Get the free Conventional Limited Review Condominium Questionnaire

Get, Create, Make and Sign conventional limited review condominium

How to edit conventional limited review condominium online

Uncompromising security for your PDF editing and eSignature needs

How to fill out conventional limited review condominium

How to fill out conventional limited review condominium

Who needs conventional limited review condominium?

A comprehensive guide to the conventional limited review condominium form

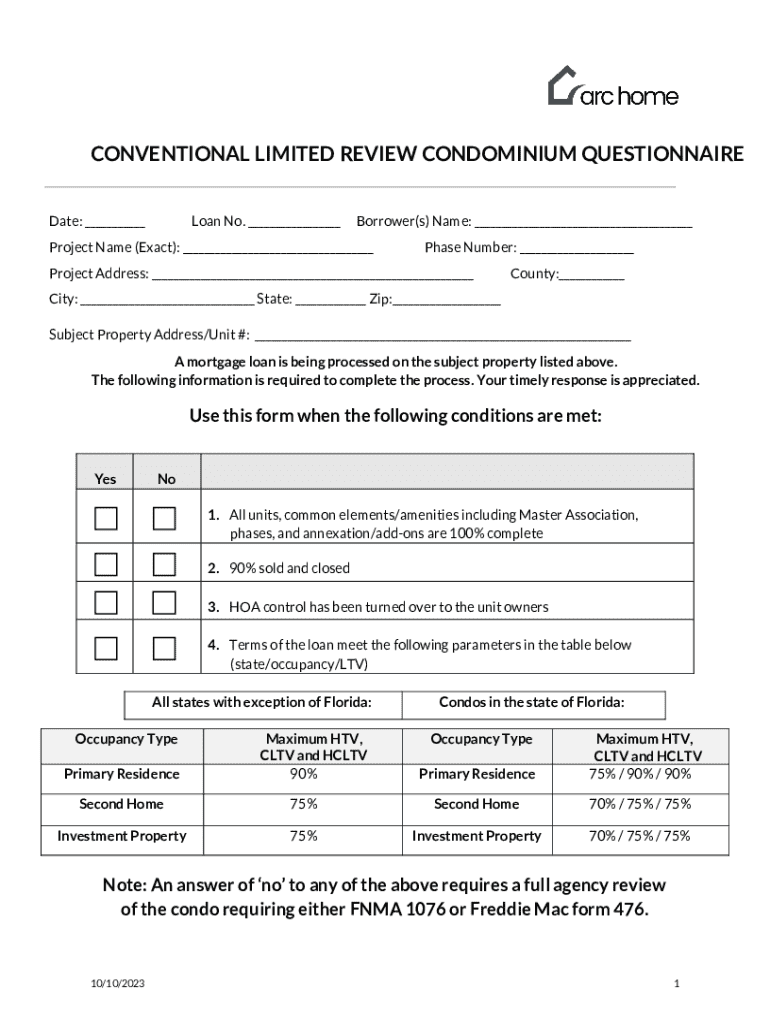

Understanding the conventional limited review process

A conventional limited review is a process designed to simplify and expedite the evaluation of condominium projects when securing financing. This method allows lenders to assess projects with reduced paperwork and quicker turnaround times, making it an ideal choice for borrowers. The major stakeholders involved in this process include real estate agents, lenders, borrowers, condominium associations, and, occasionally, underwriting teams. By collaborating effectively, all parties can navigate the limited review efficiently.

The benefits of opting for a limited review are compelling. It streamlines the usual real estate transaction protocols, thereby significantly enhancing speed and efficiency during processing. Additionally, the reduced documentation requirements lower the barriers for buyers and streamline the lender's underwriting process. Furthermore, these efficiencies typically translate into cost savings for both buyers and lenders, making it an attractive option for many.

Eligibility criteria for limited review

Not all condominium projects qualify for a limited review. Specific types of condominium projects are deemed eligible, including conventional residential condominiums, certain mixed-use developments, and newly constructed condominiums. Each of these types may have unique considerations; for instance, mixed-use developments must demonstrate a certain percentage of residential occupancy to be considered. Additionally, it is crucial to ensure the projects comply with the lender's established guidelines.

General eligibility requirements encompass minimum property standards, appropriate occupancy rates, and stable budgetary constraints. Most lenders require that at least 50% of the units be owner-occupied, along with a solid financial background for the condominium association as reflected in their current budget and reserves. Specific transactions such as purchase agreements and refinancing also have distinct requirements to meet for limited review consideration.

Important documentation for conventional limited review

When submitting a request for a conventional limited review, specific documentation is necessary to facilitate the approval process. A checklist of essential documents provides a streamlined approach for applicants. Key documents include the Condominium Project Questionnaire, financial statements, the operating budget, and the declaration of covenants, conditions, and restrictions (CC&Rs). By ensuring these documents are complete and accurate, applicants can significantly enhance their success rates.

The significance of these documents cannot be overstated. For instance, the Condo Project Questionnaire helps lenders assess whether the association adheres to the lender's guidelines, while the operating budget highlights the financial viability of the condominium. Ensuring that all necessary documents are organized and accurately completed is critical for a successful limited review.

Filling out the conventional limited review condominium form

Filling out the conventional limited review condominium form is a straightforward process when you have the right resources. The form is often available as a PDF file and can be accessed through platforms like pdfFiller, which simplifies the document management process. Start by downloading the PDF and gathering all necessary documentation to support your request.

Utilizing editing tools on pdfFiller can further enhance your ability to fill out the form seamlessly. You can collaborate with team members for input and feedback, streamlining the process. Their user-friendly interface allows for easy navigation and adjustments, ensuring your form is polished and ready for submission.

Submitting your limited review application

Once the conventional limited review condominium form is completed, the next step is to submit the application to lenders. This submission can often be done electronically through pdfFiller, which offers capabilities for managing documents securely. It's essential to follow the lender's specific submission guidelines, whether online or through physical delivery.

Common pitfalls in applications include forgetting to include required documents or incorrectly completing sections of the form. To avoid these, maintaining a checklist during preparation is advisable. A proactive approach will help prevent delays and facilitate a smoother interaction with your lender during the review process.

Managing follow-up and communication

Effective communication with lenders during the limited review process is crucial. After submission, implement a strategy for following up to check the status of your application. A recommended timeline would be to wait about seven to ten business days before reaching out, yet this can vary depending on the lender's procedures.

Handling requests for additional information is a common aspect of the review process. It’s important to be prompt in responding to lenders to avoid further delays. Having your documents organized and accessible will greatly aid in efficiently managing these requests.

Insightful resources and tools

Using resources available on pdfFiller can greatly enhance the management of your limited review application. They provide interactive tools that simplify document editing, eSigning, and collaborative features that promote teamwork. By integrating these tools into your workflow, users can save time and reduce the stress associated with document management.

Additionally, reviewing frequently asked questions can provide insights into common concerns surrounding the limited review process. Legal and compliance considerations are also crucial to ensuring the completion of the form aligns with regulatory standards, mitigating risks down the line.

Conclusion of the limited review process

After receiving approval for a limited review, the next steps involve coordinating with closing agents and lenders to finalize the transaction. This stage often includes preparing and signing the final documentation. Being attentive to detail during this phase is essential, as any errors could lead to delays in closing.

In cases where a limited review is not approved, consider alternative financing options. Understanding the reasons for denial is critical to addressing any issues and improving the chances for future applications. Maintaining open communication with lenders can help clarify these matters and guide the next steps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit conventional limited review condominium online?

Can I create an electronic signature for the conventional limited review condominium in Chrome?

Can I create an electronic signature for signing my conventional limited review condominium in Gmail?

What is conventional limited review condominium?

Who is required to file conventional limited review condominium?

How to fill out conventional limited review condominium?

What is the purpose of conventional limited review condominium?

What information must be reported on conventional limited review condominium?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.