Get the free Fully Insured Renewal Premiums

Get, Create, Make and Sign fully insured renewal premiums

How to edit fully insured renewal premiums online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fully insured renewal premiums

How to fill out fully insured renewal premiums

Who needs fully insured renewal premiums?

Understanding the Fully Insured Renewal Premiums Form

Understanding fully insured renewal premiums

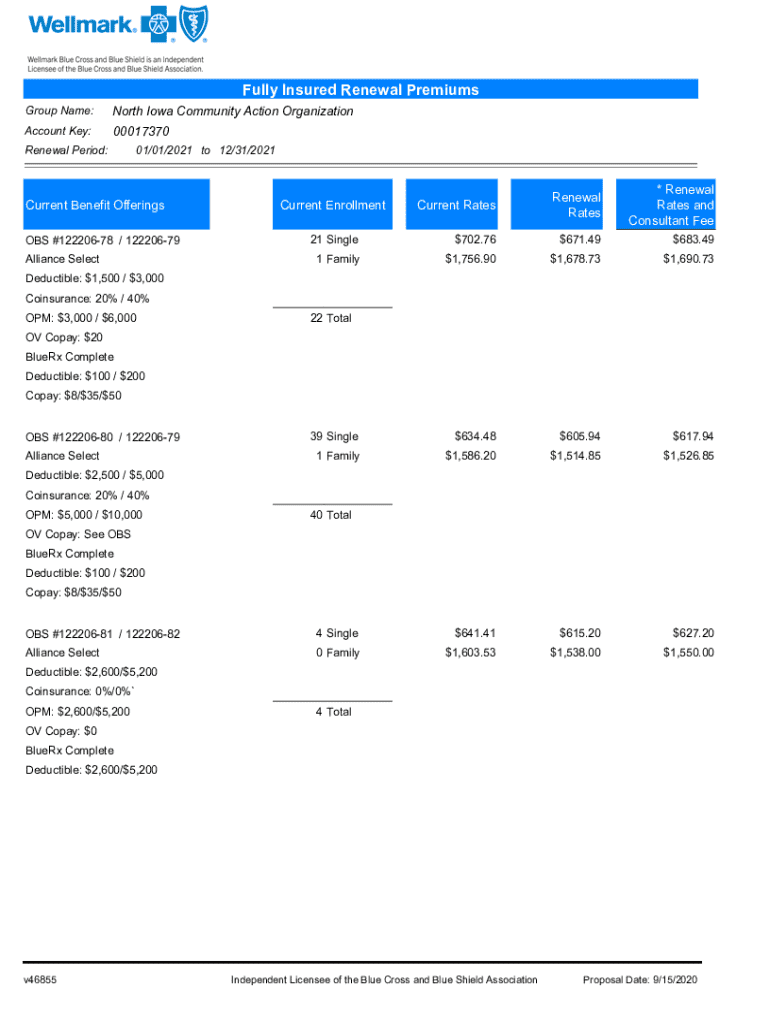

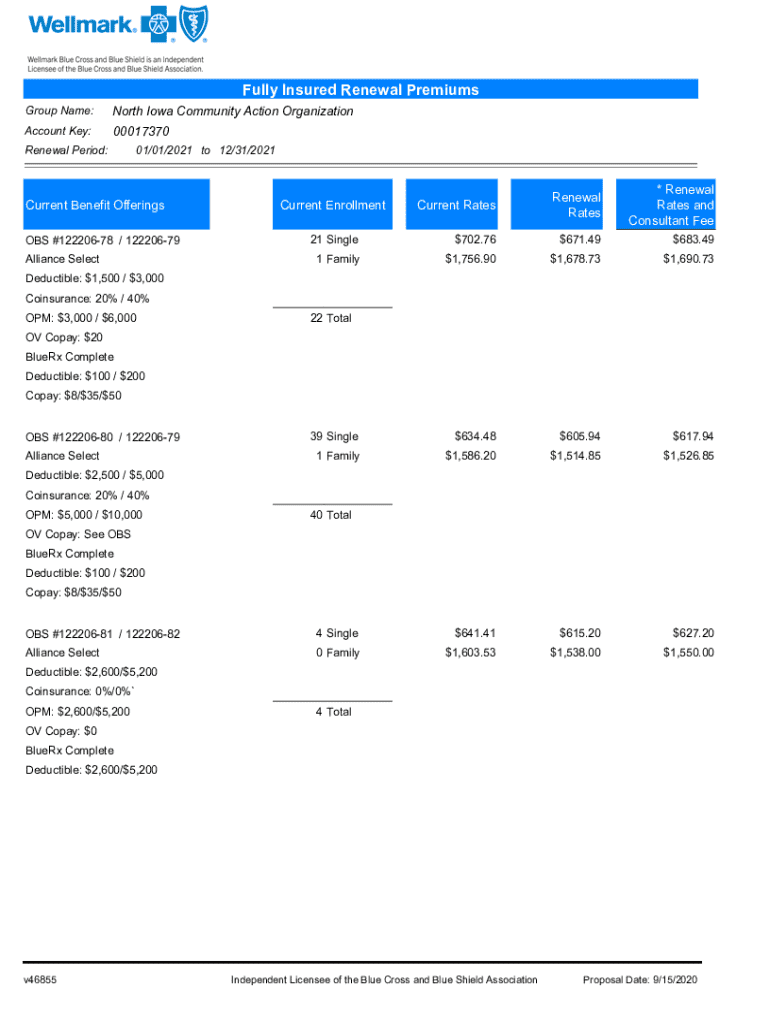

Fully insured renewal premiums refer to the costs an employer pays to renew their health insurance plan when it is fully insured. In this arrangement, an insurance carrier assumes the financial risk of healthcare costs. It is crucial for employers to understand renewal premiums as they often represent a significant part of the overall compensation package for employees. Keeping a close eye on these can also help in budgeting for the upcoming year.

The fully insured vs. self-insured landscape

In the world of employee health benefits, understanding the difference between fully insured plans and self-insured plans is essential. Fully insured plans involve paying premiums to an insurance company which then manages the risk and covers costs. Conversely, self-insured plans allow companies to pay for claims directly, retaining more control and potential cost savings but with higher risk exposure.

Key differences between the two include risk management, cash flow implications, and administrative responsibilities. When should a company opt for a fully insured renewal? This typically makes sense for businesses without the appetite to absorb risk, particularly smaller organizations or those with limited cash flow.

Essential components of a fully insured renewal premiums form

The fuller details of the fully insured renewal premiums form shed light on the essential components that employers need to fill out. Typically, the renewal form will ask for basic information regarding the organization and its employees, as well as information regarding previous claims to assess changes in risk.

Understanding key terminology used is critical. Premiums are the amount the employer pays for coverage; coverage refers to the medical expenses covered under the plan; deductibles are the amounts employees must pay before insurance kicks in, while out-of-pocket expenses are costs incurred by employees outside of premiums and deductibles.

Step-by-step guide: How to complete the fully insured renewal premiums form

Completing the fully insured renewal premiums form involves several critical steps to ensure accuracy and compliance. The first step is to gather necessary documents such as details on previous insurance policies, employee census data, and historical claims pertinent to the organization, as this information will provide the insurer with a comprehensive view of the current plan's performance.

Once you have all necessary information, filling out the renewal form can begin. The form will typically be divided into various sections covering employee details, the current plan structure, claims history, and any changes anticipated for the upcoming policy period.

Common challenges encountered and solutions

Completing a fully insured renewal premiums form isn’t without its challenges. Common issues arise primarily from incomplete or incorrect information, which can inevitably lead to delays or increases in premium costs as insurers may reassess the risk based on inaccurate data. This can be resolved by thorough document review and cross-referencing with minimal assumptions.

Another common challenge is understanding the evolving premium rates and their implications on overall insurance expenses. Employers can tackle this by regularly monitoring industry trends and claims growth metrics to stay informed. Additionally, keeping an open line of communication regarding employee needs and preferences can aid in selecting better coverage options.

The role of pdfFiller in the renewal process

Utilizing a platform like pdfFiller can streamline the complex process of managing fully insured renewal premiums forms. With real-time document editing features, employers can effortlessly update information as healthcare costs and coverage requirements change. Furthermore, the digital signature capabilities allow for immediate approvals and quick turnaround times, avoiding the lethargy associated with traditional document management.

Collaboration tools enable multiple stakeholders to provide input and verify information on the renewal form without the need for excessive back-and-forth communications. Additionally, secure document management in the cloud ensures access to important documents at any time, all while safeguarding sensitive employee information.

Strategic tips for managing your fully insured renewal premiums

Managing fully insured renewal premiums extends beyond merely completing forms; strategic foresight is essential. One critical tip involves analyzing renewal premium trends over multiple years to decipher any patterns or irregularities. This analytic approach facilitates informed discussions with insurers regarding potential adjustments and coverage optimization.

Annual reviews also play a crucial role in this management process. Conducting a yearly evaluation helps organizations reassess their coverage needs based on employee feedback, changes in business structure, and overall claim patterns. Moreover, leveraging employee feedback for future renewals encourages a culture of participation and aligns benefits packages with the expectations and requirements of the staff.

Frequently asked questions (FAQs)

As employers navigate through their insurance renewal processes, they often have several pressing questions. Notably, many seek clarity on what particular factors influence their renewal premium costs. Major influences include claims experience, employee demographics, and changes in local healthcare costs.

Another common question revolves around addressing premium increases with insurers. Open, proactive communication can help negotiate or clarify increases. Many employers also wonder about the benefits of leveraging a digital platform for this process, as digital tools not only enhance convenience but also secure data management.

Additional insights on health insurance trends

Current trends in the healthcare market are notably influencing fully insured renewal premiums. The rising cost of claims, exacerbated by demographic shifts and healthcare advancements, is a major factor impacting renewal decisions. As costs increase, insurance companies adjust premiums accordingly, making it crucial for employers to stay informed.

Furthermore, understanding the relationship between claims growth and renewals can provide insights into future premium changes. By predicting how changes in policies and benefit offerings might impact overall claims, employers can take proactive measures to buffer against price increases, helping to stabilize their health insurance budgeting strategies.

Contact information and support

For further assistance with the fully insured renewal premiums form, individuals seeking personalized support can reach out via our customer support channels. Our trained professionals are equipped to handle queries, offer guidance, and provide valuable insights tailored to your specific needs.

Additionally, links to robust online support resources and FAQs are available on the pdfFiller site, ensuring users have access to the information they need to effortlessly manage their document tasks. Whether it’s questions about specific fields or providers, we’ve set up streamlined channels for quick and efficient resolution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fully insured renewal premiums without leaving Google Drive?

How do I fill out the fully insured renewal premiums form on my smartphone?

How do I edit fully insured renewal premiums on an iOS device?

What is fully insured renewal premiums?

Who is required to file fully insured renewal premiums?

How to fill out fully insured renewal premiums?

What is the purpose of fully insured renewal premiums?

What information must be reported on fully insured renewal premiums?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.