Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

A Comprehensive Guide to the W-9 Form

Understanding the W-9 form

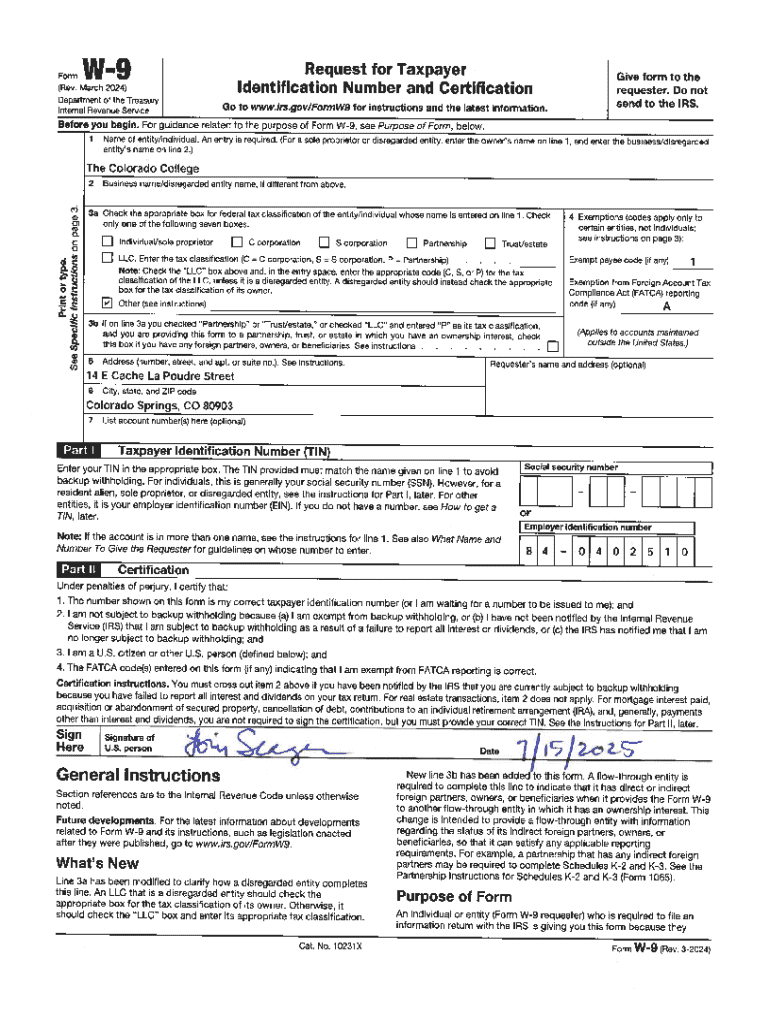

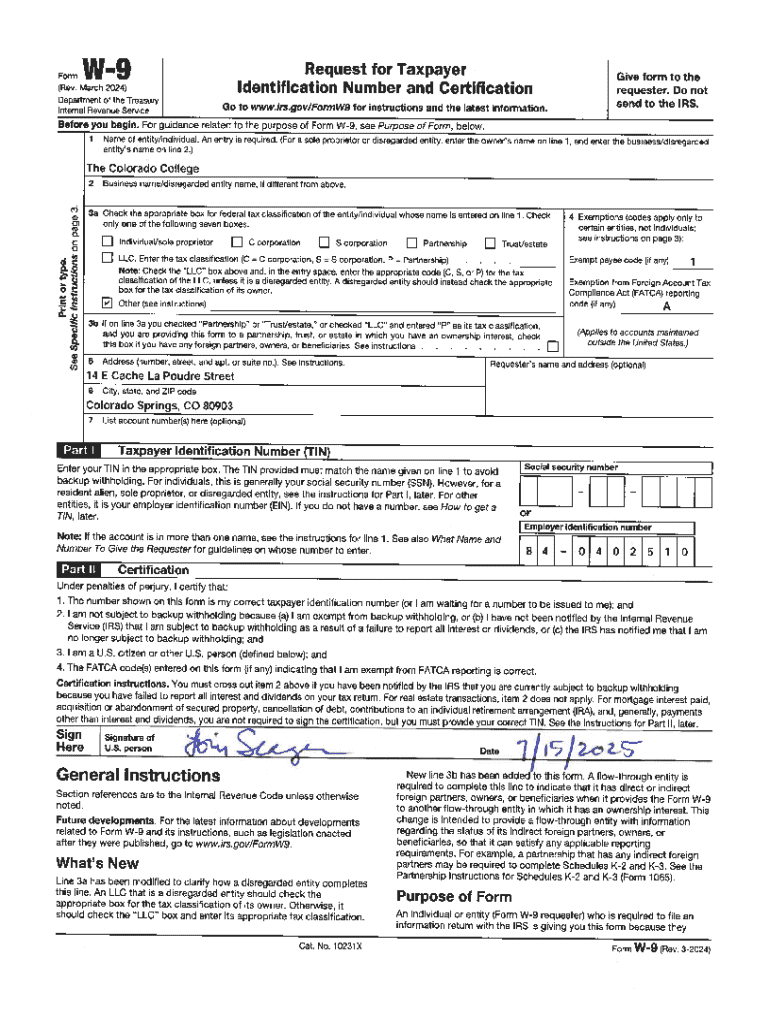

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is an essential document utilized primarily in the United States for tax purposes. This form is designed for individuals and entities to provide their correct taxpayer identification number (TIN) to those who are required to report income paid to them. Whether you're a freelancer, an independent contractor, or a business, the W-9 form plays a crucial role in tax reporting and ensures that the IRS receives accurate information.

In essence, the W-9 form serves to confirm the identity of the person or entity receiving payment. It's important for everyone involved—especially those making payments—to have this information correctly documented to avoid issues with tax withholding and reporting.

Who should use the W-9 form?

The W-9 form is predominantly utilized by freelancers, independent contractors, and businesses. Any individual or company that receives payment for services provided generally needs to fill out this form. Common scenarios include providing IT support, consultancy services, or even earning royalties. For businesses, situations may arise where they need to collect W-9 forms from vendors to fulfill reporting requirements.

In addition, financial institutions request W-9 forms from clients before opening accounts, ensuring the proper tax identification is on file. This practice not only safeguards the institution but also ensures compliance with IRS regulations.

Key components of the W-9 form

The W-9 form contains essential components that individuals must complete accurately. The personal information section requires you to provide your name and, if applicable, the name of your business. It also requires your Social Security Number (SSN) or Employer Identification Number (EIN), which is crucial for accurate tax reporting. Filling out this section correctly is vital; errors can lead to issues such as penalties or backup withholding.

Additionally, the certification and signature section at the bottom of the W-9 ensures that the information provided is accurate. By signing, you're legally certifying the information you've given is correct. This area holds importance beyond mere formalities, as incorrect information can lead to significant tax challenges, including the Internal Revenue Service penalizing you for discrepancies.

Step-by-step guide to filling out the W-9 form

Filling out the W-9 form doesn't have to be daunting. Follow these steps to ensure your form is completed correctly and efficiently. First, download the W-9 form from the pdfFiller website. The form is readily available in a user-friendly PDF format, making it accessible for any user.

Once you have the form, start filling it out by providing your personal information, including your name and business name if necessary. For tax identification purposes, ensure that you provide your SSN or EIN precisely as requested. Common mistakes that users make include typos in their SSN or providing the wrong business name.

After filling in the necessary details, save the form. You can easily save your completed W-9 form in various formats with pdfFiller. Lastly, print the W-9 to maintain a professional appearance when submitting it to your clients or employers.

Edits and revisions: Using pdfFiller tools

In the event that you need to make further edits to your W-9 form, pdfFiller offers robust editing tools that allow you to easily update the information. With a few clicks, you can modify any field on the form. This feature is particularly useful if you find that you’ve made an error after submission or if your details change.

Another significant capability of pdfFiller is the option to add digital signatures. E-signing simplifies the process of signing documents electronically, which is not only convenient but also offers enhanced security. E-signatures hold the same legal weight as traditional signatures, and the process of adding one to your W-9 form through pdfFiller is straightforward and user-friendly.

Effective management of submitted W-9 forms

Once you have submitted your W-9 form, managing your documents effectively becomes crucial. Best practices include securely storing your W-9s in your document management system. Using pdfFiller allows for easy organization of all tax documents, enabling efficient tracking and retrieval when necessary.

When it comes to sharing the W-9 form, security is key. Weighing your options for transmitting these sensitive documents matters. You can securely share W-9 forms directly from pdfFiller via encrypted email or generate shareable links, ensuring your confidential information is protected during transmission.

Use cases for the W-9 form

Freelancers and independent contractors are the most common users of the W-9 form. These individuals submit their W-9 to clients, who in turn use the information to report payments made to the IRS. It’s important for these service providers to understand their responsibilities regarding income reporting since payments made to them may be reported as taxable income.

Businesses also frequently require W-9 forms from their vendors. For example, a graphic design firm hiring an outside contractor would request a W-9 to comply with IRS regulations. Employers may also request W-9 forms from their employees, particularly if they are hiring part-time workers or consultants, ensuring compliance and accurate reporting.

Common filing methods for tax forms

When it comes to submitting the W-9 form, there are several methods available. You can mail it directly to your client, employer, or whoever has requested it. Alternatively, email submission is increasingly common, especially with the rise of digital documentation practices. Leveraging e-signatures via pdfFiller can streamline this process significantly.

It's essential to ensure that you know where to send the completed W-9. Generally, this will be to the entity requesting the information, such as an employer or a client who has engaged your services. Always confirm the recipient details to avoid complications that can arise due to misdirected forms.

Timelines and deadlines

Knowing when to request a W-9 is crucial, particularly as tax deadlines approach. It’s generally advisable for businesses to request W-9 forms before providing payment for services. This preemptive approach minimizes issues with tax reporting later in the year. The IRS encourages timely retrieval to ensure accurate processing in their systems.

Key dates to remember include the end of the calendar year, when payments over a certain threshold must be reported. Having the W-9 completed and stored before these dates can ensure compliance and smooth operations come filing season.

Navigating complex situations

Navigating backup withholding can be an additional challenge for those filling out a W-9 form. The IRS may implement backup withholding on payments made to individuals without a valid taxpayer identification number without receiving a correctly submitted W-9. To avoid this situation, ensure that your W-9 is filled out accurately.

Moreover, understanding different business structures is critical. If you operate as an LLC, corporation, or sole proprietorship, each will have specific requirements outlined in the W-9. Financial institutions also have obligations under the IRS rules to secure a W-9 from their clients, especially at the time of account opening to confirm that the TIN matches the individual or business name.

Further resources and tools

Using pdfFiller for all your document needs extends beyond just the W-9 form. Consider looking at other templates available on the platform, including 1099 forms, which are often completed in conjunction with the W-9 for accurate tax reporting. These templates can save you time and ensure compliance across the board with IRS regulations.

To further your understanding, you can access external links to the IRS’s forms and instructions directly on the pdfFiller website. This additional information can provide the guidance you need to navigate any complexities associated with the W-9 form and your tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete w-9 online?

Can I create an electronic signature for signing my w-9 in Gmail?

Can I edit w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.