Get the free 990

Get, Create, Make and Sign 990

How to edit 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

A Comprehensive Guide to the 990 Form for Nonprofits

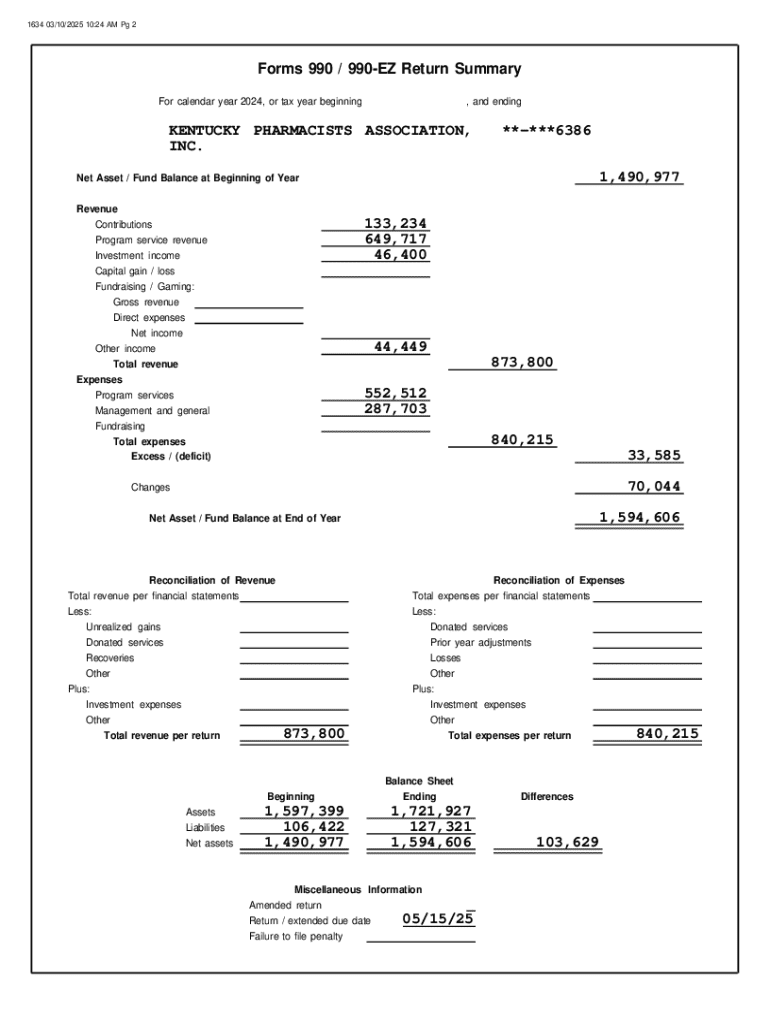

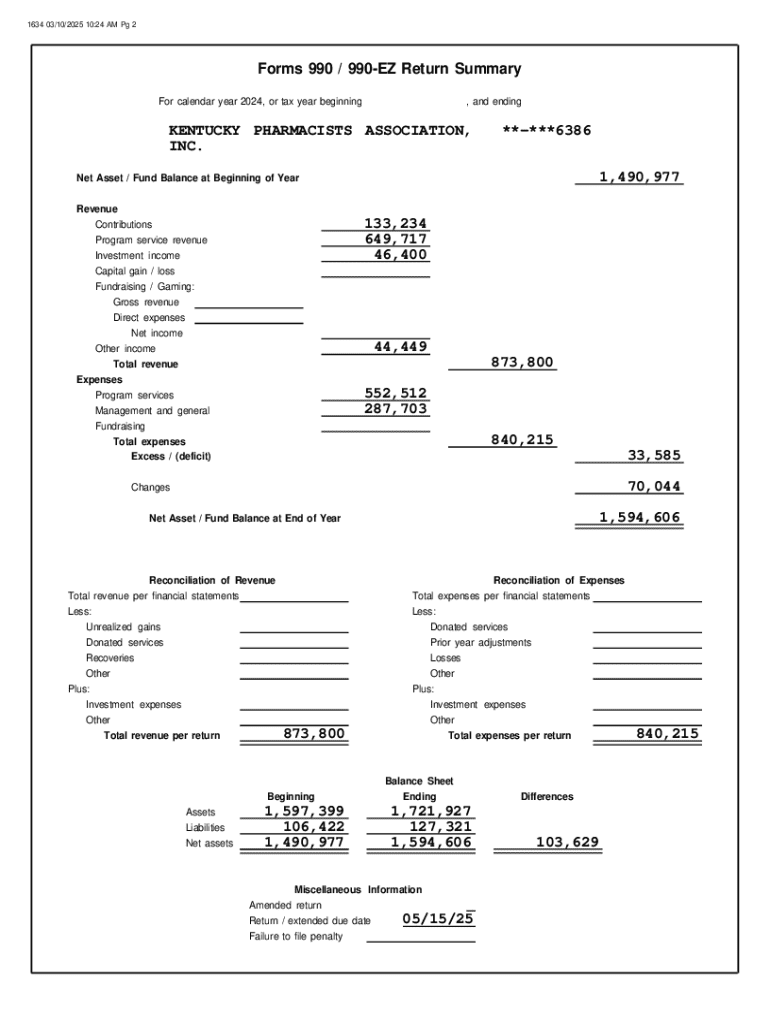

Understanding the 990 form

The 990 form is a critical IRS document that nonprofit organizations in the United States must file annually. It provides a transparent overview of a nonprofit's financial health, highlighting its revenue, expenses, and operational activities. This form plays a crucial role in maintaining accountability and transparency for nonprofit organizations, ensuring they adhere to federal tax regulations.

Filing the 990 form is not just a compliance requirement; it serves to instill trust among donors, stakeholders, and the public. By providing detailed financial information, nonprofits can demonstrate their commitment to financial stewardship and mission-driven activities.

Variants of 990 form

The IRS offers several variants of the 990 form tailored to different types of nonprofit organizations, each designed to accommodate varying levels of complexity and organizational size.

Filing requirements for the 990 form

Understanding who must file the 990 form is fundamental for nonprofit organizations to remain compliant with IRS regulations. Generally, organizations recognized as tax-exempt under Section 501(c)(3) of the Internal Revenue Code must file annually.

Eligibility criteria can vary based on gross receipts and structural considerations. For instance, any organization with gross receipts exceeding $50,000 is required to file a full 990 form, while those with receipts below this threshold may file Form 990-N.

Filing deadlines vary depending on the type of form filed, though most organizations are required to submit their forms by the 15th day of the 5th month after the end of their fiscal year.

Extensions can be requested for up to six months, which grants additional time to prepare and submit the required documents.

Best practices for filing form 990

Filing the 990 form can be streamlined by adhering to best practices that ensure thoroughness and accuracy. Effective preparation is key to a successful filing process.

When it comes to electronic filing, consider using reliable platforms for enhanced organization and ease of filing. Many organizations prefer e-filing due to its efficiency; however, it's essential to weigh the pros and cons before making a decision.

Understanding form 990 sections

The 990 form consists of several sections that provide insights into a nonprofit’s operations, including financial statements, governance, and program accomplishments. It's crucial to meticulously fill out these segments to accurately portray the organization.

Common mistakes arise during the filing process, such as incomplete sections or misreported financial information. Avoiding these pitfalls is critical for maintaining compliance and trust.

Consequences of non-compliance

Failure to file the 990 form on time can lead to significant penalties and impact a nonprofit's standing with the IRS. Consistent non-compliance may result in the loss of tax-exempt status, which could adversely affect fundraising efforts.

Public inspection regulations mean that Form 990 data is accessible to the public, further emphasizing the importance of transparency. Organizations must ensure their filings are correct, as they reflect on their credibility within the community.

Navigating the 990 form data

Form 990 data is available to the public, which underscores the significance of transparency in nonprofit operations. Stakeholders such as donors and community members can access these forms to evaluate and understand an organization's financial health and operational effectiveness.

Utilizing Form 990 data for charity evaluation can include analyzing salaries, operational spending, and overall financial health, further guiding donor decisions.

Collaboration and team management for 990 filing

Managing the filing process of Form 990 can be significantly enhanced by utilizing collaboration features within document management systems. With multiple stakeholders involved, it's essential to have a streamlined approach to draft forms, receive input, and ensure timely filing.

Enhancing client management within nonprofit organizations also requires secure, seamless document sharing. By utilizing integrated document platforms, nonprofits can simplify the complex process of Form 990 filing and ensure secure communication.

Why nonprofits need to file IRS form 990

Filing the 990 form is vital for every nonprofit looking to maintain credibility with donors and stakeholders. It serves as proof of their financial responsibility and transparency, reinforcing trust in their operations.

Frequently asked questions about form 990

Many organizations encounter common questions about the 990 form. Understanding these can streamline the filing process.

Having these questions answered can prevent errors and ensure a smoother filing experience, fostering compliance and transparency.

Support and resources for 990 form filers

Filing the 990 form can be a complex process, but many resources exist for organizations to seek assistance. Having access to live support can be invaluable for troubleshooting and clarifying filing requirements.

Enhancements and innovations in 990 filing

Technological advancements have improved how nonprofits approach Form 990 filing. Tools like pdfFiller empower users to seamlessly manage their documents, making the process more efficient.

These innovations significantly reduce the burden of nonprofit accounting efforts while enhancing compliance and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 990 online?

How can I edit 990 on a smartphone?

How can I fill out 990 on an iOS device?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.