Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out self-declaration of income

Who needs self-declaration of income?

Understanding the Self-Declaration of Income Form: A Comprehensive Guide

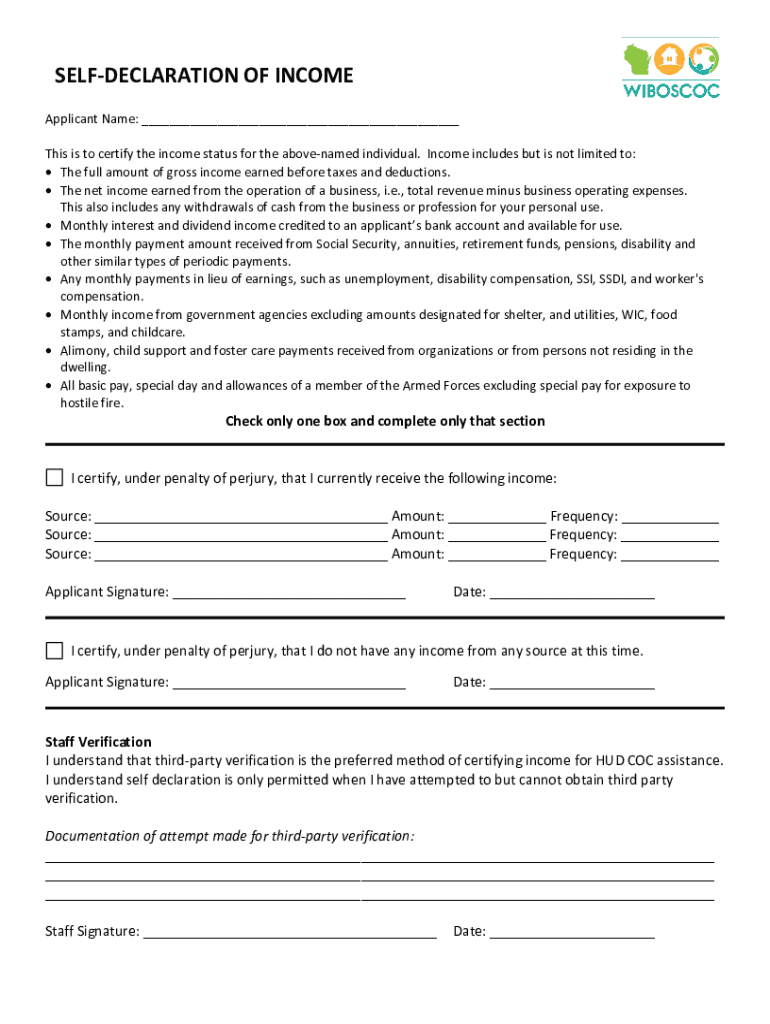

Understanding the self-declaration of income form

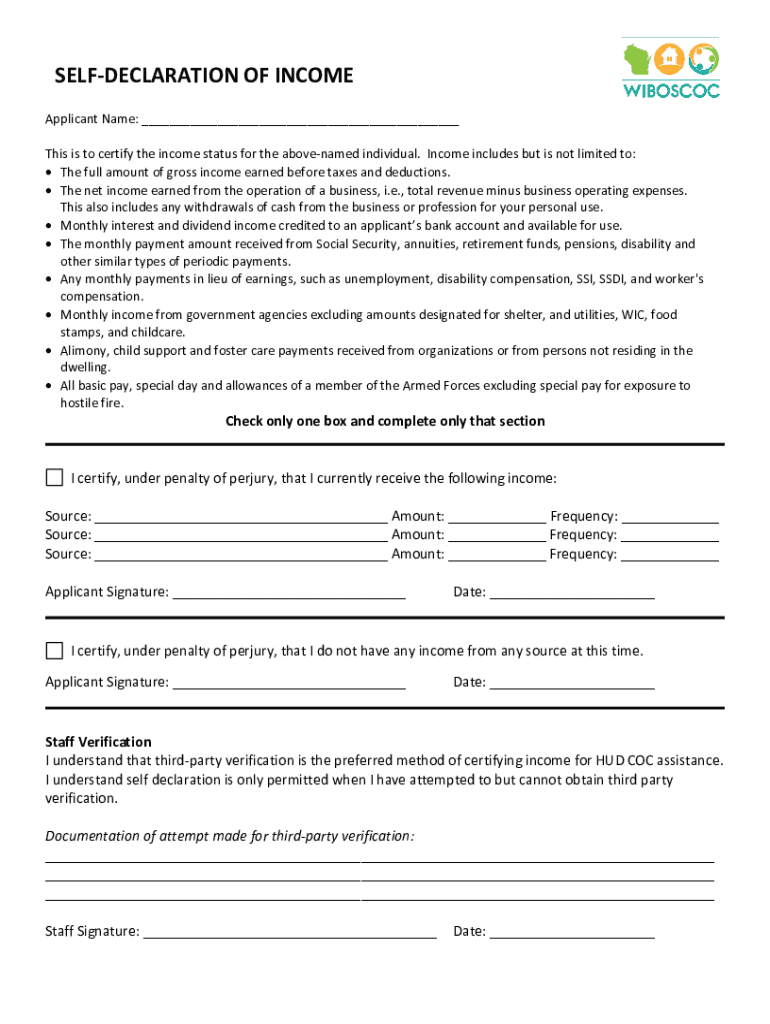

A self-declaration of income form is an essential document that individuals and teams use to report their earnings to tax authorities. This form provides a structured way to detail various sources of income, thereby aiding in accurate tax assessment. For freelancers, self-employed individuals, and teams working across diverse income streams, this form plays a pivotal role in establishing financial accountability.

The purpose of this form goes beyond simple reporting; it contributes to the overall transparency and integrity of the financial system. By voluntarily submitting accurate income information, individuals reinforce their credibility, which can be particularly beneficial when applying for mortgages or business loans.

Preparing to fill out the self-declaration of income form

Before you begin filling out the self-declaration of income form, it's crucial to gather all necessary documentation. This preparation step not only saves time but increases the accuracy of the information reported. Essential documents often include past tax returns, financial statements, and proof of income via pay stubs or invoices.

Next, it's essential to determine all your income sources. These may include salaries, wages, business earnings, and investment income. By understanding your diverse income streams clearly, you can report them accurately on the form. Furthermore, being aware of relevant tax implications enhances your capability to make informed financial decisions.

Step-by-step instructions for completing the form

To effectively complete the self-declaration of income form, start by accessing it online. Platforms like pdfFiller provide user-friendly interfaces that allow for easy navigation and completion of forms. Simply search for the form on their website and utilize their features for filling and managing documents.

A common mistake during this step is misunderstanding income categorization. For instance, freelancers must differentiate between multiple contracts and the varying payment structures compared to traditional salaried positions. It's critical to provide detailed, clear descriptions for each income stream.

Claiming deductions requires diligence. Familiarize yourself with the types of deductions available—these may include business expenses, home office costs, and investment losses. Reporting these accurately can significantly influence your taxable income, making attention to detail paramount.

Editing and revising your self-declaration of income form

Once you have filled out the self-declaration of income form, it’s pivotal to review your entries meticulously. Interactive tools like those offered by pdfFiller allow users to edit figures and collaborate with others. Many users may overlook simple errors, so employing a thorough editing process can prevent potential issues down the line.

A peer review can be invaluable. Enlisting someone else to go through your form can unveil overlooked errors or omissions. As a final step, comparing your completed form against checklists or common mistakes can safeguard your submission against inaccuracies.

Signing and submitting the self-declaration of income form

Signing your self-declaration of income form confirms the information you've provided is accurate. Platforms like pdfFiller offer eSignature solutions that simplify this process. Users can eSign documents securely without the hassle of printing and scanning.

Once your form is signed, understand where and how to submit it. This might be online or through traditional mail, depending on local laws. Staying informed about submission timelines can prevent avoidable penalties.

Managing your self-declaration of income form after submission

After submission of the self-declaration of income form, proper management of your documents is crucial. Utilizing cloud storage solutions ensures accessibility regardless of your location, which is especially beneficial if you need to reference this information later. Establish best practices for document management, including organization and backup procedures.

In case of any follow-up from tax authorities, be proactive. Keep copies of your submissions and supporting documents conveniently accessible, as you may need to clarify your situation based on inquiries.

Frequently asked questions (FAQs)

The self-declaration of income form raises numerous queries among users. One fundamental question is: who is required to file such a form? The answer typically includes anyone earning income, particularly freelancers and self-employed individuals who do not receive W-2 forms. Mistakes can happen during filling out the form; understanding the correction process can alleviate potential stress.

Through clarity and an organized approach, individuals can navigate the complexities associated with the self-declaration of income form more effortlessly.

Leveraging pdfFiller for your document needs

pdfFiller stands out with its cloud-based document management capabilities. Users can efficiently edit PDFs, eSign, and collaborate on documents from anywhere, which caters well to both individuals and teams. With its blending of functionalities, pdfFiller empowers users to streamline the entire process from filling out the self-declaration of income form to final submission.

Integration with other productivity tools furthers pdfFiller's usability. Users can collaborate efficiently and ensure that their documentation is completed seamlessly wherever they are.

Getting assistance and support

Navigating the nuances of the self-declaration of income form may require assistance at times. pdfFiller provides various support options, ensuring all users can find help as needed. Customer service is available for troubleshooting specific issues, and the platform offers a rich repository of online resources and FAQs to enhance self-help for users.

By leveraging these resources, users can enhance their understanding of the self-declaration of income form and the overall process, promoting better compliance and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pdffiller form online?

Can I edit pdffiller form on an iOS device?

How do I complete pdffiller form on an Android device?

What is self-declaration of income?

Who is required to file self-declaration of income?

How to fill out self-declaration of income?

What is the purpose of self-declaration of income?

What information must be reported on self-declaration of income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.