Get the free Credit Application

Get, Create, Make and Sign credit application

How to edit credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application

How to fill out credit application

Who needs credit application?

Credit Application Form: How to Effectively Complete Your Application

Understanding credit applications

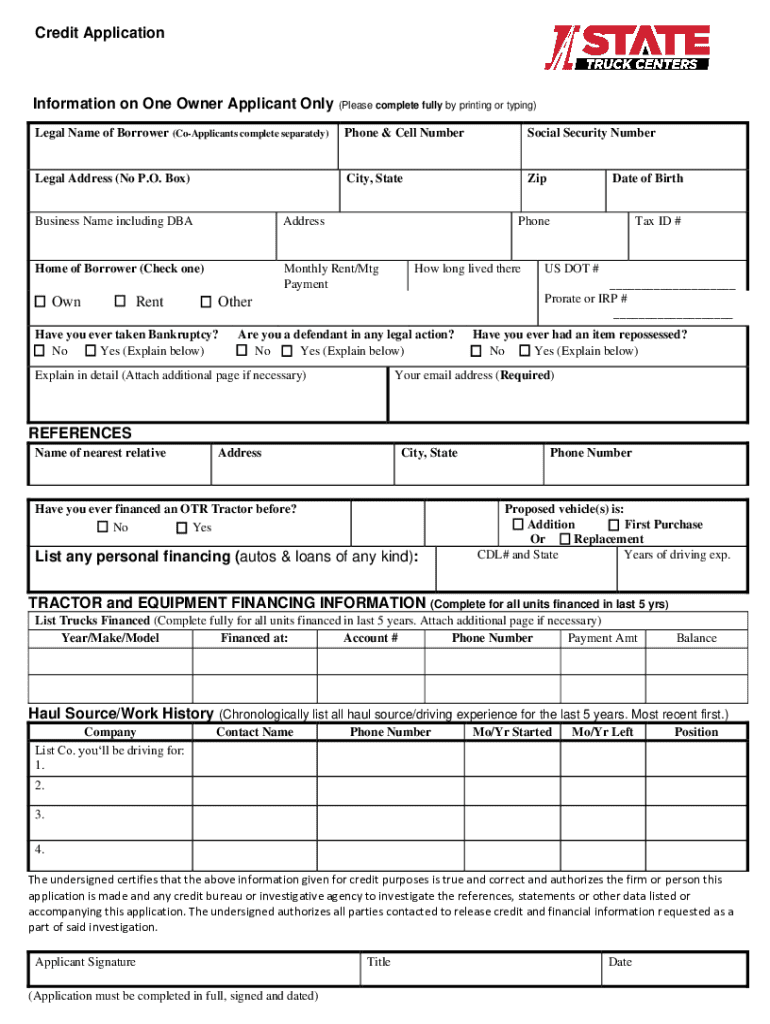

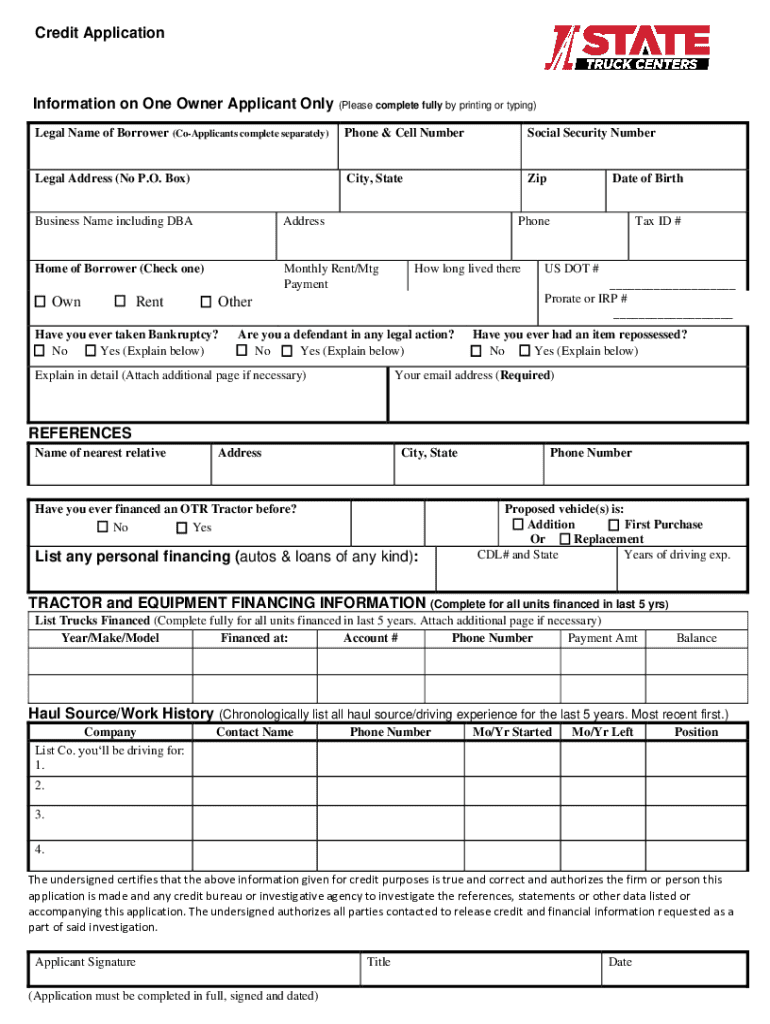

A credit application form is a formal document submitted by an individual or entity seeking credit from a financial institution or lender. It serves as a critical tool in the decision-making process for lenders to gauge the creditworthiness of an applicant. Understanding the importance of credit applications is essential, as they greatly influence financial transactions like loans and mortgages. The right credit application can open doors to substantial financial opportunities.

Common types of credit applications include those for personal loans, mortgages, and credit cards. Each type has its own requirements and implications, making it crucial for applicants to provide comprehensive information to enable a smooth approval process.

Key components of a credit application form

A well-structured credit application form comprises several critical sections that help lenders evaluate an applicant's financial status accurately.

Steps to complete a credit application form

Completing a credit application form can be straightforward if you follow a structured approach.

Editing and customizing your credit application form

pdfFiller offers a suite of tools that allow for easy editing of credit application forms. You can fill out details, make changes, and add your signature seamlessly. Utilizing features like drag-and-drop editing or form filling can streamline the process significantly.

Customizing your credit application not only reflects professionalism but also enhances your chances of approval. Tailoring specific aspects of the application based on the lender's requirements can demonstrate your commitment and attention to detail.

Understanding the review process

Once your application is submitted, it enters a review process. Typically, this phase can take anywhere from a few hours to several business days, depending on the lender’s operational protocols. Factors influencing approval timelines can include the completeness of your application and the lender's workload.

Lenders evaluate applications based on criteria like credit score, income stability, and the debt-to-income ratio. A thorough and well-supported application can significantly improve your chances of securing the credit you need.

Common mistakes to avoid

Applicants often make avoidable mistakes that can adversely affect their credit application. Complete and accurate information is essential; any inaccuracies can lead to delays or denials.

Managing your credit application post-submission

After submission, tracking your application's status is crucial. Lenders often provide a timeline for responses, but proactively following up can keep your application top of mind.

If your application is denied, it’s essential to understand why. Request feedback and take the necessary steps to rectify the issues before reapplying. Learning from past applications can position you better for future opportunities.

The role of electronic signatures in credit applications

Incorporating electronic signatures into your credit application enhances the speed of processing. Financial institutions are increasingly favoring eSignatures as they simplify the application process and reduce paperwork.

Using pdfFiller for electronic signing is a straightforward process. You can log in, select the document, and follow a step-by-step guide to add your eSignature securely and swiftly.

Frequently asked questions about credit application forms

Understanding common queries surrounding credit applications can provide reassurance.

Utilizing pdfFiller for your credit application needs

pdfFiller streamlines the entire credit application process, from document creation to management. Users benefit from its cloud-based platform, allowing access from anywhere and at any time makes it easier to manage documentation on the go.

The integration of forms and collaboration tools within pdfFiller enhances the overall experience for both individuals and teams looking to efficiently create, edit, and submit credit applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit application without leaving Google Drive?

How can I send credit application for eSignature?

Can I edit credit application on an iOS device?

What is credit application?

Who is required to file credit application?

How to fill out credit application?

What is the purpose of credit application?

What information must be reported on credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.