Get the free Coverdell Education Savings Account (esa) Application

Get, Create, Make and Sign coverdell education savings account

Editing coverdell education savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out coverdell education savings account

How to fill out coverdell education savings account

Who needs coverdell education savings account?

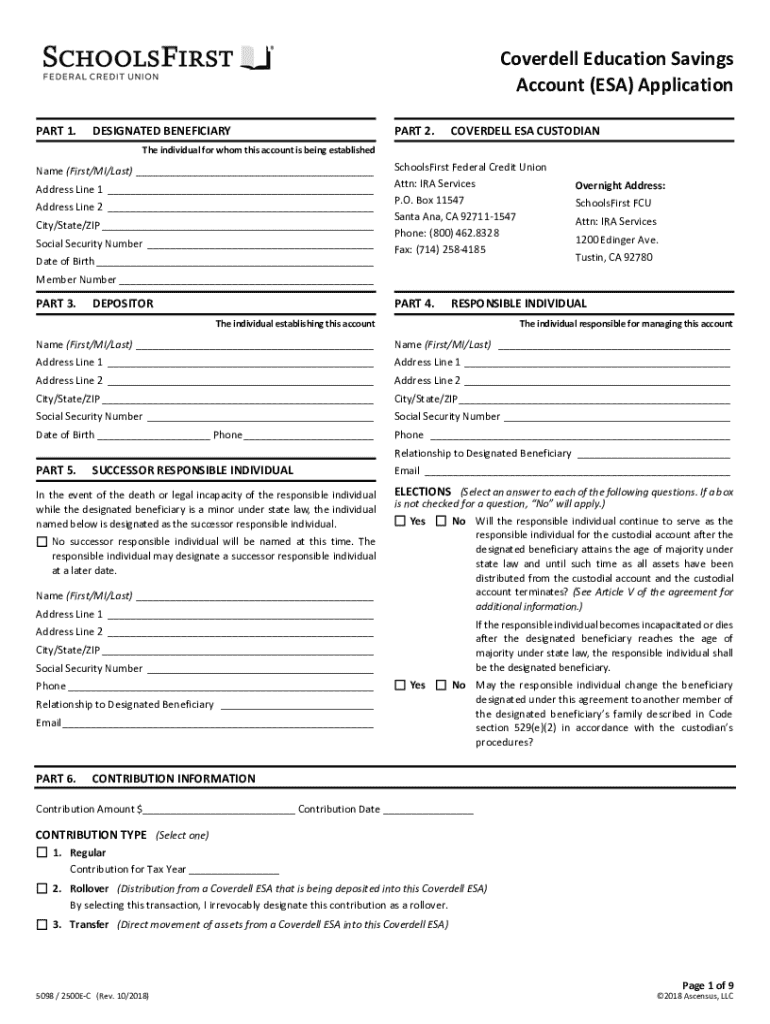

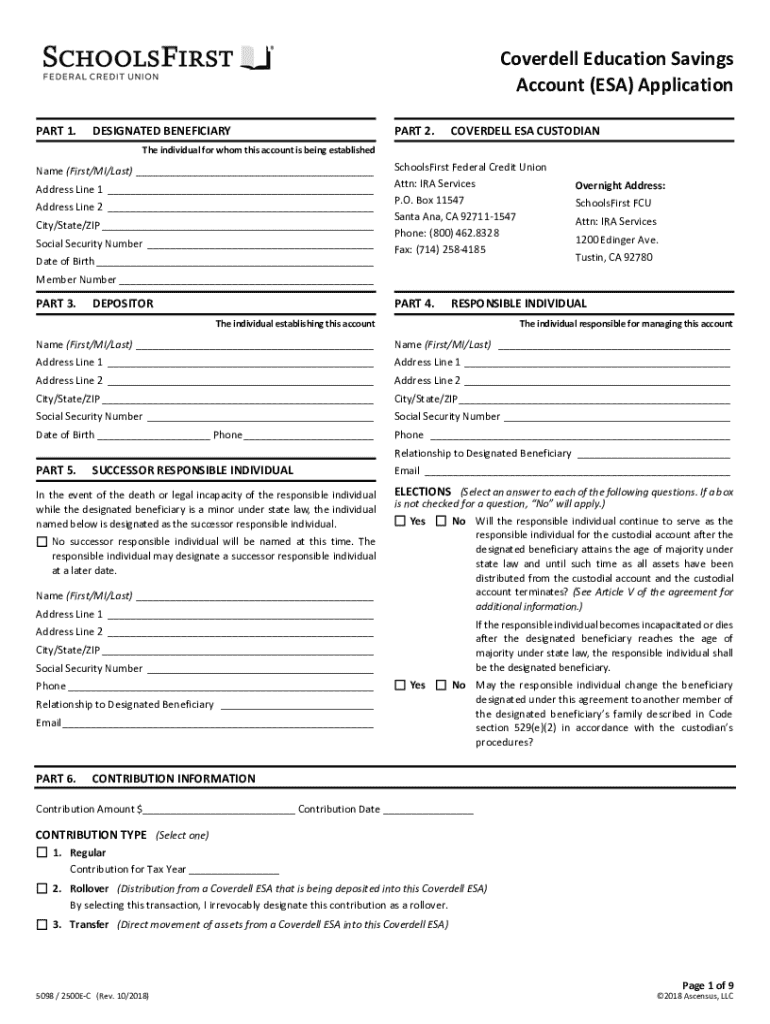

Complete Guide to the Coverdell Education Savings Account Form

Overview of the Coverdell Education Savings Account (ESA)

A Coverdell Education Savings Account (ESA) is a tax-advantaged investment account designed to help parents save for their children's education expenses. Unlike traditional savings accounts, contributions to a Coverdell ESA grow tax-free, and withdrawals for qualified education expenses are also tax-free. This makes the Coverdell ESA an appealing choice for families seeking to alleviate the financial burden of education costs, whether for elementary, secondary, or higher education.

The key benefits of using a Coverdell ESA include flexibility in investment options, tax-free growth, and the ability to use the funds for a wide range of educational expenses. Notably, students can withdraw funds for expenses such as tuition, books, and supplies, making this account incredibly versatile. Furthermore, the contributions limit allows families to contribute a maximum of $2,000 per beneficiary annually.

Eligibility for a Coverdell ESA includes having a beneficiary under the age of 18 at the time of contribution or being a special needs beneficiary. Additionally, the account owner's income must fall below a certain threshold to make the maximum contributions. This makes it essential for prospective account holders to be familiar with these regulations to ensure compliance and maximize their benefits.

Understanding the Coverdell ESA Form

Navigating the Coverdell Education Savings Account form can initially seem daunting, but understanding the different types of forms you will encounter is essential. The two primary documents involved are the Application Form and the Contribution and Distribution Form. Each serves distinct purposes: the Application Form is used to establish the account, while the Contribution and Distribution Form is utilized to manage contributions and withdrawals.

It’s crucial to complete these forms accurately, as errors can lead to unnecessary delays or complications regarding account management. A well-prepared form ensures that the account opens smoothly and that contributions are tracked correctly. Many families overlook the importance of attention to detail when filling out these forms, often causing frustration in the long run.

Step-by-step guide to filling out the Coverdell ESA form

Filling out the Coverdell ESA form involves a systematic approach. Begin with Step 1: Gather Necessary Information. This step includes compiling personal data, such as names, addresses, and Social Security numbers for both the account owner and the beneficiary. Additionally, you need to document financial information, particularly any associated costs of education you plan to use the account for.

Step 2 involves completing the Application Form. Each section has specific instructions; be sure to read these carefully before filling them in. Common pitfalls include miswriting the beneficiary's information or omitting necessary signatures. Take the time to double-check your entries to avoid these mistakes.

In Step 3, Submit the Form. Knowing where to send your completed form is key. Typically, this will be sent to the financial institution managing your Coverdell ESA. Additionally, be aware of submission deadlines, especially if making contributions for a specific tax year.

Tips for editing and managing Coverdell ESA forms

Managing your Coverdell ESA forms effectively requires the right tools. pdfFiller is an excellent resource for editing your ESA form. With it, you can easily access and upload your documents for seamless modifications. The platform allows you to incorporate changes without needing to print physical copies, streamlining the process significantly.

Upon uploading your document, you'll find various editing tools available. This includes options for adding text, formatting, and annotating directly on the form. Once edited, pdfFiller also allows you to save and manage your documents securely in the cloud, ensuring that you can access your ESA forms anytime, anywhere.

eSigning your Coverdell ESA form

eSigning is an essential component of finalizing your Coverdell ESA form. Firstly, it’s important to understand eSignature regulations. In many jurisdictions, eSignatures are legally binding, making them a reliable alternative to handwritten signatures.

To eSign your document, use pdfFiller by uploading it to the platform. After uploading, you can add signatures and initials directly within the document. This simplicity not only enhances efficiency but also secures your signed documents, containing multiple layers of encryption to protect your sensitive information.

Collaborating on Coverdell ESA forms

Collaboration can be beneficial when filling out a Coverdell ESA form, especially for families seeking input from multiple advisors or team members. PdfFiller allows you to invite others to collaborate on your documents, enabling real-time feedback and changes. This feature is particularly useful if there are multiple contributors to the account who need access to the form.

To maximize the benefits of collaboration, ensure everyone involved is aware of necessary compliance measures while reviewing changes and comments. This promotes transparency and minimizes misunderstandings regarding account details, contributions, and tax implications.

Managing your Coverdell ESA: post-submission actions

After successfully submitting your Coverdell ESA form, effective management is key. Tracking your application and contributions is vital; these records will aid in ensuring that all contributions meet IRS guidelines. You’ll want to regularly check your account to confirm that deposits are accurately reflected.

Common issues include discrepancies in contributions or unexpected withdrawal complications. Having good record-keeping practices can help provide clarity when resolving these problems. Additionally, retain any correspondence or documentation regarding your Coverdell ESA for future reference.

Frequently asked questions about Coverdell ESA forms

Parents and guardians often have questions regarding Coverdell ESA forms, especially about contribution limits and tax implications. For instance, understanding the maximum contribution limits of $2,000 per beneficiary annually is crucial for effective financial planning.

It's also common for individuals to be confused about the potential tax consequences of the withdrawals. Withdrawals for qualified education expenses are tax-free, but understanding what qualifies can mitigate confusion and ensure that families are maximizing their benefits from the account.

Conclusion: maximizing your Coverdell ESA benefits

Maximizing the benefits of your Coverdell ESA hinges on a thorough understanding of its forms and management. PdfFiller enhances your document experience by providing seamless editing, eSigning, and collaboration features that simplify the process immensely. Proper management and organization of your Coverdell ESA will ensure that the funds are ready when needed, reducing stress as educational expenses approach.

In conclusion, taking the time to familiarize yourself with the Coverdell education savings account form can yield significant long-term benefits for your child's educational journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send coverdell education savings account for eSignature?

How do I make changes in coverdell education savings account?

How do I edit coverdell education savings account in Chrome?

What is coverdell education savings account?

Who is required to file coverdell education savings account?

How to fill out coverdell education savings account?

What is the purpose of coverdell education savings account?

What information must be reported on coverdell education savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.