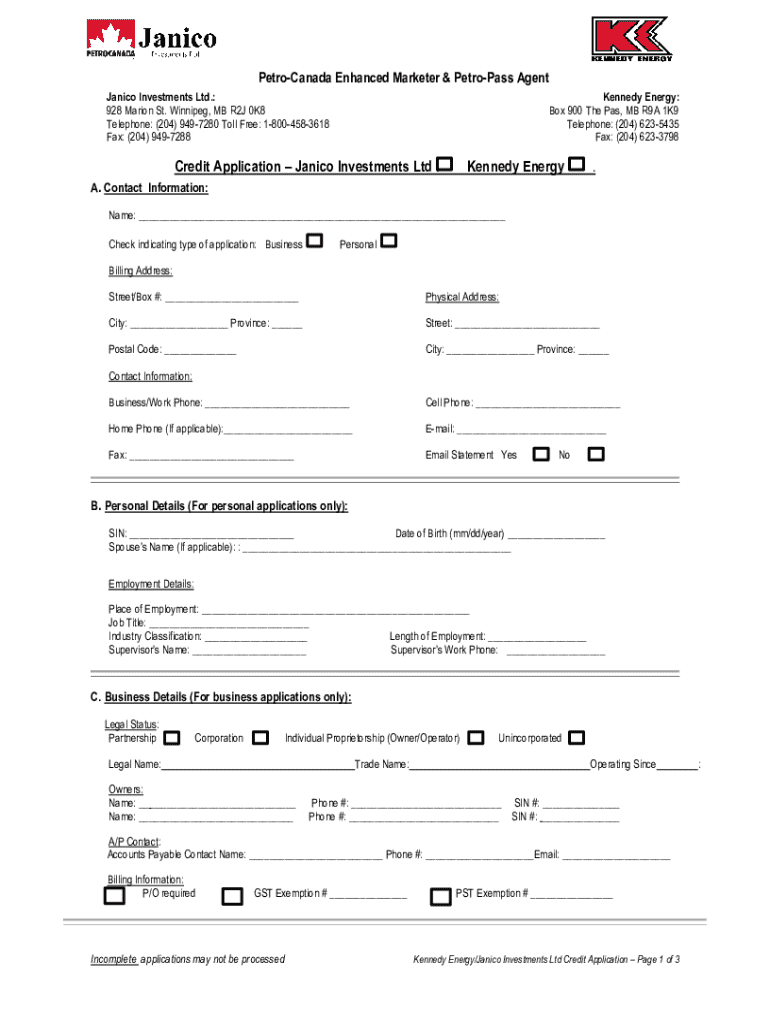

Get the free Credit Application - Janico Investments Ltd.

Get, Create, Make and Sign credit application - janico

Editing credit application - janico online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application - janico

How to fill out credit application - janico

Who needs credit application - janico?

Credit Application - Janico Form: A Comprehensive How-to Guide

Understanding the credit application process

A credit application is a formal request submitted by an individual or business to a lender, seeking funds or credit based on their financial situation. The importance of a credit application cannot be overstated; it serves as a means for lenders to assess the applicant's creditworthiness. It is a critical step in securing loans, credit cards, or leases, often determining one's financial future.

Common scenarios where credit applications are utilized include applying for a mortgage, requesting a personal loan, or seeking a credit limit increase on a credit card. Each of these situations requires applicants to provide comprehensive information regarding their financial background to facilitate informed lending decisions.

Types of credit applications

Credit applications can be categorized primarily into personal and business applications. Personal credit applications are typically individual-centric, necessitating personal identification, income verification, and credit history. In contrast, business credit applications require a broader range of documentation, including financial statements, tax returns, and details about the business structure.

Moreover, variations exist among industries where credit applications are employed. For instance, the requirements for a credit application in the mortgage industry can differ substantially from those in retail, as real estate loans necessitate extensive property documentation.

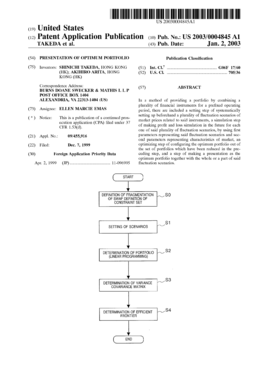

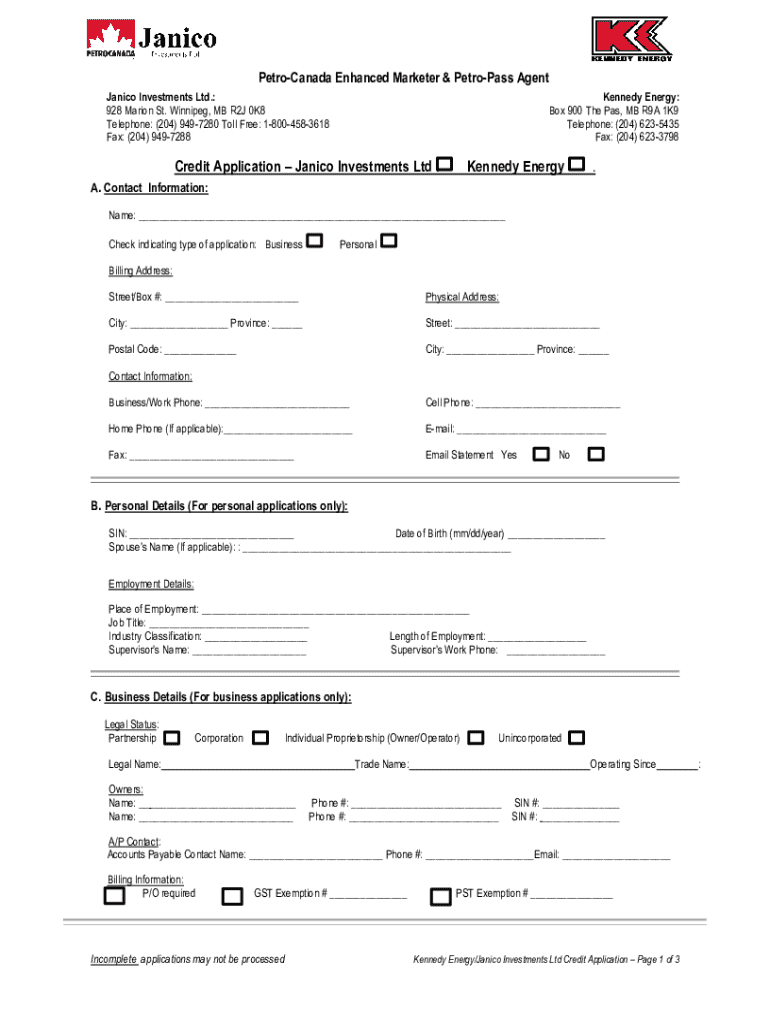

Overview of the Janico form

The Janico Credit Application Form is a streamlined template designed to simplify the credit application process. Its primary purpose is to gather essential information from applicants while ensuring that the form is intuitive and user-friendly. By utilizing the Janico form, applicants can effectively communicate their financial details without overwhelming complexity.

The benefits of using the Janico form are manifold. It significantly reduces the time needed to complete applications while enhancing the accuracy of the information provided. The form caters to a wide audience, including individuals and businesses looking to establish or expand their credit relationships.

Key features of the Janico form

Several key features of the Janico form help enhance the overall application experience. Firstly, interactive fields enable applicants to fill in details effortlessly, making the process enjoyable rather than cumbersome. Secondly, strong security attributes ensure that personal information is protected, which is critical given the sensitivity of financial data.

Additionally, customization options available through pdfFiller add significant value, allowing businesses to tailor the form to their specific needs. This flexibility can include adjusting sections, adding branding elements, or incorporating specific questions relevant to the credit inquiry.

Step-by-step guide to filling the Janico credit application

Completing the Janico Credit Application requires careful preparation. The first step is to gather all necessary information. This includes personal details such as your full name, address, social security number, and employment history. Additionally, financial information is crucial; applicants should have income statements, bank account details, and identification documents ready for submission.

The next step involves accessing the Janico form via pdfFiller. Users can easily locate the form by searching within the platform or navigating through the provided document templates. Once found, familiarize yourself with pdfFiller's interface, as it features an array of tools designed to aid in complete and efficient form completion.

When completing the form sections, each area should be treated with attention to detail. Start with Applicant Information, providing accurate personal data, followed by Financial Details including income and existing debts. It's essential to double-check each entry for errors, as inaccuracies can lead to application delays.

After filling out the form, reviewing the completed application is vital. Proofreading allows you to spot common errors, such as incorrect figures or missing information. Lastly, submit your application. You can choose to submit online through pdfFiller or print the document for postal submission. Tracking your application status post-submission is also crucial to stay informed on its progress.

Managing your credit application

Once your application is submitted, managing your credit application is equally important. If you need to edit your submission, pdfFiller allows users to make adjustments even after the application is sent. However, be aware that major changes should ideally be communicated directly to the lender, as they may affect the approval process.

After submission, understanding the approval or rejection notifications comes next. Applicants can expect to receive feedback within a specified time frame, typically ranging from a few days to a couple of weeks, depending on the lender's policies. If approved, review the terms carefully, while a rejection may require assessing the reasons behind the decision and potentially improving your credit score.

Alternative uses for the Janico form

The versatility of the Janico form extends beyond standard credit applications. It can be an effective tool for various transactions, including applying for rental leases or service agreements, where financial information is similarly needed to assess the applicant's capabilities.

Additionally, different sectors can adapt the Janico form to meet their specific needs. For example, a construction company could utilize the form to vet subcontractors, while retail businesses might use it to offer store credit. Such cross-industry variations highlight the form's adaptability in various financial contexts.

FAQs about the Janico credit application form

To help clarify some common questions about the Janico Credit Application Form, here are frequently asked inquiries from users:

Additional tools and resources by pdfFiller

pdfFiller provides a robust suite of additional tools designed to enhance the document management experience. Interactive features such as eSignature capability help users finalize documents swiftly and securely. Collaboration tools also exist to allow teams to work together seamlessly on credit applications or related forms, speeding up the review and approval process.

Other related forms that may be required include those for credit analysis or default management, further adapting pdfFiller's offerings to various user needs. By utilizing these resources, teams can comprehensively manage and track their financial documents without hassle.

Personalizing your experience with pdfFiller

Creating a customized document solution using pdfFiller is essential for optimizing your workflow. Tailoring document workflows allows users to specify their needs, ensuring that forms, including the Janico credit application, meet their exact requirements. This feature is highly beneficial for businesses with specific branding or legal obligations.

Furthermore, pdfFiller’s analytics and tracking capabilities enable users to monitor application status and performance over time. This insight helps identify any bottlenecks in the process and makes it easier to manage future submissions.

Best practices for credit applications

When applying for credit, avoiding common pitfalls is crucial. This includes ensuring all information is accurate and complete. Missing details or errors can lead to significant delays or denials. Take the time to double-check figures, especially regarding income, debts, and identification. Writing a well-worded application can further enhance your chances of approval.

Effective communication strategies are equally important. Following up on your application with the lender can demonstrate your keen interest and professionalism. Timing is essential; reach out if you haven’t heard back within the expected time frame to maintain momentum in your application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit application - janico in Gmail?

How do I edit credit application - janico in Chrome?

Can I edit credit application - janico on an iOS device?

What is credit application - janico?

Who is required to file credit application - janico?

How to fill out credit application - janico?

What is the purpose of credit application - janico?

What information must be reported on credit application - janico?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.