Get the free Pre-authorized Credit Card Form

Get, Create, Make and Sign pre-authorized credit card form

Editing pre-authorized credit card form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-authorized credit card form

How to fill out pre-authorized credit card form

Who needs pre-authorized credit card form?

Pre-Authorized Credit Card Form - How-to Guide

Overview of pre-authorized credit card forms

A pre-authorized credit card form is a document that enables businesses to charge a customer's credit card on a recurring basis without requiring the customer to provide payment details for each transaction. This method is primarily used for subscription services, memberships, and any payments that occur regularly, ensuring convenience for both the consumer and the business.

The importance of pre-authorized credit card forms in financial transactions cannot be overstated. They streamline payment processes, reducing the likelihood of missed payments which can result in service interruptions. Not only do they simplify bookkeeping for businesses, but they also offer consumers peace of mind, knowing their payments are automated.

Understanding credit card authorization processes

Pre-authorization is a method used by businesses to verify that funds are available on a credit card before processing a payment. This involves securing a particular amount from the cardholder's account. The authorization does not finalize the payment; rather, it locks a specified amount for the business to capture later.

The step-by-step process of obtaining pre-authorization involves the following stages: First, the customer provides their credit card information, which gets encrypted and sent to a payment gateway. Next, the payment gateway communicates with the bank to check the available balance. Once verified, the bank puts a hold on the funds for a specified period, allowing the business to settle the charge later.

It's crucial to note that pre-authorization differs from regular transactions in that it does not immediately deduct money from the account. Instead, it secures funds for a set period, ensuring that the business can complete the transaction once it is ready.

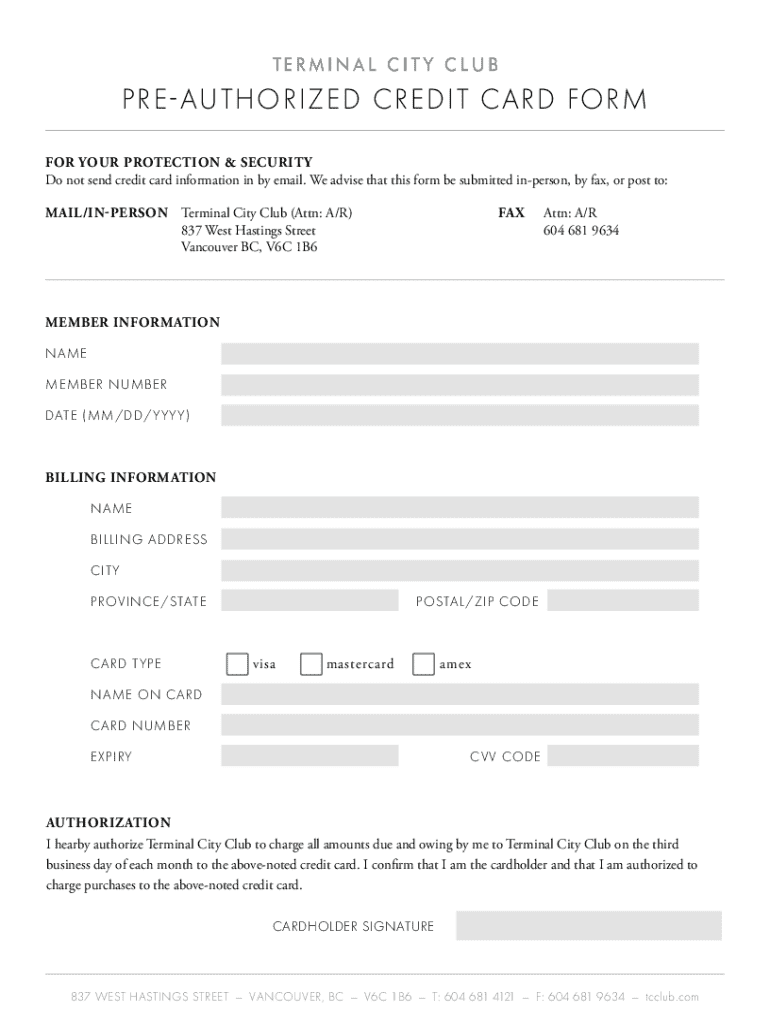

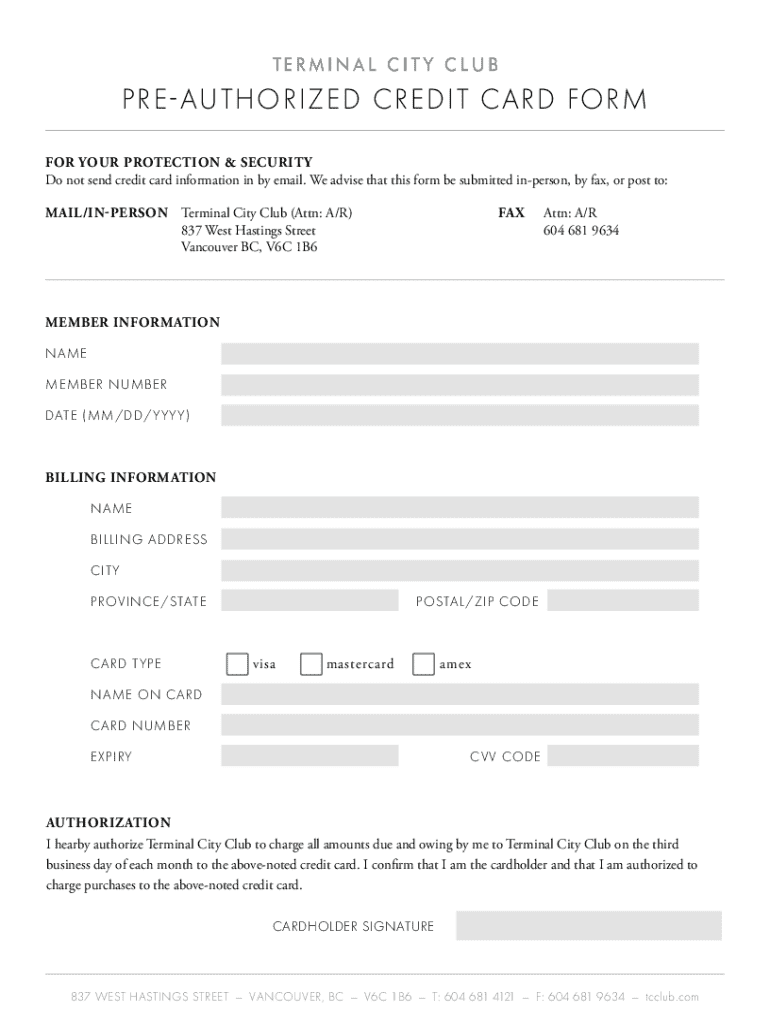

Key components of a pre-authorized credit card form

A pre-authorized credit card form should include several essential components to ensure smooth processing and security. Basic cardholder details such as the cardholder's name, billing address, and phone number are required to verify the identity of the user. Additionally, payment information like the amount and frequency of the payment, together with the card's expiry date and CVV code (if applicable), is necessary for processing.

Optional fields can also enhance the utility of the form. For instance, fields for additional contact information or consent for later charges can improve communication and transparency between the business and the customer.

Filling out a pre-authorized credit card form

Filling out a pre-authorized credit card form may seem straightforward, yet attention to detail is essential. Start by providing personal information, ensuring it's accurate and up-to-date. Next, enter the payment details: specify the payment amount and how frequently it should be charged (monthly, quarterly, etc.). Finally, the cardholder must sign the authorization section to confirm they agree to the terms.

Common mistakes include failing to double-check the card information, submitting incorrect payment amounts, or forgetting to sign the form. To enhance accuracy, always cross-reference provided details with your credit card statement and confirm all fields are completed before submitting the form.

Legal implications of using pre-authorized credit card forms

Understanding the legal agreements associated with pre-authorized transactions is paramount for both businesses and consumers. The terms of the agreement should clearly outline the responsibilities of both parties, detailing payment schedules, refund policies, and cancellation procedures. Consumers need to be aware of their rights, which include the ability to dispute unauthorized charges and the requirement for businesses to maintain transparent billing practices.

Additionally, compliance with the Payment Card Industry Data Security Standards (PCI DSS) is crucial for any business handling cardholder data. This compliance helps protect sensitive information against breaches and fraud, which further enhances trust between businesses and their customers.

Managing pre-authorized payments

Managing pre-authorized payments is crucial for maintaining financial oversight. To edit or cancel a pre-authorized transaction, contact the service provider directly, providing them with any necessary identification information and your current billing details. Tracking and monitoring expenses associated with pre-authorized transactions can help prevent over-expenditures or missed payments. Utilize tools provided by platforms like pdfFiller for easy document management and expense tracking.

Best practices for record-keeping include maintaining physical or digital copies of all agreements, invoices, and correspondences related to pre-authorizations. Regular reviews of your financial statements can help you stay on top of recurring charges, ensuring no unexpected expenses pop up on your credit report.

Frequently asked questions (FAQ)

Understanding common concerns regarding pre-authorized credit card forms can help potential users feel more at ease when utilizing them. For instance, the typical duration of a pre-authorization can vary, often lasting from a few days to a few weeks, depending upon the business policy and what the transaction is for.

Security is always a concern, and consumers often wonder if pre-authorized transactions are secure. When using reputable service providers who comply with PCI standards, consumers can feel confident in their transactional security. Exceeding a pre-authorized limit will often lead to declined transactions, necessitating account management with the service provider. Importantly, consumers are not legally obligated to exclusively use pre-authorized forms for recurring payments; alternatives include direct debit and one-time payments, depending on their preferences.

Interactive tools for better management

To maximize efficiency when managing pre-authorized credit card forms, consider utilizing tools such as pdfFiller's interactive features. The platform offers e-signature capabilities that streamline the signature process, making it easier to obtain approvals from multiple stakeholders quickly. Furthermore, real-time collaboration options can facilitate team discussions around billing procedures, enhancing transparency and communication.

Storing and organizing signed forms securely is a critical aspect of managing financial documents. Using pdfFiller, users can ensure that all forms are stored in an accessible yet secure manner, allowing for easy retrieval during audits or reconciliations.

Related documents and forms

Understanding how pre-authorized credit card forms fit within the broader context of payment authorization is essential. This includes recognizing the differences between them and other types of payment authorization forms, such as one-time payment forms and contracts for direct debits, which may have different requirements and implications.

For businesses utilizing subscription services, having templates readily available can improve both efficiency and compliance. pdfFiller provides a variety of templates for different documents, enhancing workflow by simplifying processes like payment authorization and contract agreement.

Tips for businesses on best practices

To foster trust and encourage smooth transactions, businesses should be transparent about their use of pre-authorized credit card forms. Clear communication regarding payment terms and conditions can mitigate misunderstandings and ensure customers are fully informed. Providing concise and easy-to-read information can go a long way in building customer confidence.

Another strategy to reduce chargeback risks involves establishing proactive customer support. Addressing concerns before they escalate can help prevent disputes, while clear authorization forms help to enforce the understanding of the payment process. Businesses can also leverage tools like pdfFiller to track customer feedback and refine their billing practices.

Industry insights

The landscape of payment authorizations is rapidly evolving, particularly with advancements in digital solutions that enhance both security and user experience. Trends indicate an increasing reliance on automated systems for payment authorizations, streamlining processes and minimizing human error. The use of biometric verification and advanced encryption technologies are also gaining traction as consumers demand more secure payment methods.

Looking forward, the future of pre-authorized payment solutions seems bright. Innovations in financial technology are expanding the capabilities of businesses and consumers alike, allowing for more customized payment plans and enhanced user engagement. Case studies of businesses successfully implementing pre-authorized processes have shown substantial increases in customer retention rates and smoother cash flow management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pre-authorized credit card form in Gmail?

How do I edit pre-authorized credit card form on an Android device?

How do I complete pre-authorized credit card form on an Android device?

What is pre-authorized credit card form?

Who is required to file pre-authorized credit card form?

How to fill out pre-authorized credit card form?

What is the purpose of pre-authorized credit card form?

What information must be reported on pre-authorized credit card form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.