Get the free Certificate of Exemption to Issue Charitable Gift Annuities Application

Get, Create, Make and Sign certificate of exemption to

How to edit certificate of exemption to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption to

How to fill out certificate of exemption to

Who needs certificate of exemption to?

Certificate of Exemption to Form: A Comprehensive Guide

Understanding the certificate of exemption

A Certificate of Exemption is a vital document that allows certain individuals or organizations to avoid paying specific taxes or fees under applicable laws. This exemption is often granted under particular circumstances such as charitable activities or sales activities conducted by non-profit entities. The importance of exemption certificates cannot be overstated; they enable organizations to allocate more resources towards their missions rather than tax liabilities.

Exemption certificates vary by industry and jurisdiction, but they generally serve a similar purpose. They are crucial for non-profit organizations, educational institutions, and governmental bodies that rely on donations or public funding. Understanding the different types of exemption certificates available is essential for ensuring compliance and capitalizing on available benefits.

Why you might need a certificate of exemption

There are various scenarios in which you might find yourself needing a Certificate of Exemption. For example, nonprofit organizations often require such certificates to make tax-exempt purchases for their charity initiatives or events. This not only helps reduce operational costs but also ensures that more funds are directed towards their missions.

Another scenario involves charitable donations. When making a contribution to a nonprofit, donors often need reassurance that their gifts will be utilized in a tax-efficient manner. Furthermore, certain types of tax-exempt purchases require a Certificate of Exemption to ensure that the transaction is legitimate and compliant with the laws governing tax-exempt status.

Eligibility criteria for obtaining a certificate of exemption

To obtain a Certificate of Exemption, it's crucial to first understand who qualifies for such a certificate. Generally, specific organizations are eligible, including but not limited to charitable organizations, educational institutions, and governmental agencies. These entities must demonstrate that they operate under a charitable, educational, or public benefit purpose, thereby qualifying them for exemption.

Certain industries also frequently utilize exemption certificates. For example, healthcare organizations may qualify for exemptions related to medical supplies, while religious institutions could benefit from exemptions on donations and fundraising events. Understanding the eligibility requirements ensures that organizations can leverage these benefits correctly.

Steps to acquire a certificate of exemption

Acquiring a Certificate of Exemption involves several steps. First, you need to prepare the required documentation, which can include proof of your organization’s tax-exempt status, detailed descriptions of your intended use for the exemption, and any relevant identification numbers.

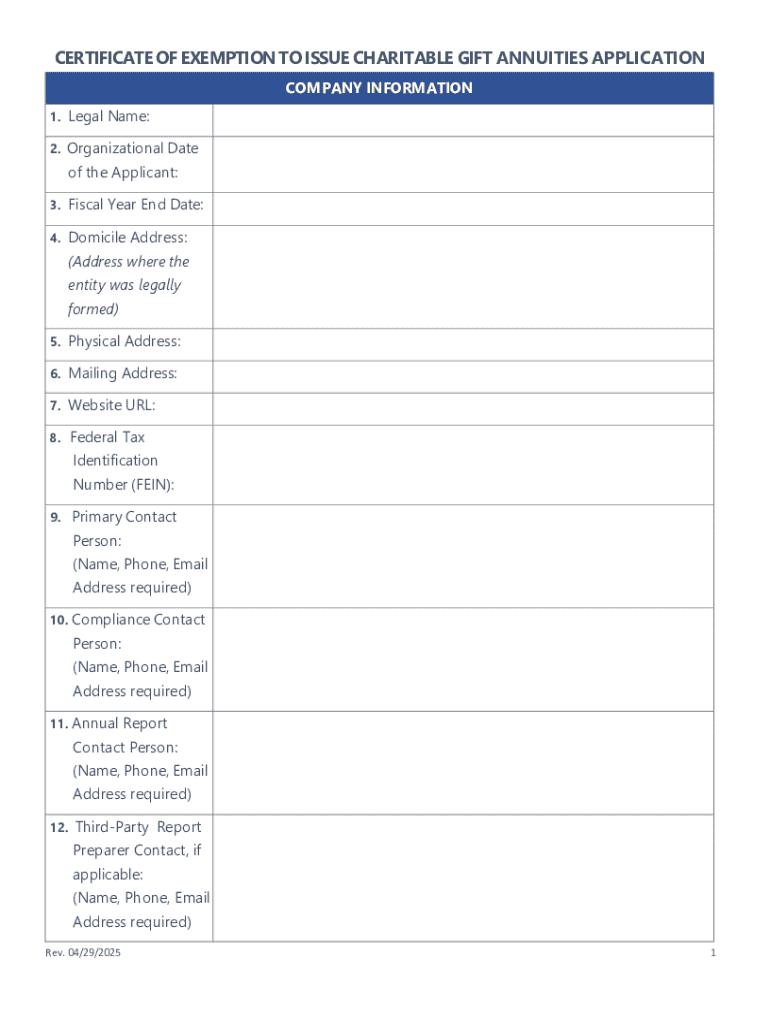

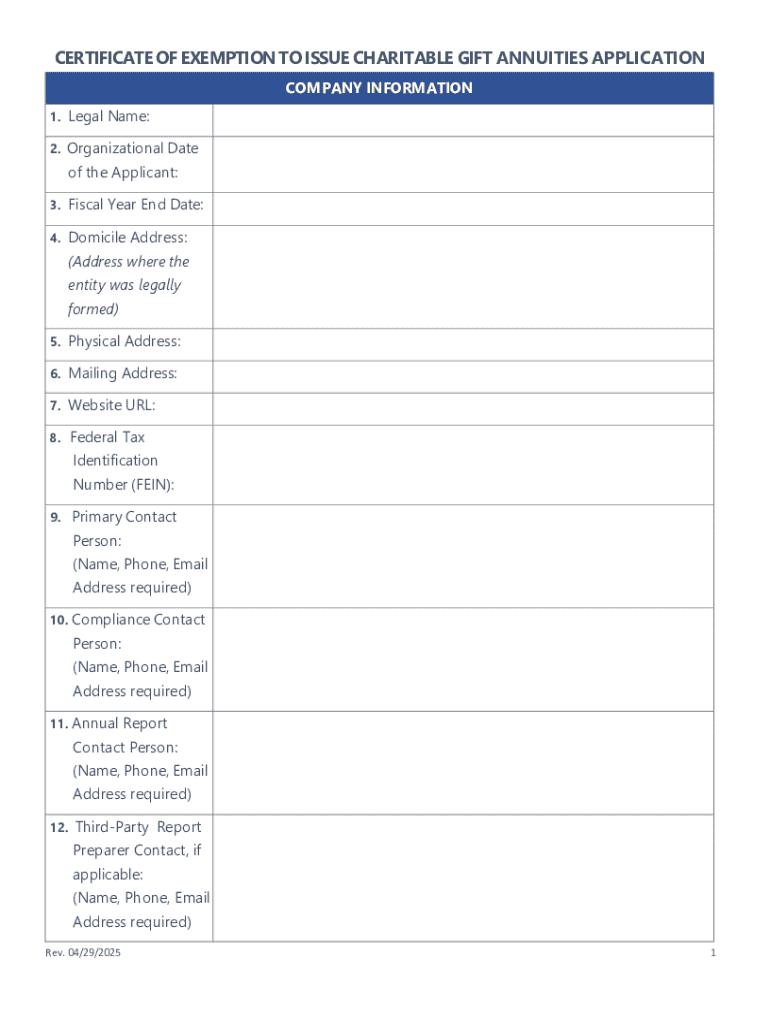

Next, filling out the exemption certificate form is essential. Key sections to complete include your organization's name, the type of exemption you're claiming, and your signature. It's critical to avoid common mistakes such as filling out incorrect information or failing to include all necessary signatures. Lastly, submission of the form can vary; know where and how to send your application by consulting your local tax authority’s guidelines.

Utilizing the certificate of exemption

Once obtained, understanding how to use the Certificate of Exemption correctly is crucial. The scope of use extends to tax-exempt purchases and transactions that qualify under the guidelines specified on the certificate. Misuse can lead to severe consequences, so it is important to only use it for the designated purposes outlined in the certificate.

When presenting the certificate to vendors, ensure you follow vendor-specific protocols. Each vendor may have different requirements for accepting exemption certificates. Additionally, be aware of the duration of validity, as certificates can expire, and the renewal process may vary based on state regulations.

Blanket certificates and their application

A blanket certificate is a type of exemption certificate that allows a buyer to make multiple tax-exempt purchases without needing a separate certificate for each transaction. This can significantly streamline the purchasing process for eligible organizations, making transactions more efficient.

To obtain a blanket certificate, organizations typically need to provide proof of their exempt status and possibly additional documentation depending on the jurisdiction. Once approved, organizations can implement blanket certificates in their transactions by presenting them each time they make a purchase.

Consequences of misuse of exemption certificates

Misusing a Certificate of Exemption can result in severe legal implications and penalties for the organization involved. For instance, if an organization uses the certificate for personal purchases or transactions that do not qualify, it may face audits, fines, and back payments of taxes owed.

Common scenarios leading to misuse include accidental submissions for unqualified purchases or intentional misuse to avoid taxes. Best practices to ensure proper use include regular training for employees, creating awareness about the certificate's limits, and maintaining accurate records of transactions.

Key information for sellers and vendors

Sellers and vendors play a crucial role in the exemption certificate process. When accepting an exemption certificate, it’s essential for sellers to verify the document's validity. This may involve checking the certificate's details against state or local tax authority requirements. By doing this, sellers can protect themselves from potential liabilities associated with accepting invalid certificates.

Sellers should also be aware of the procedures for processing these certificates. Maintaining a clear procedure for validation and documentation can help mitigate the risks associated with accepting exemption certificates.

State-specific variations and important documents

Exemption certificate requirements can vary significantly from one state to another. Some states may have specific forms, while others may accept a more generalized document. Understanding these state-specific variations is pivotal for compliance. For instance, the Florida Consumer’s Certificate of Exemption provides intricate details that differ from standard exemption certificates elsewhere.

Additionally, tax bulletins and guidelines often offer deeper insights into how exemption certificates are handled within each state. Being familiar with these documents will ensure that organizations remain compliant and current with any changes in tax laws.

Special considerations for non-profit, charitable, and government entities

Non-profit, charitable, and government entities have unique challenges when obtaining exemption certificates. For example, non-profits must often demonstrate their charitable mission while navigating complex state and federal laws regarding their exempt status. Certain specific certificates may also be available primarily for public entities, complicating the process further.

The challenges these groups face often include limited resources, complexities associated with proving exemption eligibility, and maintaining compliance with various state regulations. By leveraging available resources and undertaking thorough preparatory steps, these organizations can more effectively navigate the certification process.

Navigating the certification process with pdfFiller

pdfFiller provides an invaluable tool for individuals and teams navigating the complexities of exemption certificates. Users can create and manage their exemption certificates seamlessly, utilizing pdfFiller's extensive array of features for document editing. The platform allows for user-friendly modifications to templates and forms to suit specific needs.

Additionally, pdfFiller supports collaborative features that enable teams to work on submissions together, enhancing efficiency and accuracy. eSigning capabilities ensure that important documents remain secure while being accessible for users on the go.

FAQs about certificate of exemption

Common queries often arise regarding the certificate of exemption process. One frequently asked question pertains to the timeline for approval. This can vary by state but generally takes anywhere from a few days to a few weeks. Additionally, applicants may want guidance on how to handle denials or re-submissions, which often involve confirming the accuracy of initial submissions or providing additional documentation.

For first-time applicants, understanding the process can feel daunting. However, reaching out to local tax authorities or utilizing platforms like pdfFiller to streamline documentation can significantly ease the procedure.

Essential resources and tools

Finding exemption certificate templates can be a crucial first step for those navigating this process. pdfFiller offers a library of readily available templates to facilitate the creation of exemption certificates, ensuring users can initiate the process effortlessly. The interactive features on pdfFiller simplify the process, providing real-time editing and collaboration options.

Furthermore, pdfFiller's customer support options provide additional help for users who may have questions or require assistance. This combination of resources makes it easier for users to complete their exemption certificate tasks with confidence.

Trends and rethinking exempt certificates in a digital age

The landscape of document management is evolving, especially with the rise of cloud-based solutions. This shift has made it easier for organizations and individuals to create, share, and manage documents without the constraints of physical paperwork. However, this digital transformation also brings concerns regarding data security; ensuring that sensitive information is protected amid increasing digital interactions is paramount.

Organizations are rethinking how to manage exemption certificates in light of this shift. Moving towards digital documentation enhances efficiency, but it also necessitates robust security measures to safeguard personal and sensitive data.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of exemption to to be eSigned by others?

Can I create an eSignature for the certificate of exemption to in Gmail?

How do I edit certificate of exemption to on an Android device?

What is certificate of exemption to?

Who is required to file certificate of exemption to?

How to fill out certificate of exemption to?

What is the purpose of certificate of exemption to?

What information must be reported on certificate of exemption to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.