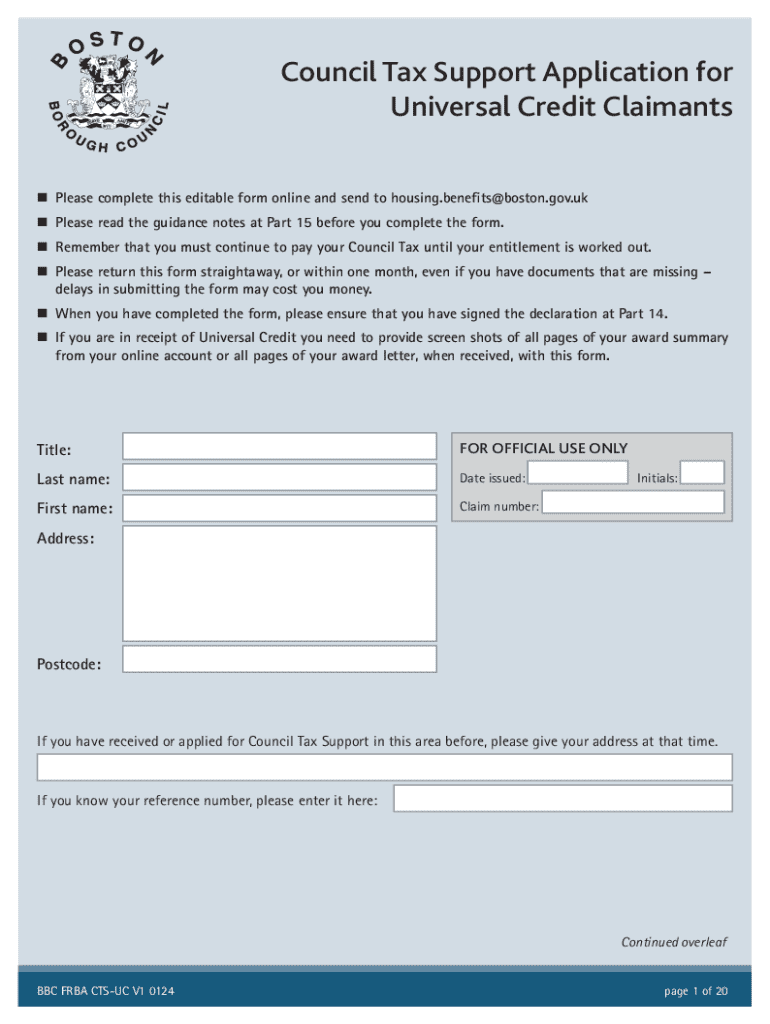

Get the free Council Tax Support Application for Universal Credit Claimants

Get, Create, Make and Sign council tax support application

How to edit council tax support application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out council tax support application

How to fill out council tax support application

Who needs council tax support application?

Your complete guide to the council tax support application form

Understanding council tax support

Council Tax Support (CTS) is a financial assistance program designed to help low-income households reduce their council tax bills. Depending on individual circumstances and local council criteria, eligible applicants may receive significant discounts or exemptions that lessen their financial burden. This support is crucial for individuals and families striving to manage living expenses, especially in economically challenging times.

With rising living costs, the importance of Council Tax Support cannot be overstated. It plays a vital role in ensuring that residents can afford their essential expenses while providing safety nets for those facing financial hardship. Understanding and applying for this support is an essential step in any financial strategy.

Eligibility criteria for council tax support

Eligibility for Council Tax Support generally hinges on several core factors, including income, savings, and household composition. Most local authorities assess these criteria differently, so it's essential to check specific regulations for your area as you prepare your application.

For instance, working-age applicants usually undergo a more stringent means test compared to those of pensionable age, who may qualify for higher support levels without strict financial scrutiny. If you're unsure of your eligibility status, reaching out to your local council’s benefits office or visiting their website can provide clarity.

Preparing to apply

Before filling out the council tax support application form, gathering necessary documentation is crucial for a successful submission. These documents will substantiate your claims and expedite the processing of your application.

In addition to these standard documents, specific circumstances such as overpayments or recent changes in your financial situation may require additional paperwork. Being prepared can help prevent delays in your application.

Step-by-step guide to the council tax support application form

To begin your application for council tax support, you first need to access the application form, which can typically be obtained from your local council's website. Most councils offer an online application that can save you time and effort.

Filling out the application form requires careful attention. Start by providing accurate personal details including your address and any reliant individuals in your household, followed by financial information regarding your income and savings.

Beware of common mistakes such as omitting required documents or providing misleading information, as these can lead to delays or denials in support. Once completed, carefully upload all necessary documents using the guidelines provided by your council.

After you've applied

Once your council tax support application is submitted, it will be processed by your local council. You can typically expect a confirmation of receipt, and the council will then begin evaluating your eligibility based on the provided documentation.

Understanding this timeline can help you manage your finances and expectations during the waiting period.

Making changes to your application

Circumstances can change, and if they do after you've submitted your application, it's crucial to report these changes to your local council promptly. Changes in income, residency status, or dependent situations can affect eligibility for council tax support.

Updating your application helps ensure that you receive the appropriate level of support as your situation evolves.

What to do if your application is denied

Receiving a denial for your council tax support application can be disheartening. Common reasons for denial often include insufficient income or improperly documented financial information. Understanding why your application was rejected is the first step toward rectifying the situation.

Taking immediate action can make a significant difference in your ability to receive support.

Frequently asked questions

Navigating the council tax support application process can lead to several questions, especially regarding timelines and requirements. Understanding these FAQs can help clarify the process.

Additional support and resources

Beyond council tax support, various financial assistance programs may also be available that provide crucial help. Investigating these options can offer additional relief, especially if support is limited.

Reaching out to your local council's benefits team directly can provide personalized assistance, empowering you with information about resources available in your area.

Using pdfFiller for your application

The council tax support application process can be seamless through pdfFiller. This innovative platform not only allows you to access and fill out forms conveniently but also provides tools to enhance your application experience.

The cloud storage feature of pdfFiller also allows you to store your documents securely and access them from any location at any time, ensuring that all your important paperwork is always within reach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit council tax support application from Google Drive?

How do I edit council tax support application on an Android device?

How do I complete council tax support application on an Android device?

What is council tax support application?

Who is required to file council tax support application?

How to fill out council tax support application?

What is the purpose of council tax support application?

What information must be reported on council tax support application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.