Get the free Miller County Residential Real Estate Property Sb190 Tax Credit Freeze Program

Get, Create, Make and Sign miller county residential real

How to edit miller county residential real online

Uncompromising security for your PDF editing and eSignature needs

How to fill out miller county residential real

How to fill out miller county residential real

Who needs miller county residential real?

A Comprehensive Guide to the Miller County Residential Real Form

Overview of Miller County Residential Real Form

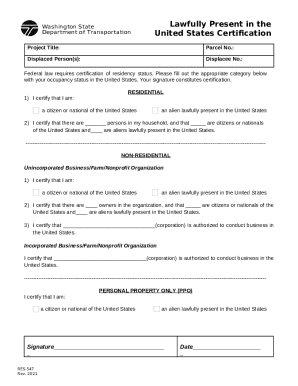

The Miller County Residential Real Form is an essential document used for property transactions, ensuring compliance with local regulations. This form streamlines the process of property ownership transfer, making it a crucial tool for homeowners, renters, and real estate professionals.

The importance of the Miller County Residential Real Form cannot be overstated; it provides a clear record of property ownership and helps to prevent disputes. Key features of the form include sections for personal information, property descriptions, and specific details regarding ownership rights and obligations.

Understanding the purpose of the residential real form

This residential real form is required whenever a property transaction occurs, such as a sale, lease agreement, or refinancing. It serves multiple purposes, including legal documentation, tax assessment, and establishing ownership records.

Each of these groups has specific reasons to utilize the form, understanding its nuances is essential for complex transactions.

Detailed insights into Miller County residential real form

The Miller County Residential Real Form consists of several sections that gather crucial information about the property and its owners. Start with Basic Information, which includes the property's location, type, and zoning classification.

When filling out this form, common mistakes to avoid include providing incomplete information or omitting critical details. It's important to ensure every section is thoroughly completed to prevent processing delays.

Step-by-step instructions for filling out the residential real form

Preparing to fill out the Miller County Residential Real Form involves gathering necessary documents such as previous titles, identification, and any related contracts. Understanding local regulations will also prepare you for specific requirements.

Interactive tools for document management

Using pdfFiller’s editing features enhances the way users interact with the Miller County Residential Real Form. This platform allows for real-time edits, making document management efficient and user-friendly.

Managing your submitted documents

After submitting the Miller County Residential Real Form, it's essential to know how to track your submission. Keeping track of your form status saves time and reduces anxiety during processing.

FAQ about the Miller County residential real form

For individuals navigating the Miller County Residential Real Form, several frequently asked questions arise. Understanding these can clarify the form’s requirements and help avoid common pitfalls.

Local government resources for property forms

Local government resources are invaluable for accessing the Miller County Residential Real Form and related documents. The Miller County Assessor’s Office is the primary contact for inquiries regarding property forms and regulations.

Accessibility features

Accessibility is critical for all users of the Miller County Residential Real Form. It is essential to ensure that all individuals, including those with disabilities, can navigate and fill out the form effectively.

Engaging with the community

Engaging with the community around the Miller County Residential Real Form is vital for improving user experience. Feedback mechanisms allow users to share their experiences and suggestions on the form and its processes.

Staying updated on Miller County property guidelines

Remaining informed about updates to the Miller County Residential Real Form and wider property guidelines is essential for compliance. Keeping track of local news ensures that you are aware of any changes that may affect your property status or transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in miller county residential real without leaving Chrome?

How do I fill out the miller county residential real form on my smartphone?

How do I edit miller county residential real on an Android device?

What is miller county residential real?

Who is required to file miller county residential real?

How to fill out miller county residential real?

What is the purpose of miller county residential real?

What information must be reported on miller county residential real?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.