Get the free Term Life

Get, Create, Make and Sign term life

Editing term life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out term life

How to fill out term life

Who needs term life?

Term Life Form – How-to Guide Long-Read

Understanding term life insurance

Term life insurance is a straightforward, affordable option designed to provide coverage for a specified period. Unlike whole life insurance, which lasts for the policyholder's entire life and includes a cash value component, term life offers pure death benefit protection. It ensures that your loved ones receive financial support should you pass away unexpectedly during the policy term, which can range from one to thirty years.

Key features of term life insurance include fixed premiums and the option to convert to a permanent policy. The primary benefits lie in its affordability compared to whole life policies and its flexibility tailored to temporary financial obligations, such as a mortgage or children's education. This makes term life appealing to many, especially young families and individuals seeking cost-effective insurance coverage.

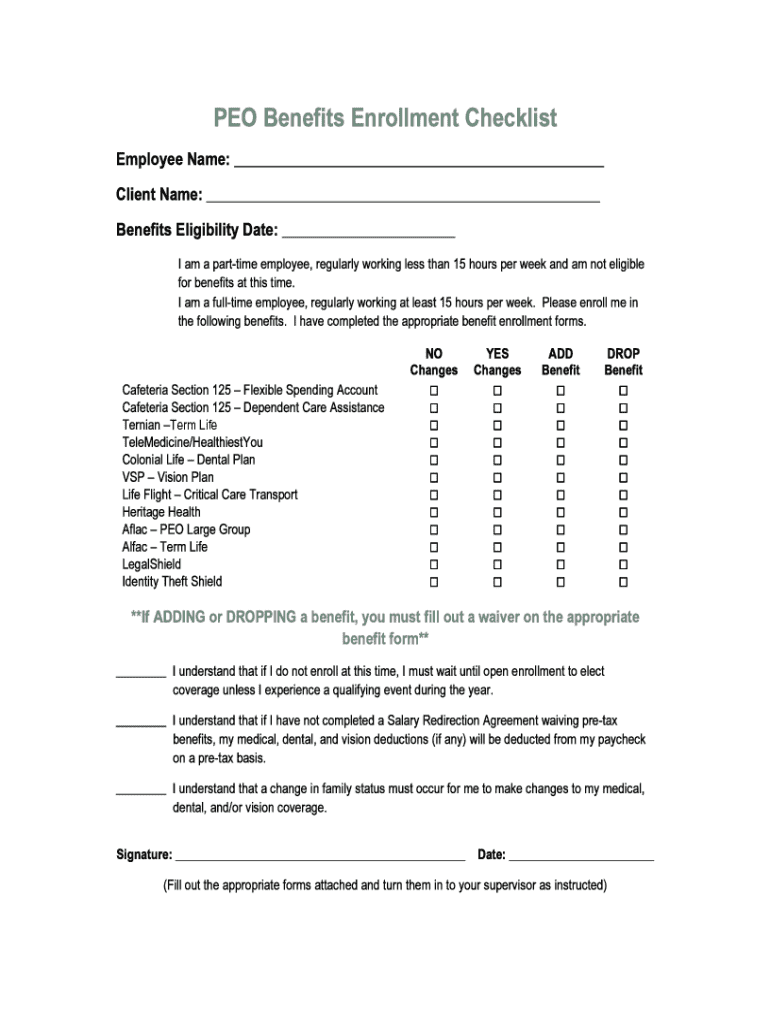

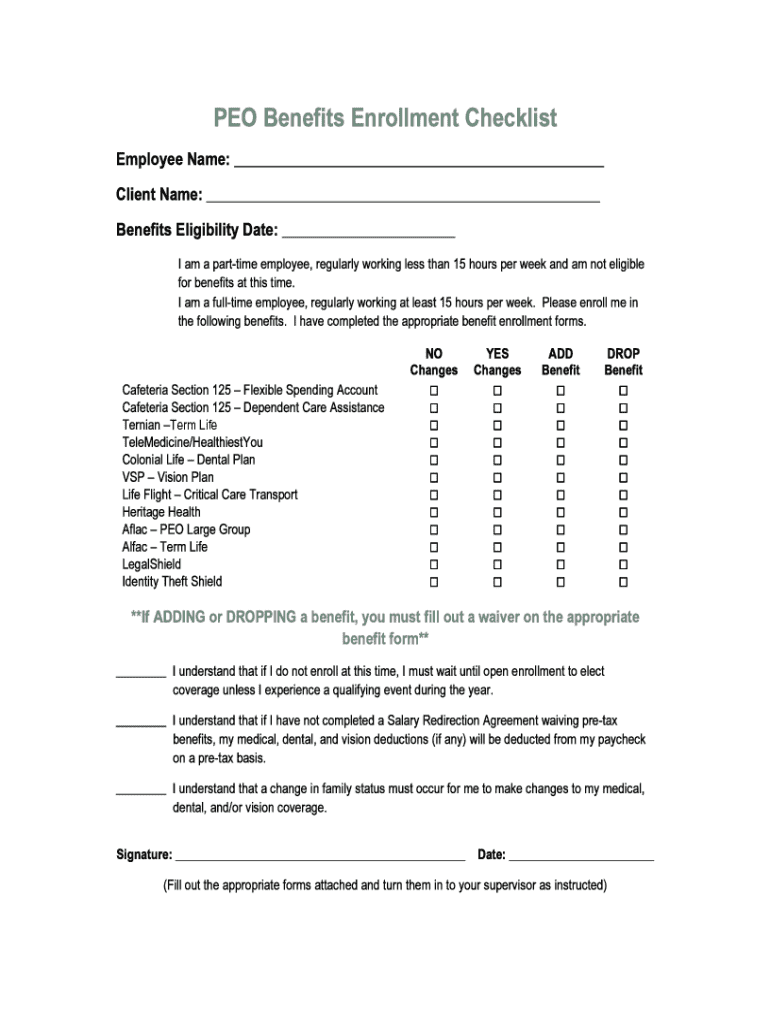

Importance of having a term life form

Completing a term life form is crucial for several reasons. First, it serves as the official documentation required to initiate your insurance policy. Without this form, you cannot secure the financial protection your loved ones may need in your absence. Additionally, the accuracy of information provided impacts the acquisition process and any claims that may arise in the future. A well-completed term life form ensures that your policy is correctly underwritten and that the coverage amount aligns with your needs.

Moreover, a correctly filled-out term life form facilitates the claims process for your beneficiaries. If the form contains inaccuracies or omissions, it could lead to delays or, worse, denial of the claim, creating unnecessary stress for your loved ones during an already difficult time.

Getting started with your term life form

Before diving into the term life form itself, gather all necessary information to streamline the process. This includes personal information such as your full name, physical address, and contact details. Be prepared to disclose your health history, including any pre-existing conditions, medications, and lifestyle choices such as smoking or alcohol use. This information is vital for determining your premium rates and overall insurability.

Another critical consideration is choosing the appropriate policy length and coverage amount. Start by evaluating your financial responsibilities, such as mortgages, education costs, or outstanding debts. Additionally, assess what financial legacy you wish to leave behind. A common pitfall in this step is underestimating the coverage needed or selecting a policy length that doesn’t match your financial obligations.

Detailed steps in filling out the term life form

To start, you’ll need to access your term life form. You can conveniently find it on pdfFiller, a reliable online document management tool that simplifies form completion. Once you access the form, begin filling in your personal information. Ensure that all data is accurate; even small errors can create complications later on.

Following personal details, you'll encounter health and lifestyle questions. It’s crucial to be honest and thorough in your disclosures. Insurers rely on this information to assess risk and determine premiums. Next, as part of the form, you’ll select your beneficiaries. Understanding who will receive the death benefit and the implications of their designation is important – this can influence financial planning for your loved ones.

After including all necessary details, the last step before submission is reviewing your information. A detailed review is vital to ensure accuracy; double-check for typos or mistakes in names, addresses, or numbers. This step can prevent complications in the future, allowing for a smoother policy issuance process.

Editing and managing your term life form

With pdfFiller, managing your term life form becomes a seamless experience. The platform offers various editing tools allowing you to modify fields quickly or correct any mistakes. Additionally, you can add signature fields to finalize your document. This ease of use simplifies the process, ensuring you can make changes as needed without the hassle of paper documents.

Collaboration features further enhance your experience. If you wish, you can easily share your form with family members or financial advisors for additional support. If collaboration is required, setting permissions and access levels ensures that each participant can view or edit only what you allow. Such capabilities not only streamline the workflow but also offer peace of mind in managing essential documents.

Signing your term life form

Once your term life form is filled out and reviewed, signing it is the next crucial step. pdfFiller accepts various types of signatures, including electronic and handwritten signatures, ensuring that you can choose the most convenient method for you. Electronic signing through pdfFiller is straightforward; simply follow the prompts to eSign your document securely.

Maintaining document security is a top priority when signing sensitive forms like a term life policy. pdfFiller employs robust encryption methods and security protocols, protecting your personal and financial information against unauthorized access. Understanding the security measures in place gives you confidence as you complete this essential step in securing your coverage.

Submitting your term life form

After completing the signing process, the next step is submitting your term life form. pdfFiller users can choose between online or offline submission options depending on the insurer’s requirements. Online submission allows for quick processing, while offline methods might require mailing or faxing your documents. Ensure you understand your insurer's preferred method to avoid delays.

Once submitted, you can expect a confirmation of receipt from your insurer. Processing times can vary; it’s essential to be patient as the underwriting process takes place. Keeping a record of your submission confirms that you’ve completed this vital step in securing life coverage.

Next steps post submission

Following submission, your insurer will initiate a policy review process. During this period, the insurer will assess the information provided in your term life form and determine your eligibility for coverage. You may receive requests for additional information or clarification during this stage.

Once approved, you’ll receive initial documentation outlining your new coverage. Understanding your policy thoroughly is essential, including any exclusions or specifics that may affect your benefits. As a policyholder, maintaining awareness of your responsibilities, such as premium payments and updating information, will ensure your coverage remains effective.

Common questions and answers about term life forms

Navigating the complexities of a term life form may raise several questions. One frequently asked question is how to amend your term life form once submitted. If you need to make changes, contact your insurer promptly to initiate the process. They may require an amendment or new form submission, depending on the nature of the changes.

Another common concern is what to do if you need to change beneficiaries later. Most policies allow changes to beneficiaries; you will typically fill out a simple beneficiary change form. It's essential to review your beneficiary designations regularly to ensure they align with your current wishes.

Leveraging pdfFiller for ongoing document management

Managing your term life form doesn’t end with submission. pdfFiller provides excellent features for document storage and retrieval, ensuring that your essential documents are always accessible. By leveraging cloud-based storage, you can easily reference your term life form anytime, from anywhere.

Setting reminders for premium payments is another smart feature offered by pdfFiller. This ensures you never miss a payment, maintaining the active status of your life insurance. Additionally, when any changes occur, such as address changes or the addition of dependents, you can swiftly update your information, ensuring that your policy remains current and aligned with your life circumstances.

Testimonials and success stories

Real-life experiences highlight the effectiveness of pdfFiller in simplifying document management. Many users express appreciation for the intuitive design and ease of collaboration offered by the platform. Testimonials often cite how pdfFiller has empowered individuals and families to navigate the often daunting world of insurance paperwork with confidence.

For example, one user noted how the collaborative features allowed them to work with their financial advisor seamlessly, resulting in a term life policy that met their family’s needs perfectly. Such stories emphasize not just convenience but the empowerment users feel when managing essential documents like the term life form.

Related document templates and resources

In addition to the term life form, pdfFiller offers numerous related document templates that can enhance your insurance experience. For instance, you can find templates for policy claims and beneficiary designations, helping streamline your insurance management process further.

These additional tools complement the term life form, providing a comprehensive toolkit for individuals and families navigating their insurance needs. By utilizing pdfFiller’s vast library of resources, you can ensure that you are fully prepared to manage your coverage effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my term life directly from Gmail?

How do I execute term life online?

Can I create an electronic signature for the term life in Chrome?

What is term life?

Who is required to file term life?

How to fill out term life?

What is the purpose of term life?

What information must be reported on term life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.