Get the free Credit Card Authorization for Payment of Fines

Get, Create, Make and Sign credit card authorization for

Editing credit card authorization for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization for

How to fill out credit card authorization for

Who needs credit card authorization for?

Credit card authorization for form: A comprehensive guide

Understanding credit card authorization forms

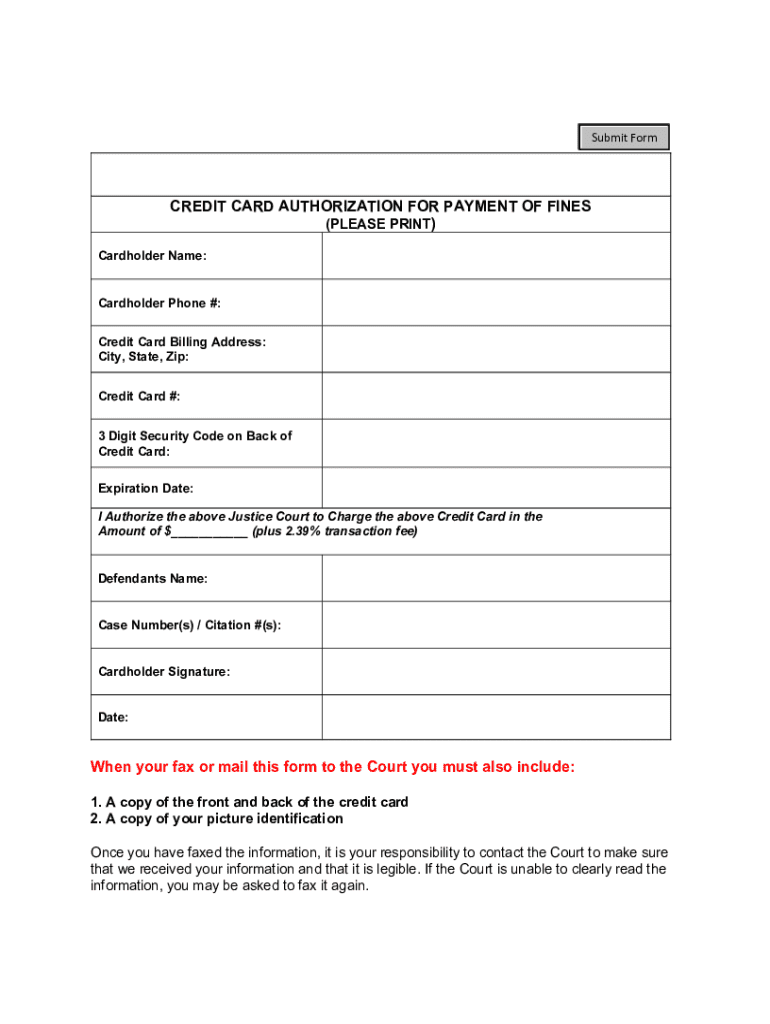

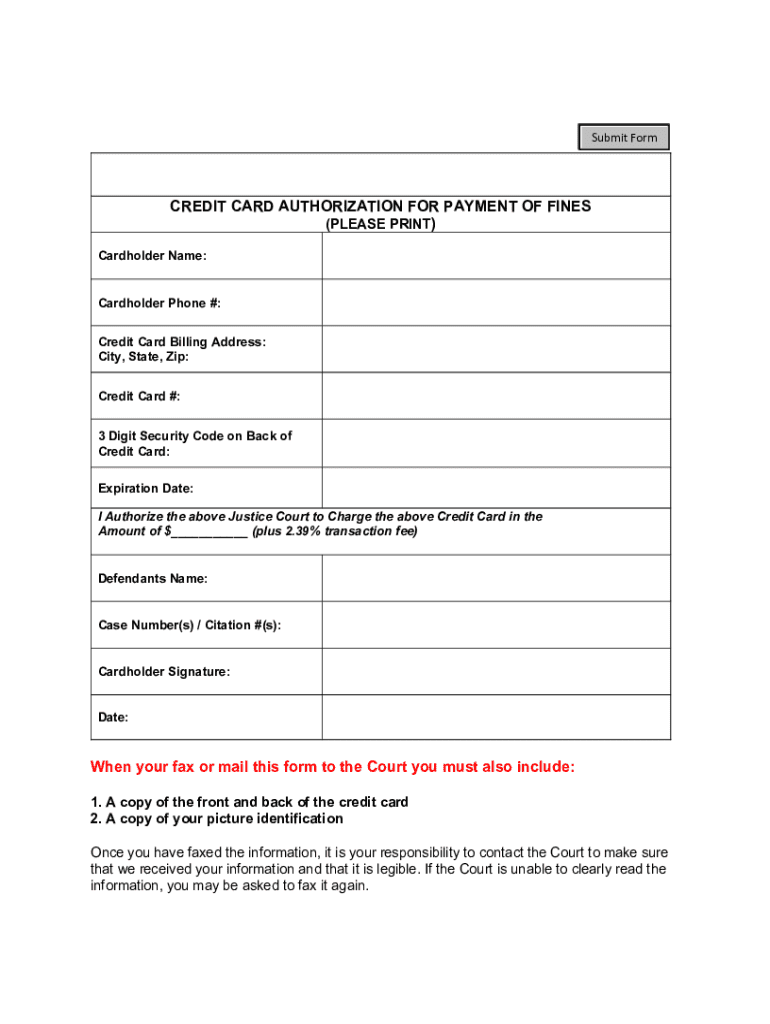

A credit card authorization form is a vital document used for securing permission from a cardholder to charge their credit card for a specified amount. This form serves both the businesses and consumers involved, offering a written record that can protect against disputes. It is essential in contexts where a card is not physically present, such as e-commerce transactions or service agreements.

Key components typically included in the form comprise the cardholder's name, address, contact information, and specific payment details like the credit card number, expiration date, and type of card. Additionally, the form will often contain a statement outlining the nature of the transaction and may require the cardholder's signature for approval.

The benefits of credit card authorization forms

Credit card authorization forms inherently play a crucial role in preventing chargeback abuse, a common issue in online transactions. By documenting explicit permission from the cardholder, merchants can provide sufficient evidence if a chargeback dispute arises. For example, in cases where a customer claims that they did not authorize a transaction, having a signed authorization form significantly strengthens the merchant’s position.

Moreover, these forms enhance security and trust between the parties involved. When customers see a transparent process that includes clear terms for authorization, their confidence in the transaction grows. In a world where identity theft is rampant, proper authorization procedures serve as legal safeguards to protect both businesses and consumers from potential liabilities.

Streamlining payment processes is another pivotal benefit. A well-structured authorization form allows merchants to expedite billing and invoicing, leading to quicker payment resolutions. This efficiency can result in improved cash flow for businesses, which is critical in today’s competitive marketplace.

Key elements of a credit card authorization form

When creating a credit card authorization form, it is essential to include crucial information that ensures clarity and compliance. This includes cardholder details such as their name, address, and contact information—elements that are vital for verifying identity and authorization. Subsequently, payment details like the credit card number, expiration date, and type should be clearly stated to prevent any confusion regarding the funds being accessed.

Understanding the concept of 'card on file' is equally important. This term refers to the storage of a customer’s card information for future transactions, which can simplify repeat billing or subscription services. However, businesses must adhere to best practices for securely storing such information to protect against unauthorized access and comply with data protection regulations.

How to create a credit card authorization form

Creating an effective credit card authorization form involves several steps that ensure clear communication between the business and the cardholder. Begin by gathering the necessary customer information, including their name and contact details. This step is crucial as it lays the foundation for personalization and accountability.

Next, clearly outline the transaction amount alongside the purpose of the charge. Transparency is key in fostering trust. Additionally, you should include terms and conditions related to the authorization, specifying charges and circumstances under which they may occur. Finally, provide options for the cardholder to provide their signature—this can either be through eSigning or a handwritten signature—facilitating convenience for both parties.

To customize your form effectively, consider incorporating branding elements to align with your business identity. Furthermore, legal language should be precise to avoid ambiguity, and compliance with relevant regulations such as PCI DSS is a must to protect both you and your customers.

Common questions about credit card authorization forms

One of the prevalent inquiries surrounds whether businesses are legally obligated to use a credit card authorization form. While a specific requirement isn't universally mandated, the form significantly benefits both parties involved by ensuring transactional clarity and legal protectiveness. In cases involving financial transactions, especially where the card isn't physically present, it's highly recommended to utilize such a form.

Another item of interest is why some credit card authorization forms do not include a CVV space. This choice often aligns with secure payment processing methods where the CVV is captured differently to comply with security protocols. Lastly, businesses frequently question how long to store signed forms. Best practices suggest maintaining these records for a minimum of three years while ensuring compliance with data protection regulations to safeguard customer information.

FAQs about credit card authorization and transaction processing

A frequently discussed topic is Card-Not-Present (CNP) transactions, which are prevalent in online and over-the-phone purchases. CNP transactions often incur higher processing fees due to their associated risks. Understanding this can help businesses strategically assess their payment solutions and optimize their profit margins.

Additionally, many are curious about what constitutes a payment gateway within the authorization process. A payment gateway acts as an intermediary between the customer and the merchant, facilitating the secure transfer of payment information. Knowing the difference between payment processors and gateways can help businesses streamline their transaction processes to ensure the highest level of efficiency without compromising security.

Regulatory and compliance considerations

Achieving PCI compliance is crucial for any business using credit card authorization forms. PCI compliance refers to the Payment Card Industry Data Security Standard, established to protect customer card information from fraud. Businesses must take appropriate steps to secure their payment systems, which include maintaining a secure network, encrypting transmission of cardholder data, and implementing strong access control measures.

In keeping with customer data security, it's vital that merchants adopt best practices that protect sensitive information. Regularly updating security protocols and adhering to local data protection laws ensure compliance and safeguard against potential data breaches. The evolving landscape of data privacy laws necessitates ongoing education and adaptation to new regulations to maintain consumer trust.

Related topics for further exploration

As you delve deeper into the world of credit card authorization, consider exploring how to create a secure business environment. Understanding effective strategies to prevent fraud in transactions can further equip you with the necessary tools to protect your business and your customers. Finally, reviewing how to choose the right payment processing system can lead to enhanced efficiency, cost savings, and improved customer satisfaction.

Interactive tools and templates

To assist in your credit card authorization needs, pdfFiller offers a customizable, downloadable credit card authorization form template. This tool provides immediate access, allowing users to create specific forms tailored to their business requirements. Additionally, an interactive guide highlighting various payment methods and their authorization needs can be invaluable in navigating the complexities of payment transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in credit card authorization for?

Can I sign the credit card authorization for electronically in Chrome?

Can I edit credit card authorization for on an iOS device?

What is credit card authorization for?

Who is required to file credit card authorization for?

How to fill out credit card authorization for?

What is the purpose of credit card authorization for?

What information must be reported on credit card authorization for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.