Get the free Form 990 / 990-ez Return Summary

Get, Create, Make and Sign form 990 990-ez return

Editing form 990 990-ez return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 990-ez return

How to fill out form 990 990-ez return

Who needs form 990 990-ez return?

Comprehensive Guide to Form 990 and 990-EZ Return Forms for Nonprofits

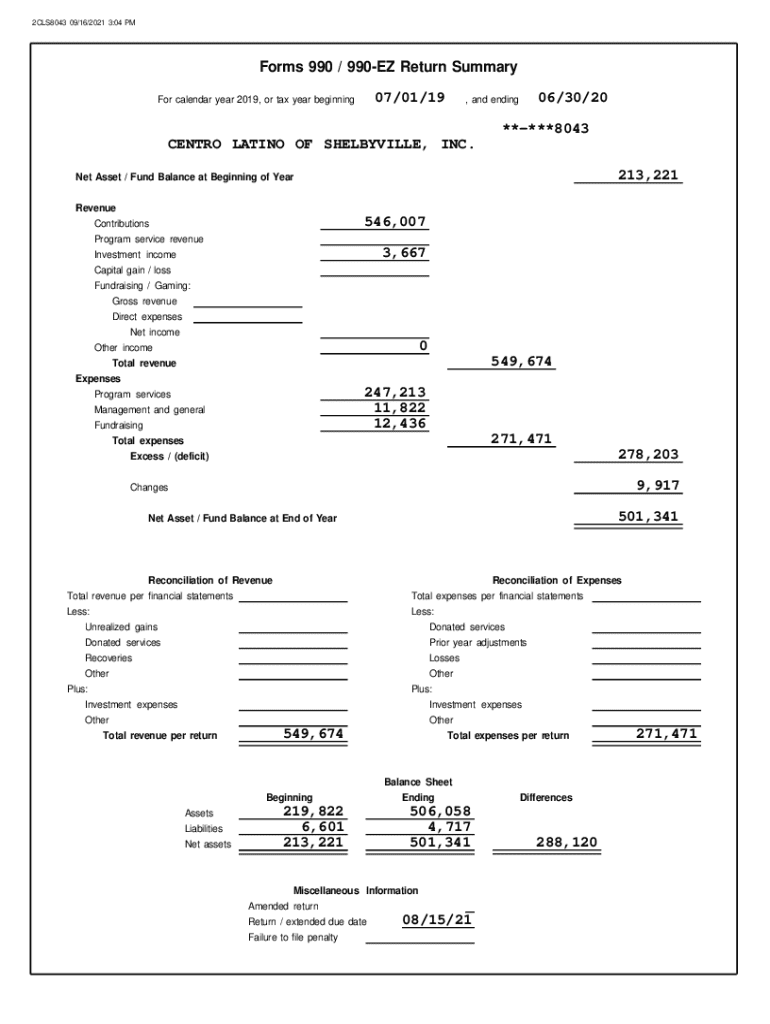

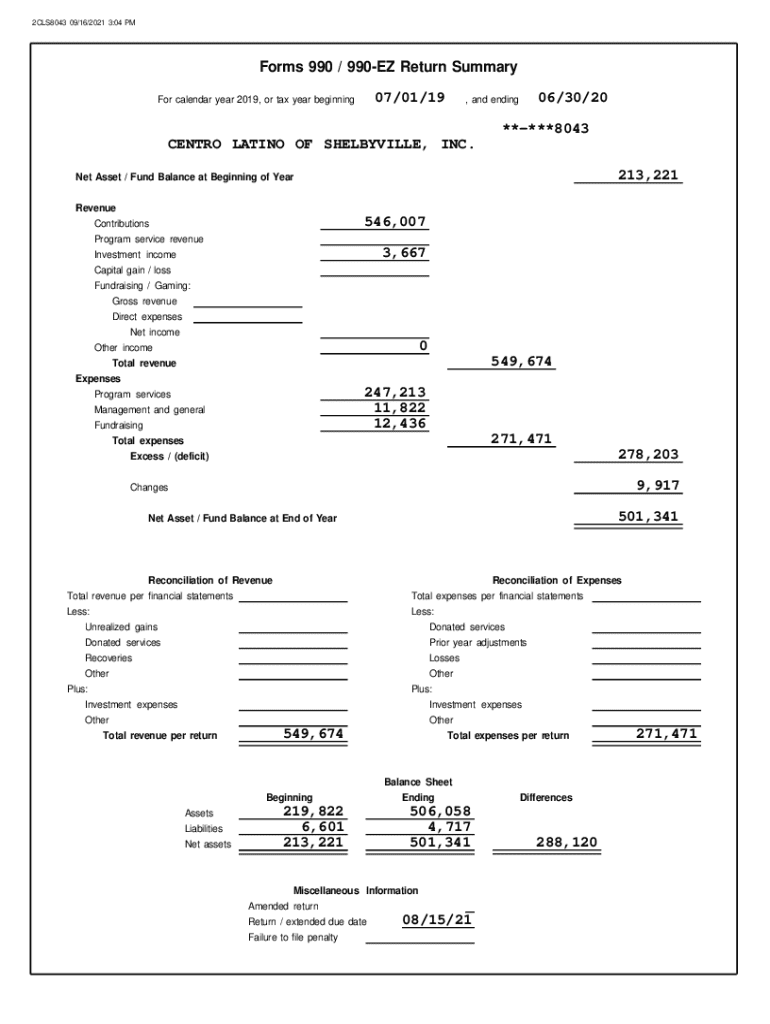

Understanding the form 990 and 990-ez

Nonprofit organizations in the United States must file annual information returns to maintain their tax-exempt status, and this is primarily done through Form 990 or its simpler variant, Form 990-EZ. Both forms provide essential operational data about the organization, including financial health and governance. Understanding the distinctions between them ensures organizations file the appropriate form based on their size and activities.

Key components of form 990-ez

Form 990-EZ consists of several critical sections that gather vital information for the IRS and the public. These sections serve to outline the financial activities of the nonprofit, showcasing their revenue, expenses, and overall financial health, which is essential for transparency and accountability.

Preparing to file form 990-ez

Filing Form 990-EZ requires thorough preparation to ensure accuracy and compliance with IRS guidelines. Organizations must gather numerous documents and pieces of information, which are pivotal for completing the form successfully.

Detailed instructions for completing form 990-ez

Completing Form 990-EZ requires attention to detail and adherence to IRS regulations. Each section demands accurate reporting to avoid common pitfalls that could result in fines or lost tax-exempt status.

Filing deadlines and extensions for form 990-ez

Nonprofits must adhere to strict filing deadlines to maintain compliance with IRS regulations. It's crucial to be aware of these dates and understand options for filing extensions when necessary.

The consequences of failing to file form 990-ez

Neglecting to file Form 990-EZ can have serious repercussions for nonprofit organizations. The IRS imposes strict penalties for non-compliance, which can affect not just finances but also the organization's reputation.

Comparing form 990-ez to other irs forms

Understanding the differences between Form 990, Form 990-EZ, and other related IRS forms, such as Form 990-PF, is essential for nonprofit organizations aiming for compliance and proper reporting.

Interactive tools and resources for filing

Utilizing tools designed for form management can significantly ease the burden of completing Form 990-EZ. Platforms like pdfFiller offer comprehensive solutions for nonprofits to manage their documentation effectively.

Frequently asked questions about form 990-ez

Nonprofit organizations often have pressing questions regarding their obligations and procedures related to Form 990-EZ. Clarifying these common concerns can significantly ease the filing process and enhance compliance.

Best practices for nonprofits in filing form 990-ez

Adhering to best practices is vital for nonprofits striving for successful management and timely filing of Form 990-EZ. Proactively engaging with financial data and maintaining accurate records can make a significant difference.

Case studies and examples

Exploring real-life examples of how nonprofits effectively manage their Form 990-EZ submissions can provide valuable insights. These case studies illustrate the common practices of accurately reporting finances and avoiding typical mistakes.

Connecting with support and resources

Finding assistance when filing Form 990-EZ is crucial for organizations needing guidance. Engaging with the right resources can help navigate potential challenges associated with the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990 990-ez return?

How do I make edits in form 990 990-ez return without leaving Chrome?

How do I edit form 990 990-ez return on an iOS device?

What is form 990 990-ez return?

Who is required to file form 990 990-ez return?

How to fill out form 990 990-ez return?

What is the purpose of form 990 990-ez return?

What information must be reported on form 990 990-ez return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.