Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Guide for Nonprofits

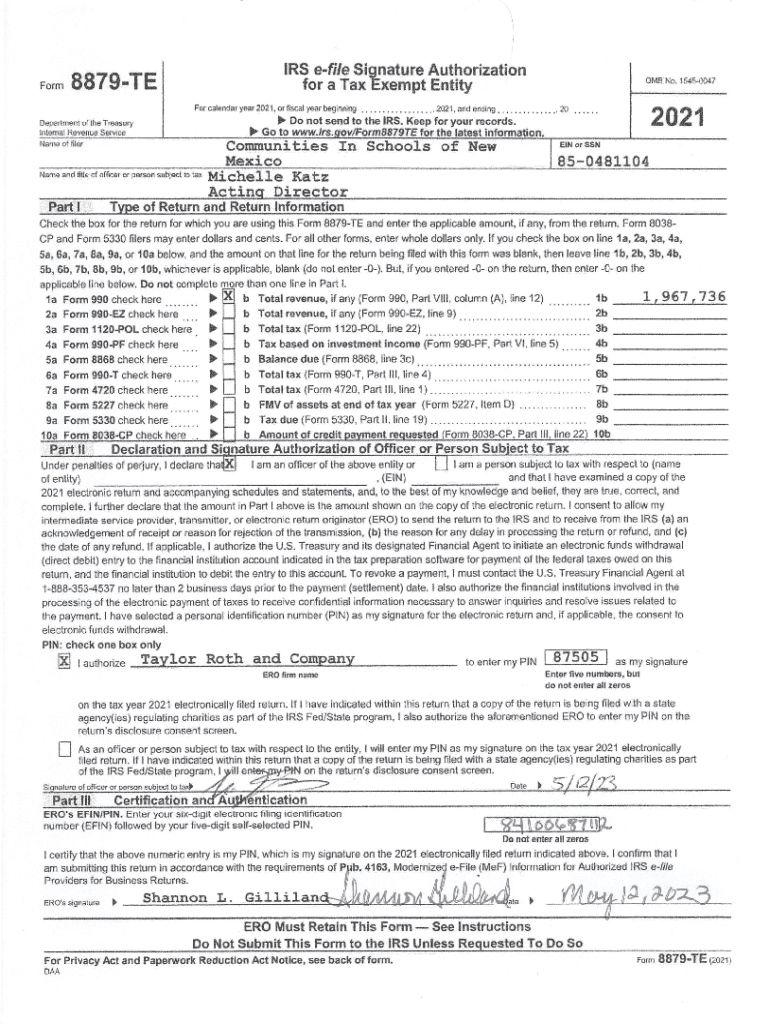

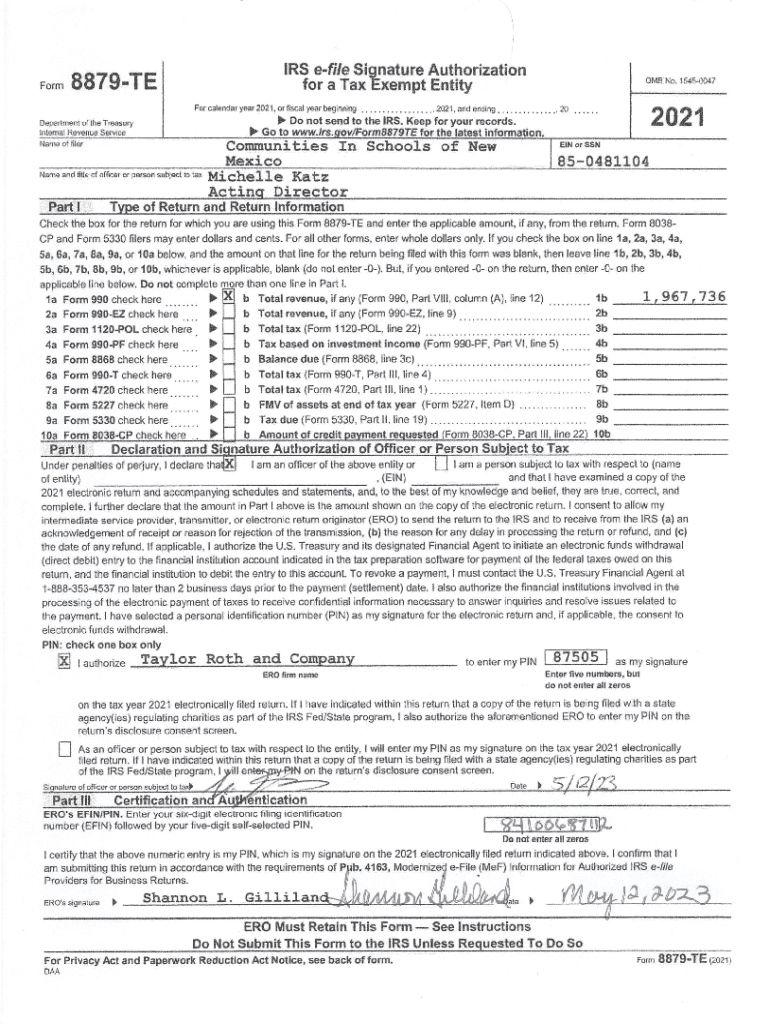

Overview of Form 990

Form 990 is an essential document required by the Internal Revenue Service (IRS) for tax-exempt organizations, including nonprofits and charities. This form serves as a comprehensive annual report that provides critical information about the organization’s financial activities, governance, and program accomplishments. The significance of Form 990 extends beyond merely fulfilling tax obligations; it plays a crucial role in promoting transparency and accountability within the nonprofit sector.

By providing detailed financial and operational information, Form 990 allows stakeholders, including donors, regulators, and the public, to assess a nonprofit's performance and financial health. This transparency fosters trust and confidence, which are vital for nonprofit sustainability.

Understanding the different variants of Form 990

There are several versions of Form 990, including Form 990, Form 990-EZ, and Form 990-N, each tailored for different types of organizations based on their size and revenue. Understanding which variant to use is crucial for compliance and accuracy.

Detailed instructions on filling out Form 990

Filling out Form 990 requires careful attention to detail across various sections. Understanding each part ensures compliance and reduces the risk of audit discrepancies.

Common challenges include accurately categorizing expenses and ensuring compliance with IRS guidelines. Utilize resources like pdfFiller to simplify this process and maintain accuracy.

Filing requirements for Form 990

Ensuring compliance with filing requirements for Form 990 is paramount. Nonprofits must assess their earnings and organizational structure to determine their filing obligations. Generally, most tax-exempt organizations, with a few exceptions, are required to file Form 990 or one of its variants.

E-filing vs. paper filing

The IRS encourages e-filing for Form 990 due to its efficiency and streamlined process, which is where pdfFiller becomes invaluable. Using a platform like pdfFiller offers several advantages.

Managing and storing Form 990

Organizing and storing Form 990 is crucial for maintaining compliance and enabling easy access for audits. Organizations should develop a systematic approach to manage these documents.

Understanding penalties and compliance

Failure to file Form 990 or submitting inaccurate information can result in significant penalties. Understanding these risks is essential for all nonprofits.

Public inspection regulations for Form 990

Form 990 is not just a tax document; it is also a public record. The IRS requires organizations to make Form 990 available for public inspection, thereby contributing to transparency.

Insights from Form 990: Charity evaluation research

Form 990 serves as a critical resource for researchers and potential donors seeking to evaluate nonprofit organizations. The data presented reveals essential insights into organizational health.

Learning from historical trends in Form 990 filings

The evolution of Form 990 reflects changing regulations and increasing expectations for financial transparency. Organizations can learn from trends over the years to adapt their reporting strategies.

Resources for further understanding Form 990

Navigating Form 990 can be challenging, but various resources are available to assist organizations in the process. Utilizing these resources can significantly enhance understanding and compliance.

Expert tips for navigating Form 990

Expert advice can be invaluable when it comes to successfully completing Form 990. Nonprofit professionals often have insights that can help streamline the filing process.

Related documents and forms

Alongside Form 990, organizations may need to file additional documents to comply with IRS guidelines. Understanding these related forms is key to maintaining comprehensive compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 from Google Drive?

Can I create an eSignature for the form 990 in Gmail?

How do I edit form 990 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.