Get the free Ca36

Get, Create, Make and Sign ca36

How to edit ca36 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ca36

How to fill out ca36

Who needs ca36?

CA36 Form: How-To Guide

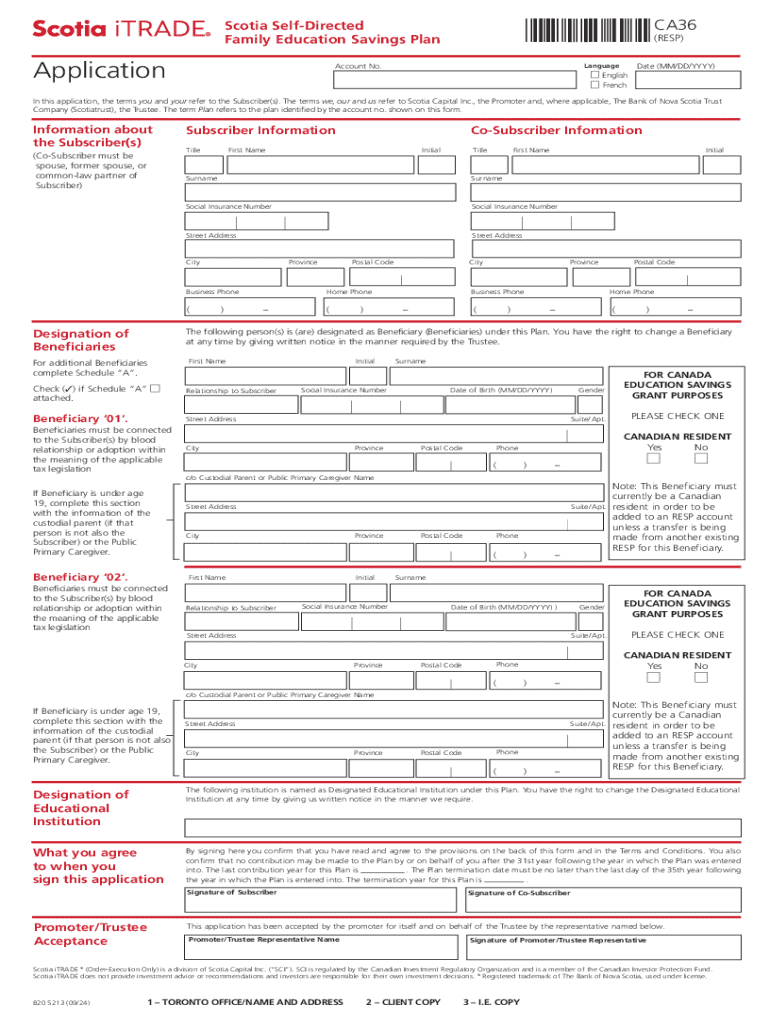

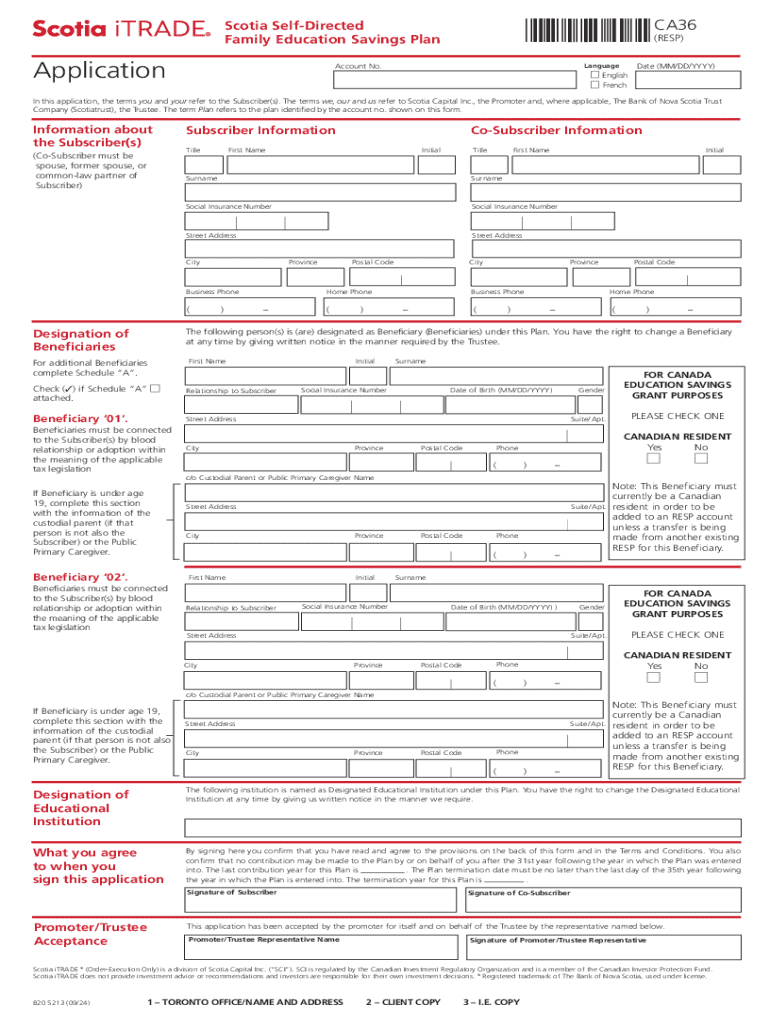

Understanding the CA36 Form

The CA36 form is a specific document used primarily in the realm of finance and taxes, particularly in various jurisdictions to report specific financial activities. It serves as a standardized means for individuals and businesses to provide essential information to tax authorities, ensuring compliance and proper assessment of liabilities.

When is the CA36 Form Required?

The CA36 form is mandated in various scenarios, particularly during tax reporting periods, audit requests, or when businesses undergo financial evaluations. Industries like banking, insurance, and real estate frequently utilize this form to ensure they meet regulatory requirements.

Step-by-step guide to filling out the CA36 Form

Filling out the CA36 form may seem daunting, but with the right preparation and understanding of each section, it becomes manageable. First, gather all necessary documentation to support the information you're required to disclose in the form.

Gather necessary information

A detailed compilation of documents is crucial for accurately completing the CA36 form. Collect items such as your income statements, past tax returns, and any supporting documentation related to deductions or financial claims you intend to assert.

Completing the CA36 Form

Let’s break down the sections of the CA36 form to simplify the completion process. Each section serves a distinct purpose and demands specific information.

Section 1: Personal Information

In this section, you will need to provide your name, address, and contact details. Ensure that all information is accurate and up-to-date. Using your full legal name as it appears on identification documents prevents mismatches that can delay processing.

Section 2: Financial Data

Here, you are required to disclose various financial data, including income sources, expenses, and any other pertinent information. It's essential to be transparent to avoid complications down the line.

Section 3: Supplementary Information

This area allows you to include optional information that may be beneficial to your submission, such as notes explaining discrepancies or other contextually relevant data. Although optional, adding insightful supplementary information can aid in the evaluation process.

Common mistakes to avoid

Errors can occur during form completion, including providing inaccurate information and omitting necessary data. One notable mistake is neglecting to double-check figures and calculations, which could lead to discrepancies later. Reviewing your document carefully and using checklists can help mitigate such errors.

Editing the CA36 Form

Once the CA36 form is filled out, you might realize edits are necessary. Using tools like pdfFiller simplifies the editing process, allowing users to upload and modify their forms effortlessly.

Using pdfFiller for editing

To begin editing your CA36 form in pdfFiller, simply upload the document to the platform. The intuitive interface guides users through the editing features available and ensures your document can be revised without hassle.

Step-by-step instructions for making edits

Once your CA36 form is uploaded, you can edit text fields directly, insert images if necessary, and annotate or highlight sections, making your revisions clear and accessible.

Features of pdfFiller for enhanced editing

pdfFiller offers features such as commenting, highlighting, and various tools for text modification. Streamlined editing enhances collaboration potential by allowing team members to review and approve changes easily.

Signing the CA36 Form

Signing the CA36 form is a crucial step before submission. Digital signatures carry significant weight in compliance and legalities. Everyone involved can efficiently complete their signatures using electronic methods.

eSigning options with pdfFiller

pdfFiller allows for easy eSigning, wherein users can select from standard or customizable signature options based on preference and context. This flexibility is helpful for businesses with diverse needs.

Choosing between standard and customizable signatures

Standard signatures are premade options accessible to everyone, while customizable signatures can include unique stylizations that reflect personal or brand identity. It's beneficial to choose which suits the document’s tone and audience better.

Security measures for eSigning

When using eSigning features, security is paramount. pdfFiller employs encryption measures to protect your data and signature. Understanding the legal validity of eSignatures within your jurisdiction further ensures that the process remains legitimate.

Managing the CA36 Form

Effective management of the CA36 form after completion and signing involves taking steps to store, share, and monitor revisions. Properly managing forms boosts organization and reduces the likelihood of errors in future dealings.

Saving and storing your form

When storing your completed CA36 form, digital solutions are ideal. pdfFiller offers cloud storage solutions, allowing users to access their forms from anywhere.

How to organize forms using pdfFiller’s tools

Users can categorize and tag forms for easy retrieval, making it simpler to manage document flows within teams or businesses. With pdfFiller, the organization becomes straightforward and stress-free.

Sharing the CA36 Form

To share the CA36 form, pdfFiller provides seamless avenues for collaboration. You can send documents to team members or external parties for review through easily manageable links.

Step-by-step guide on sharing via pdfFiller

Simply select the form, click the share option, and enter the email addresses of recipients. This gives them immediate access to review or contribute.

Tracking changes and version control

pdfFiller's tracking features allow users to monitor alterations made to the CA36 form, promoting transparency in collaborative efforts. This capability comes in handy, especially when reviewing histories of numerous edits and creating accountability.

Frequently asked questions (FAQs) about the CA36 Form

Individuals often have queries regarding the CA36 Form stemming from its significance and detailed nature. Understanding the common points of confusion helps ensure a smoother filing process.

Answers to common queries

If a mistake is made on the CA36 form, it's crucial to address it promptly by retaking the steps to correct the error and resubmitting. Handling disputes regarding submissions involves contacting the relevant authority and providing supporting evidence to clarify issues that have arisen.

Additional considerations

As regulations evolve, staying informed on updates and changes to the CA36 form is essential for compliance. Regularly checking official resources or guidance from tax professionals keeps you in the loop about necessary adjustments.

Resources and tools

pdfFiller provides invaluable resources for users dealing with the CA36 form, enhancing the documentation experience significantly.

Templates and examples

Links to sample CA36 forms and customizable templates can greatly assist in understanding the expected format and required entries for your submissions.

Interactive tools on pdfFiller

pdfFiller offers various interactive tools to facilitate form management. These could include calculators for estimating tax liabilities or interactive checklists to ensure all documentation is complete.

Conclusion and next steps

Managing your CA36 form effectively is pivotal for ensuring smooth compliance and promoting transparency in financial dealings. With the comprehensive capabilities of pdfFiller at your disposal, you can streamline every step, from initial drafting to final submission.

Utilize pdfFiller for all document needs

Expanding your experience with pdfFiller can transform how you handle documents. Whether editing, signing, or sharing, engage with the platform fully to explore all available features.

Contact information for customer support

Should you encounter challenges or need assistance with the CA36 form process, pdfFiller has dedicated support channels available. Reach out via email, live chat, or check the comprehensive support section on the website.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ca36 to be eSigned by others?

How do I edit ca36 in Chrome?

How can I fill out ca36 on an iOS device?

What is ca36?

Who is required to file ca36?

How to fill out ca36?

What is the purpose of ca36?

What information must be reported on ca36?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.