TTB F 5110.40 2021-2026 free printable template

Get, Create, Make and Sign TTB F 511040

How to edit TTB F 511040 online

Uncompromising security for your PDF editing and eSignature needs

TTB F 5110.40 Form Versions

How to fill out TTB F 511040

How to fill out ttb f 511040

Who needs ttb f 511040?

Your Complete Guide to TTB F 511040 Monthly Form

Breadcrumb Navigation

Home > Forms > TTB Forms > TTB F 511040 Monthly Form

Before You Begin

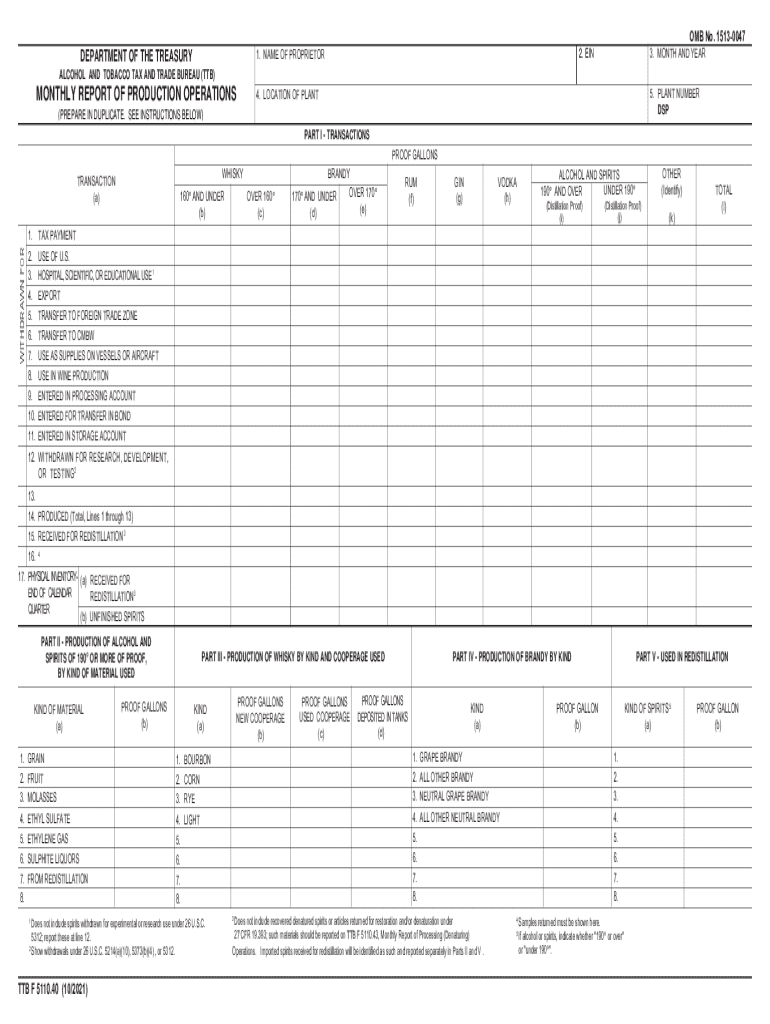

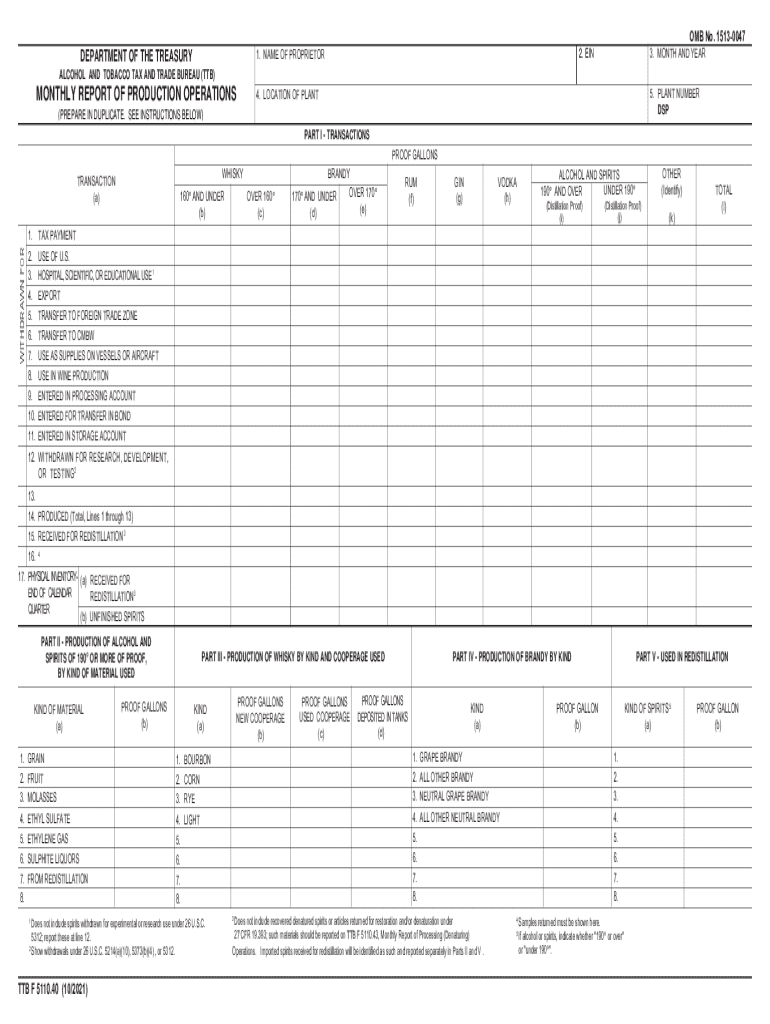

The TTB F 511040 Monthly Form is crucial for individuals and businesses engaged in alcohol production or distribution. It serves as a reporting tool for various alcoholic beverages, ensuring that producers comply with federal regulations. This form helps track production quantities, sales, and inventory adjustments, playing a vital role in the alcohol tax system.

Individuals and businesses that must file this form include manufacturers, importers, and wholesalers of alcoholic beverages. If you are producing or distributing alcohol, understanding when and how to file this form is essential for maintaining compliance with federal alcohol regulations.

The key deadlines for the submission of the TTB F 511040 Monthly Form are typically set for the last day of the month following the reporting period. Failure to submit on time can lead to significant penalties, including fines and potential legal issues.

Required Information

Completing the TTB F 511040 Monthly Form accurately requires you to gather specific personal and business details. This includes your name, contact information, and federal employer identification number (EIN). Additionally, financial data is needed for accurate reporting, such as production volumes, sales figures, and any adjustments to inventory.

Be prepared to provide data on the types of alcoholic products produced or sold, as this will affect the calculations and reporting on the form. Having your financial records organized will streamline the completion process.

Step-by-step instructions for completing TTB F 511040

Gathering essential documents is the first step before you begin filling out the TTB F 511040 Monthly Form. Compile all necessary paperwork, including previous filings, transaction records, and financial statements. This will create a solid foundation for your current filing.

Next, you need to access the form through pdfFiller. Here’s how to locate and download it: visit the pdfFiller website, navigate to the TTB forms section, and locate the TTB F 511040 form. You will find the form available in various formats like PDF and an online fillable form, allowing you to choose based on your preference.

Filling out the form requires attention to detail. Go through the form section-by-section. Typically, it includes headings for production data, net tax, and sales. Ensure all entries are accurate and double-check for any common mistakes, such as miscalculations or incorrect values.

Using visual aids, such as charts or tables, can help clarify your information and make verification easier. Keep in mind that accurate reporting is not just crucial for compliance, but also for your business’s financial forecasting.

Editing your form

Once you have filled out the TTB F 511040 Monthly Form, it's essential to review and edit your entries. pdfFiller provides various editing tools that allow you to modify text, update figures, or add any necessary annotations. Ensure that you double-check all input data for consistency, as accuracy is crucial in the eyes of the TTB.

After reviewing, the importance of ensuring your form is accurate cannot be overstated. Pay attention to formatting, as both poor formatting and inaccurate data can lead to issues during submission. Utilize pdfFiller's features to add or remove entries and make modifications easily. This ensures that your submission is polished and professional.

Signing and submitting the form

Digital signatures are now accepted for TTB forms, which makes signing your TTB F 511040 Monthly Form straightforward. With pdfFiller, you can electronically sign the form directly within the platform. This feature offers convenience while ensuring your signature is legally binding.

Submitting your completed form is the next step. Once you've signed the form, follow the submission guidelines provided by the TTB. Often, this will involve sending your form via email or traditional mail to the designated TTB office. Make sure to track your submission and keep a copy for your records so that you have a reference of the filing date.

Collaborating and managing your documents

pdfFiller also offers collaboration tools that can significantly enhance how you manage your TTB F 511040 Monthly Form. You can share the form with team members for review and gather feedback efficiently. These features enable real-time collaboration, which ensures that all inputs are considered before final submission.

Effective document management is crucial in maintaining organized records. pdfFiller allows you to store forms securely, ensuring easy access when needed. Take advantage of their security features to protect sensitive information, which is particularly important in financial reporting.

FAQ

Frequently asked questions regarding the TTB F 511040 Monthly Form often revolve around common concerns such as errors on the form, handling corrections post-submission, and deadline issues. If you make an error on your form, it's vital to contact the TTB for guidance on how to correct it properly without incurring penalties.

Missing the deadline is another significant concern. Late submissions can attract fines and repercussions, so it’s advisable to plan ahead. For any uncertainties, the TTB support team is available to provide specific guidance and assistance.

Helpful hints

To ensure a smooth filing process, adhere to best practices. Make deadlines your priority, and aim to submit reports early to avoid last-minute stress. Document your processes and create checklists to ensure all necessary entries are made before submission.

Investing in reliable online tools for document management, such as pdfFiller, can significantly reduce filing complications. An organized system not only aids in timely submissions but also enhances your overall efficiency in handling compliance-related tasks.

Glossary of terms

Understanding key terms associated with the TTB F 511040 Monthly Form is essential for effective navigation and compliance. Here are some common terms:

How to avoid problems

To minimize issues during submission, take a proactive approach. Double-check your entries, ensuring that all information aligns with your business records. Signs of form rejection usually stem from discrepancies or lack of information. Make it a habit to validate figures and review against previous submissions to maintain continuity.

If your form gets rejected, promptly address the specified problems outlined in the notification. Statistics have shown that businesses who maintain thorough documentation and actively engage with compliance checks report fewer issues with TTB submissions. Taking these steps significantly enhances your experience handling TTB forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete TTB F 511040 online?

How can I fill out TTB F 511040 on an iOS device?

Can I edit TTB F 511040 on an Android device?

What is ttb f 511040?

Who is required to file ttb f 511040?

How to fill out ttb f 511040?

What is the purpose of ttb f 511040?

What information must be reported on ttb f 511040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.