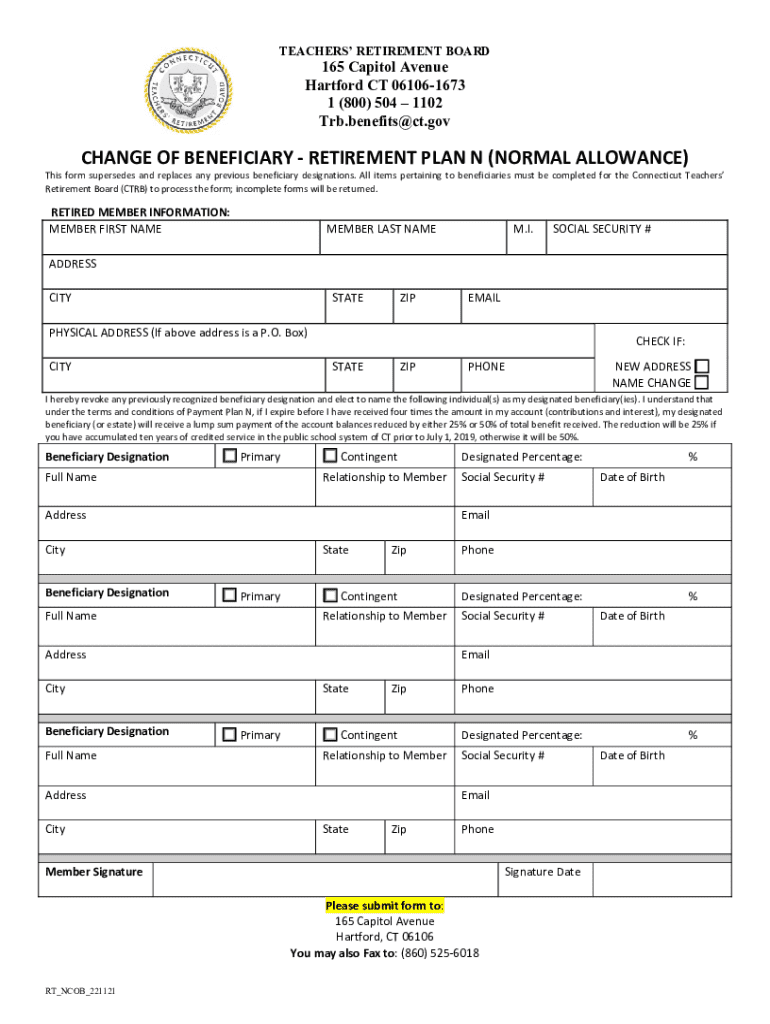

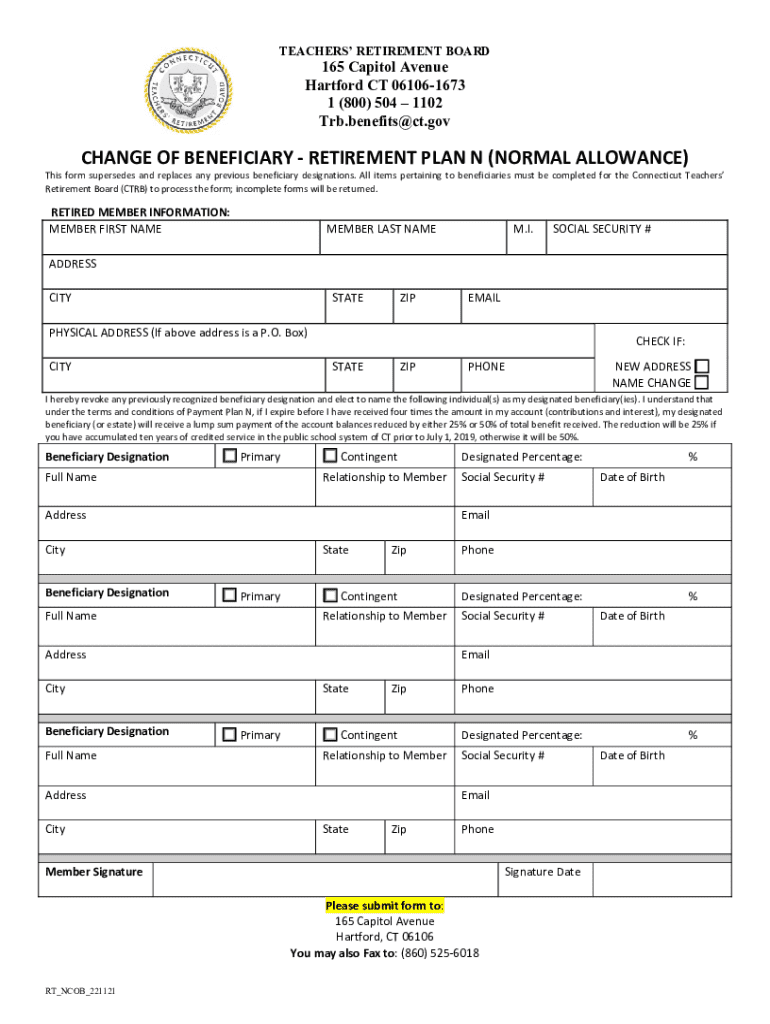

Get the free Change of Beneficiary - Retirement Plan N (normal Allowance)

Get, Create, Make and Sign change of beneficiary

Editing change of beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out change of beneficiary

How to fill out change of beneficiary

Who needs change of beneficiary?

Understanding the Change of Beneficiary Form: A Comprehensive Guide

Understanding the change of beneficiary form

A change of beneficiary form is a crucial document that allows an individual to modify the designated recipients of benefits from life insurance policies, retirement accounts, and trusts. The primary purpose of this form is to ensure that the intended beneficiaries receive the financial benefits or assets upon the policyholder's death or a triggering event. This document serves to legally update beneficiary information and can avoid complications or disputes in the future.

Updating beneficiaries is not merely a good practice; it's a necessity as life circumstances change. Factors such as marriage, divorce, or the birth of a child can significantly impact your beneficiary choices. Regular updates help ensure that your assets are distributed according to your current intentions, preventing unintended heirs from receiving what you intended for someone else.

Types of beneficiary forms

Various types of beneficiary change forms cater to different financial products and estate planning tools. Understanding the specific requirements of each is essential for properly managing your assets.

When to use a change of beneficiary form

Certain life events are significant triggers for updating beneficiary information. For instance, marital changes can lead to adjustments in who you want to name as a beneficiary, while new family members may prompt new designations.

In addition to personal milestones, financial planning considerations may also require a change of beneficiary form to adapt to new financial goals or circumstances.

How to obtain a change of beneficiary form

Obtaining a change of beneficiary form is generally straightforward, as most financial institutions and insurers provide them. You can find these forms on official websites, ensuring you have the most up-to-date version.

Step-by-step guide to completing the change of beneficiary form

Filling out a change of beneficiary form accurately is critical to ensure that your intentions are honored. Here’s a detailed guide.

Submitting the change of beneficiary form

Once completed, the change of beneficiary form must be submitted to the relevant institution for processing. This step is crucial to ensure that your changes are acknowledged officially.

Managing your beneficiary information

Keeping track of your beneficiary information is as important as designating beneficiaries in the first place. Proper management can prevent misunderstandings among heirs and ensure that your wishes are honored.

Common questions and answers

Navigating the change of beneficiary form can lead to questions. Here, we address some of the most common inquiries.

Utilizing pdfFiller for a smooth process

Using pdfFiller can significantly enhance your experience in managing the change of beneficiary form. Its platform offers a variety of tools designed for ease and efficiency.

Real-life scenarios and testimonials

Hearing from others can provide insights into how essential updating beneficiary information is.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my change of beneficiary in Gmail?

How can I send change of beneficiary to be eSigned by others?

Can I sign the change of beneficiary electronically in Chrome?

What is change of beneficiary?

Who is required to file change of beneficiary?

How to fill out change of beneficiary?

What is the purpose of change of beneficiary?

What information must be reported on change of beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.