Get the free Computation of Liquid Capital

Get, Create, Make and Sign computation of liquid capital

Editing computation of liquid capital online

Uncompromising security for your PDF editing and eSignature needs

How to fill out computation of liquid capital

How to fill out computation of liquid capital

Who needs computation of liquid capital?

Computation of Liquid Capital Form: A Comprehensive Guide

Understanding liquid capital

Liquid capital refers to the assets held by an individual or corporation that can be quickly converted into cash. This includes cash, bank deposits, and other easily sellable assets.

Understanding liquid capital is essential for managing finances effectively whether for personal budgeting or business operations. A healthy liquid capital position enables a business to cover its short-term obligations without liquidating its long-term investments.

The need for a structured liquid capital form

Using a structured liquid capital form ensures accuracy and consistency in reporting financial standing. It formalizes the process of calculating liquid capital, making it easier to present to stakeholders such as banks or investors.

Liquid capital assessments are particularly crucial in scenarios such as applying for loans, negotiating terms with suppliers, or assessing the financial health of a business before mergers or acquisitions.

Overview of pdfFiller's liquid capital form template

pdfFiller provides a user-friendly liquid capital form template designed for seamless editing and collaboration. This platform ensures that individuals and teams can efficiently compute and manage their liquid capital.

The template features an intuitive interface, allowing for easy editing and signing, and it provides collaboration tools that facilitate multiple users to input and manage data collectively.

Step-by-step guide to computing liquid capital

To effectively compute liquid capital, follow these structured steps:

Step 1 involves gathering necessary financial information. Collect relevant documents like bank statements, invoices for receivables, and evaluations of marketable securities.

In Step 2, fill out the liquid capital form on pdfFiller. The platform offers interactive fields for ease, allowing you to enter each financial component accurately.

Step 3 emphasizes reviewing your inputs. Carefully check calculations and ensure all relevant assets and liabilities are reported correctly to avoid common pitfalls such as omitted items or miscalculations.

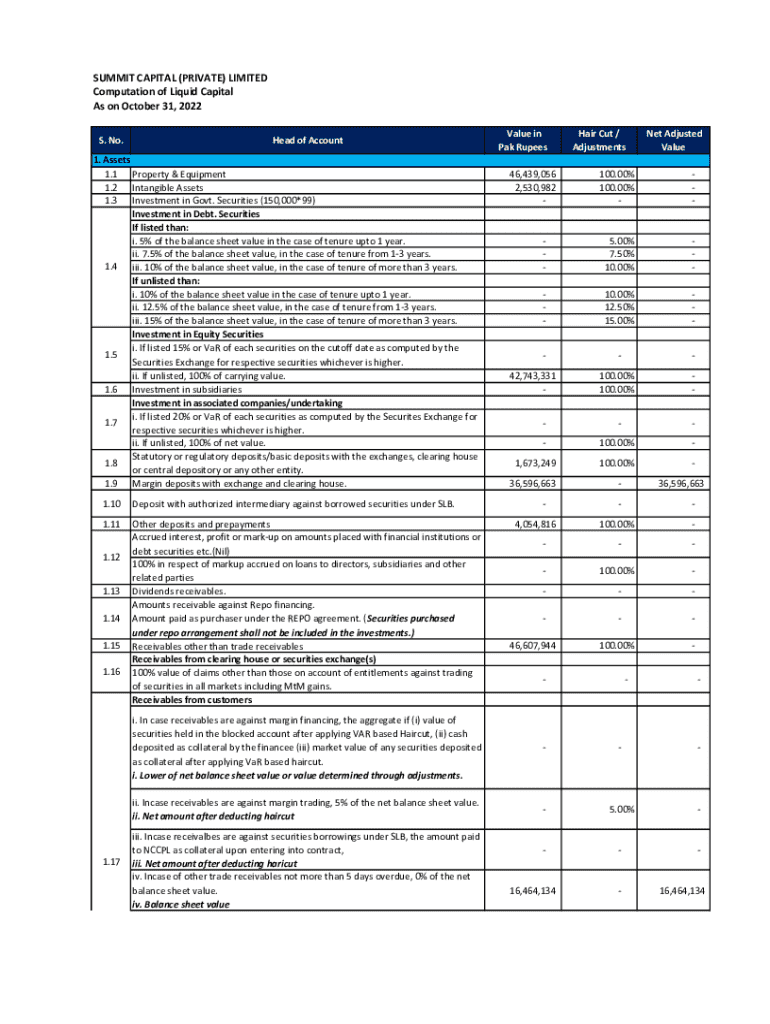

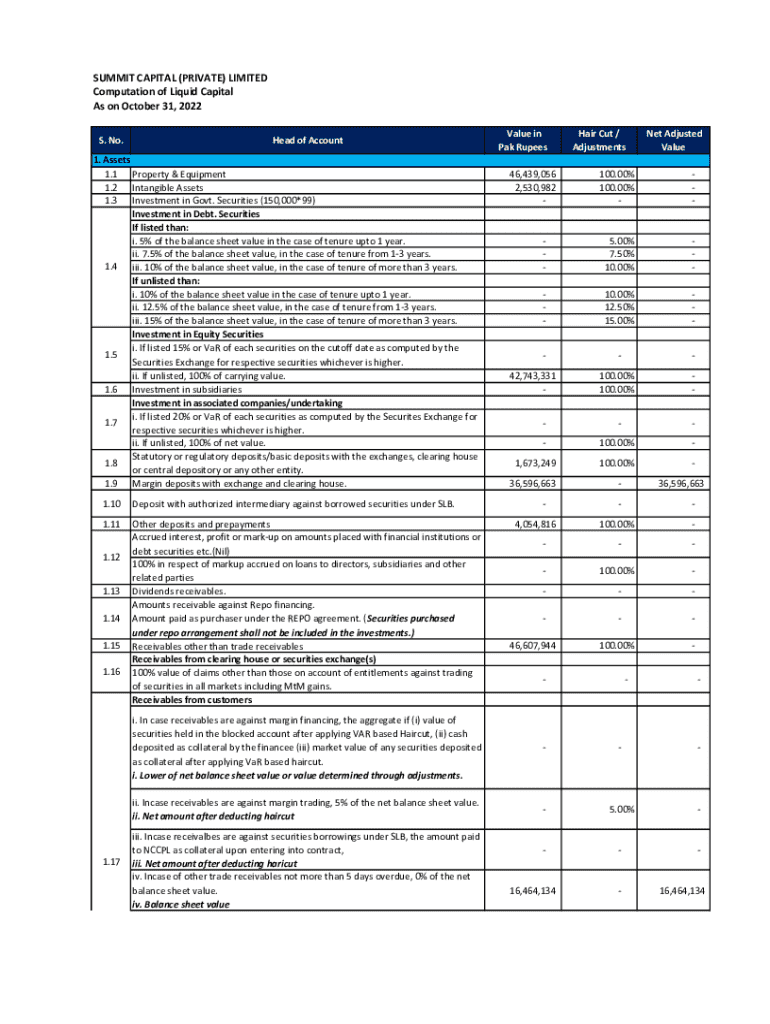

Key sections of the liquid capital form

Each section of the liquid capital form plays a crucial role in providing a complete picture of your financial situation. The primary components include assets and liabilities.

When listing assets, it's essential to include all forms of liquid resources: cash, bank balances, and marketable securities. Liabilities, on the other hand, should consist of debts and other financial obligations.

Submitting the liquid capital form

Once the liquid capital form is completed, submitting it through pdfFiller is straightforward. You have several options to share or send the form depending on your needs.

Additionally, pdfFiller provides eSigning features, enhancing your ability to authenticate the document digitally, thus maintaining the integrity of your submissions.

Maintaining a digital copy of the completed form is essential for your records. It can aid in tracking changes over time or in preparing for future assessments.

Frequently asked questions (FAQs)

Common queries often arise regarding the computation of liquid capital. Understanding these can help streamline the summarization process.

One typical question revolves around how to handle assets that are not liquid but support overall financial health. Another common query is about the frequency of updating the liquid capital form.

Real-world applications of liquid capital analysis

In practice, understanding and accurately computing liquid capital has significant implications. Businesses utilize liquid capital assessments in loan applications where the ability to demonstrate a solid liquid position can make or break an approval.

Individuals too benefit from liquid capital analysis when attempting to navigate financial systems, whether securing a mortgage or funding a personal project.

Advanced tips for liquid capital management

Monitoring liquid assets and liabilities should be a continuous practice, allowing for timely interventions or financial adjustments. Utilize the pdfFiller platform to track your documents and record updates efficiently.

Consider strategies to improve your liquid capital over time. This may involve reducing liabilities or increasing your liquid asset base through investments or savings.

Interactive tools and resources on pdfFiller

pdfFiller not only offers a liquid capital template but provides a range of interactive tools and additional templates for financial documentation, facilitating effective management of your financial resources.

Collaboration features allow for multiple team members to input changes and assess documents together, ensuring a comprehensive review process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find computation of liquid capital?

How do I edit computation of liquid capital in Chrome?

How do I fill out the computation of liquid capital form on my smartphone?

What is computation of liquid capital?

Who is required to file computation of liquid capital?

How to fill out computation of liquid capital?

What is the purpose of computation of liquid capital?

What information must be reported on computation of liquid capital?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.