Get the free Credit Card Authorization

Get, Create, Make and Sign credit card authorization

How to edit credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization

How to fill out credit card authorization

Who needs credit card authorization?

A Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

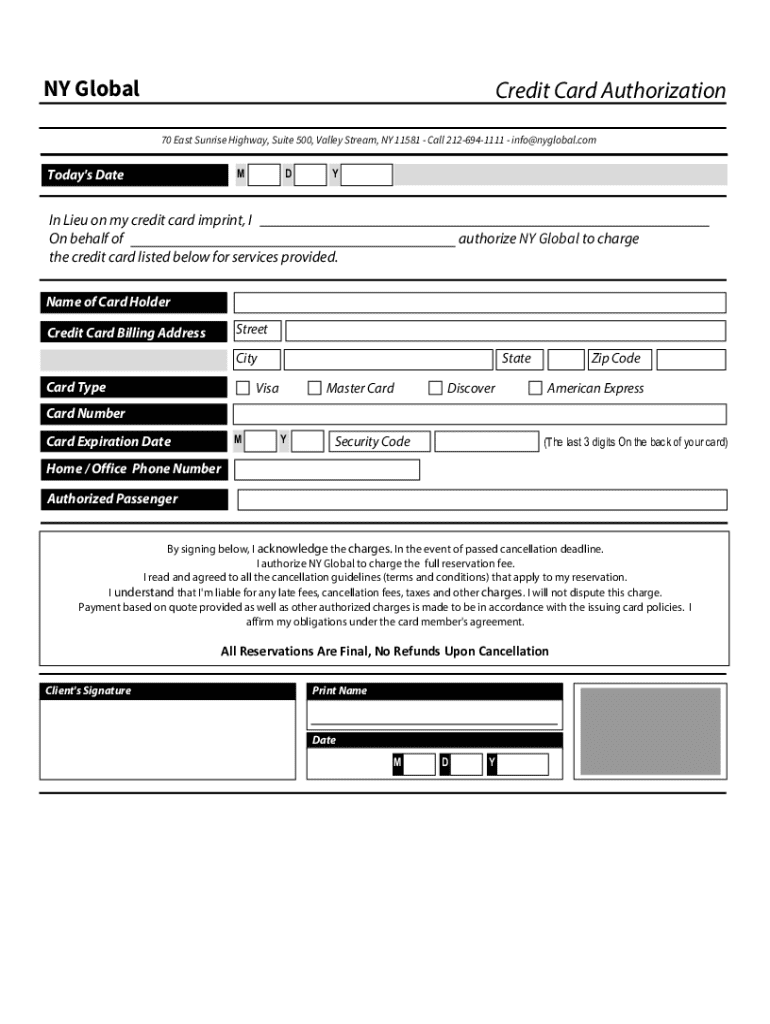

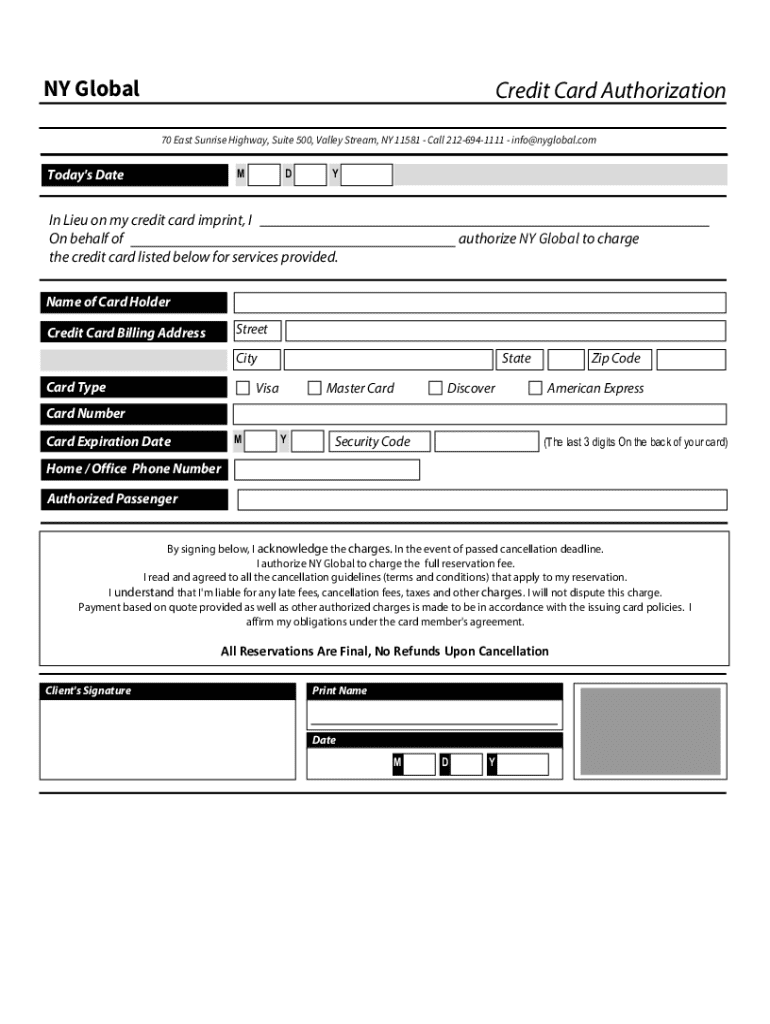

A credit card authorization form is a document that allows businesses to charge a customer's credit card for a specific transaction. This form captures the necessary information from the cardholder and verifies their consent to process the payment, making it a vital component in various financial transactions.

The primary purpose of authorization forms is to provide evidence of the customer's agreement to charge their card. This is essential for businesses to uphold integrity and comply with industry regulations, while also offering consumers a layer of protection against unauthorized charges. These forms help clarify the terms of the transaction, thereby promoting transparency.

For both merchants and customers, the authorization form serves as a safety net, minimizing fraud risks for the company and ensuring that customers are being charged accurately.

Benefits of using a credit card authorization form

One of the most significant advantages of using a credit card authorization form is the prevention of chargeback abuse. Chargebacks can lead to financial losses for businesses, so having a robust system in place helps mitigate these risks. When customers authorize charges upfront, it creates a strong case against unfounded chargebacks.

Additionally, these forms streamline payments for repeat customers. For instance, subscription-based services can easily process recurring charges without the need for frequent customer interaction. This convenience not only saves time but also enhances the overall customer experience.

Using credit card authorization forms also fosters trust. By clearly communicating payment terms, businesses demonstrate their commitment to security, which can build customer loyalty. Legally, these forms strengthen the merchant’s position, as they serve as documented proof of consent for the transaction.

Key components of a credit card authorization form

A well-structured credit card authorization form should include specific information necessary for processing the transaction while safeguarding customer data. Key components include:

Optional elements might include terms and conditions, cancellation policies, and directions for how the signed forms should be stored, thereby providing comprehensive coverage for all parties involved.

When and why to use a credit card authorization form

Credit card authorization forms are particularly important in specific situations. Recurring payments, such as memberships or subscription services, often require these forms to ensure that charges occur seamlessly and with customer consent. In phone or online transactions, where physical card presence is not possible, an authorization form offers added security against fraudulent activities.

Implement effective practices when introducing these forms. Clear communication about the purpose and necessity of authorization forms can significantly improve customer acceptance and compliance. Engage customers through detailed explanations about how their information will be used and stored, reinforcing a sense of involvement and trust.

Creating a credit card authorization form

Designing an effective credit card authorization form can be a straightforward process. Here’s a step-by-step guide to help you get started:

Effective form design should prioritize clarity and ease of use. Use straightforward language and clean layouts to facilitate quick understanding. Utilizing platform features offered by pdfFiller for editing and signatures can further enhance the user's experience.

Storing and managing signed authorization forms

Once you have the signed credit card authorization forms, it’s essential to manage and store these documents securely. Adopting best practices ensures compliance and protects sensitive customer information. For digital storage, implement the following measures:

Utilizing pdfFiller’s cloud-based solutions for form storage can help centralize access and ensure that your data management strategy is efficient and compliant.

Frequently asked questions about credit card authorization forms

Clarifying common questions can help demystify the process of using a credit card authorization form. Here are a few frequent inquiries:

Real-world applications and case studies

Various industries benefit from the implementation of credit card authorization forms. For instance, subscription services like gyms, software companies, and any business model involving recurring payments rely significantly on these forms to secure payments and build customer trust.

Small businesses that utilize credit card authorization forms often report decreased instances of chargebacks and improved cash flow management. Customer testimonials have highlighted their appreciation for businesses that maintain transparency through authorization forms, reinforcing positive relationships and loyalty.

Downloadable resources

To assist you in creating your credit card authorization forms, we offer a variety of resources. Access free templates tailored to your needs, and utilize our quick reference guide, which highlights essential elements to include when completing authorization forms.

Related topics and further reading

Understanding broader concepts around payment processing can enhance your knowledge. Explore related topics such as an overview of payment processing solutions; learn about secure online payment acceptance, and familiarize yourself with card-not-present (CNP) transactions to ensure comprehensive insight into the payment landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization without leaving Google Drive?

Can I create an electronic signature for the credit card authorization in Chrome?

Can I edit credit card authorization on an Android device?

What is credit card authorization?

Who is required to file credit card authorization?

How to fill out credit card authorization?

What is the purpose of credit card authorization?

What information must be reported on credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.