Comprehensive Guide to the MHT Capital Loan Program Form

Overview of the MHT Capital Loan Program

The MHT Capital Loan Program is a vital funding mechanism designed to support and foster the development of affordable housing and community-based projects. It serves to bridge financing gaps, enabling various projects that may struggle to secure traditional funding. By offering low-interest loans, the program aims to stimulate economic growth and improve quality of life in underserved areas.

The importance of this loan program cannot be overstated; it plays a crucial role in empowering non-profits, developers, and local organizations to undertake transformative projects, thereby enhancing access to affordable housing. As such, the MHT Capital Loan Program stands as a pillar of community development, impacting not just individual lives, but entire neighborhoods and regions.

Who can apply?

Eligibility for the MHT Capital Loan Program is broad, encompassing a variety of applicants including individual developers, non-profit organizations, and partnerships that are committed to creating housing opportunities. This inclusive approach ensures that a diverse range of projects can be considered for funding.

Specific criteria for applicants typically include a proven track record of financial stability, a well-defined project plan, and the capacity to deliver on the proposed timeline. Factors such as the feasibility of the project and its potential impact on the community are also assessed to ensure responsible lending practices.

Understanding the MHT Capital Loan Program Form

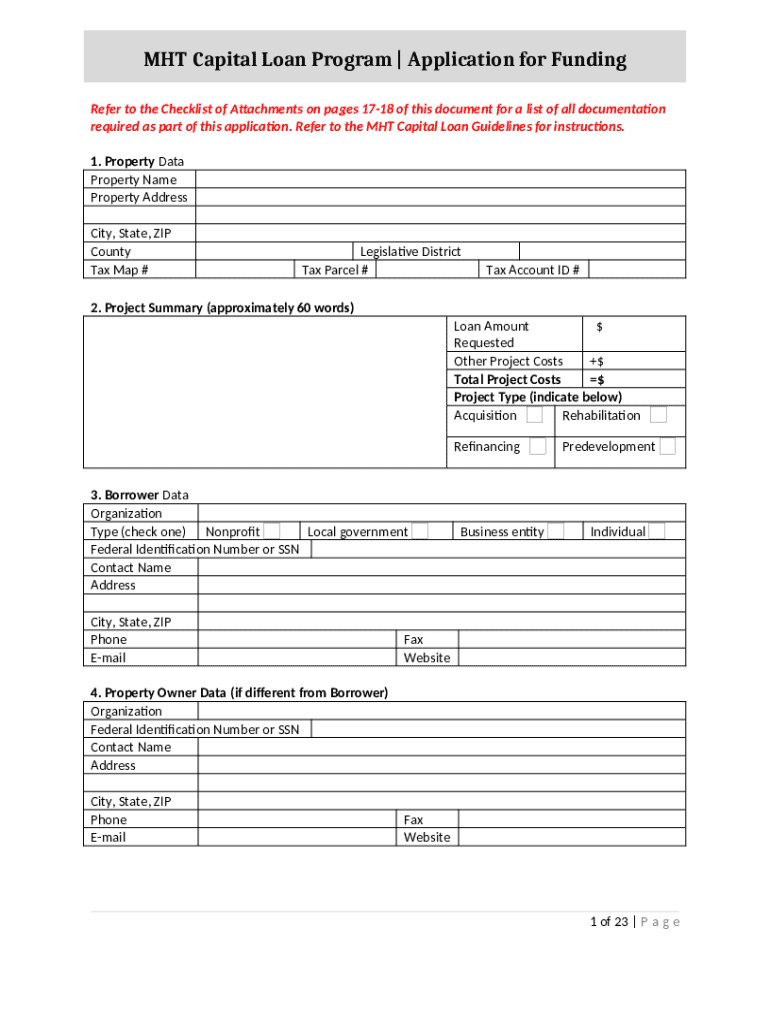

The MHT Capital Loan Program Form stands at the heart of the application process. It captures essential information that enables evaluators to assess the viability of the proposed project and the applicant's capability to execute it. Completing this form accurately is critical, as it can significantly influence the outcome of the funding request.

The form is readily available as a downloadable PDF on the official website, providing convenience for applicants. Utilizing platforms like pdfFiller can enhance the process, allowing for better document management, editing, and sharing capabilities. This not only simplifies information submission but also increases the likelihood of a successful application.

Step-by-step guide to completing the MHT Capital Loan Program Form

Completing the MHT Capital Loan Program Form requires attention to detail and an understanding of the required information. Let’s break down the sections:

Applicant Information: This section gathers your personal details, including your name, address, contact information, and any relevant organizational details.

Project Details: Outline your project’s name, purpose, and target demographics. Include timelines and any anticipated outcomes.

Financial Information: Provide a thorough financial overview. This includes the budget, funding sources, expected expenditures, and financial statements.

Supporting Documents: Attach any supporting documentation that showcases project plans, past projects, or financial history.

Pay careful attention to each box and section, as incomplete forms can lead to delays or rejections. Avoid common mistakes such as miscalculating budgets or omitting required signatures, and ensure every required field is filled out.

How to fill out the MHT Capital Loan Program Form using pdfFiller

Leveraging pdfFiller can greatly streamline the process of filling out the MHT Capital Loan Program Form. Here’s how to effectively use its features:

Using Interactive Tools: pdfFiller offers various editing tools such as text boxes, dropdowns, and annotations that make filling out the form intuitive.

Saving and Sharing Options: Once completed, you can save your form in multiple formats or share it directly for review without compromising security.

eSignature Features: pdfFiller simplifies the signing process through electronic signatures, allowing you to sign documents without the need for printing. This can significantly speed up your application.

The electronic signing process is straightforward; simply follow the prompts provided by pdfFiller to ensure your signature is appropriately placed and legally binding.

Submitting your application

Once the MHT Capital Loan Program Form is completed, you have several submission methods available to ensure your application reaches the appropriate reviewers:

Online Submission: If you choose to submit via pdfFiller, you can do so directly through the platform, ensuring quick delivery and easy management.

Alternative Methods: You also have the option to mail the completed form or deliver it in person to designated offices, but be mindful of processing times.

Expect application processing times to vary, generally falling between four to eight weeks. After submission, you'll receive communication regarding the status of your loan application, including potential follow-up questions or additional documentation requests.

Managing your application status

Keeping track of your application status is essential to stay updated on progress and next steps. Using pdfFiller, you can monitor the status of your submitted form, allowing you to manage your application proactively.

Tracking Your Application: Many platforms, including pdfFiller, provide status updates and insights into where your application is in the review process.

Common Follow-up Questions: Be prepared for potential follow-ups, such as requests for additional documentation or clarification on your project details. Respond promptly to avoid delays.

Keeping communication lines open with the funding source will help in addressing any issues that arise efficiently.

Tips for a successful loan application

To enhance the viability of your project within the MHT Capital Loan Program, consider implementing several strategies to bolster your application. Clear articulation of your project’s impact, community benefit, and financial sustainability can significantly strengthen your case.

Research: Familiarize yourself with similar projects funded in the past to understand best practices.

Engage with Stakeholders: Proactively involving community members and stakeholders can provide valuable feedback and enhance project support.

Consult Financial Advisors: Utilize financial management tools to prepare accurate budgets and projections for your project, increasing your application’s credibility.

Utilizing resources from pdfFiller can streamline your documentation process, aiding in efficient project planning.

FAQs about the MHT Capital Loan Program Form

When applying for funding through the MHT Capital Loan Program, many applicants have common questions that can facilitate smoother submission. Clarifications on eligibility requirements, necessary documentation, and deadlines are frequent inquiries.

Eligibility Clarifications: It's vital to understand the specific demographic and project eligibility requirements to avoid wasting time on disqualified projects.

Application Steps: Detailed knowledge of each step in the process, including form completion, document submission, and expected timelines, can significantly ease anxiety.

Technical Support: For users experiencing issues with pdfFiller, ample support resources are available through their help center and customer service channels.

Having a clear understanding of these FAQs can prepare applicants for a successful application experience.

Additional resources for applicants

Exploring further funding opportunities is essential for applicants looking to maximize their financial support avenues. Several similar loan and grant programs exist that offer unique benefits tailored to various project needs.

Community Development Financial Institutions (CDFI): These organizations offer affordable loans and investment opportunities aimed at revitalizing underserved areas.

Federal Housing Administration (FHA) Loans: This government-backed program can facilitate more flexible funding options for housing projects.

Local Grants and Loans: Many regions offer specific grants aimed at fostering community development that can complement the MHT program.

Additionally, tools for financial management can assist in creating comprehensive budgets and financial assessments for projects, enhancing overall preparedness.