Get the free Camel Insurance Proposal Form - general futuregenerali

Get, Create, Make and Sign camel insurance proposal form

How to edit camel insurance proposal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out camel insurance proposal form

How to fill out camel insurance proposal form

Who needs camel insurance proposal form?

Camel Insurance Proposal Form: A Comprehensive How-to Guide

Overview of the camel insurance proposal form

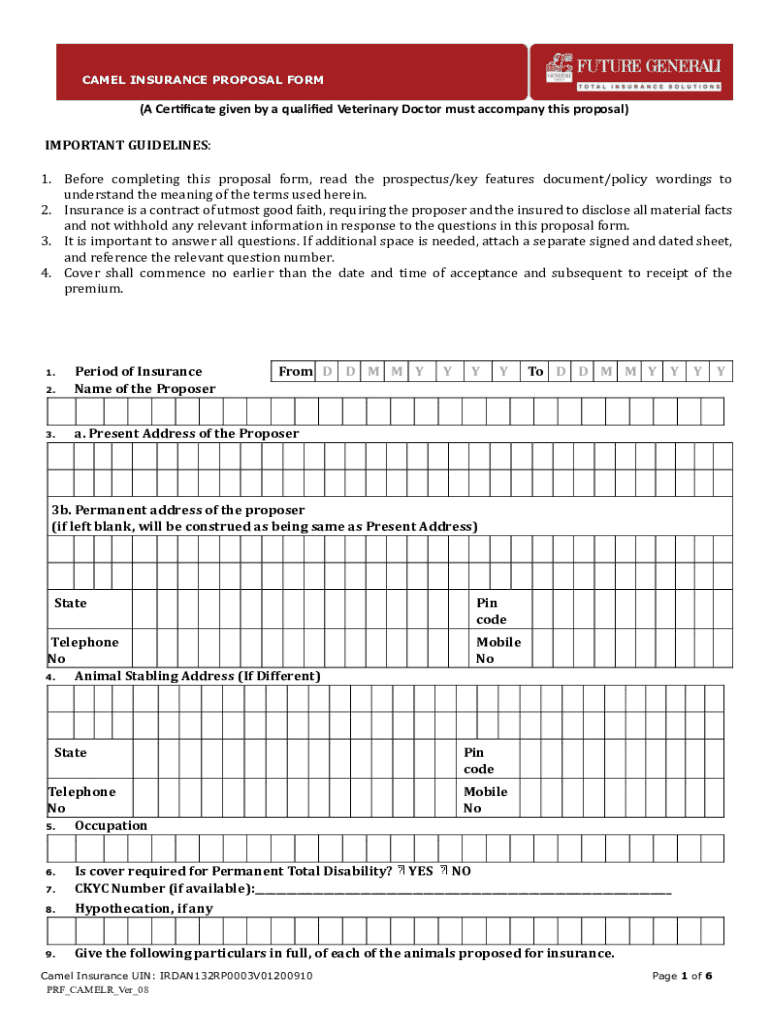

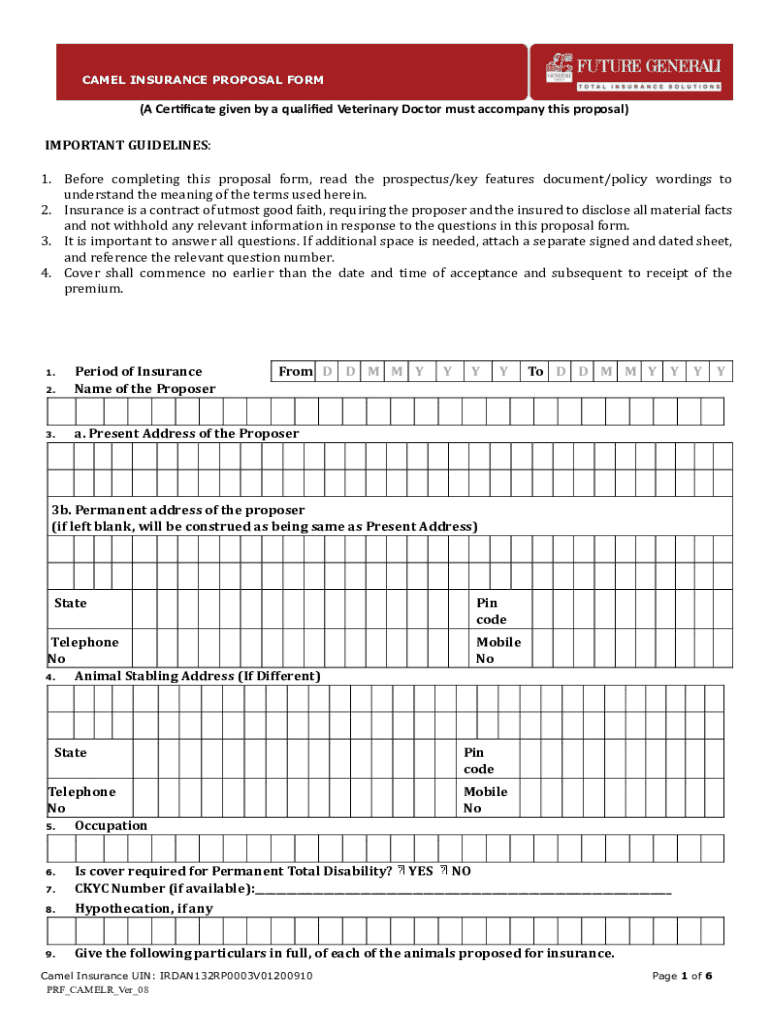

The camel insurance proposal form is a crucial document designed for camel owners to secure the necessary insurance for their animals. By filling out this form accurately, owners can protect their investments and ensure their camels receive the care they need in various circumstances. The proposal's primary purpose is to collect vital information regarding the camel and the owner's insurance requirements, which can significantly influence policy applicability and pricing.

Submitting an accurate proposal is essential as it directly impacts the insurance company's ability to assess risk and determine appropriate coverage options. Misrepresentation or omissions can lead to declined claims or policy cancellations. Furthermore, using a digital proposal form streamlines the collection process, allowing for quicker submissions and enhanced organization of related documents.

Understanding camel insurance

Camel insurance is a specialized type of coverage tailored to meet the unique needs of camel owners. It protects against various risks associated with owning camels, including health issues, liability claims, and event-related risks. This type of insurance is particularly popular among farmers, breeders, and individuals involved in events such as camel racing and shows.

The types of coverage offered under camel insurance can vary significantly. Common options include:

Selecting the right policy is vital since it determines the level of protection available and can safeguard not only the camel's health but also the owner’s financial stability in adverse situations.

Preparing to fill out the camel insurance proposal form

Before beginning the process of completing a camel insurance proposal form, it's important to gather all necessary information and supporting documents. This preparation ensures a more efficient submission process.

Essential information needed includes:

To streamline this gathering process, camel owners are encouraged to create a checklist and ensure all records are up-to-date and readily accessible prior to filling out the proposal.

Step-by-step guide to filling out the camel insurance proposal form

Filling out the camel insurance proposal form can be straightforward if you follow a structured approach. Here’s a step-by-step guide to effectively complete your form:

Step 1: Personal information

Start by entering your personal information. This includes your name, address, and contact details. Providing accurate information is crucial as it serves as the primary contact point for the insurance company.

Step 2: Camel details

Next, provide specific information about your camel. Include details such as gender, age, purpose (e.g., breeding, racing), and any essential health history or incidents that could affect overall health.

Step 3: Insurance coverage selection

This section involves selecting the coverage options that best suit your needs. Review the available plans carefully, and be sure to consider optional coverages that might be beneficial, such as enhanced health coverage or specific liability extensions.

Step 4: Reviewing and confirming details

Before submitting, it’s critical to review all entries for accuracy. Common mistakes occur in miswriting contact information or omitting key camel details. Double-checking your form can prevent delays in approval.

Interactive tools for enhanced proposal submission

pdfFiller offers innovative tools designed to facilitate the completion and submission of the camel insurance proposal form. One key feature is the online editing capability, allowing users to fill out the form seamlessly.

Additional features include:

These interactive tools not only optimize the submission process but also provide an organized way to manage your documents.

Managing your camel insurance proposal after submission

Once you've successfully submitted your camel insurance proposal form, it’s essential to manage your application effectively. Make a note of tracking your application status to stay informed about any progress or changes to your proposal.

If necessary, you should be aware of how to modify your proposal after submission. This may include clarifying information or adjusting coverage selections if your circumstances change. Understanding the follow-up procedures is equally important, as this can dictate how quickly claims and processing occur.

Frequently asked questions about camel insurance proposal forms

Understanding the common queries regarding the camel insurance proposal form can help you navigate the process efficiently. Here are a few frequently asked questions:

Troubleshooting common issues with the proposal form

Encountering issues while submitting your camel insurance proposal is not uncommon. Understanding potential problems can help you resolve them more effectively.

Common issues include:

Conclusion: maximizing your camel insurance experience

In conclusion, completing the camel insurance proposal form involves several critical steps that, when followed, can lead to a successful insurance outcome. From gathering accurate information to utilizing pdfFiller’s advanced features, you can streamline your experience significantly.

Staying informed about policy changes and engaging with resources for ongoing support is also crucial to ensure that your insurance remains relevant and beneficial. Being proactive in managing your camel insurance proposal ensures that you are always equipped to handle any eventualities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify camel insurance proposal form without leaving Google Drive?

Can I create an eSignature for the camel insurance proposal form in Gmail?

How do I edit camel insurance proposal form on an iOS device?

What is camel insurance proposal form?

Who is required to file camel insurance proposal form?

How to fill out camel insurance proposal form?

What is the purpose of camel insurance proposal form?

What information must be reported on camel insurance proposal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.