Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms

Understanding credit card authorization forms

A credit card authorization form is a crucial document used by businesses to obtain permission from customers to charge their credit card for specific transactions. This form serves as a written record of the customer’s consent, detailing the amount being charged and associated conditions. Its primary purpose is to protect both the merchant and the cardholder during the payment process.

Authorization forms play a pivotal role in transactions, especially in environments where card-not-present (CNP) transactions occur, such as online purchases. They help prevent fraud and ensure that the payment process is transparent. By requiring a signed authorization, businesses can mitigate the risk of chargebacks and fraudulent activities, enhancing trust in their operations.

Why use a credit card authorization form?

Using a credit card authorization form is essential for various reasons. Primarily, it helps prevent chargeback abuses, providing businesses with a documented consent that validates the transaction. When a customer disputes a charge, having a signed authorization can protect merchants from financial losses.

Additionally, these forms ensure payment security by verifying that the transaction is legitimate before proceeding. They serve to facilitate smoother sales transactions, thereby enhancing the overall operational efficiency for sellers. Authorization forms are particularly useful in scenarios involving subscriptions, service agreements, or any recurring payments.

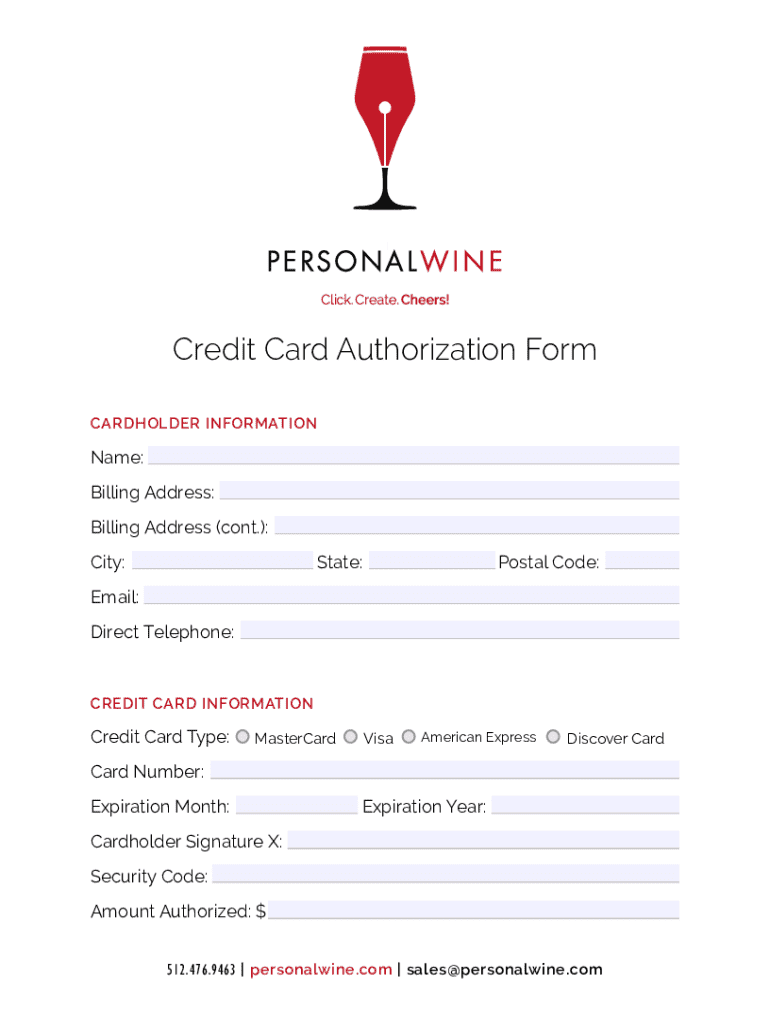

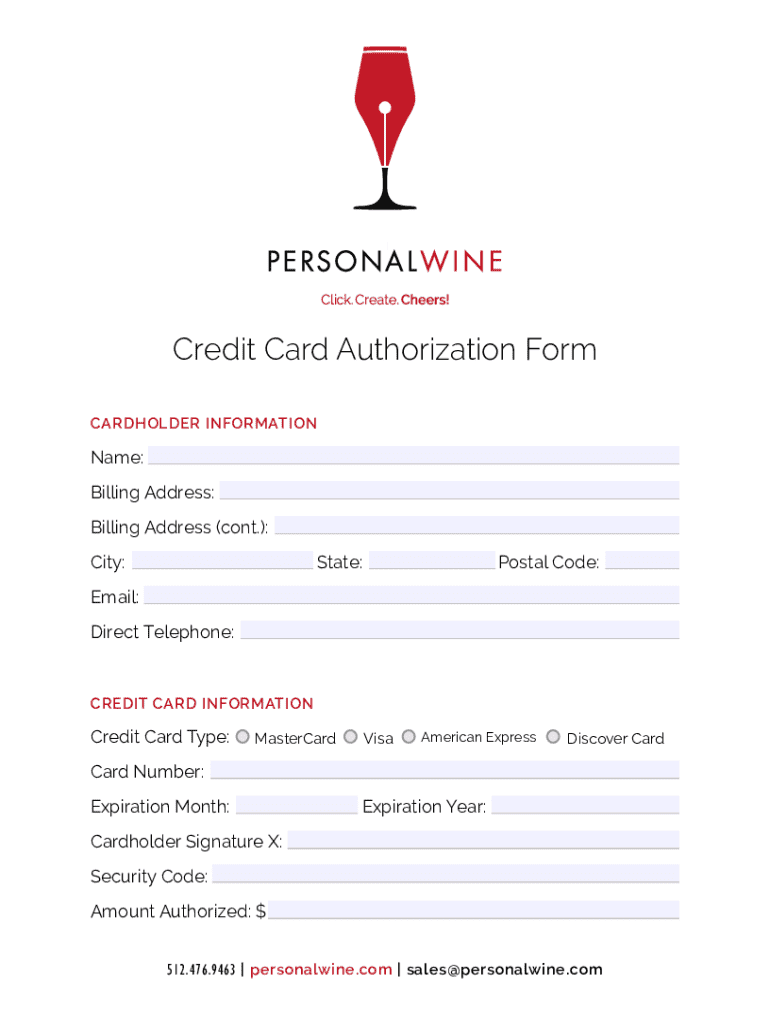

Components of a credit card authorization form

Creating an effective credit card authorization form requires including essential elements that provide clarity and prevent misunderstandings. These components ensure that both the cardholder and the merchant are on the same page regarding transaction terms.

Essential elements include cardholder information, transaction details, the total amount to be authorized, and card expiration and CVV considerations. Additionally, a signature line and date solidify the consent of the cardholder, making the form legally binding.

Optional sections may also enhance the form's effectiveness. Including a reason for authorization, terms and conditions, and a privacy agreement can provide additional context and assurance for all parties involved.

How to create your own credit card authorization form

Building a personalized credit card authorization form can seem daunting, but following a structured approach simplifies the process. Start by choosing a template that aligns with your business needs or opt to create one from scratch for complete customization.

Customization is key; incorporate essential fields to ensure clarity and completeness. Utilizing eSignature features allows clients to sign directly on the document, facilitating convenient and secure transactions. Compliance with data protection laws is paramount; ensure your form meets GDPR and PCI DSS standards to safeguard customer information.

For effective design, focus on user-friendliness by using clear fonts and leaving ample space for information. Highlight important elements like the transaction amount to draw attention and promote comprehension.

Tips for filling out the credit card authorization form

For cardholders, filling out a credit card authorization form correctly is crucial to avoid processing delays or disputes. Begin by providing accurate and up-to-date cardholder information. Double-check transaction amounts to ensure correctness; discrepancies can lead to complications later on.

Understanding privacy implications is essential, as this information contains sensitive data. Review the privacy policy attached to the authorization form to know how your information will be used and protected. Common mistakes include inaccurate entries and overlooking required fields.

Storing and managing your authorized forms

Once a credit card authorization form is completed, secure storage is paramount to protect customer information from unauthorized access. Using encrypted digital storage solutions is recommended for managing these documents effectively. Physical forms, if necessary, should be stored in locked cabinets with limited access to trained personnel.

Best practices dictate retaining signed authorization forms for a specified period, typically between three to seven years, to accommodate potential disputes. Compliance with data protection laws, such as GDPR and PCI DSS, should guide your storage and retention policies, ensuring that data handling is above board.

Frequently asked questions (FAQ)

Understanding the legal obligations surrounding credit card authorization forms is crucial for both consumers and businesses. Some may wonder whether it is legally required to use an authorization form. While not universally mandated, it is a best practice that can significantly shield merchants from disputes.

If a customer encounters an unauthorized charge, they should immediately contact their bank or card issuer to dispute the transaction. The bank will guide them through the necessary steps to rectify the issue. Moreover, many people are curious about what happens to their information once the authorization is completed; data retention policies should clarify this to reassure customers about their privacy.

Interactive tools to enhance your experience

For individuals and teams looking for comprehensive document solutions, having access to downloadable templates can simplify form creation. pdfFiller offers customizable credit card authorization form templates that you can easily adapt for your specific needs.

Additionally, eSignature solutions can facilitate quick and easy signing processes, allowing customers to authorize payments seamlessly from anywhere. Explore various payment processing options that complement your business operations to maximize efficiency. These tools enhance the experience of creating, filling out, and managing credit card authorization forms.

Related topics for further exploration

Further understanding the context of credit card authorization forms can lead to broader payments insights. Payment gateways play a significant role in processing transactions securely, so learning about their function can enhance your operational knowledge. Moreover, grasping how to safely accept card payments over the phone can significantly expands the opportunities for businesses, especially in service-based industries.

Additionally, consider studying the evolution of payment methods in e-commerce, as this is a rapidly changing landscape. Keeping abreast of trends and innovations can help improve transaction security and customer satisfaction.

Engage with us

We encourage our readers to share their experiences with credit card authorization forms to foster a community of learning and support. By sharing insights and best practices, we can collectively improve the processes surrounding payment authorizations. Sign up for our newsletter to receive more insights and updates that can help streamline your document management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my credit card authorization form in Gmail?

How do I edit credit card authorization form straight from my smartphone?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.