Get the free Telenor Microfinance Bank Limited Condensed Interim Financial Statements

Get, Create, Make and Sign telenor microfinance bank limited

How to edit telenor microfinance bank limited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out telenor microfinance bank limited

How to fill out telenor microfinance bank limited

Who needs telenor microfinance bank limited?

Understanding the Telenor Microfinance Bank Limited Form

Understanding the Telenor Microfinance Bank Limited Form

Telenor Microfinance Bank Limited stands as a pivotal institution in Pakistan's financial landscape, offering essential microfinance services to underserved communities. With a mission to enhance financial inclusion, the bank plays a crucial role in empowering individuals and small businesses by providing access to credit, savings, and other financial products. The Telenor Microfinance Bank Limited Form is a key tool in this process, designed to facilitate applicants in obtaining the financial assistance they need.

This form is specifically crafted for applicants seeking loans or financial services offered by Telenor Microfinance Bank. Its primary purpose is to gather essential information that enables the bank to assess an applicant's eligibility for microfinance services. By completing the form correctly, individuals can streamline their application process and enhance their chances of securing needed funds, thus promoting better financial health and opportunities.

Key features of the Telenor Microfinance Bank Limited Form

The Telenor Microfinance Bank Limited Form collects a variety of information necessary for evaluating loan applications. Understanding these features can greatly aid applicants in effectively filling out the form.

The benefits of using the Telenor Microfinance Bank Limited Form are significant. It not only provides streamlined access to essential microfinance services but also improves the assessment of loan eligibility. By filling out the form accurately, applicants position themselves favorably for financial support, potentially unlocking opportunities for entrepreneurship and economic stability.

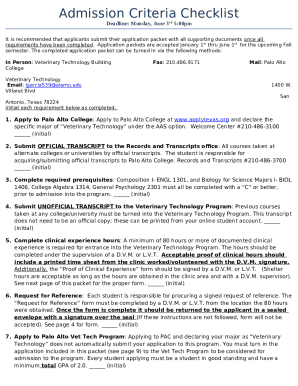

Preparing to fill out the form

Before diving into the Telenor Microfinance Bank Limited Form, applicants should ensure they have all necessary documents in hand. This preparation can save time and reduce errors in submission.

Understanding the eligibility criteria is also vital. Usually, this includes having a verifiable source of income, a good credit history, and sometimes, collateral depending on the loan amount. Applicants should double-check that all information provided is accurate to avoid unnecessary delays in processing.

Step-by-step guide to filling out the form

Filling out the Telenor Microfinance Bank Limited Form can be made easier by following a structured approach. Here’s a comprehensive guide that will lead you through the process, ensuring your application is complete and precise.

Managing your form after submission

After submitting your Telenor Microfinance Bank Limited Form, it’s important to stay informed about your application status. Managing your form correctly can greatly aid in this process.

Frequently asked questions (FAQs)

It’s common for applicants to have questions about the Telenor Microfinance Bank Limited Form process. This section addresses some frequent concerns that arise during and after the application process.

Real-world examples and case studies

To understand the practical impact of the Telenor Microfinance Bank Limited Form, several success stories illustrate how this application process can change lives.

Incorporating interactive tools for enhanced user experience

In today's digital era, using innovative tools can significantly improve the document management experience. pdfFiller offers a suite of features that facilitate form handling.

Conclusion: maximizing the benefits of the Telenor Microfinance Bank Limited Form

Filling out the Telenor Microfinance Bank Limited Form is more than just completing a task; it’s a step toward financial empowerment. By leveraging a cloud-based document management approach with pdfFiller, users can maximize their experience.

Emphasizing the strength of digital solutions can lead to improved accuracy and efficiency in the application process. As applicants take initiative to utilize these tools, they foster a better chance of realizing their financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the telenor microfinance bank limited in Chrome?

How do I fill out telenor microfinance bank limited using my mobile device?

How do I complete telenor microfinance bank limited on an Android device?

What is telenor microfinance bank limited?

Who is required to file telenor microfinance bank limited?

How to fill out telenor microfinance bank limited?

What is the purpose of telenor microfinance bank limited?

What information must be reported on telenor microfinance bank limited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.