This practice has allowed the distributor to provide competitive prices to consumers. Feedback indicates that retailers feel empowered through their ability to manage tax-exempt purchases seamlessly, thus enabling them to focus on growing their business in ways that would be hampered without the advantages provided by the CRT-61.

These case studies collectively highlight the positive impact that understanding and leveraging the CRT-61 certificate can have on the transaction efficiency and financial health of businesses across various industries.

Related topics and resources

Understanding how sales tax exemption works across different states opens up opportunities for businesses to explore potential savings in other jurisdictions. Furthermore, businesses should familiarize themselves with other forms used in sales tax exemption processes to improve overall compliance. The Illinois Department of Revenue offers resources that allow businesses to access detailed information regarding exemption certificates and their applications.

Interactive tools available on pdfFiller

At pdfFiller, we provide users with an interactive, fillable, and editable template for the CRT-61 form, making it easier than ever to complete and manage necessary documents. The integration of eSignatures expedites the approval process, enhancing operational efficiency for retail businesses. Additionally, we offer document management features that enable users to store, access, and share their CRT-61 certificates securely from anywhere.

Utilizing pdfFiller's document management platform not only simplifies the entire process of handling the CRT-61 certificate of resale but also empowers businesses to stay compliant and organized in today’s fast-paced market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my crt-61 certificate of resale directly from Gmail?

How do I edit crt-61 certificate of resale straight from my smartphone?

How do I complete crt-61 certificate of resale on an Android device?

What is crt-61 certificate of resale?

Who is required to file crt-61 certificate of resale?

How to fill out crt-61 certificate of resale?

What is the purpose of crt-61 certificate of resale?

What information must be reported on crt-61 certificate of resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.