Get the free Credit Card Authorization

Get, Create, Make and Sign credit card authorization

How to edit credit card authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization

How to fill out credit card authorization

Who needs credit card authorization?

Your Complete Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

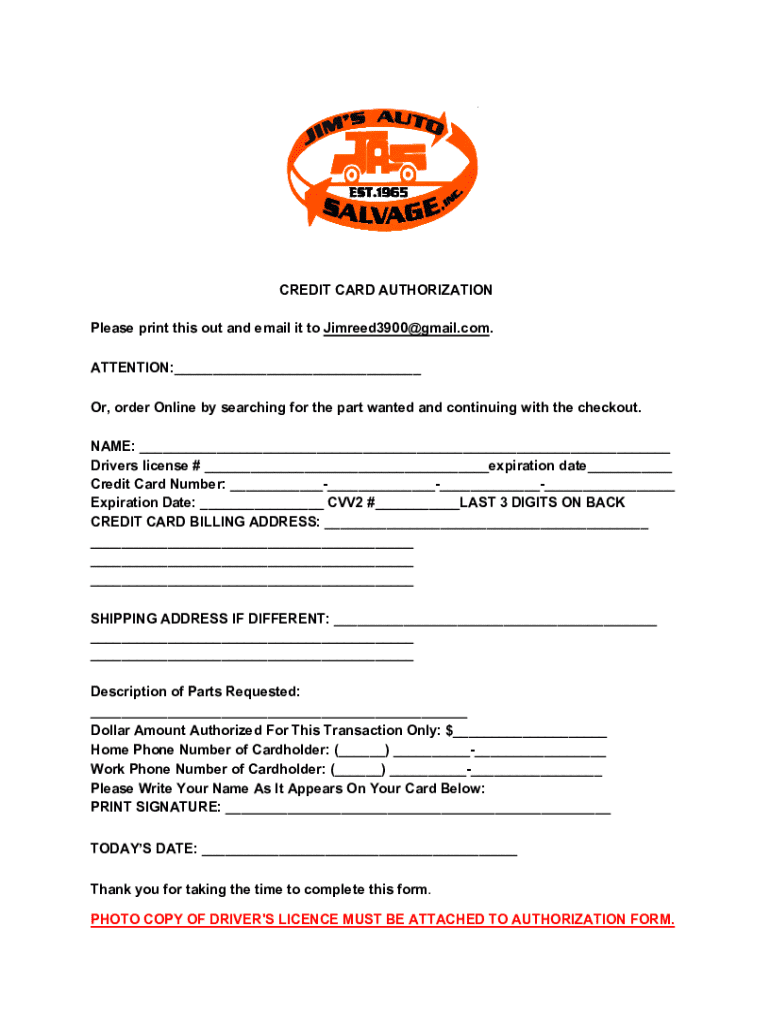

A credit card authorization form is a document used by businesses to obtain permission from a customer to charge their credit card for a specified amount. This form serves as a crucial tool in transactions, formalizing the agreement between the customer and the merchant. It outlines the terms of the transaction, including the amount, the date of authorization, and the services or products being purchased.

The significance of credit card authorization forms lies in their ability to protect both the vendor and the consumer. Understanding the boundaries of what an authorization form constitutes versus other payment methods is essential. Unlike a simple credit card transaction, which may not require explicit consent for each purchase, an authorization form actively verifies the customer’s agreement beforehand, which can help mitigate disputes and chargeback risks.

Benefits of using credit card authorization forms

One of the primary benefits of using a credit card authorization form is the prevention of chargeback abuse. Chargebacks — when a customer disputes a charge and requests a refund through their credit card issuer — can be costly for businesses. The form provides documented evidence that the consumer agreed to the transaction, making it easier for sellers to contest illegitimate disputes.

Additionally, these forms enhance security for both sellers and customers. For sellers, they serve as proof of consent, reducing the risk of fraudulent transactions. For customers, knowing that their credit card information is documented with explicit consent can foster trust with the merchant. Properly executed authorization forms also come with legal protections; should an issue arise, having this documentation protects both parties in dispute resolutions.

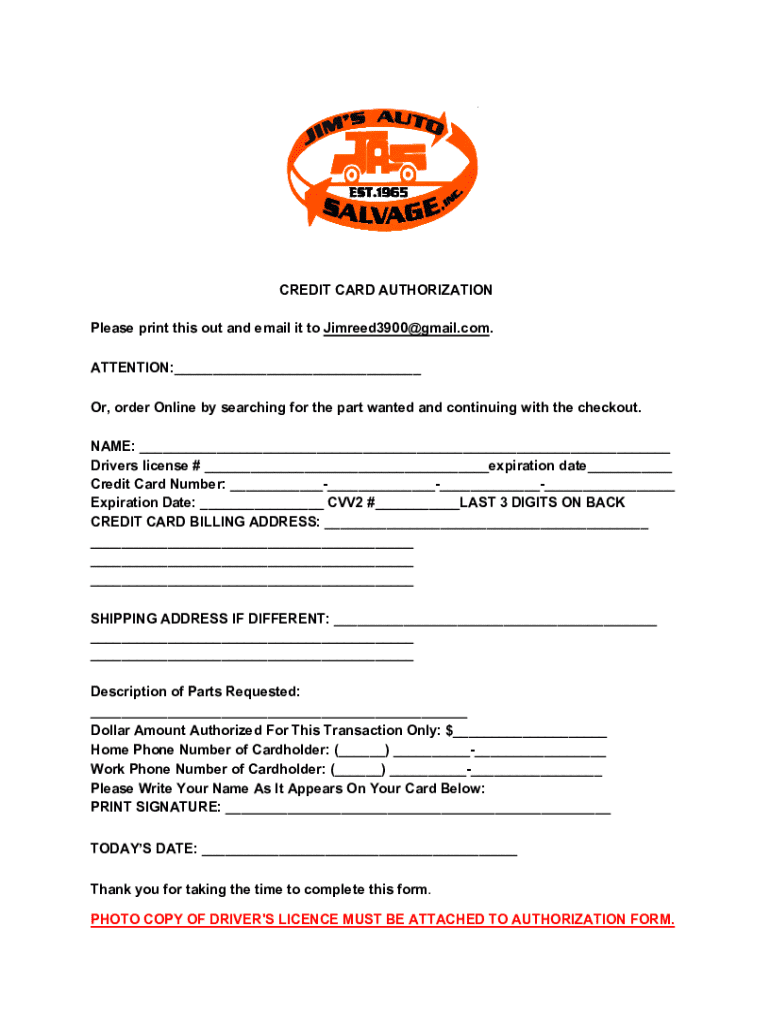

Key components of a credit card authorization form

When creating a credit card authorization form, several essential pieces of information must be included to ensure it is comprehensive and effective. At a minimum, the form should consist of the following components:

Optional components can also enhance the form's functionality, such as a requirement for the CVV (Card Verification Value) to further authenticate the cardholder. Some forms may omit this for convenience, but including it can add an extra layer of security. Furthermore, providing clear instructions on how to store and protect data is crucial to compliance and customer trust.

Situations where credit card authorization forms are essential

Credit card authorization forms are particularly important for various scenarios involving recurring transactions. Sellers should utilize these forms for long-term agreements, such as rentals, subscriptions, and any pre-authorized payments. These situations often entail ongoing charges, making it essential to have documented consent.

Case studies highlight the effectiveness of these forms. For example, subscription-based services that use a credit card authorization form have noted a decrease in chargebacks and fraudulent charge disputes. This streamlined approach not only protects the business but also enhances customer satisfaction, as users appreciate the transparent and secure transaction process.

How to create and implement a credit card authorization form

Creating a credit card authorization form may seem daunting, but with the right approach, it can be straightforward. Here’s a step-by-step guide:

It’s also vital to maintain compliance with relevant payment regulations, including data protection laws. Regularly review and update the form to ensure it meets any new legal requirements or standards.

Managing and storing credit card authorization forms securely

Once you’ve created and collected credit card authorization forms, secure storage becomes a priority. Follow these best practices:

Moreover, implementing robust security measures, such as regular audits and access controls, will help protect customer data. Ensuring that only authorized personnel have access to these documents mitigates the risk of data breaches.

FAQ about credit card authorization forms

A few common questions arise regarding credit card authorization forms, including legal obligations and flexibility. Notably, while there isn’t a mandatory legal obligation to use these forms universally, they are highly recommended to protect your business and reduce the risk of disputes.

In the event a customer disputes a charge, the presence of a well-documented credit card authorization form can significantly strengthen your case. Furthermore, the forms can be flexible and be tailored to suit different transaction scenarios, ensuring that both parties are aware of the terms.

Interactive tools and resources

Utilizing templates from resources like pdfFiller is not just about creating a form; it’s about enhancing your overall document management process. Accessing customizable templates enables you to adapt the forms based on specific needs and changes.

Subscribing to updates and best practices can also keep you informed of new legal requirements or industry standards. Sharing customer stories about how businesses have successfully benefited from using credit card authorization forms can inspire and guide your implementation strategies.

Related topics of interest

Understanding the wider context of credit card transactions can also prove beneficial. Topics such as the role of payment gateways in facilitating secure credit card transactions, understanding chargebacks, and their impact on businesses are worth exploring.

Additionally, tips for building a customer-centric payment process highlight how putting the customer first ensures smoother transactions, builds trust, and facilitates a better overall experience. Keeping an eye on trends in secure payment solutions for upcoming years will ensure your business remains at the forefront of payment technology.

Explore more with pdfFiller

pdfFiller is designed to empower users with tools for document management, enabling seamless edits, eSignatures, and collaboration. Starting your journey to creating effective credit card authorization forms today can transform your transaction management approach.

The platform’s comprehensive features will not only simplify the creation of forms but also ensure that your documents are stored securely and are easy to access from anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization for eSignature?

How can I get credit card authorization?

How do I edit credit card authorization straight from my smartphone?

What is credit card authorization?

Who is required to file credit card authorization?

How to fill out credit card authorization?

What is the purpose of credit card authorization?

What information must be reported on credit card authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.