Get the free W-4p

Get, Create, Make and Sign w-4p

Editing w-4p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4p

How to fill out w-4p

Who needs w-4p?

A Comprehensive Guide to the W-4P Form: Everything You Need to Know

Understanding the W-4P form

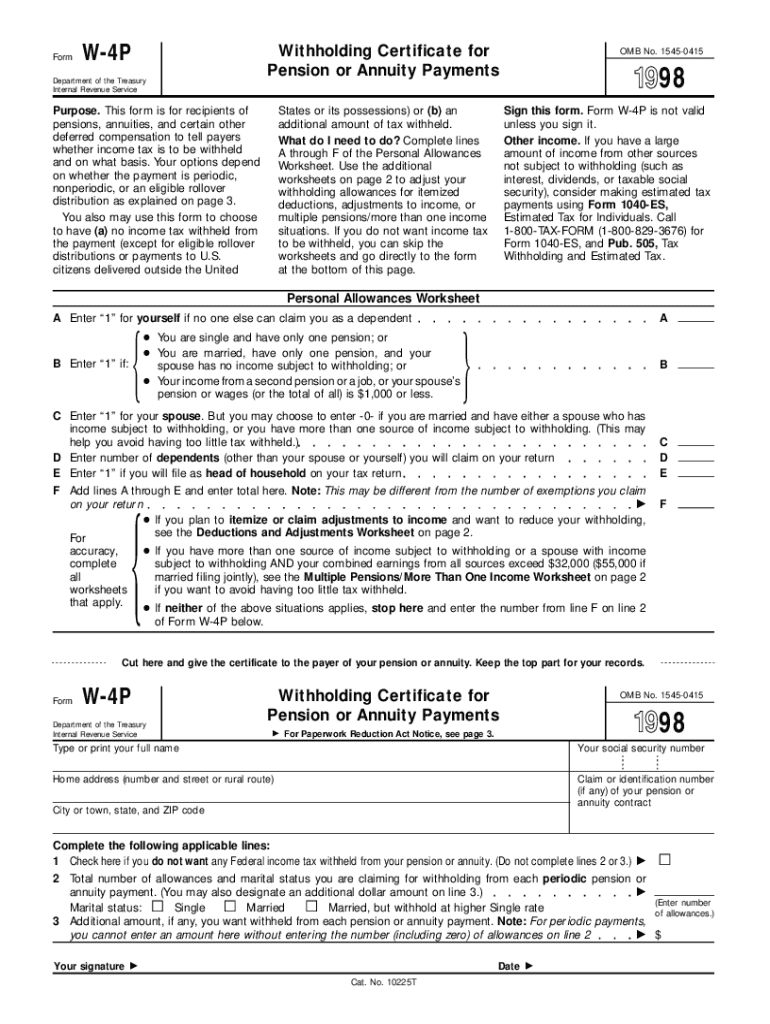

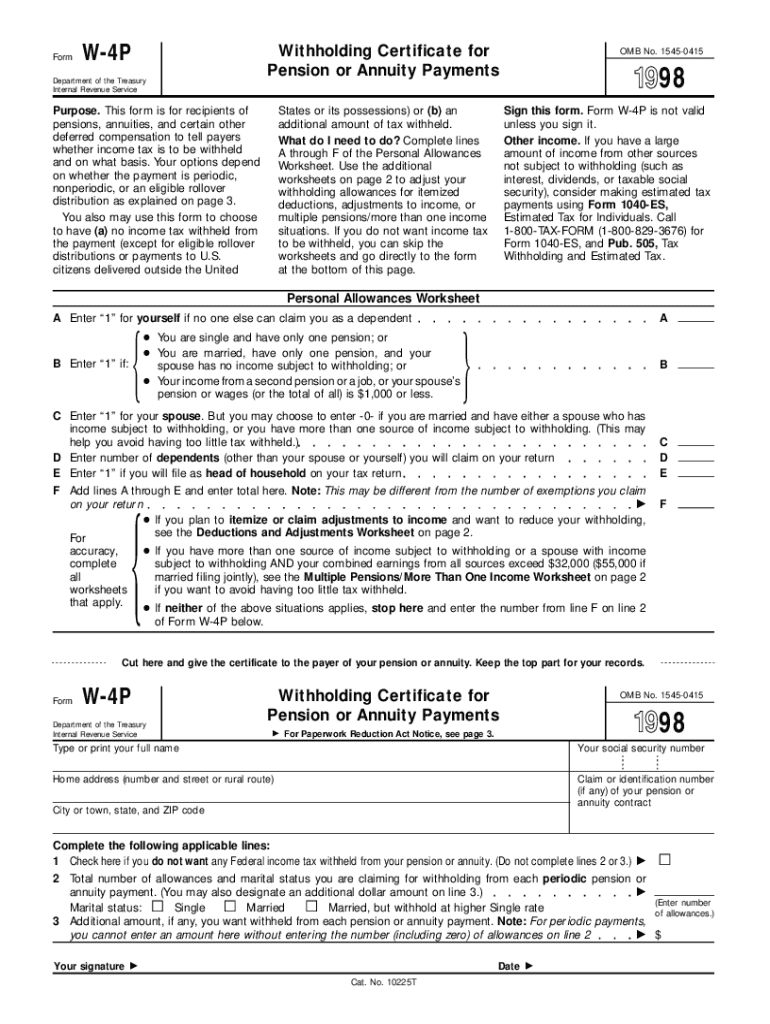

The W-4P form, officially known as the 'Withholding Certificate for Pension or Annuity Payments,' is a crucial document for retirees who receive pension income. Its primary purpose is to instruct payers on how much federal income tax to withhold from pension or annuity payments. This form is distinctly different from the standard W-4 form, which is primarily used for employees and regular wages. While the W-4 form focuses on withholding taxes based on job income, the W-4P specifically tailors to annuities and pensions, reflecting the unique financial situations of retirees.

Understanding who the W-4P form is designed for helps clarify its role. It's primarily targeted at individuals receiving regular pension distributions or annuity payments, which can arise from retirement accounts or life insurance policies. If you're a retiree, a surviving spouse receiving a pension, or just starting to collect Social Security benefits, you may find yourself needing to complete this form to ensure your tax withholding aligns with your financial needs.

Key components of the W-4P form

The W-4P form comprises several critical sections that provide essential information about the individual’s tax circumstances. The first section generally requires personal information, including your name, address, and Social Security number. This data is crucial for the tax authorities to match your form to your tax records accurately.

The tax withholding preferences section allows you to specify how much should be withheld from your pension or annuity payments. You can choose specific withholding amounts or rely on the IRS's guidelines. Finally, don’t forget to provide your signature and date at the end of the form, as it confirms the accuracy of the submitted information. Additionally, understanding terms like 'tax withholding' and 'pension' found within the form can aid in filling it out accurately.

Step-by-step guide to filling out the W-4P form

Filling out the W-4P form can seem daunting, but following a systematic approach can simplify the process significantly. Start with a comprehensive document gathering session to ensure you have all necessary papers at hand, such as previous year's tax forms, Social Security information, and current pension statements. Ensuring accuracy in this information is critical to avoid issues with tax withholding later.

Next, proceed to complete the personal information section. This includes your name, current address, and Social Security number. Accuracy in this section is key for tax processing. Once personal details are filled out, you will need to determine your withholding amount. Understanding the tax implications of your pension and eligibility for certain tax brackets is essential here. Use the IRS guidelines or consult a financial advisor to calculate your withholding accurately.

Once you’ve gathered all necessary information and made your calculations, ensure you provide additional information if required, especially if you have multiple income sources. Finally, review your form thoroughly for any discrepancies. Common errors to avoid include miscalculating tax withholding and forgetting to sign or date the form, which can impede its processing.

Common mistakes to avoid

Filling out the W-4P form requires attention to detail, and common mistakes can lead to significant problems down the line. One frequent error is miscalculating withholding amounts, which could either lead to owing taxes at the end of the year or having too much withheld, affecting your cash flow. Additionally, many individuals overlook the importance of providing a signature and date, which are essential for validation. It's crucial to check every part of the form before submission to avoid these pitfalls.

The consequences of submitting an incorrect form can be severe. Not only can it lead to over- or underpayment of taxes, but it may also result in unexpected financial burdens. Understanding these potential impacts can motivate individuals to approach form completion with the seriousness it requires.

Submitting your W-4P form

Once completed, where to submit the W-4P form depends on your pension provider or plan administrator. Specific institutions will have their own guidelines, so checking your provider's website or contacting them directly is essential. Keep an eye on submission deadlines, especially if you're nearing the tax year. Some forms may need to be submitted annually or whenever your financial situation changes.

To ensure you have submitted your W-4P form correctly, consider following up with your pension provider to confirm they’ve received your form. Documentation of submission is essential, and keeping a copy for your records can help track changes in your tax withholding in the future.

Modifying your W-4P form

Life circumstances often change, which might require updating your W-4P form. Significant life events such as divorce, job loss, or changes in income can all affect your financial landscape and necessitate a revision of how much tax you wish to withhold from your pension or annuity payments. It's wise to reevaluate your withholding amounts regularly to reflect these changes.

To revise your W-4P form, simply complete a new form with updated information and submit it to your pension provider, ensuring you follow any specific instructions they have for revisions. Keep documentation of all changes made to have a clear financial history in case of discrepancies later.

Interactive tools for managing your W-4P form with pdfFiller

Utilizing tools like pdfFiller can enhance your experience with filling out, editing, and managing your W-4P form. With pdfFiller, editing your W-4P form online is streamlined, allowing you to make changes easily and quickly. The platform is user-friendly, which simplifies the process of inputting your financial information and tax preferences.

Moreover, eSigning your W-4P form through pdfFiller guarantees that your documents remain secure and compliant with online regulations. The cloud-based features also allow you to collaborate with financial advisors or family members, helping you to easily share the form for feedback or assistance with filling it out.

Frequently asked questions (FAQs) about the W-4P form

You may have various queries regarding the W-4P form, especially if you’re new to pensions and annuity payments. For instance, if you don't receive your pension payment, it's advisable to consult your pension provider immediately, as this could signal an error in processing or eligibility.

Another common question revolves around whether the W-4P form can be used for other types of income. The answer is no; it is specifically designed for pension and annuity payments. Additionally, changes in tax laws do affect your withholding amounts, so staying informed about recent tax legislation will help you manage your withholdings effectively.

Additional insights on managing your pension payments

Having a thorough understanding of how pension income is taxed can significantly impact your retirement planning. Generally, pension payments are considered taxable income. This means that it's crucial to factor tax considerations into your financial planning to avoid surprises during tax season. Knowing how much to withhold can greatly help in budgeting for living expenses.

Moreover, consider strategies for managing taxation and benefits post-retirement. Consulting with a financial planner can assist in devising a comprehensive financial plan to maximize your retirement income while minimizing taxes, ensuring that you live comfortably and confidently during your retirement years.

Effective document management with pdfFiller

Managing your tax documents and forms digitally can remove the stress of paperwork. Using pdfFiller provides a streamlined workflow for handling your W-4P form and all related documents. The ability to edit, sign, and store your forms in a cloud-based platform means you can access your documents anytime, anywhere. This flexibility is particularly beneficial for retirees who may be traveling or who want on-the-go access to their tax information.

Moreover, utilizing pdfFiller eliminates the fear of losing critical documents. Its organization capabilities make it effortless to keep all your financial documentation in one centralized location, facilitating effective document management and ensuring that you stay compliant with tax laws while also keeping records organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-4p in Gmail?

How can I modify w-4p without leaving Google Drive?

How do I fill out the w-4p form on my smartphone?

What is w-4p?

Who is required to file w-4p?

How to fill out w-4p?

What is the purpose of w-4p?

What information must be reported on w-4p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.