Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding the Form 990: A Comprehensive Guide for Nonprofits

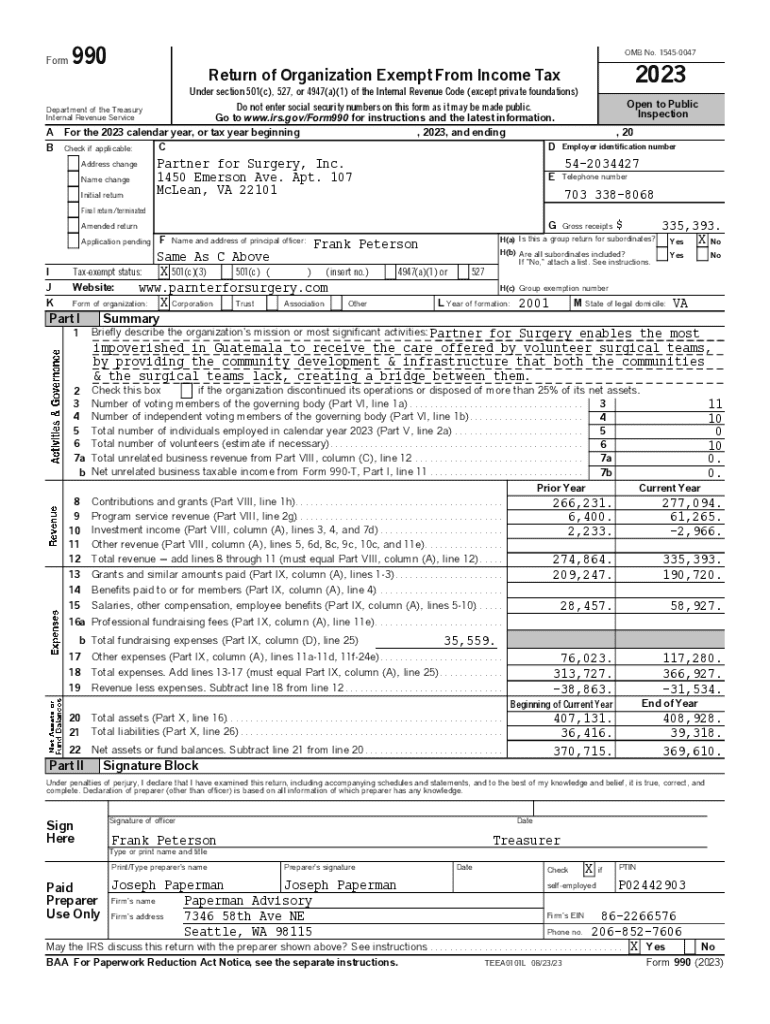

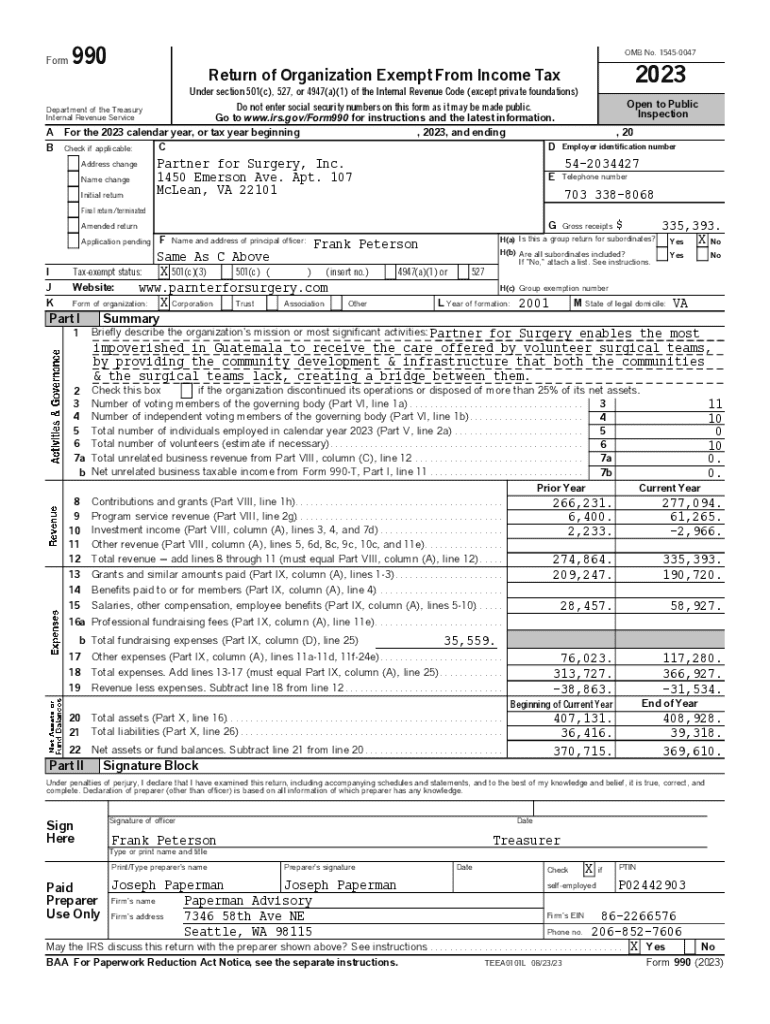

What is Form 990?

Form 990 is a crucial document that nonprofit organizations in the United States are required to file annually with the Internal Revenue Service (IRS). This form serves as a public disclosure tool, detailing the organization’s financial activities, governance, and compliance with tax laws. By providing a comprehensive overview of a nonprofit's structure and operations, the Form 990 plays a significant role in promoting transparency within the nonprofit sector.

The primary purpose of Form 990 is to keep the public informed about how charitable organizations operate, including how funds are raised and spent. It is particularly important for potential donors, government agencies, and regulatory bodies assessing a nonprofit's financial health and integrity.

Why nonprofits need to file Form 990

Filing Form 990 is a legal requirement for many tax-exempt organizations. Nonprofits recognized under section 501(c)(3) of the Internal Revenue Code must file the form annually to maintain their tax-exempt status. Failing to do so can lead to revocation of this status, which can have dire financial implications.

However, the benefits of filing extend beyond mere compliance. By completing Form 990, nonprofits demonstrate their commitment to accountability and transparency. This builds public trust, making potential donors more likely to contribute, knowing their funds will be managed responsibly.

Types of Form 990

There are several variations of Form 990 tailored to different sizes and types of nonprofits. Understanding which type to file is crucial for compliance.

Key components of Form 990

Form 990 consists of various sections that detail an organization's financial activities and governance structures. Each section covers critical information that stakeholders need to review.

Each of these sections holds significant importance; for example, the financial statements help potential donors gauge financial stability, while compensation disclosures promote ethical practices in nonprofit hiring.

Filing requirements

Not all nonprofits are required to file Form 990. Generally, organizations that earn over $50,000 in gross receipts must submit the form annually. It’s also essential to note that some organizations, like churches, may be exempt from this requirement.

Deadlines for Form 990 vary depending on the organization’s fiscal year-end, typically due on the 15th day of the fifth month following the end of the fiscal year. However, organizations can file for extensions if needed.

Penalties for noncompliance

Noncompliance with Form 990 filing requirements can lead to serious repercussions. The IRS imposes penalties for late filings, making timely submission imperative.

For organizations that fail to file for three consecutive years, the IRS may automatically revoke their tax-exempt status, significantly impacting their operations and funding opportunities.

Detailed step-by-step guide to filing Form 990

Successfully filing Form 990 requires thorough preparation. Here’s a detailed guide to assist nonprofits in this process.

Using tools like pdfFiller can streamline the process, allowing for easy edits and electronic signatures, ensuring a completed and accurate filing.

Best practices for easy preparation of Form 990

Preparing Form 990 becomes more manageable with systematic practices in place. Here are some best practices.

By implementing these practices, nonprofits can reduce errors and improve their readiness for annual filings.

Public inspection regulations

Form 990 must be made available to the public, ensuring transparency in nonprofit operations. Organizations are required to provide access to their Forms 990 at their principal offices or upon request.

Transparency is paramount, as it allows stakeholders and potential donors to evaluate a nonprofit’s legitimacy and effectiveness. Additionally, Form 990s of other organizations can be accessed online, providing a benchmarking tool for stakeholders.

How to read and interpret Form 990

For those evaluating a nonprofit organization, understanding how to read Form 990 is essential. Key metrics provide valuable insights into the financial health of the organization.

When assessing Form 990, focus on revenue sources and distribution of expenditures. Investigating how funds are used relative to the organization's mission can inform potential donors and stakeholders.

Using this insight can aid in making informed decisions about donations and supporting various causes.

Locating a Form 990 text

Finding a Form 990 is quite straightforward, thanks to digital tools. Most forms are available through the IRS website and various nonprofit databases. Organizations can also directly request Forms 990 from nonprofits.

When searching online, consider utilizing specific databases focused on nonprofit information, which often have user-friendly interfaces.

Third-party sources of Form 990 data

Numerous third-party organizations and databases compile and provide access to Form 990 information. Utilizing these sources can save time and provide a wealth of comparative data.

These platforms can offer insights beyond mere numbers, analyzing trends and patterns within the nonprofit sector.

The nonprofit sector in the United States: A resource guide

The nonprofit sector plays a vital role in addressing social issues and delivering essential services across the U.S. Organizations vary from small local groups to large national entities, and understanding this landscape is crucial for effective management.

Numerous resources are available to aid nonprofits in compliance, fundraising, and management, ensuring a sustainable and impactful presence within the community.

Final thoughts on filing Form 990

Successfully navigating the complexities of Form 990 is essential for all nonprofits. Timely and accurate filings not only fulfill legal obligations but also enhance credibility with donors and stakeholders.

Nonprofits are encouraged to take advantage of digital tools, such as those offered by pdfFiller, to streamline the filing process and ensure compliance.

Additional tools and resources for managing Form 990

Being familiar with various forms related to Form 990, such as Form 990-EZ or Form 990-N, can be helpful. Each form caters to different types of organizations, ensuring that suitable structures guide their reporting obligations.

Furthermore, leveraging a platform like pdfFiller can significantly improve the document preparation process through its features that enhance collaboration, editing, and eSigning capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 online?

How do I edit form 990 in Chrome?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.