Get the free Form 500

Get, Create, Make and Sign form 500

Editing form 500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 500

How to fill out form 500

Who needs form 500?

How to Fill Out Form 500

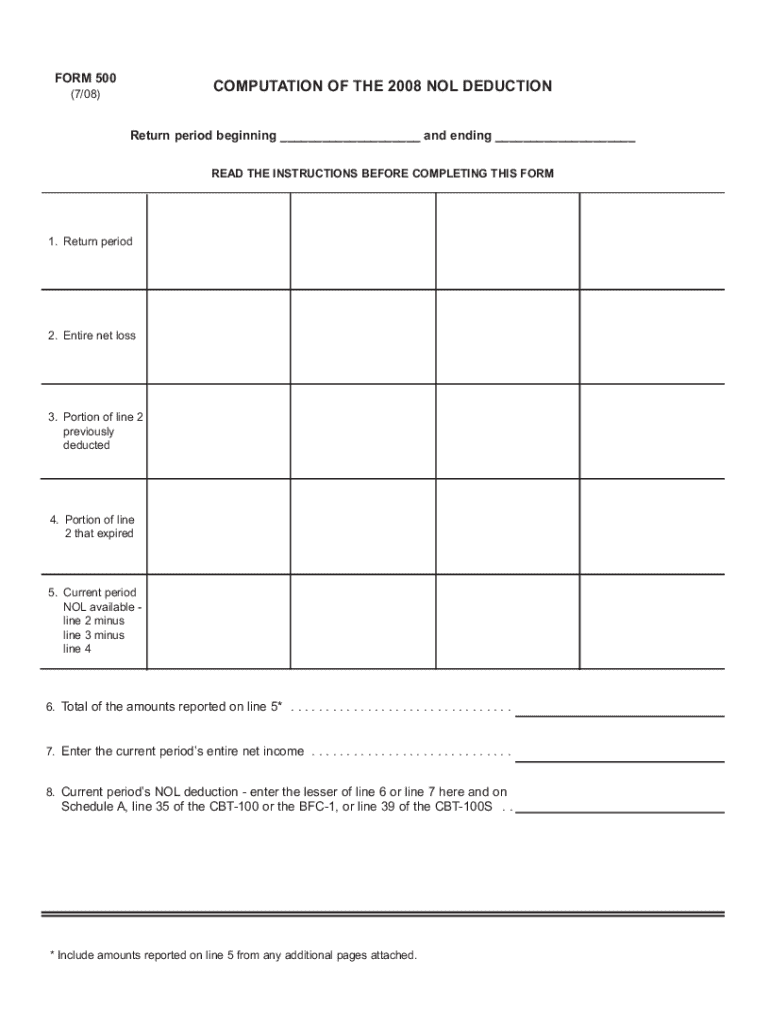

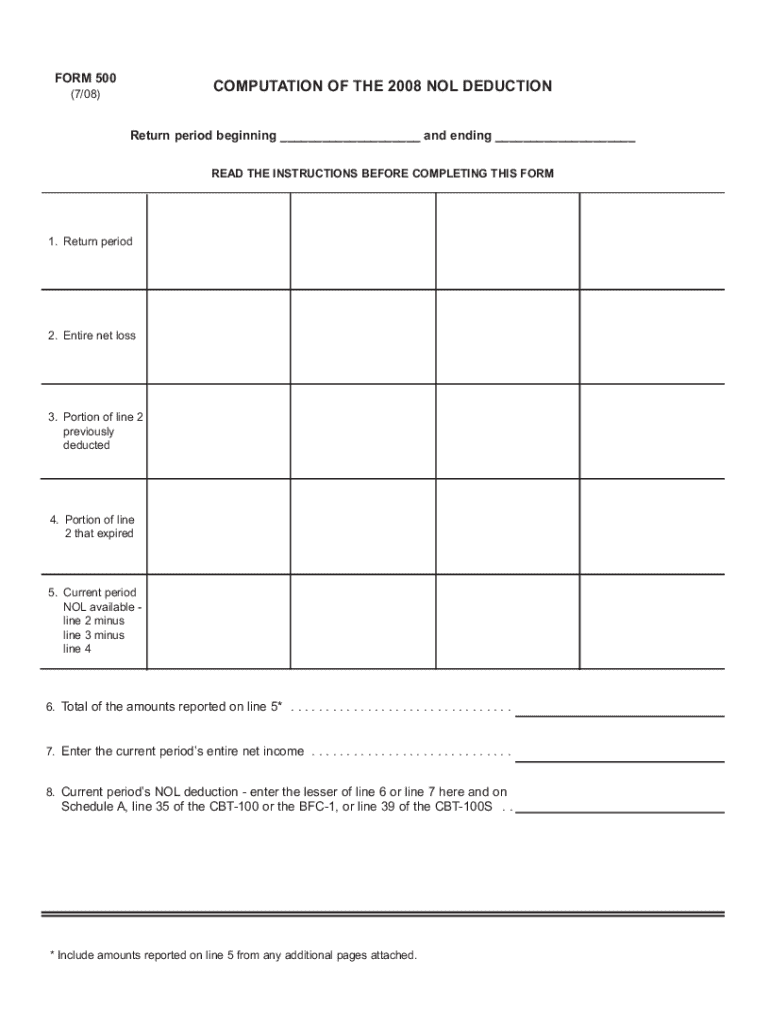

Overview of Form 500

Form 500 is an essential document used for state income tax reporting. Specifically, it is utilized by residents and certain non-residents of states that require comprehensive income reporting to ensure proper calculation of tax liabilities. Designed to capture various sources of income, deductions, and tax credits, this form serves as a foundational element in the tax filing process.

Understanding the importance of Form 500 in tax reporting cannot be overstated. It directly impacts the total tax burden and potential refunds a filer may receive, making it crucial for accurate financial management. Filing Form 500 aids in maintaining compliance with state tax regulations, thus avoiding penalties and interest charges.

Individuals who earn income within a state requiring Form 500 need to file this form. This includes employees, self-employed individuals, and those receiving various types of income, such as rental income or investment earnings. It's imperative to identify whether your income sources and residency status require submission of Form 500 to prevent issues during tax season.

Preparing to fill out Form 500

Before tackling Form 500, copious preparation can lead to a smoother and more efficient filing experience. Essential documentation is paramount, as it provides the necessary evidence to support your income claims, deductions, and credits. The foundational documents include W-2 forms, which report your earnings and tax withholdings from employers, and 1099 forms that cover other forms of income such as freelance earnings, dividends, and interest.

Additionally, having your prior year tax returns can assist in maintaining consistency and accurate reporting. Other supporting documents, such as records of deductible expenses, receipts, and bank statements, play a significant role in substantiating your claims while filling out the form.

Filing deadlines are also crucial to bear in mind. Most states align closely with the federal tax deadline, which is typically April 15th each year. Understanding and adhering to these deadlines will keep your tax affairs in order and help evade potential late fees.

Obtaining Form 500 is straightforward, as it is available online through various state tax websites and platforms like pdfFiller. Access the form, ensuring you are using the latest version to avoid outdated information resulting in inaccuracies during filing.

Detailed guide to completing Form 500

Filling out Form 500 involves several key sections that require careful attention. Begin with the personal information section, where you will provide basic details such as your name, address, and filing status. Your filing status is significant, as it determines your tax rate and eligibility for various credits. Ensure accuracy here, as data discrepancies can lead to complications down the line.

Next, the income section requires you to report all sources of income. This includes wages from employment documented on your W-2 forms and any additional income from self-employment or freelance work reported on 1099 forms. Aggregate all figures to capture your total gross income accurately.

Another essential area is the adjustments and deductions section. You'll choose between taking the standard deduction and itemizing expenses. If you opt for itemizing, include details that qualify, such as medical expenses or mortgage interest. Identifying applicable adjustments can also reduce your taxable income, so explore every option available.

Once these sections are complete, proceed to calculate your tax based on current rates and determine if you'll receive a refund or owe additional taxes. Understand the refund process and payment options available, including electronic filing and payment methods, to ensure a timely resolution of your tax responsibilities.

Managing Form 500 with pdfFiller

Using pdfFiller for editing Form 500 streamlines the process, allowing you to manage your forms efficiently. To begin, upload the Form 500 template into the platform. pdfFiller’s intuitive interface makes it easy to modify any fields and input your information accurately without the worry of ambiguous handwriting or lost paperwork.

Once you’ve edited Form 500, ensure your document is signed electronically. Setting up an eSignature within pdfFiller is straightforward—simply follow the prompts to add your signature and date. You can also send the document for signature to others simply by inputting their email addresses, promoting easy collaboration.

Saving and storing your completed Form 500 in pdfFiller offers significant advantages. Cloud storage ensures that you don’t lose vital documentation, keeping all your tax documents organized in one accessible place. Keep track of all versions of the form so that you can easily reference any changes in the event of inquiries from tax authorities.

Common challenges and solutions

As with any tax form, common challenges arise while completing Form 500. Awareness of frequently encountered mistakes can safeguard you from filing errors. Typical errors include incorrect personal information, misreported income figures, and miscalculating deductions. It's pivotal to double-check all entries before submission.

In cases where submissions need to be corrected, follow your state’s guidelines for rectifying errors on Form 500. If you e-filed and discover issues, some platforms allow direct amendments while others may require a paper form submission for corrections. Should you face filing issues, such as difficulties in sending the form through eFiling, contact the appropriate support services as most states provide assistance to resolve such concerns.

Additional tips for successful filing

Best practices keep your tax filing experience streamlined and straightforward. Always read the instructions provided with Form 500 carefully, as they contain vital information pertinent to your specific filing situation. Organizing documents chronologically can also simplify the process and minimize confusion.

Staying updated with tax law changes ensures you don't miss deductions or credits that may benefit your financial situation. Tax regulations can shift annually, and awareness helps in maximizing your return or minimizing what you owe.

Related forms and resources

Navigating through tax forms can be daunting. Familiarize yourself with other key tax forms that may be necessary for your situation, such as Form 1040 for federal returns or specific local forms based on your filing requirements..

It's helpful to gather frequently asked questions about Form 500; these can provide insight into common concerns and clarify aspects of the filing process that might otherwise seem ambiguous. Accessing state-specific tax guidelines can further refine your understanding, particularly to address nuances in your area.

Interacting with tax professionals

Consulting a tax expert can yield substantial benefits, especially if your tax situation is complex. When to engage an expert might include scenarios such as self-employment income, sizable investments, and significant deductions that require expert interpretation. Finding a tax professional who understands the intricacies of Form 500 and your specific financial landscape can deliver tailored insights.

Prepare a list of questions for your tax advisor that ensures clarity around the intricacies of Form 500, addressing concerns like deductible items, filing status choices, and strategic tax-saving avenues. Their advice can prove invaluable in optimizing your tax position and enhancing your financial well-being.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 500 online?

Can I create an electronic signature for signing my form 500 in Gmail?

How do I edit form 500 on an Android device?

What is form 500?

Who is required to file form 500?

How to fill out form 500?

What is the purpose of form 500?

What information must be reported on form 500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.