Get the free Annual Account

Get, Create, Make and Sign annual account

Editing annual account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual account

How to fill out annual account

Who needs annual account?

Complete Guide to the Annual Account Form: What You Need to Know

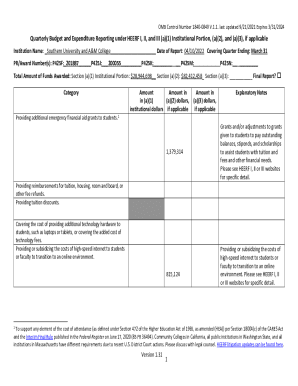

Understanding the annual account form

An annual account form is an essential document that summarizes the financial activities of an organization over a fiscal year. It provides a comprehensive overview of the entity’s financial performance and position, including statements such as the income statement, balance sheet, and cash flow statement. The purpose of this form is not only to comply with legal requirements but also to communicate financial health to stakeholders.

The importance of the annual account form cannot be understated. It plays a critical role in financial reporting, allowing businesses to showcase their revenue, expenses, assets, and liabilities. This transparent reporting is essential for regulatory compliance, attracting investors, and maintaining trust with customers and suppliers. Organizations of all types, including corporations, non-profits, and partnerships, are generally required to file an annual account form.

Types of annual accounts

There are several types of annual accounts, each designed for different organizational structures. Understanding which type applies to your entity is crucial in the reporting process. Corporate annual accounts are required for publicly traded and private companies, while non-profit annual accounts focus on donations and mission-centered financials. Furthermore, partnerships have their unique reporting needs, based on the contributions and distributions among partners.

While all annual account forms communicate financial status, key differences arise in structure and content required. Corporate annual accounts typically include a more extensive balance sheet and income statement than non-profit reports, which may prioritize funding sources. Partnership reports focus on individual partners’ share of profits and losses rather than overall organizational performance.

Preparing to fill out your annual account form

Before starting on your annual account form, gathering necessary documents is vital. Have your financial statements ready, including the profit and loss statement and balance sheet. Additionally, ensure you have all relevant transaction records from the accounting period, alongside the previous year's annual account to inform and guide your current reporting.

Understanding key financial terms is also crucial for accurately completing your annual account form. Familiarize yourself with concepts such as assets, liabilities, and equity, which form the backbone of your balance sheet. Similarly, a grasp of income, expenses, and cash flow is necessary for establishing your income statement. Knowing these terms will help ensure that every line item on your annual account form is recorded correctly.

Step-by-step guide to completing the annual account form

Filling out your annual account form can be daunting, but breaking it down into steps simplifies the process. Start by entering your company information, including the official name, address, and registration number. Accuracy here is critical, as it ensures that your form is correctly attributed to your business.

Next, report on your financial performance through the income statement. Here, you need to include total revenue generated during the year, followed by listing all expenditures to determine net profit or loss. This aspect gives stakeholders insight into your operational efficiency.

Then, report your financial position through the balance sheet. Break down your assets, detailing what your company owns, and align these with liabilities and equity to illustrate what you owe and the ownership structure. Conclusively, fill out the statement of cash flows to show the movement of cash across operating, investing, and financing activities, providing a comprehensive view of your liquidity.

Common mistakes to avoid

When completing your annual account form, several common pitfalls can occur. Many individuals enter inaccurate financial data, whether due to miscalculations or forgetfulness. It’s essential to double-check figures for accuracy to maintain the integrity of your report. Missing required signatures can also lead to delays or rejections of submissions, so ensure all necessary parties review and sign the document before filing.

Another mistake is neglecting to verify compliance with local regulations. Each jurisdiction may have specific requirements, deadlines, and forms to fill out. A lack of attention to these details can cause issues down the line. To avoid these pitfalls, always have a reliable checklist or guidelines during the preparation of your annual account form, ensuring nothing slips through the cracks.

Filing your annual account form

Once your annual account form is complete, you must determine how to file it. There are typically two submission channels: online or offline. Online submissions are more efficient and often recommended due to faster processing times. However, check your local jurisdiction’s guidelines, as specific forms may require physical submission.

Timelines for filing your annual account form vary depending on the entity type and local regulations. Generally, most organizations must submit their forms within a set time frame following the fiscal year-end. Additionally, be aware of any filing fees associated with the submission. Reviewing payment options in advance ensures a smooth filing process without unexpected delays.

After submission: what happens next?

Once you submit your annual account form, the first step is to receive a confirmation of receipt. This acknowledgment indicates that your document has been accepted for processing. Be sure to keep this confirmation as it can serve as proof of compliance if needed later.

In some cases, your submission may trigger an audit or a request for additional documentation from relevant authorities. Being proactive in maintaining precise records will ease this process. Lastly, be mindful of deadlines for any potential revisions or corrections, as addressing discrepancies promptly is vital for maintaining your organization’s credibility.

Utilizing pdfFiller for your annual account forms

pdfFiller can significantly simplify the annual account form process. With interactive tools for easy editing and completion, users can fill out forms accurately and efficiently. Additionally, pdfFiller’s eSigning features ensure compliance, allowing necessary parties to sign documents effortlessly.

Moreover, its cloud-based document management system lets users access their annual account forms from anywhere, promoting flexibility and collaboration. Whether you’re part of a team or an independent business owner, pdfFiller provides a comprehensive platform that caters to diverse needs.

FAQs about the annual account form

As you navigate the world of the annual account form, several questions may arise. For instance, what should you do if you miss the filing deadline? Many jurisdictions allow for some form of late filing but may impose fees. It's crucial to familiarize yourself with local regulations to minimize potential penalties.

Another common query is whether you can amend your annual account after filing. Generally, yes; amendments are often permissible if errors are found, but timing and procedures vary. Finally, if you disagree with the reviewer’s feedback during an audit, it’s important to seek clarification and, if necessary, provide additional documentation to support your position.

Additional tips for enhanced document management

To ensure smoother organization and better management of your financial documents, establish best practices early on. For example, digitizing paper records can minimize clutter and enhance accessibility. Regularly updating your annual account form can also aid in preparation for the future, ensuring consistency and accuracy across reporting periods.

Leveraging collaboration tools can be particularly beneficial for teams involved in compiling financial reports. By facilitating input from multiple department members, you can ensure comprehensive data representation in your annual account form. Consider adopting a shared digital workspace to increase efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in annual account?

How do I edit annual account in Chrome?

Can I create an electronic signature for the annual account in Chrome?

What is annual account?

Who is required to file annual account?

How to fill out annual account?

What is the purpose of annual account?

What information must be reported on annual account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.