Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Comprehensive Guide to Credit Card Authorization Forms

Understanding credit card authorization forms

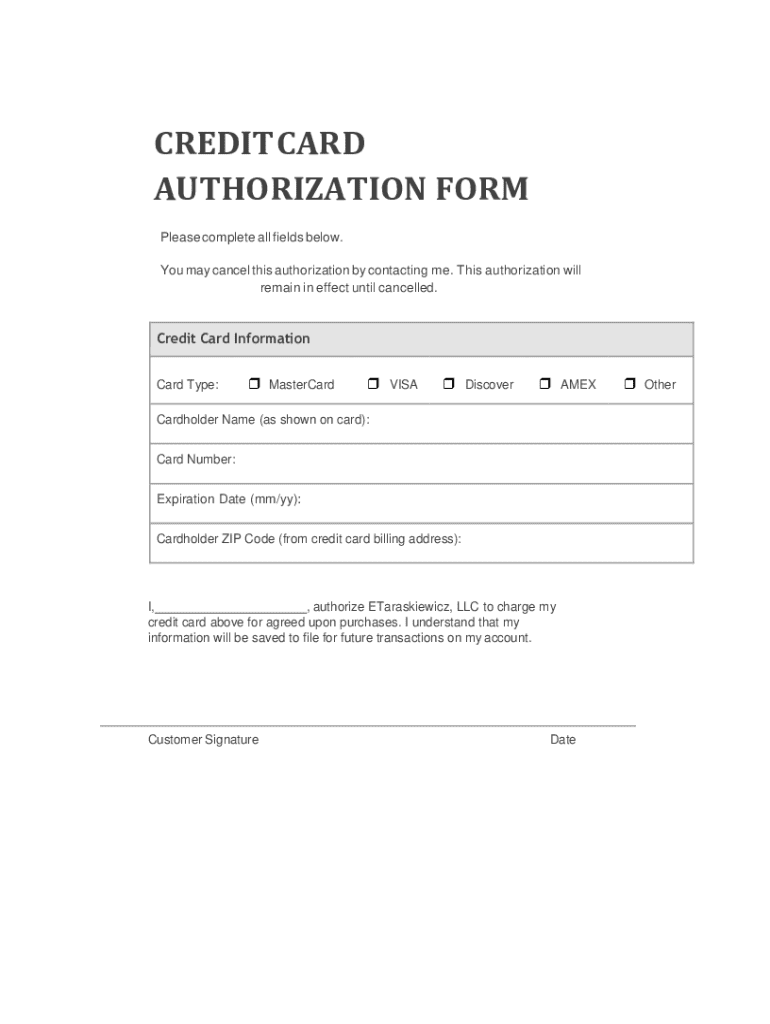

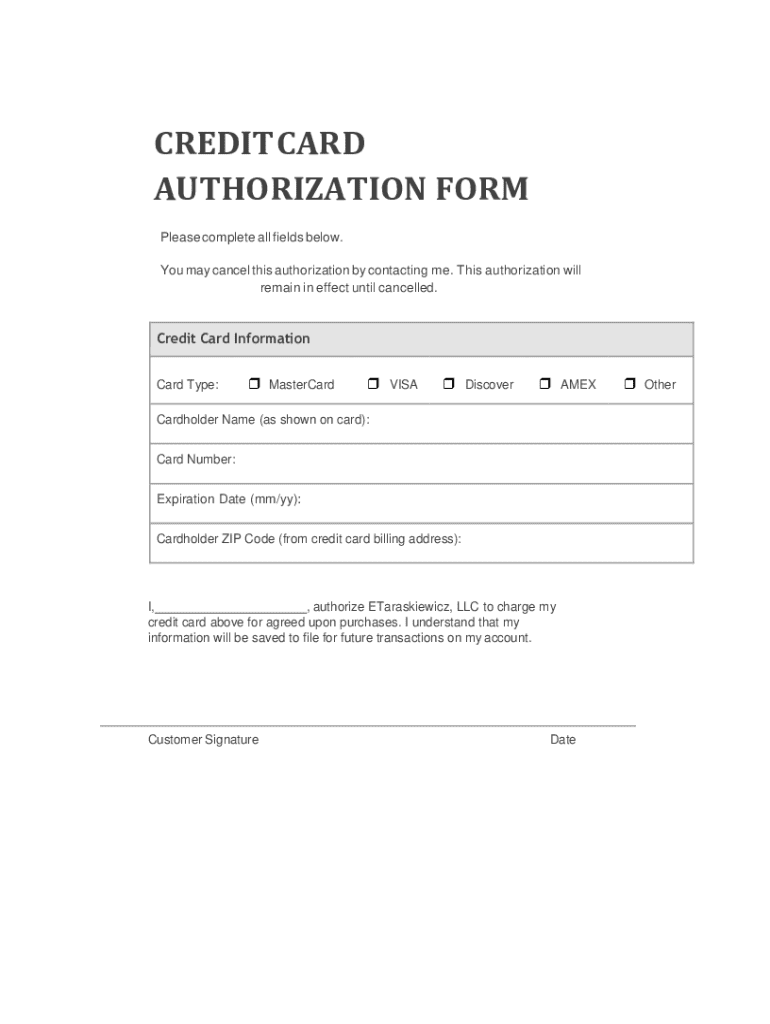

A credit card authorization form is a document used to obtain permission from a cardholder to charge their credit card for goods or services. This form serves as a formal agreement between the merchant and the customer, indicating that the customer authorizes the business to access their credit card information for a specified transaction or series of transactions. The importance of credit card authorization forms cannot be understated, particularly in safeguarding both parties against fraud and misunderstandings.

Unlike payment receipts, which confirm that a transaction has occurred, a credit card authorization form precedes the transaction itself. It provides evidence that the customer has consented to the charge before the service is rendered or the product is shipped, minimizing disputes and chargebacks.

Benefits of using a credit card authorization form

Using a credit card authorization form offers several critical benefits for both businesses and consumers. Firstly, it significantly reduces the risk of chargeback abuse, where customers dispute legitimate charges to evade payment. This protection not only saves businesses from financial losses but also reinforces trust between consumers and merchants.

Additionally, secure transactions foster consumer confidence. Customers feel safer knowing their financial details are protected and that their transaction has a clear, documented basis. For businesses, the form simplifies payment processes, providing a clear record of authorized transactions that can streamline accounting and auditing processes.

Key components of a credit card authorization form

A well-structured credit card authorization form should include several essential fields. These components ensure that the form is complete and legally binding. Key elements include:

Optional sections can further enhance usability, such as an email address for confirmation and an option for recurring payments, which adds flexibility for both businesses and consumers.

When to use a credit card authorization form

Certain situations necessitate the use of a credit card authorization form. These include cases involving product or service pre-orders, where a customer is charged upfront for an item not yet available. Recurring payments, such as subscription services, also require authorization to process regular charges efficiently.

Additionally, remote services where the customer cannot be physically present, such as online services, heavily rely on these forms to ensure transaction integrity. In all these cases, implementing a credit card authorization form bolsters transaction security and reinforces customer trust.

Best practices for completing credit card authorization forms

Filling out a credit card authorization form requires accuracy and clarity. Here’s a step-by-step guide:

For both digital and physical formats, clarity is crucial. Digital forms can leverage technology for mandatory fields and error prompts, while physical forms should emphasize legibility to avoid confusion.

Legal considerations surrounding credit card authorization forms

Ensuring compliance with legal standards is vital when handling credit card authorization forms. Adhering to PCI-DSS standards protects against breaches and ensures the secure handling of cardholder information. Additionally, being aware of data protection regulations, like GDPR or local laws, is crucial to maintain trust and legality in businesses.

Moreover, establish a clear process for validating authorization. This includes documenting consent effectively to provide protection against any disputes that may arise relating to unauthorized charges.

Storing and managing signed credit card authorization forms

Once filled, storing credit card authorization forms securely is paramount. Consider using encrypted digital solutions, which not only ensure accessibility but also bolster security. Maintaining these records for a specified duration is also important, generally in line with financial regulations, often around 3-7 years.

Accompanying storage practices should include ensuring customer data security. This means limiting access to authorized personnel and employing secure methods for data handling and deletion once retention periods have expired.

Frequently asked questions (FAQs)

Here are some common questions regarding credit card authorization forms:

Innovative tools for credit card authorization management

Using platforms like pdfFiller can revolutionize how businesses handle credit card authorization forms. With its interactive features, you can create templates that reduce errors and streamline the process. The eSigning capabilities offered by pdfFiller allow for quick and secure signing, enhancing collaboration among team members.

Real-time collaboration on forms further improves efficiency, allowing for multiple team members to review or amend the documentation as needed, regardless of their location.

Additional considerations and alternatives

In some cases, a credit card authorization form may not be necessary, such as within established trust levels between vendors and frequent clients. Alternatively, 'card on file' agreements can simplify transactions for returning customers, allowing for quicker checkouts while retaining customer consent.

Integration with other payment processing systems can also streamline operations, ensuring that all transactions are documented and authorized in a seamless manner.

Industry applications

Credit card authorization forms find utility across various industries. In e-commerce, they help to combat fraud and ensure authorized sales. Service providers, from gyms to subscription models, use these forms for recurring payments, establishing clear authorization upfront. Retail stores utilize them for pre-order items, ensuring that customers are aware of charges before transactions are completed.

Every industry benefits from implementing a reliable system for handling credit card authorization, ensuring customer trust while protecting financial interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card authorization form?

Can I create an eSignature for the credit card authorization form in Gmail?

How do I fill out credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.