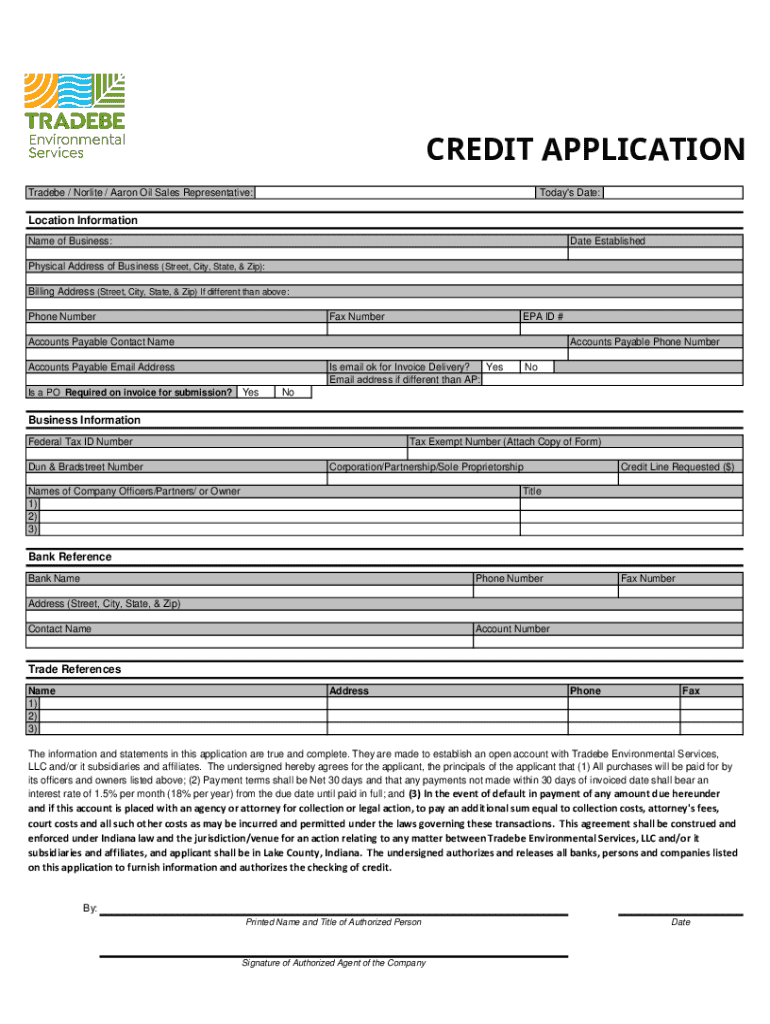

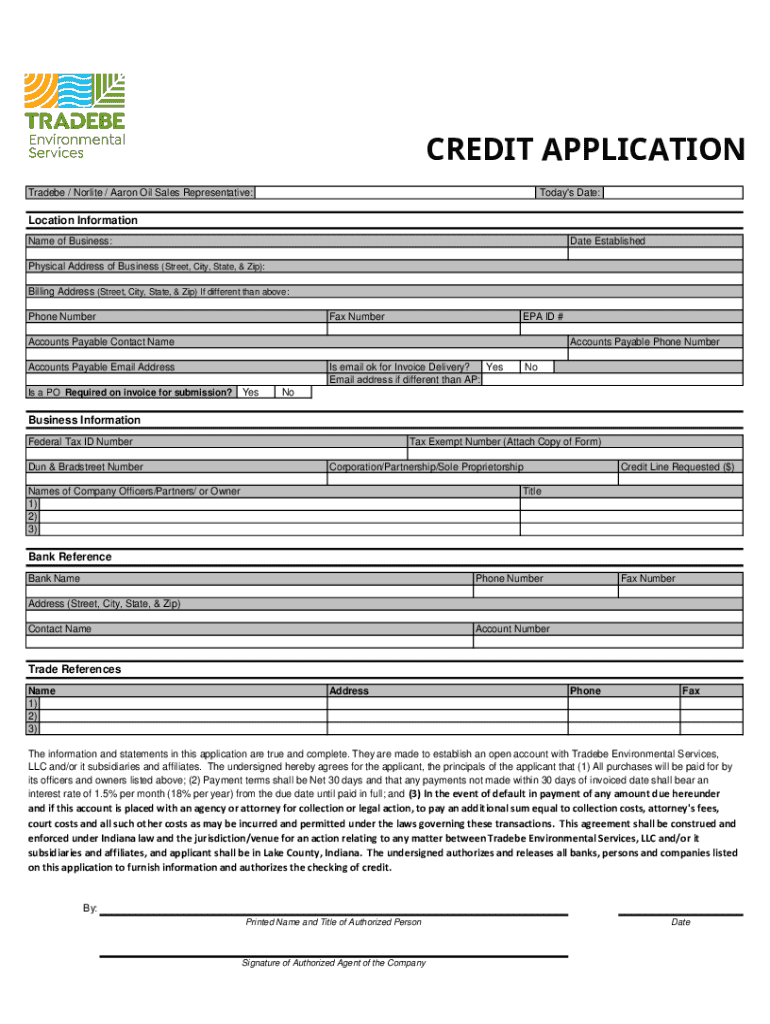

Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Complete Guide to the Credit Application Form

Understanding the credit application form

A credit application form is a structured document that individuals or businesses complete when seeking credit, loans, or financing from a lender. This form collects essential information about the applicant’s financial health and creditworthiness to assess risk and determine eligibility for loans.

Accurate information on the application form is crucial, as it influences the lender's decision. Incomplete or misrepresented data can delay or derail the loan approval process. Being transparent about your financial situation ensures that lenders assess your application correctly and offer terms suitable to your credit profile.

Common scenarios for using a credit application form include applying for personal loans, mortgages, car loans, or credit cards. Each situation may require specific details but fundamentally revolves around the applicant's capabilities to repay the obligation.

Preparing to complete the credit application form

Before filling out a credit application form, it's essential to gather the necessary documentation that supports your creditworthiness. Typical requirements include identification, financial information, and a summary of your credit history.

To facilitate the gathering of information, consider using organizational tools like digital folders or spreadsheet applications that help you track your financial information efficiently.

Step-by-step guide to filling out the credit application form

Filling out a credit application form can seem daunting, but breaking it down into sections makes it manageable. Several fields typically populate the form, including personal information, employment details, financial information, and credit history.

Section 1: Personal information

Begin with your full name, current address including city and state, and contact details. Don’t forget to include your Social Security number and date of birth, as these help lenders verify your identity.

Section 2: Employment details

In this section, detail your current employment status. It’s also crucial to provide income verification, which could include recent pay stubs or tax returns.

Section 3: Financial information

List your assets and liabilities accurately. Consider all your properties, savings, and any investments as assets, while detailing liabilities like loans and credit card debts.

Section 4: Credit history and loan purpose

Outline your past credit experience, including any late payments or defaults. Further, specify the intended use of the funds, whether for a home, vehicle, or unexpected expenses.

Interactive tools for completing the credit application form

Utilizing digital tools such as pdfFiller can simplify the process of completing your credit application form. Electronic forms come with numerous benefits, such as ease of use and accessibility from any device.

If you are applying jointly or require assistance, leverage collaboration features to share the form with financial advisors or co-applicants seamlessly.

Common mistakes to avoid when completing the credit application form

Mistakes on your credit application can lead to delays, denials, or unfavorable terms from lenders. It's vital to take a careful approach while filling out the application.

Editing and eSigning your credit application form

If you made a mistake after filling out your credit application, using pdfFiller makes editing fields easy. You can add comments or notes where necessary and ensure all errors are corrected before submitting.

Digital signature options

Most credit applications require a signature to verify authenticity. With pdfFiller, you can eSign your document conveniently. The process typically involves clicking on the area designated for signatures, following on-screen prompts, and then saving the document.

Submitting your credit application form

Once your application is complete and signed, the next step is submission. There are various methods available, including online portals, email, or traditional mail.

After submission, expect a confirmation of receipt from your lender. Knowing what to anticipate can help you maintain peace of mind during the waiting period.

Managing your credit application after submission

After submitting your application, it’s important to track its status. Many lenders provide online platforms where you can check the progress of your application easily.

Be prepared to respond promptly to any requests from the lender for additional information. Timely responses can speed up the decision-making process.

Frequently asked questions (FAQs) about credit application forms

Additional considerations for specific situations

Certain circumstances might require additional attention when filling out your credit application form.

Editing and customizing your credit application form with pdfFiller

With pdfFiller, users can take advantage of form templates that allow for easy editing. Personalize each section to reflect your information accurately, ensuring a tailored application.

Saving and retrieving customized forms is straightforward. You can access previously completed forms, easily update them, and manage your documents securely from the same platform.

Understanding lender expectations and requirements

Lenders have specific expectations when it comes to your credit application form. They look for thoroughness, accuracy, and evidence of financial responsibility. Completing the form without missing information can positively influence the loan terms offered.

As you prepare your application, consider the nuances of your financial situation and prepare to clearly articulate these to your lender.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit application?

Can I create an eSignature for the credit application in Gmail?

How do I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.