Get the free Ytd Expense-school

Get, Create, Make and Sign ytd expense-school

How to edit ytd expense-school online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ytd expense-school

How to fill out ytd expense-school

Who needs ytd expense-school?

Your Comprehensive Guide to the YTD Expense-School Form

Understanding the YTD expense-school form

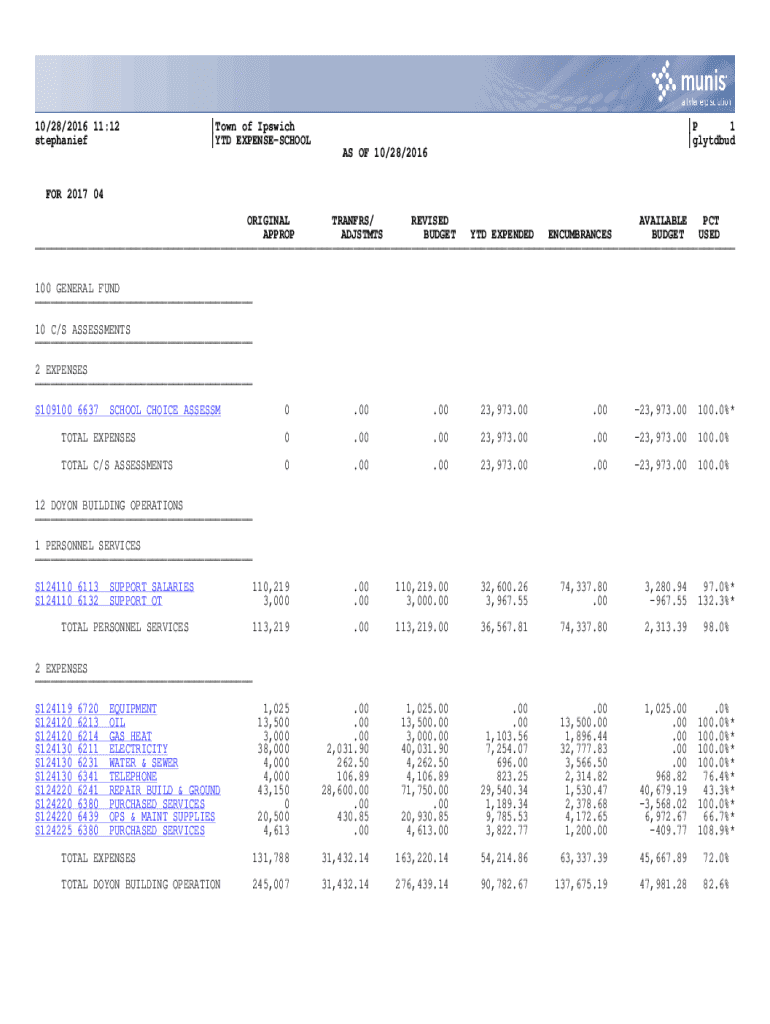

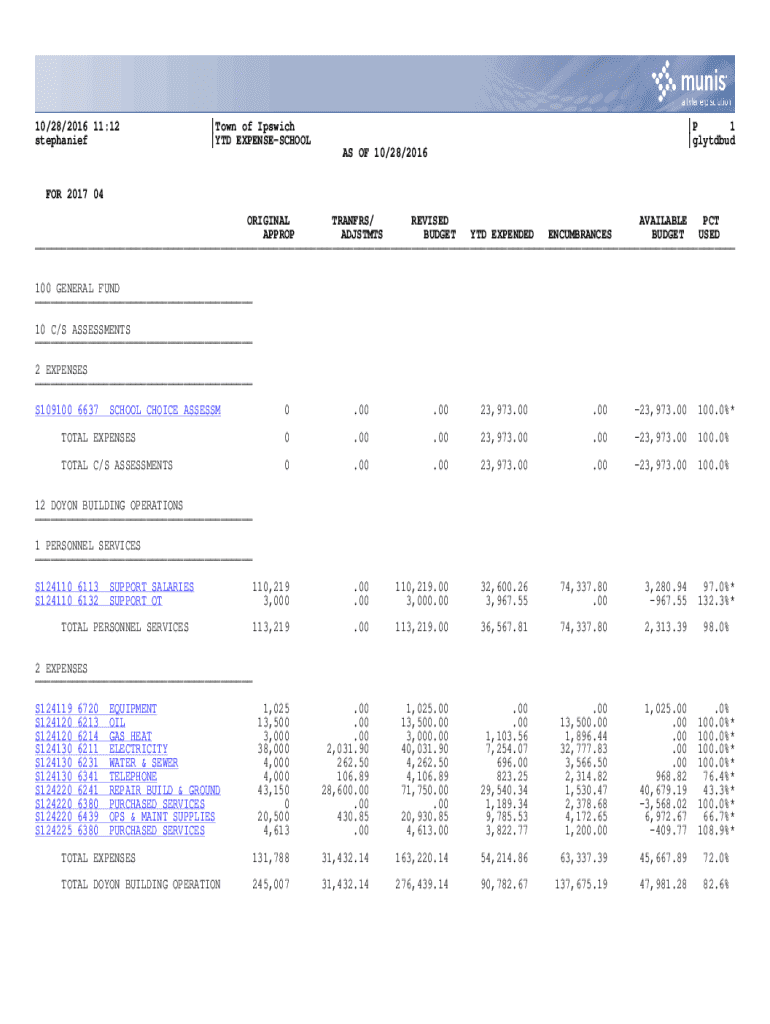

The YTD Expense-School Form, or Year-To-Date Expense-School Form, is a vital document that helps individuals and organizations track and manage educational expenses over a calendar year. This form becomes an essential tool, especially for parents, students, and administrators, as it allows for meticulous documentation of all related costs. Accurate record-keeping is crucial, not only for budgeting but also for potential tax deductions related to educational expenditures.

Documenting these expenses is important for several reasons. It provides clarity on how funds are being utilized, helps in budget planning for the upcoming academic year, and ensures compliance with financial aid requirements. The key features of the form include sections for personal information, a detailed list of expenses such as tuition, school supplies, and extracurricular activities, and spaces for notes and comments to capture any additional relevant information.

Who should use the YTD expense-school form?

The YTD Expense-School Form caters to a diverse audience. Primarily, it is designed for individuals such as parents, students, and tutors who wish to keep a close account of their educational spending. For parents, having a record of expenses can aid in ensuring they're not overspending and are making the most of financial resources available to them. Students can also benefit by getting a firsthand look at what their education truly costs.

Moreover, teams such as school administrators and financial officers can leverage the YTD Expense-School Form for streamlined budget management within the institution. It’s particularly useful during grant applications, audits, or financial planning sessions. Scenarios where this form shines include managing financial aid, preparing for tax season, or simply tracking monthly expenses related to school activities and resources.

Navigating the pdfFiller platform

pdfFiller’s intuitive interface makes it incredibly easy to navigate through various forms, including the YTD Expense-School Form. Users can quickly find and edit required documents, making it a popular choice for effective document management. The platform enhances the user experience by providing cloud-based solutions, allowing individuals to create, edit, and manage their forms from anywhere with an internet connection.

Using pdfFiller offers several benefits, such as the capability to eSign documents, seamless collaboration with team members, and easy access to previously saved forms. This level of flexibility is crucial for individuals and teams looking for efficient ways to handle and organize their school-related expenses without the hassle of traditional paper filing systems.

Step-by-step guide to filling out the YTD expense-school form

Accessing the YTD Expense-School Form on pdfFiller is a straightforward process. Users can navigate the platform's search feature or browse through categories until they identify the form. Once located, the pdfFiller editor provides an array of tools to assist in completing the form effectively. Key tools include text fields, checkbox options, and interactive features that encourage thorough completion.

Common mistakes to avoid when completing the form

Completing the YTD Expense-School Form can be straightforward, but certain pitfalls can derail the process. One common mistake is inaccurate expense documentation; it is vital to ensure all figures are correct and verifiable. Inconsistent tracking of expenses can lead to discrepancies that may cause issues during audits or when applying for financial aid.

Another frequent error is missing essential signatures or dates, which can render the document invalid. It's crucial to provide all requested information and to double-check that your form is complete. Additionally, failing to keep a copy of the completed form for personal records can lead to confusion and hinder future planning or financial analysis.

Tips for effective expense tracking using the YTD expense-school form

To maintain accurate records throughout the year, consider implementing best practices for effective expense tracking. Regularly updating the YTD Expense-School Form ensures that you have the most current data at your fingertips. Each month, take time to review and categorize new expenses, making adjustments as necessary.

Utilizing additional tools such as budgeting apps or spreadsheets can enhance tracking efforts. Coupling your YTD form with other digital tools makes it easier to visualize your spending. As the tax season approaches, having a well-organized YTD Expense-School Form can greatly simplify tax preparation, especially when looking for eligible deductions or credits related to educational costs.

Collaboration features of pdfFiller

pdfFiller excels in collaborative functionality, allowing multiple users to work on the YTD Expense-School Form concurrently. Team members can be invited to participate by sharing access to the document, making it easier for parents, students, and financial officers to coordinate effectively. Using the comments feature facilitates streamlined communication, enabling users to share feedback or clarify details swiftly.

Version control is another key aspect, as pdfFiller maintains access to previous form iterations. This way, if discrepancies arise, users can revert to an earlier version of the document. This is invaluable for ensuring that all changes are tracked and approved among collaborating parties, creating clarity in the financial documentation process.

Troubleshooting common issues

While pdfFiller provides a seamless experience, users may encounter occasional issues with accessing forms or permission settings. Ensure you have the necessary access rights if you face difficulties opening documents. If problems arise while editing or saving, first check your internet connection and refresh the page.

If issues persist, contacting pdfFiller support is a sound option. They offer assistance for various technical problems and can guide users through more complex situations related to form management. With dedicated support, users can resolve issues promptly, returning their focus to managing their educational expenses.

Case studies: real-life applications of the YTD expense-school form

Understanding practical applications of the YTD Expense-School Form can illuminate its benefits. In one case study, a parent effectively tracked their child’s education expenses over the year using the form. By regularly updating their entries and categorizing costs, they not only managed their budget more efficiently but also prepared thoroughly for financial aid renewal applications.

In another instance, a school utilized the YTD Expense-School Form to enhance its financial management. By aggregating expense data from teachers, staff, and programs, the administration achieved a clearer picture of its budgets and future funding needs. These case studies highlight that by utilizing the form correctly and consistently, all stakeholders can enjoy a more streamlined process for managing educational costs.

Frequently asked questions (FAQs)

The YTD Expense-School Form often prompts specific inquiries from users. One common question is regarding what types of educational expenses can be reported. Generally, costs related to tuition, textbooks, fees for activities, and even supply purchases qualify. This form's comprehensive nature allows for a complete overview of various expenditure types.

Another question frequently arises concerning modifications to saved forms. If your expenses change throughout the year, pdfFiller enables easy editing capabilities, allowing you to adjust your form accordingly. Users often ask about data security and privacy, and pdfFiller employs robust measures to ensure your information remains confidential and secure from unauthorized access.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ytd expense-school in Chrome?

Can I sign the ytd expense-school electronically in Chrome?

How can I fill out ytd expense-school on an iOS device?

What is ytd expense-school?

Who is required to file ytd expense-school?

How to fill out ytd expense-school?

What is the purpose of ytd expense-school?

What information must be reported on ytd expense-school?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.