Get the free Declaration Form for Beneficial Owner

Get, Create, Make and Sign declaration form for beneficial

Editing declaration form for beneficial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out declaration form for beneficial

How to fill out declaration form for beneficial

Who needs declaration form for beneficial?

Declaration Form for Beneficial Ownership: A Comprehensive Guide

Understanding beneficial ownership

Beneficial ownership refers to the natural person(s) who ultimately own or control an entity, even if the ownership is held through another layer of entities or accounts. Individuals or groups may qualify as beneficial owners based on varying thresholds of ownership, commonly recognized as holding a certain percentage of shares or voting rights. Understanding who qualifies is crucial, as the importance of declaring beneficial ownership surmounts mere compliance—it contributes to transparency in corporate structures.

Failure to declare beneficial ownership can lead to significant legal ramifications, including fines and reputational damage. Regulations worldwide, such as those in the EU’s Anti-Money Laundering Directive or the UK’s Companies Act, impose strict reporting requirements. Companies must identify their beneficial owners accurately to mitigate risks of engaging in illicit activities, thereby ensuring integrity within the financial markets.

Purpose of the declaration form

The necessity of a declaration form for beneficial ownership extends beyond compliance; it is a vital instrument for ensuring legal and financial transparency. By declaring who holds the beneficial ownership, businesses can foster trust with stakeholders, including investors, regulators, and the general public. This document enhances accountability and responsibility within corporate governance, ultimately shaping optimistic perceptions around business practices.

In a global economy where businesses are more interconnected than ever, transparency around ownership structures is vital. A well-prepared declaration form can positively impact business operations, aiding in the smooth functioning of financial transactions and reinforcing confidence among potential business partners and clients.

The components of the declaration form

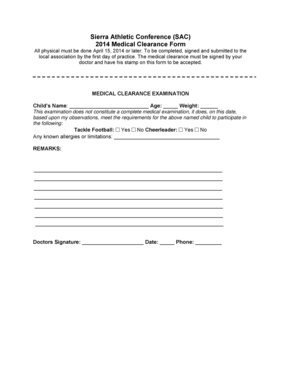

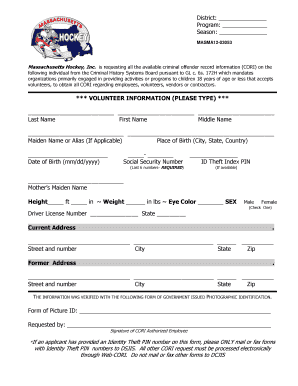

Completing a declaration form for beneficial ownership requires several critical components. Essential information includes the personal details of the beneficial owner(s), such as their full name, contact information, and the nature of their ownership interest. Furthermore, the ownership structure must be clearly laid out—whether it’s direct or indirect ownership must be delineated to present a clear image of control.

Supporting documents are equally important. Examples might include proof of ownership through share certificates, partnership agreements, or registration documents. Gathering these documents ensures that you can complete the declaration accurately and substantiates the information provided within the form, reducing the risks of inaccuracies in reporting.

How to fill out the declaration form

Filling out the declaration form for beneficial ownership does not have to be daunting. Here’s a step-by-step guide to help you navigate this process seamlessly: First, carefully read the instructions accompanying the declaration form, ensuring you understand each section’s requirements. Next, provide your personal details in the designated area, ensuring accuracy. Accurately describe your ownership structure, including how your interests are held, whether directly or indirectly, alongside any entities involved.

When using pdfFiller, the online platform revolutionizes form completion through its intuitive interface. You can easily enter data, upload necessary documents, and store them securely in the cloud. This approach eliminates manual errors and significantly enhances the efficiency of documenting your declaration.

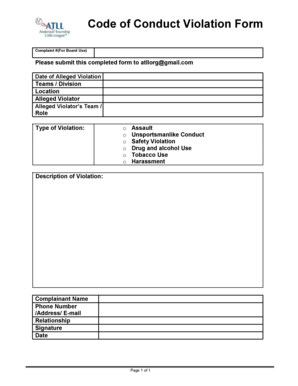

Editing and managing your declaration form

Using pdfFiller for managing your declaration form is straightforward. If you need to make edits, the platform allows you to amend sections effortlessly. Simply open the document, adjust the required fields, and navigate through the interface using intuitive controls designed for ease of use. The collaborative features enable multiple team members to work on a document simultaneously, which is particularly beneficial for businesses requiring input from various stakeholders.

Version control is crucial for compliance. PdfFiller records each revision, allowing you to track changes over time. This management feature is not only useful for maintaining up-to-date information but also pertinent in meeting regulatory obligations and ensuring that you are always compliant with the latest ownership structures.

Signing the declaration form

Signing your declaration form is the final yet critical step in the process. You can choose between electronic signatures and traditional handwritten signatures. In many jurisdictions, eSignatures hold the same legal validity as handwritten ones, simplifying the signing process significantly. With pdfFiller, you have the option to sign electronically within the platform, eliminating the need for printing and scanning.

If you require signatures from multiple stakeholders, pdfFiller enables you to route the document for signing. Utilizing features to collect electronic signatures efficiently ensures you receive all necessary approvals in a timely manner, helping to expedite the process and maintain momentum in your business dealings.

Submitting your declaration form

Once your declaration form is complete and signed, understanding the submission requirements is crucial. Typically, you may submit the form online through a designated government portal or via postal services, depending on regional regulations. Before submission, conducting compliance checks against the requirements necessitated by the governing bodies ensures a smooth handling of your documentation.

After submitting, confirmation of receipt is usually sent by the authority, and it’s vital to keep a digital or physical copy of the submitted form. Maintaining records safeguards you against any future inquiries and ensures you have access to necessary documentation whenever required.

Frequently asked questions (FAQs)

A common question around the declaration form for beneficial ownership pertains to its necessity. Many are unsure whether the form is required for all types of entities. Generally, if an entity has beneficial owners, it must submit the declaration irrespective of size, as per regulatory frameworks. Others question the consequences of failing to submit the declaration; non-compliance can lead to significant fines and legal ramifications, emphasizing the need for diligence in this area.

In troubleshooting, users often face issues when gathering supporting documents or filling in complex ownership structures. Utilizing resources such as pdfFiller’s help feature can provide clarity, and seeking advice from legal professionals regarding the declaration process can prevent complications.

Additional considerations and best practices

Regular updates to your declaration form are essential to maintain compliance with shifting ownership structures. Implementing a schedule for routine reviews of ownership and associated declarations can ensure that your records remain accurate and relevant. Keeping accurate records reduces the risk of potential issues arising from outdated information.

It's equally vital to stay informed about changes in regulations pertaining to beneficial ownership. Subscribing to legal updates or joining relevant professional organizations can provide you with resources necessary for ongoing education in compliance. This proactive approach empowers individuals and businesses to adapt to evolving legal landscapes efficiently.

Interactive tools and resources available on pdfFiller

PdfFiller offers a suite of interactive tools designed to enhance document management. With features for creating templates, customizing forms, and managing workflows, professionals and teams can streamline their documentation processes effectively. This encompasses everything from the initial drafting of declarations to their final submission.

Finding related forms is also easy with pdfFiller. With a comprehensive range of templates available, users can quickly locate forms integral to their organizational needs. Utilizing these resources ultimately enhances compliance and minimizes the time spent on document management, creating a more efficient operational framework for individuals and businesses alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send declaration form for beneficial for eSignature?

How do I make changes in declaration form for beneficial?

Can I create an eSignature for the declaration form for beneficial in Gmail?

What is declaration form for beneficial?

Who is required to file declaration form for beneficial?

How to fill out declaration form for beneficial?

What is the purpose of declaration form for beneficial?

What information must be reported on declaration form for beneficial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.