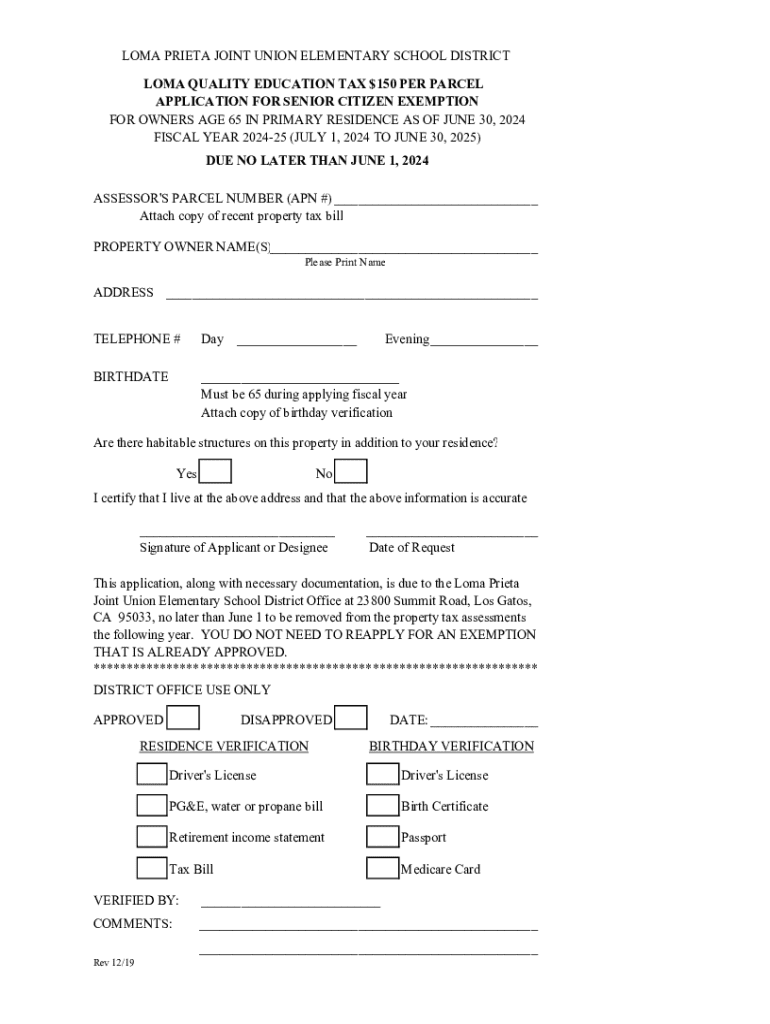

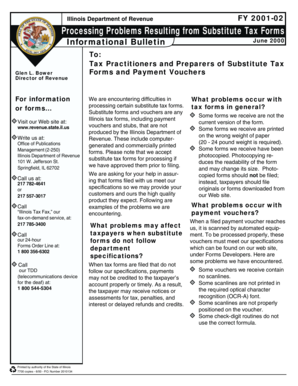

Get the free Senior Citizen Exemption Application

Get, Create, Make and Sign senior citizen exemption application

Editing senior citizen exemption application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out senior citizen exemption application

How to fill out senior citizen exemption application

Who needs senior citizen exemption application?

A Complete Guide to the Senior Citizen Exemption Application Form

Overview of senior citizen exemption

The senior citizen exemption serves as a critical financial relief program aimed at helping seniors manage their living expenses more effectively. This exemption reduces the taxable value of a property owned by eligible seniors, resulting in lower property tax bills. For many, this financial break means the difference between comfortably maintaining their homes and facing potential financial strain as they age.

As the senior population grows, the importance of such exemptions is magnified. It allows retirees on fixed incomes to allocate more of their limited resources to essential needs such as healthcare and daily living expenses. The benefits provided by this exemption can vary significantly by state or municipality, including reductions in property taxes that can alleviate some economic pressures on aging homeowners.

Eligibility requirements for the senior citizen exemption

To qualify for the senior citizen exemption application form, applicants must meet specific eligibility criteria. These requirements ensure that assistance is targeted to those who truly need it. Common eligibility requirements include:

Application process for the senior citizen exemption

Filing for the senior citizen exemption can be an intimidating process if you are unfamiliar with the requirements. However, breaking it down into manageable steps can make the process seamless. Here’s how you can prepare to apply and navigate the application form.

Preparing to apply

Start by gathering all required documentation. This may include:

Step-by-step instructions for filling out the application form

Once you have collected the necessary information, it’s time to fill out the application. Follow these steps:

Methods of submission

After completing the application, you can submit it via several methods. Depending on your locality, options may include:

Changes to the senior citizen exemption for 2024

The senior citizen exemption program is periodically reviewed and can undergo adjustments which impact eligibility and benefits. For the year 2024, there are several noteworthy updates. Policies may be implemented to broaden eligibility criteria based on income adjustments, offering potential relief to a greater number of seniors.

Existing exemption holders might find that the new guidelines affect the renewal process or the amount of exemption they receive. Staying informed about these changes can ensure that seniors continue to benefit from the program adequately.

Timelines and deadlines

Understanding critical timelines in the exemption application process is vital. For the year 2024, pay attention to the following dates:

Additional benefits of the senior citizen exemption

The benefits of the senior citizen exemption extend beyond mere property tax savings. Qualifying for this exemption can interact positively with other benefits such as.

Getting help with your application

Navigating the application process can be challenging, and seeking assistance can make it easier. Here are a few resources available to help you:

Frequently Asked Questions (FAQ)

Curious about common concerns related to the application? Here are some frequently asked questions:

Tools and resources for managing your documents

Utilizing efficient tools can greatly simplify managing documents throughout the application process. pdfFiller is an excellent platform for editing and signing PDFs seamlessly.

Apart from these functionalities, users have access to additional tips for efficient document management, including sharing documents with family members or caregivers for collaborative support.

Keeping your information updated

Maintaining accurate information is crucial for continued eligibility for the senior citizen exemption. Here’s when and how to update your application:

Keeping your information up to date ensures you remain eligible for benefits and avoid any unexpected issues during the renewal process.

Final notes on the senior citizen exemption process

In conclusion, navigating the senior citizen exemption application form doesn't have to be overwhelming. By understanding the requirements, preparing properly, and utilizing resources effectively, seniors can ensure that they take full advantage of the benefits available to them. The key points to remember include eligibility criteria, the necessary documentation, and staying informed about any changes to the program.

Utilizing tools like pdfFiller can streamline the process and enhance your experience, making it easier to complete, sign, and manage the necessary documentation.

Feedback and support

If you have suggestions or feedback regarding the senior citizen exemption application process, many jurisdictions welcome input from the public to help improve services.

For ongoing support, always refer to contact channels provided by your local tax office. They are equipped to assist with any issues or questions you may have moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send senior citizen exemption application to be eSigned by others?

Where do I find senior citizen exemption application?

How do I edit senior citizen exemption application online?

What is senior citizen exemption application?

Who is required to file senior citizen exemption application?

How to fill out senior citizen exemption application?

What is the purpose of senior citizen exemption application?

What information must be reported on senior citizen exemption application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.