Get the free Connecticut Resident Income Tax Return

Get, Create, Make and Sign connecticut resident income tax

Editing connecticut resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out connecticut resident income tax

How to fill out connecticut resident income tax

Who needs connecticut resident income tax?

Connecticut Resident Income Tax Form: A Comprehensive How-to Guide

Overview of Connecticut Resident Income Tax Filing

Connecticut resident income tax refers to the state income taxes that residents of Connecticut are legally obligated to pay on their income. Filing this tax return accurately is essential for compliance with state laws, and it ensures that your contributions to state funding are accurately recorded and utilized. Residents must file their income tax returns by the designated deadlines to avoid incurring penalties. Late filing can lead to interest charges on unpaid taxes and other penalties that add financial strain to your obligations.

Key Eligibility Criteria

To qualify as a Connecticut resident for tax purposes, individuals must have their permanent home in Connecticut for the entire tax year or for part of the year if they meet certain conditions. Full-year residents file as individuals who maintained residency for 12 months, while part-year residents must establish that they were domiciled in Connecticut for a defined period. Non-residents are individuals who earn income in Connecticut but do not reside there.

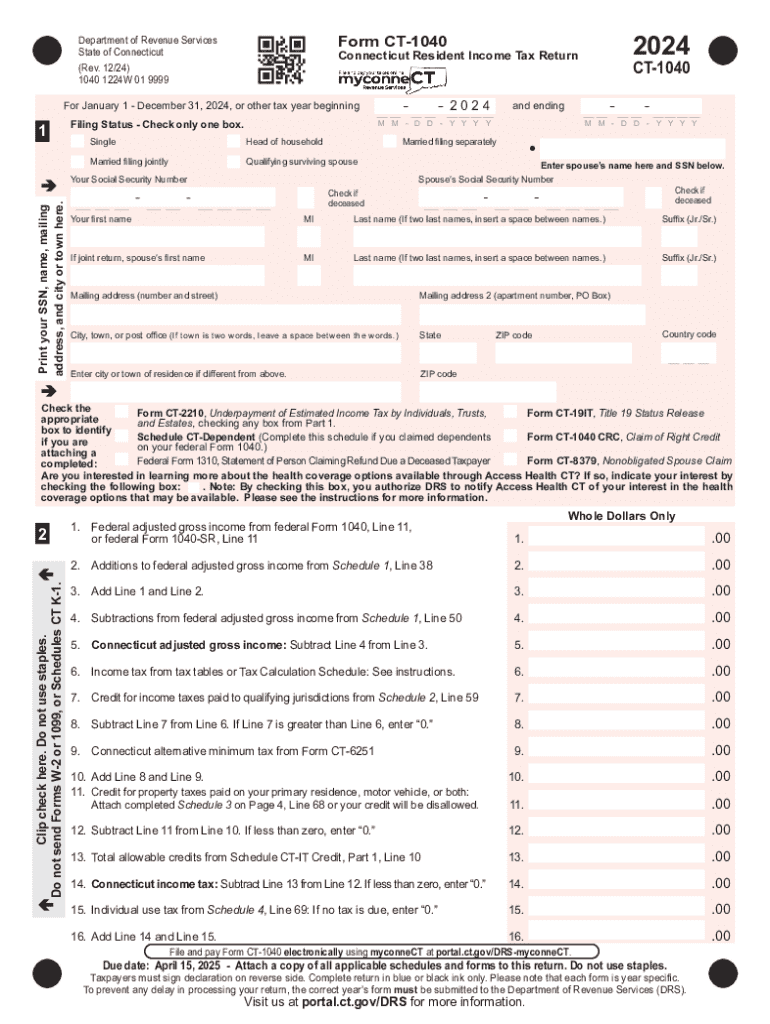

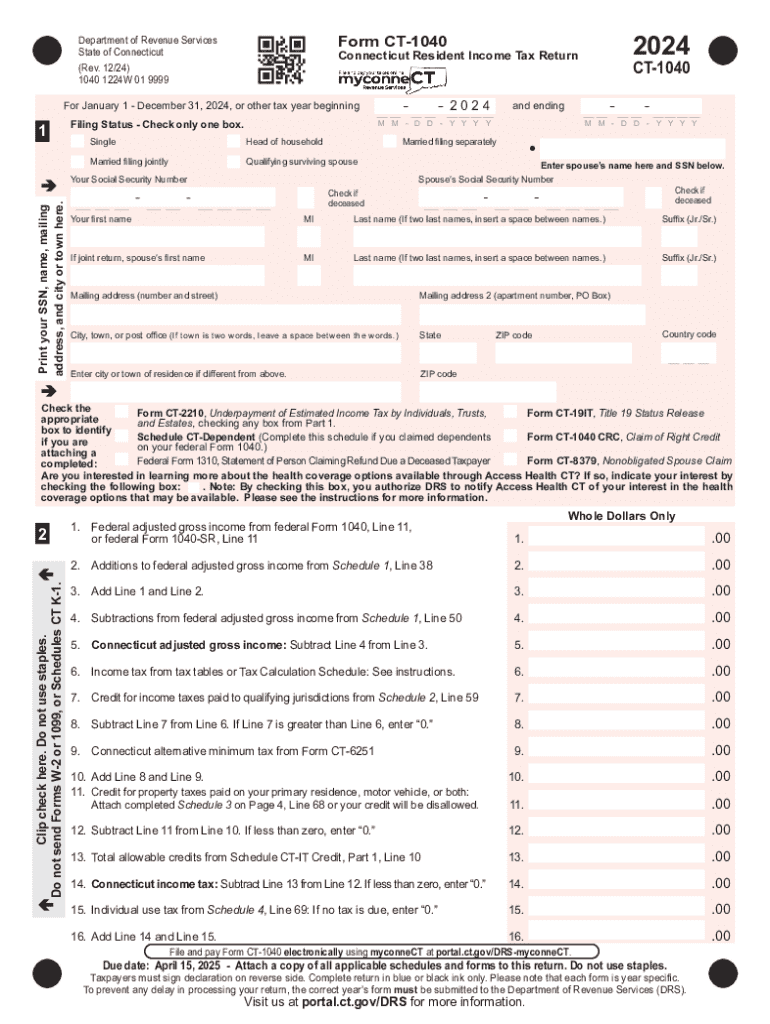

Understanding the Connecticut Resident Income Tax Form

The primary form for Connecticut resident income tax is the CT-1040. This document is essential for individuals filing their state income taxes. It includes sections for reporting various types of income, claiming applicable deductions, and calculating the total tax owed. Understanding the CT-1040 structure is critical, as it also ties into federal tax requirements, ensuring that residents leverage both state and federal benefits appropriately.

Gathering Required Documentation

Before completing your Connecticut resident income tax form, it is essential to gather the necessary documentation. This includes W-2 forms from employers that detail your earnings and any 1099 forms that report additional sources of income. Proof of residency, such as lease agreements or property tax statements, may also be required to substantiate your claims. To streamline the process, create a checklist of all needed documents ahead of time.

Step-by-step instructions for filling out the Connecticut resident income tax form

Filling out the Connecticut resident income tax form requires attention to detail. Here’s a step-by-step guide on how to effectively complete the CT-1040, starting with Section 1, which collects personal information such as your name and address. Ensuring these details are accurate is vital for proper identification with the state.

Section 2 focuses on income reporting. Here, you will report wages from your W-2 forms, as well as any interest, dividends, and other income. It’s crucial to attach any relevant documents that support your claims. Section 3 involves calculating your state tax liability and applying know-your-tax-rates to determine how much you owe. Residents can benefit from tax credits, which should be factored into the final calculations.

Filing your Connecticut resident income tax return

Once you have completed the CT-1040, the next step is filing your return. You have a choice between electronic filing (e-filing) and paper filing. E-filing is often quicker and easier, as it allows for automatic calculations and faster submission processing. Keep in mind the key deadlines for submission to avoid penalties. For the 2023 tax year, the deadline remains April 15 for timely filing.

Understanding state tax refunds and payments

If you have overpaid your Connecticut state taxes, you may be eligible for a refund. Tracking the status of your refund can be done via the Connecticut Department of Revenue Services website. If you have obligations to pay taxes, various payment options are available, including electronic payments or mailing a check. Should you find yourself needing to adjust estimated taxes, it’s essential to keep accurate records of your income throughout the year.

Frequently asked questions (FAQs) about Connecticut resident income tax

Many residents have common questions about their Connecticut resident income tax obligations. Understanding filing status and how tax exemptions work can often prevent confusion. For instance, some deductions might be specific to certain professions or income levels. It’s also crucial to know what could trigger an audit, allowing taxpayers to engage in best practices for record-keeping.

Resources for Connecticut tax filers

Navigating taxes can be challenging, which is why resources that assist Connecticut residents are valuable. The Connecticut State Department of Revenue Services provides numerous tools and calculators to help in tax preparation. Accessing these resources allows taxpayers to accurately estimate liabilities, ensuring they file correctly and on time. Additionally, online platforms like pdfFiller offer tools for filling out and managing tax documents electronically, making the process efficient and user-friendly.

Interactive tools and features on pdfFiller

pdfFiller offers an array of interactive tools that can assist Connecticut residents in completing their income tax forms accurately and efficiently. With features for filling out the CT-1040 form online, users can easily insert their information and calculate their tax liabilities seamlessly. The platform's editing capabilities allow tax filers to make quick adjustments and corrections as needed, while secure sharing options ensure their documents are transmitted safely.

Post-filing: best practices for document management

After filing your Connecticut resident income tax form, it is essential to adopt best practices for document management. Safekeeping your filed forms and any supporting documents can prevent issues in the future, especially if you are subject to an audit. Consider maintaining a digital record of all submissions, which is easily facilitated through platforms like pdfFiller. This way, you can access your information without rummaging through physical files.

Conclusion about tax compliance

Understanding and complying with Connecticut’s tax regulations is crucial for all residents. Keeping informed about changes in tax law and staying organized can alleviate the stress that often accompanies tax season. Utilizing electronic solutions like pdfFiller not only simplifies the filing process but also contributes to the efficient management of tax documentation for future needs. Staying proactive and informed will ensure continued compliance and prevent potential issues with the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my connecticut resident income tax in Gmail?

How do I fill out the connecticut resident income tax form on my smartphone?

Can I edit connecticut resident income tax on an iOS device?

What is connecticut resident income tax?

Who is required to file connecticut resident income tax?

How to fill out connecticut resident income tax?

What is the purpose of connecticut resident income tax?

What information must be reported on connecticut resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.