Get the free Consolidated Financial Statements

Get, Create, Make and Sign consolidated financial statements

Editing consolidated financial statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consolidated financial statements

How to fill out consolidated financial statements

Who needs consolidated financial statements?

Comprehensive Guide to Consolidated Financial Statements Form

Understanding consolidated financial statements

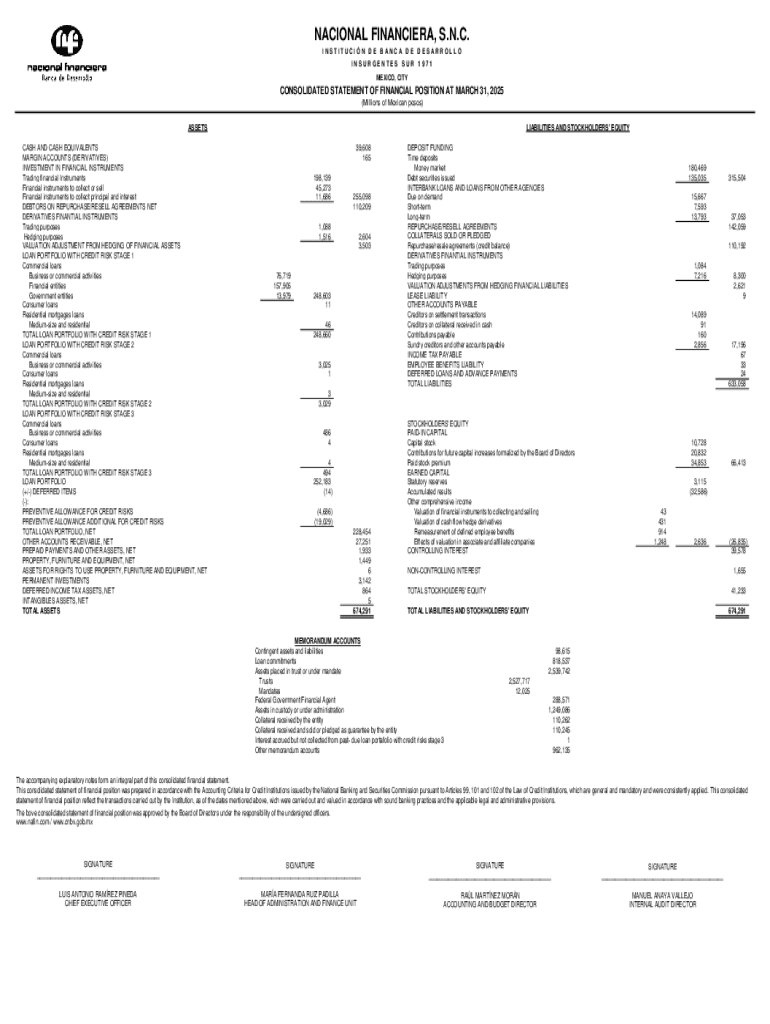

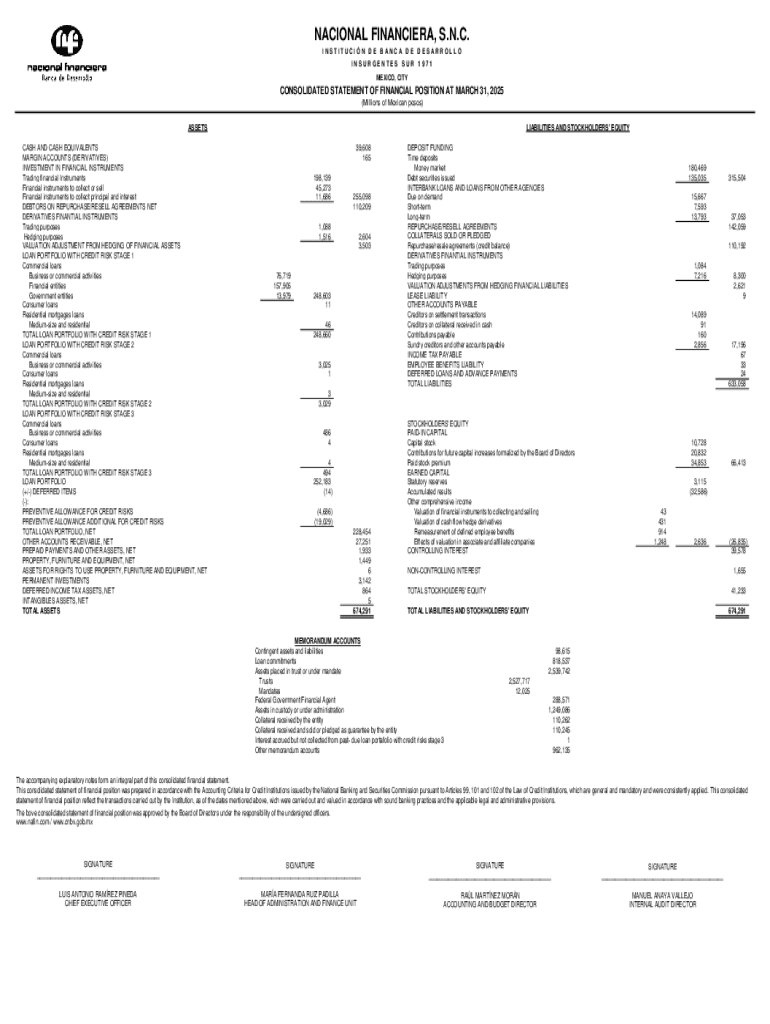

Consolidated financial statements form an essential part of the financial reporting process for organizations with multiple subsidiaries. They provide a clear picture of the overall financial health of a parent company and its subsidiaries as a single economic entity. This approach combines all financial activities, reflecting complete transactional data in a unified manner, ensuring stakeholders get an accurate assessment of performance, risk, and viability.

The importance of these statements cannot be overstated, as they help facilitate transparency in financial reporting and improve the quality of information available to investors, regulators, and internal management. By consolidating financial data, companies can analyze performance trends, make strategic decisions, and comply with legal obligations.

Several key components constitute consolidated financial statements: the Balance Sheet, the Income Statement, and the Cash Flow Statement. The Balance Sheet provides insights into the company's assets, liabilities, and equity at a specific point in time. The Income Statement details revenue and expenses over a reporting period, thus offering a snapshot of profitability. The Cash Flow Statement indicates the flow of cash in and out, reflecting operational efficiency and liquidity.

Businesses that operate multiple entities, ranging from corporate groupings to large conglomerates, need to utilize consolidated financial statements to synthesize their financial data. Stakeholders, such as investors, creditors, regulators, and management, depend on this integrated information to make informed decisions.

The legal framework surrounding consolidated financial statements

The preparation and presentation of consolidated financial statements are guided by frameworks such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Organizations are required to follow these standards rigorously to ensure compliance and maintain the trust of their stakeholders.

Compliance with these accounting standards plays a pivotal role in promoting transparency and accountability. Adherence to prescribed norms not only impacts a company's credibility but also affects its ability to raise capital and sustain stakeholder relationships.

Timelines for submission vary between public companies and private entities. Publicly listed organizations often face stringent deadlines, usually aligning with quarterly and annual reporting cycles. Alternatively, private companies may have more flexible reporting requirements, depending on size, industry, and stakeholder expectations.

Preparing your consolidated financial statements

The preparation of consolidated financial statements begins with gathering necessary data from all subsidiaries. Required documents typically include individual financial statements of subsidiaries and any relevant adjustments for intercompany transactions. It is advisable to have all financial data organized in one central database or document management system.

When preparing your consolidated financial statements, utilize available tools that can streamline data collection, such as Excel spreadsheets, accounting software, and document management solutions like pdfFiller.

Detailed instructions for filling out the consolidated financial statements form

Filling out the consolidated financial statements form requires attention to format and structure. A standard form typically includes several sections, such as header information where you state the reporting entity’s name, reporting period, and other essential details. It is imperative to maintain the prescribed structure, as discrepancies can lead to errors in reporting and potential compliance issues.

Every section of the form serves a specific purpose, and it is essential to follow a systematic approach while filling it out. This ensures clarity and completeness throughout the document. For the financial data inputs, include figures derived from consolidated Balance Sheets, Income Statements, and Cash Flow Statements.

Utilizing pdfFiller for your consolidated financial statements

pdfFiller provides a robust platform for managing your consolidated financial statements form with efficiency and ease. One of its standout features is a suite of editing tools that allow for seamless adjustments, such as adding comments, highlighting errors, and inputting new data without starting from scratch.

Additionally, pdfFiller enhances the signing process with its eSigning capabilities, enabling faster approvals from necessary stakeholders. This feature can significantly reduce the turnaround time for submissive financial statements.

Moreover, pdfFiller supports collaborative workrooms, allowing users to share forms with team members for their input. This facilitates communication and feedback management, ensuring that all parts of the financial statements are accurate and complete before submission.

Common challenges and solutions

Preparing consolidated financial statements can sometimes present complexities that could lead to errors. Common pitfalls include overlooking intercompany transactions or failing to adjust subsidiary statements for uniform accounting policies. Identifying these pitfalls early in the process is critical to ensuring accuracy.

Frequent mistakes when filling out forms might include miscalculating totals or neglecting to reconcile accounts. Quick fixes for such errors often involve doing a thorough review of each section and validating figures against subsidiary records to ensure accuracy.

Benefits of electronic form management

Adopting an electronic approach for managing consolidated financial statements comes with significant advantages. Cloud-based solutions provide efficiency and accessibility, allowing users to access necessary documentation from anywhere, which is especially beneficial for teams working remotely or across different locations.

Security is another critical aspect of electronic form management. pdfFiller implements data protection measures, helping safeguard sensitive financial information against unauthorized access or breaches, thus ensuring compliance with regulations and maintaining stakeholder trust.

Looking ahead, the trend of integrating AI tools into document management is becoming prevalent. These technologies can automate routine tasks, enhance financial analysis, and simplify the preparation of consolidated financial statements, leading to greater accuracy and efficiency.

Interactive tools and resources

pdfFiller offers an array of interactive tools and resources designed to make working with consolidated financial statements easier. One valuable feature is access to templates, which allow users to initiate the process swiftly, reducing the time spent formatting a document from scratch.

In addition, pdfFiller provides tutorials and webinars to facilitate a better understanding of consolidated statements and the nuances involved. These educational opportunities can empower users to refine their skillsets and improve their reporting processes significantly.

Lastly, the integration of AI capabilities into financial reporting services represents a significant advancement. These tools can help businesses analyze vast volumes of financial data rapidly, leading to more informed decision-making and precise reporting across all operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consolidated financial statements for eSignature?

How do I edit consolidated financial statements online?

How do I fill out the consolidated financial statements form on my smartphone?

What is consolidated financial statements?

Who is required to file consolidated financial statements?

How to fill out consolidated financial statements?

What is the purpose of consolidated financial statements?

What information must be reported on consolidated financial statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.