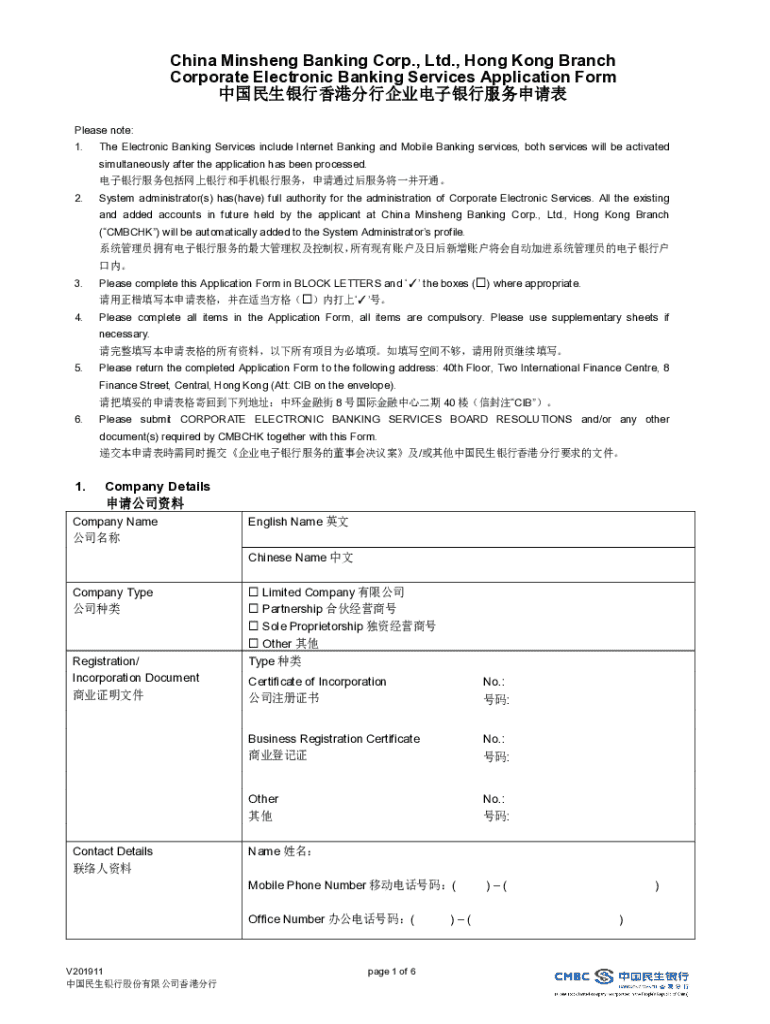

Get the free Corporate Electronic Banking Services Application Form

Get, Create, Make and Sign corporate electronic banking services

Editing corporate electronic banking services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate electronic banking services

How to fill out corporate electronic banking services

Who needs corporate electronic banking services?

Comprehensive Guide to Corporate Electronic Banking Services Form

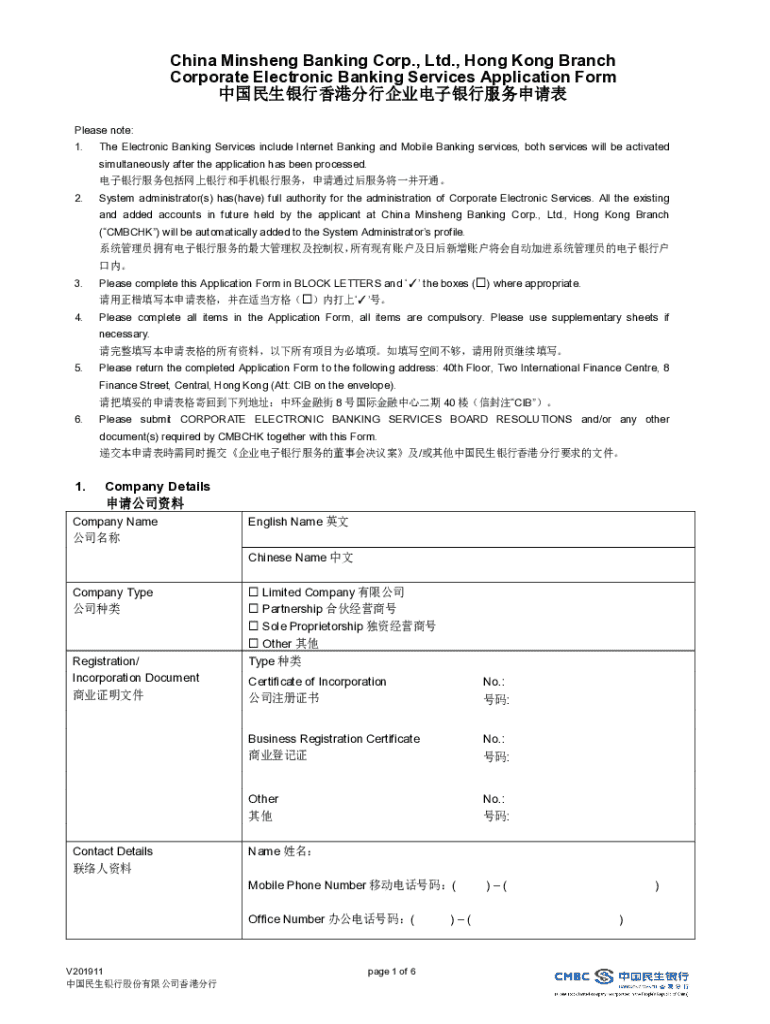

Overview of corporate electronic banking services

Corporate electronic banking services are specialized banking solutions designed to meet the needs of businesses. They allow companies to conduct financial transactions efficiently, manage accounts, and streamline operations from anywhere in the world. As businesses increasingly rely on digital solutions, the role of corporate electronic banking services has grown significantly, providing a crucial infrastructure that can adapt to evolving market demands.

The importance of these services cannot be overstated; they offer businesses the flexibility to operate in real-time, reduce costs associated with traditional banking methods, and enhance overall financial management capability. With numerous features tailored for corporate needs, electronic banking empowers organizations to manage finances securely and efficiently.

Types of corporate electronic banking forms

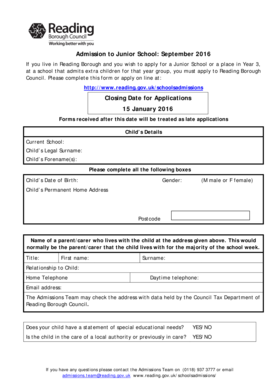

Understanding the types of forms associated with corporate electronic banking is essential for effective financial management. Each form serves a specific purpose and typically requires detailed information from the business to ensure compliance and security.

The primary types include: application forms for account setup, transaction request forms that guide users on how to submit transactions, and compliance and risk assessment forms ensuring that businesses adhere to regulatory frameworks. These forms help mitigate risks and enhance transparency in financial operations.

How to fill out the corporate electronic banking services form

Filling out the corporate electronic banking services form is a direct process that requires attention to detail to avoid errors. Here's a step-by-step guide on how to complete this task efficiently.

To start, access the form via pdfFiller, a versatile tool for managing documents. After opening the form, input your corporate information, focusing on aspects such as the business name and registration details. Ensure this information matches official documentation to avoid complications.

When completing the form, double-check your information to reduce errors that could lead to complications. Utilizing auto-fill features available in pdfFiller can help streamline this process, saving time and minimizing mistakes.

Editing and managing your corporate banking form

Once you've filled out the corporate electronic banking services form, you may find that changes need to be made after its initial completion. pdfFiller provides robust editing tools to simplify this process.

Editing your form is straightforward; simply access the document on pdfFiller and use the editing capabilities to adjust any necessary fields. You can save and store your forms in the cloud, allowing access from any location, which is especially beneficial for businesses with multiple team members involved in financial management.

Signing and submitting the form

The final steps to completing your corporate electronic banking services form involve signing and submitting it to your bank. With pdfFiller, the eSignature process is designed to be simple and user-friendly.

Start by electronically signing the document within pdfFiller. The platform provides various methods for eSigning, ensuring that you can choose one that suits your preferences. After signing, follow the submission guidelines outlined by your bank to ensure your form is processed correctly.

Troubleshooting common issues

Even with careful preparation, issues may arise during the submission of your corporate electronic banking services form. It’s essential to know how to troubleshoot these common problems effectively.

For instance, if your form is not submitting, various reasons could be at play, such as internet issues or incomplete information. It's a good practice to check all data entries. In case of errors in submitted information, the steps to rectify mistakes post-submission should involve immediate contact with your bank to address any discrepancies.

Best practices for corporate electronic banking management

For effective management of corporate electronic banking, implementing best practices is crucial. Keeping financial data secure is the first step in protecting against cyber threats that can jeopardize sensitive company information.

It is also advisable for businesses to regularly monitor their banking activities, which aids in identifying any unusual transactions quickly. Moreover, utilizing analytics tools provided through corporate banking platforms can empower organizations to make informed decisions based on real-time data and trends.

Interactive tools to enhance your experience

To complement the use of corporate electronic banking services forms, integrating interactive tools can enhance financial management. For example, budgeting and expense management tools can significantly improve a business's financial planning capabilities.

Additionally, comparison tools for banking features can guide businesses in choosing the right products or services for their needs. Access to real-time financial planning resources can facilitate strategic planning and position your company for future growth.

Ongoing support for businesses

Navigating corporate electronic banking can raise questions. It's vital for businesses to have access to ongoing support to resolve uncertainties that may arise during the process.

Having a well-structured FAQ section can be extremely beneficial for common queries. Furthermore, direct support contact information should be easily accessible, ensuring assistance is just a click away. Engaging with online tutorials and webinars provided by pdfFiller can enhance understanding and proficiency in utilizing electronic banking forms.

Future of corporate electronic banking services

As technology continues to evolve, the landscape of corporate electronic banking services is also undergoing significant changes. It's essential to recognize emerging trends that are shaping the industry.

Automation and artificial intelligence are becoming integrated into banking services, allowing for streamlined operations and improved customer service. Furthermore, enhancements in digital banking security will help protect corporate data and mitigate risks associated with cyber threats.

pdfFiller's commitment to innovation means ongoing improvements to their services, ensuring that users have access to the latest tools and features necessary for effective document and financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find corporate electronic banking services?

How do I edit corporate electronic banking services straight from my smartphone?

Can I edit corporate electronic banking services on an Android device?

What is corporate electronic banking services?

Who is required to file corporate electronic banking services?

How to fill out corporate electronic banking services?

What is the purpose of corporate electronic banking services?

What information must be reported on corporate electronic banking services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.